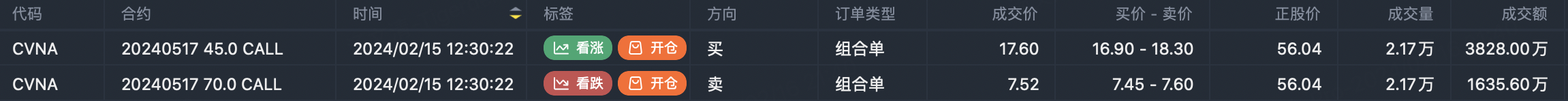

Options Spy | Institutions believe that CVNA earnings share price fluctuates between 45~ 70

Retail sales figures have shaken expectations of a "soft landing" for the US economy. On Thursday, the Commerce Department reported that retail sales growth fell 0.8% in January, the biggest monthly decline since March last year and well below economists' expectations of -0.2%, mainly because of lower receipts at car dealerships and gas stations, and the market did not expect a rate cut until June. Still, the labor market continues to show signs of strengthening. After the data, Goldman Sachs cut its forecast for first-quarter U.S. economic growth to 2.5 percent from 2.9 percent previously.

Federal Reserve Governor Bill Waller predicted Thursday that the U.S. dollar won't lose its status as the world's reserve currency anytime soon, and that while recent developments may threaten that position, it has been strengthened, at least so far.

$Carvana Co.(CVNA)$will report earnings after the closing bell on February 22, and the portfolio large order shows institutional bullish, buy call option $CVNA 20240517 45.0 CALL$ sell call option $CVNA 20240517 70.0 CALL$

* 10:30 ~ 11:30 every day, real-time sharing of exclusive screening options large order, welcome to click to subscribe.

FANNG option active

$Apple(AAPL)$ buy put option $AAPL 20240308 185.0 PUT$

$Microsoft(MSFT)$ sell call option $MSFT 20240301 407.5 CALL$

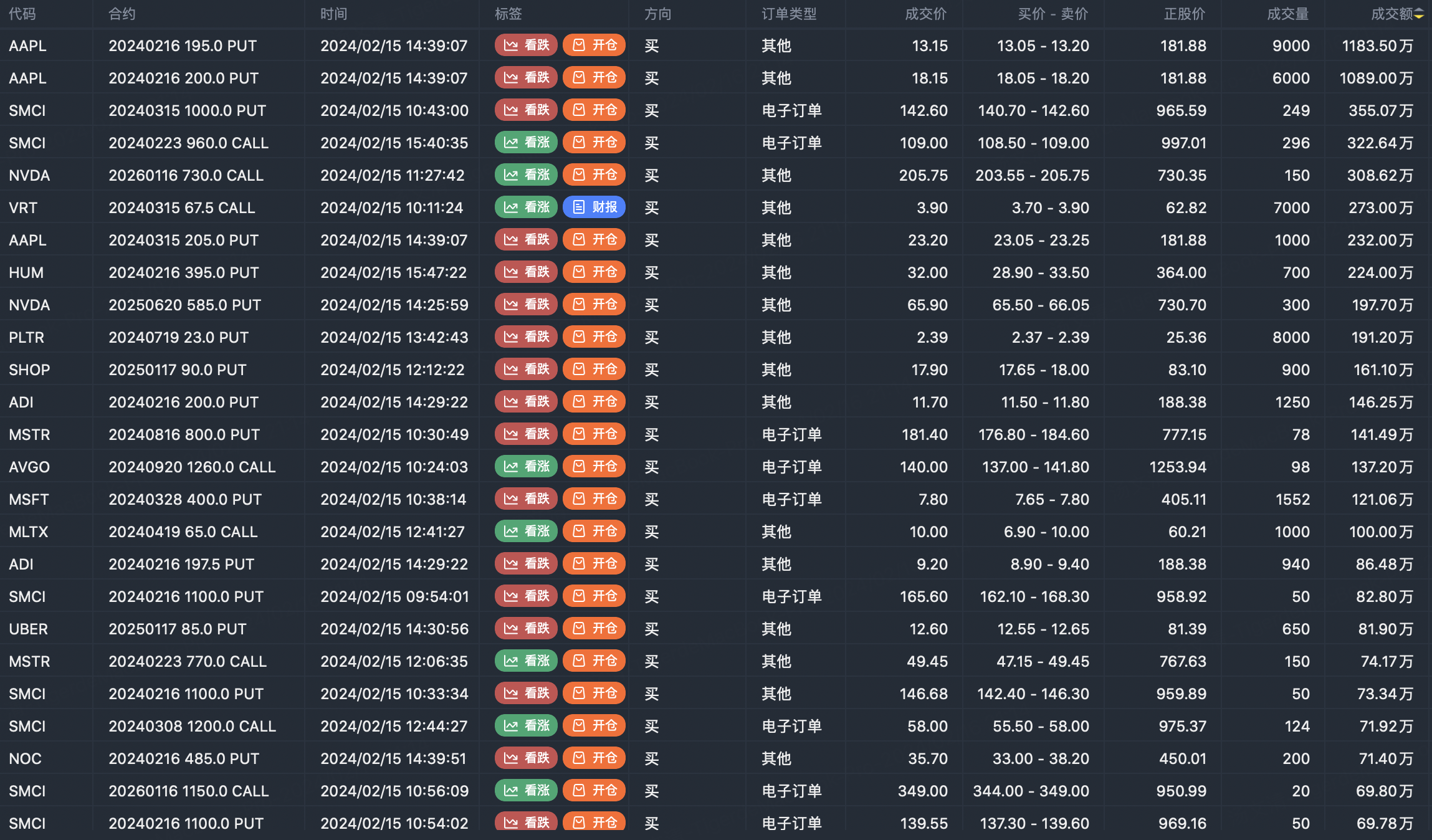

Option buyer open position (Single leg)

Buy TOP T/O:

$AAPL 20240216 195.0 PUT$ $SMCI 20240315 1000.0 PUT$

Buy TOP Vol:

$MPW 20240223 3.5 PUT$ $CCL 20240315 14.0 PUT$

Option seller open position (Single leg)

Sell TOP T/O:

$BA 20240216 225.0 PUT$ $AAPL 20240216 192.5 PUT$

Sell TOP Vol:

$NKLA 20240419 1.0 CALL$ $PTEN 20240419 9.0 PUT$

Note: This image data is from Tiger PC. This screen is a significant sell open position for an option contract in the market. A sell of a call option means that the trader believes that the underlying trend has peaked, and a sell of a put option means that the trader believes that the underlying trend has bottomed. These contract openings typically indicate significant activity in the underlying stock, including whether the trader is willing to accumulate a long or short option position.

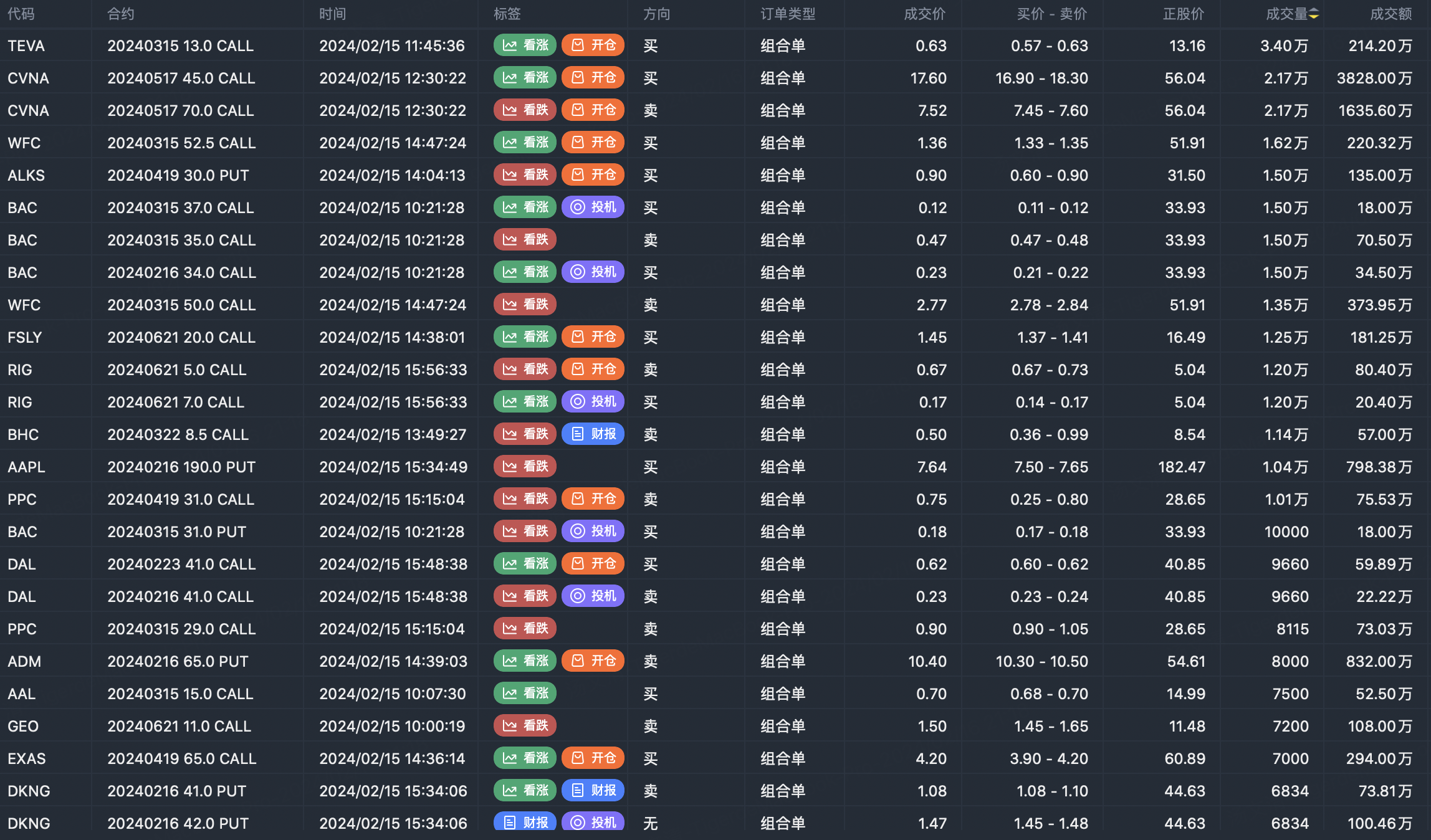

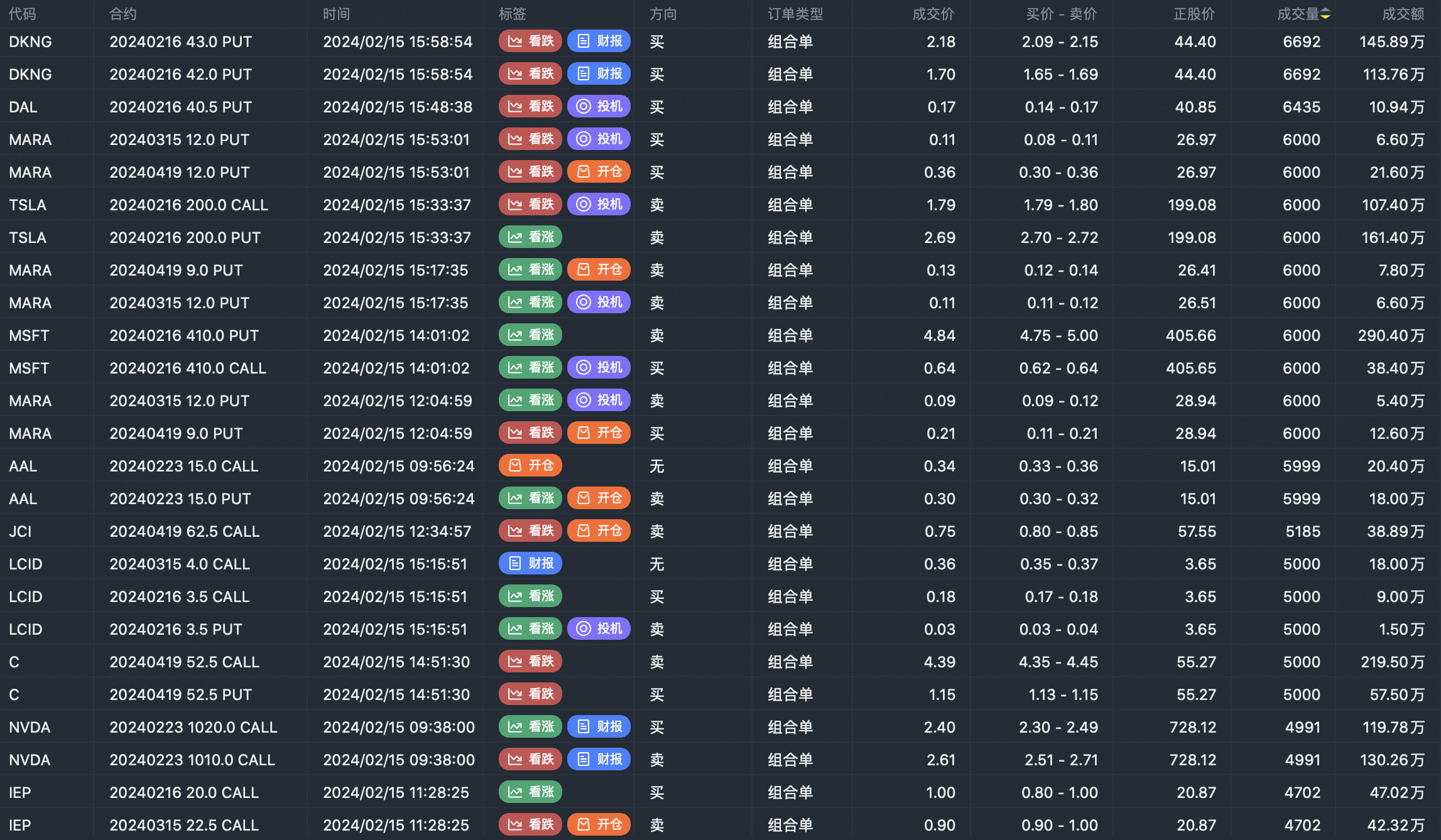

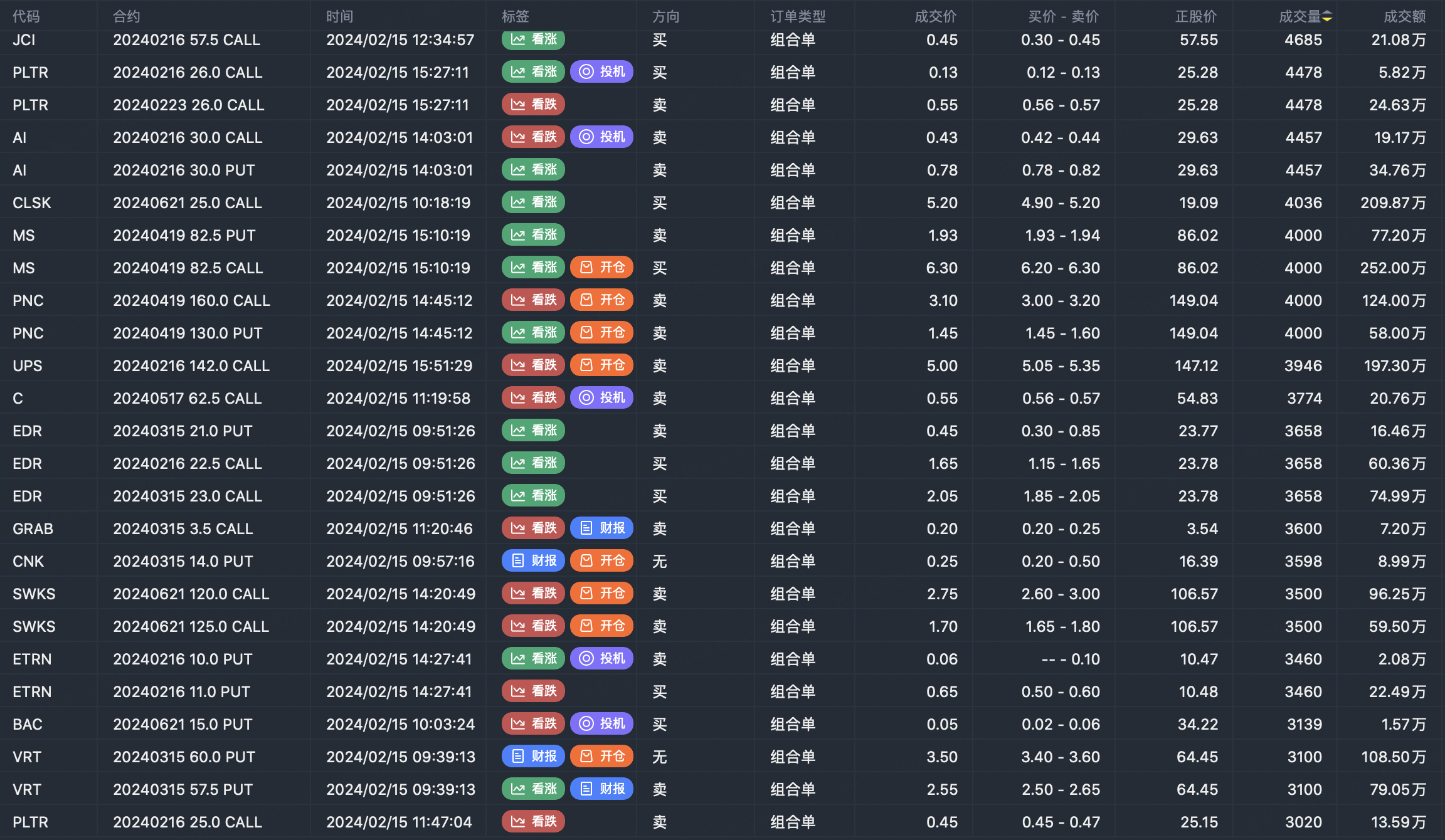

Options portfolio open position

Note: This image data is from Tiger PC. This screening is a significant portfolio of options contracts in the market. Portfolio opening includes a variety of underlying trends, requiring traders to further master the basic knowledge of options for analysis and judgment.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Great ariticle, would you like to share it?