Nvidia earnings preview: Break or the beginning of a big sideways?

Conclusion: The rise and fall of NVIDIA's financial report is not more than 8%, and it is biased toward bullish. The average market forecast is for a rise or fall of 5.5%, which may be more in line with the results. Considering the high iv of options, this financial report may not be conducive to the option single-leg buyer.

For Nvidia's fourth quarter earnings report, some analysts forecast Q3 revenue of $21.5 billion and Q1 revenue of $23 billion. Revenue is expected to be $99 billion in fiscal year 2025, double that of fiscal year 2024. Ai demand remains strong, and data center and GPU growth will be a focus.

However, the stock price rose more than 46% in less than two months before the earnings report, indicating that the market has fully priced in the basic expectation of doubling. It is conceivable that if there is no unexpected development, then this round of rally is likely to stall.

The volatility pricing of this financial report has become the focus of trading attention. Based on this week's expiration at the parity options pricing, the market forecast an average rise or fall of 5.5 percent, based on Friday's closing price of $686-766, the price movement of about $40. So is this range accurate, and more specifically, do stock prices tend to rise or fall?

As I was sifting through options, a set of big orders caught my eye:

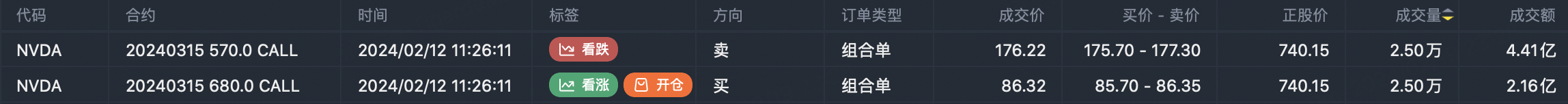

Sell $NVDA 20240315 570.0 CALL$ , buy $NVDA 20240315 680.0 CALL$

The volume of this group of options reached 25,000, and the largest single transaction reached 440 million. But open the options chain to see that this is not a set of strategies, but roll positions.

The trader bought 25,000 lots of $NVDA 20240315 570.0 CALL$ at a cost of 145 million on January 22, gained 440 million after closing the position on February 12, and then used 200 million of the profit to buy $NVDA 20240315 680.0 CALL$ to continue the bullish call.

With profit roll position generally reflects the last fight, the exercise price is the bottom line of the last fight. OTM embodies radical, ITM embodies conservative. While Nvidia's stock price on February 12 was 740, the trader chose a strike price of 680 for the in-the-money option.

And we calculated above, the market forecast rise and fall range is $686 ~ 766, the exercise price just stuck at the lower limit. In other words, the trader wants the stock price to continue to rise, but is not quite sure, so he sets a strike price with a high probability of not completely losing. This is a one-legged strategy that is bullish but also prepared for small losses.

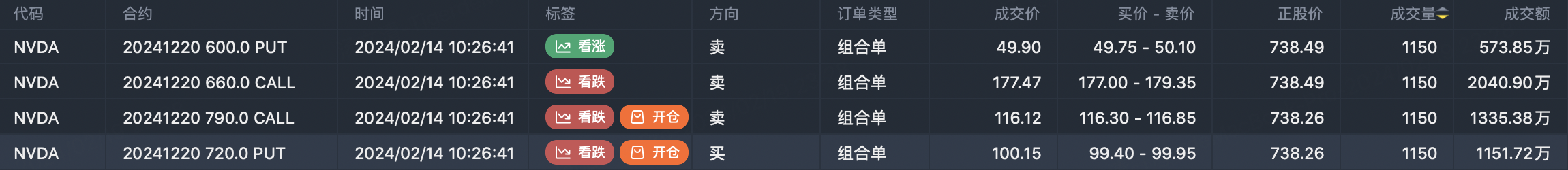

Another group of roll players had a slightly different choice. The player chose to close the straddle strategy, then sell $NVDA 20241220 790.0 CALL$ , buy $NVDA 20241220 720.0 PUT$ , still in the 686-766 range he chose to bear.

The advantage of this strategy is that the premium from selling the call option covers the cost of buying it, but the disadvantage is that if the stock price soars, it doubles the loss.

But if the trader himself owns 115,000 Nvidia shares, this is a mostly no-loss neckline strategy that effectively protects upside profits while preventing downside losses.

If I didn't own a positive stock this time I would consider selling $NVDA 20240301 680.0 PUT$ , but selling an at-the-money put in the last earnings report and holding now, I would prioritize an option strategy with a positive stock portfolio.

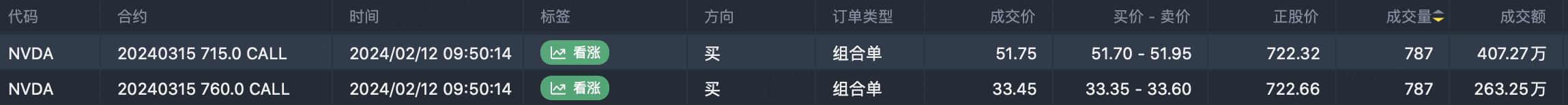

There is a strategy that is very attractive to me, that is, sell (the single direction of the figure shows that buy is wrong) $NVDA 20240315 715.0 CALL$ , buy $NVDA 20240315 760.0 CALL$ . The stock price has not lost money, and the positive shares continue to hold at the same time is equivalent to doing a spread portfolio. If the stock price rises, it does not lose money. This leg of 715 covers the exercise and obtains the premium at the same time. 50 is equivalent to 765 exercise, and the 760 call option gains the premium increase.

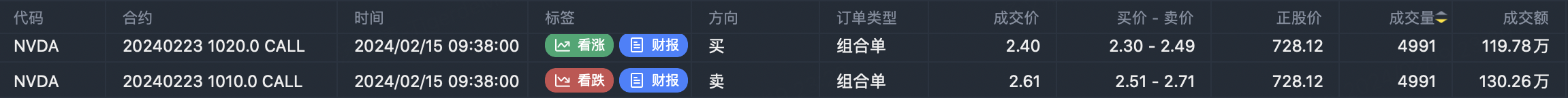

Of course, there is one of the simplest strategies for this earnings report, that is, the earnings comparison is not good, CALL spread combination: sell $NVDA 20240223 1010.0 CALL$ , buy $NVDA 20240223 1020.0 CALL$

To sum up, this financial report option single-leg buyer advantage is low, Nvidia option price is expensive, you can consider the combination strategy to cover the cost of royalties.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- phongy 45·2024-02-20are warning real ?LikeReport

- YueShan·2024-02-20Good⭐️⭐️⭐️LikeReport

- Tom Chow·2024-02-20goodLikeReport

- KSR·2024-02-20👍2Report