Options Spy | Institutional sell call orders suggest Tesla shares will stay low in the near term

Earnings season is in full swing, ASML orders increased more than 2.5 times in the last quarter, sending out semiconductor optimism, Netflix subscribers in the fourth quarter of the record, its shares soared more than 10 percent. Microsoft (MSFT)$intraday market value exceeded $3 trillion for the first time, becoming the second "3 trillion club" in history.

Former Fed official James Bullard said the central bank could start cutting rates before inflation reaches its 2 percent target, as soon as March.

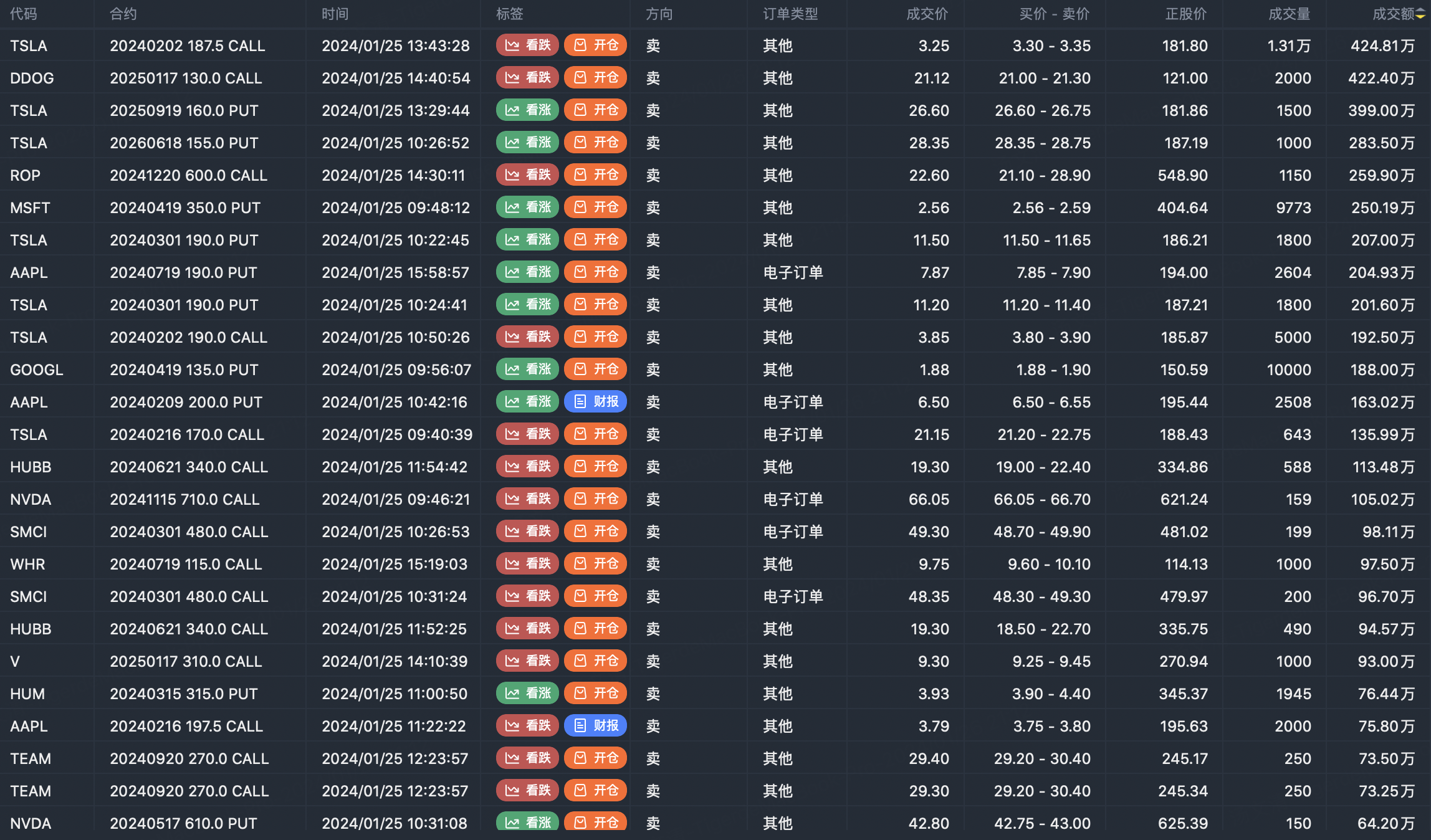

Tesla shares fell 12.13% to close at $182.63 on Thursday. The announcement came after the company reported fourth-quarter results that missed expectations and warned of a marked slowdown in sales growth this year, raising investor concerns about weak demand and competition from Chinese carmakers. Option transactions indicate continued pressure on Tesla's stock price in the near term, with institutions selling large call options orders: $TSLA 20240202 187.5 CALL$

* 10:30 ~ 11:30 every day, real-time sharing of exclusive screening options large order, welcome to click to subscribe.

FANNG option active

$Apple(AAPL)$ Sell PUT option $AAPL 20240209 200.0 PUT$

$Microsoft(MSFT)$ Sell PUT Option $MSFT 20240419 350.0 PUT$

$Tesla Motors(TSLA)$ Buy CALL option $TSLA 20240202 190.0 CALL$ , buy call option $TSLA 20240202 187.5 CALL$

Option buyer open position (Single leg)

Buy TOP T/O:

$TSLA 20250321 170.0 PUT$ $NVDA 20240920 550.0 PUT$

Buy TOP Vol:

$AAL 20240315 16.0 CALL$ $SOFI 20240202 12.0 CALL$

Option seller open position (Single leg)

Sell TOP T/O:

$TSLA 20240202 187.5 CALL$ $DDOG 20250117 130.0 CALL$

Sell TOP Vol:

$LVS 20240315 60.0 CALL$ $VZ 20240315 46.0 CALL$

Note: This image data is from Tiger PC. This screen is a significant sell open position for an option contract in the market. A sell of a call option means that the trader believes that the underlying trend has peaked, and a sell of a put option means that the trader believes that the underlying trend has bottomed. These contract openings typically indicate significant activity in the underlying stock, including whether the trader is willing to accumulate a long or short option position.

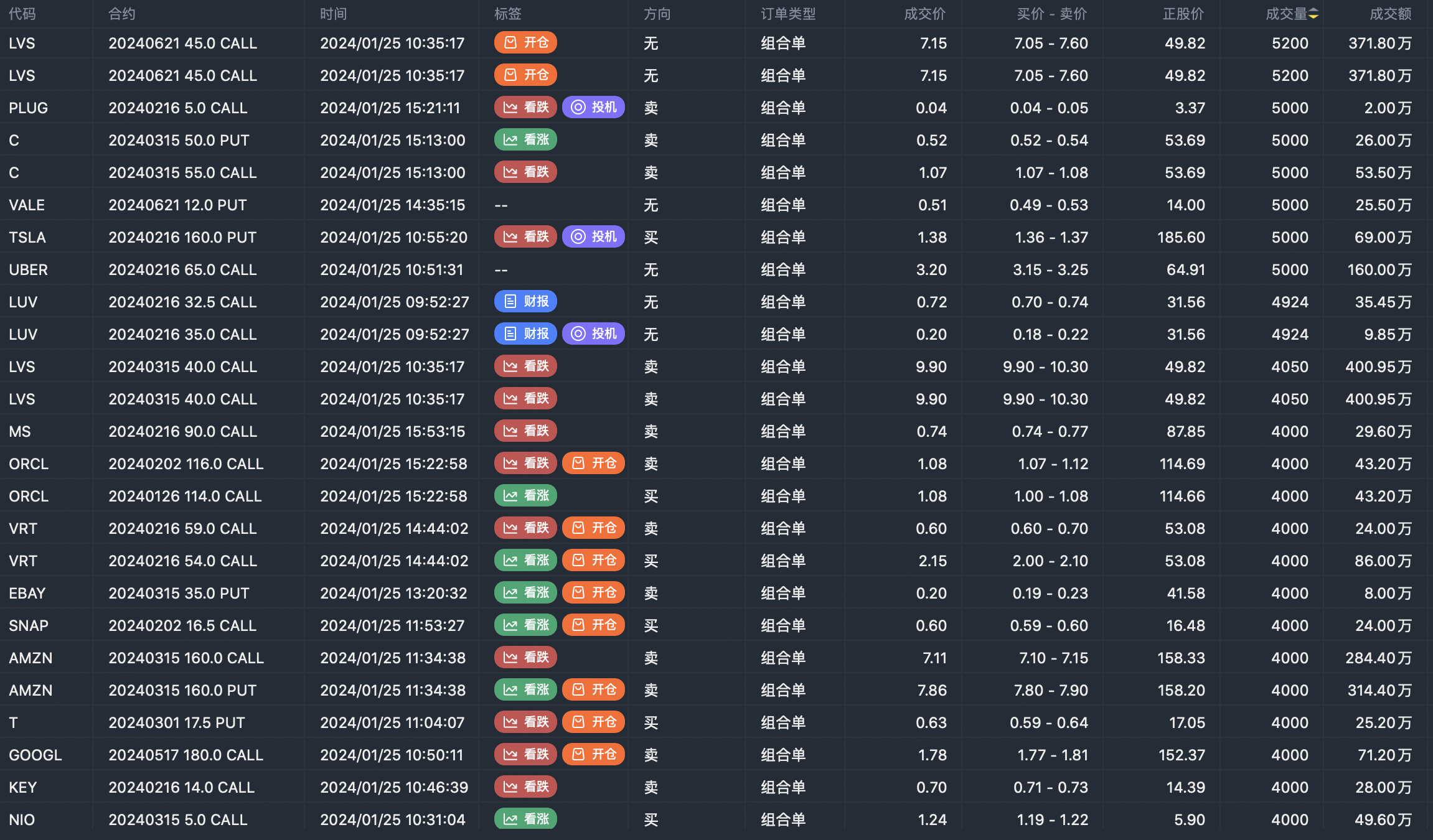

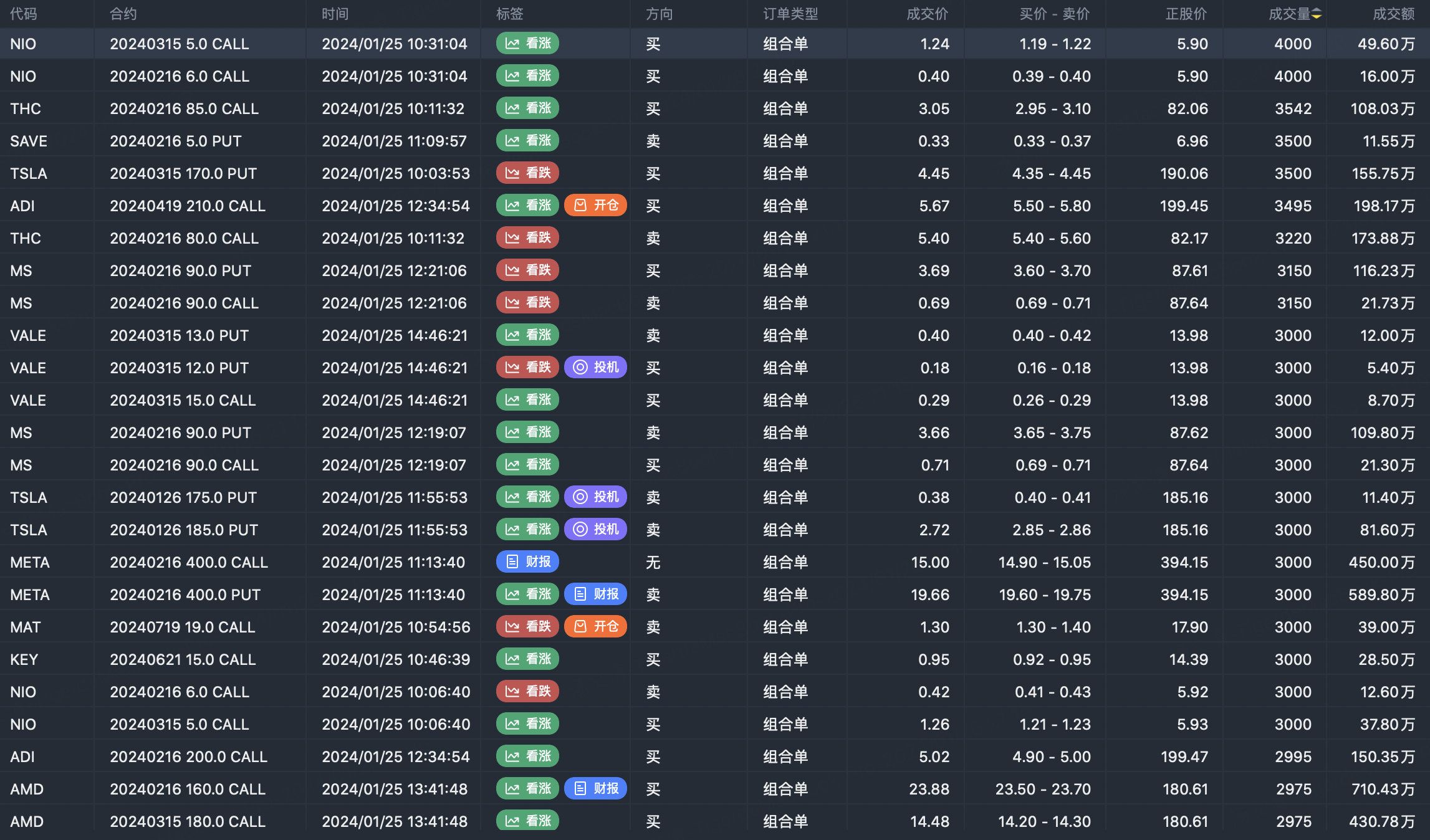

Options portfolio open position

Note: This image data is from Tiger PC. This screening is a significant portfolio of options contracts in the market. Portfolio opening includes a variety of underlying trends, requiring traders to further master the basic knowledge of options for analysis and judgment.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Great ariticle, would you like to share it?