Options Spy | Failed to take the AI ride, bears set against Apple, put options exploded large orders

The S&P rose above the 5,100 mark, and Nvidia's market value rose above $2 trillion with the AI wave. International financial events this week include the U.S. presidential primary "Super Tuesday", February non-farm and unemployment rates, ISM non-manufacturing index and last week's unemployment benefits and other economic data. The Fed's Beige Book is due out this week, and the market is also focused on congressional testimony by Fed Chairman Jerome Powell and speeches by several Fed officials.

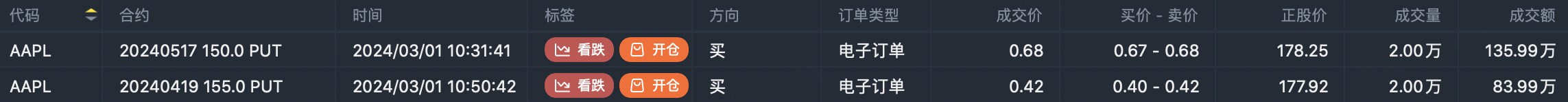

The European Commission has announced a €1.8 billion fine against Apple for abusing its monopoly position by restricting music streaming competitors, including Spotify. Earlier, it was reported that Apple will release new products through the official website press release this week. Large put buy orders occur in option transactions: $AAPL 20240517 150.0 PUT$ $AAPL 20240419 155.0 PUT$

* 10:30 ~ 11:30 every day, real-time sharing of exclusive screening options large order, welcome to click to subscribe.

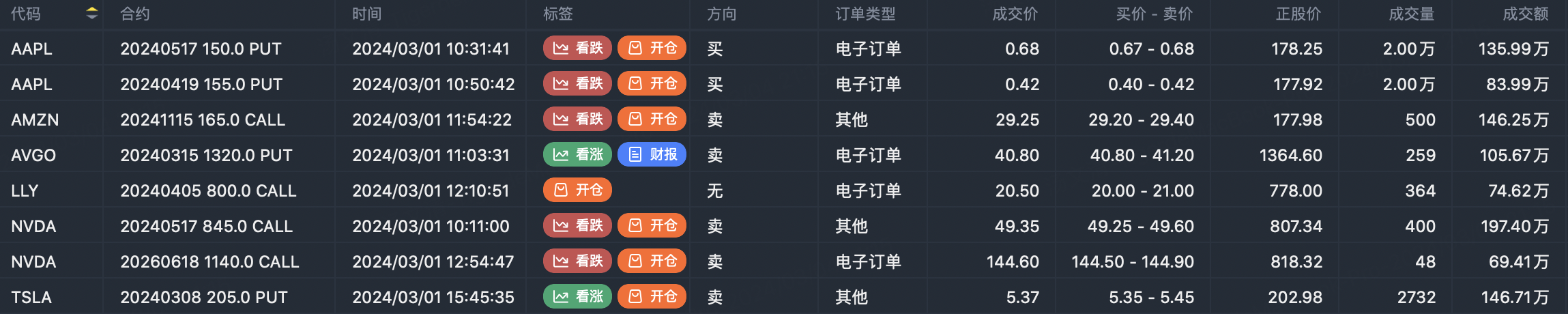

FANNG option active

$Apple(AAPL)$ buy put options$AAPL 20240517 150.0 PUT$ $AAPL 20240419 155.0 PUT$

$Tesla Motors(TSLA)$ sell put options $TSLA 20240308 205.0 PUT$

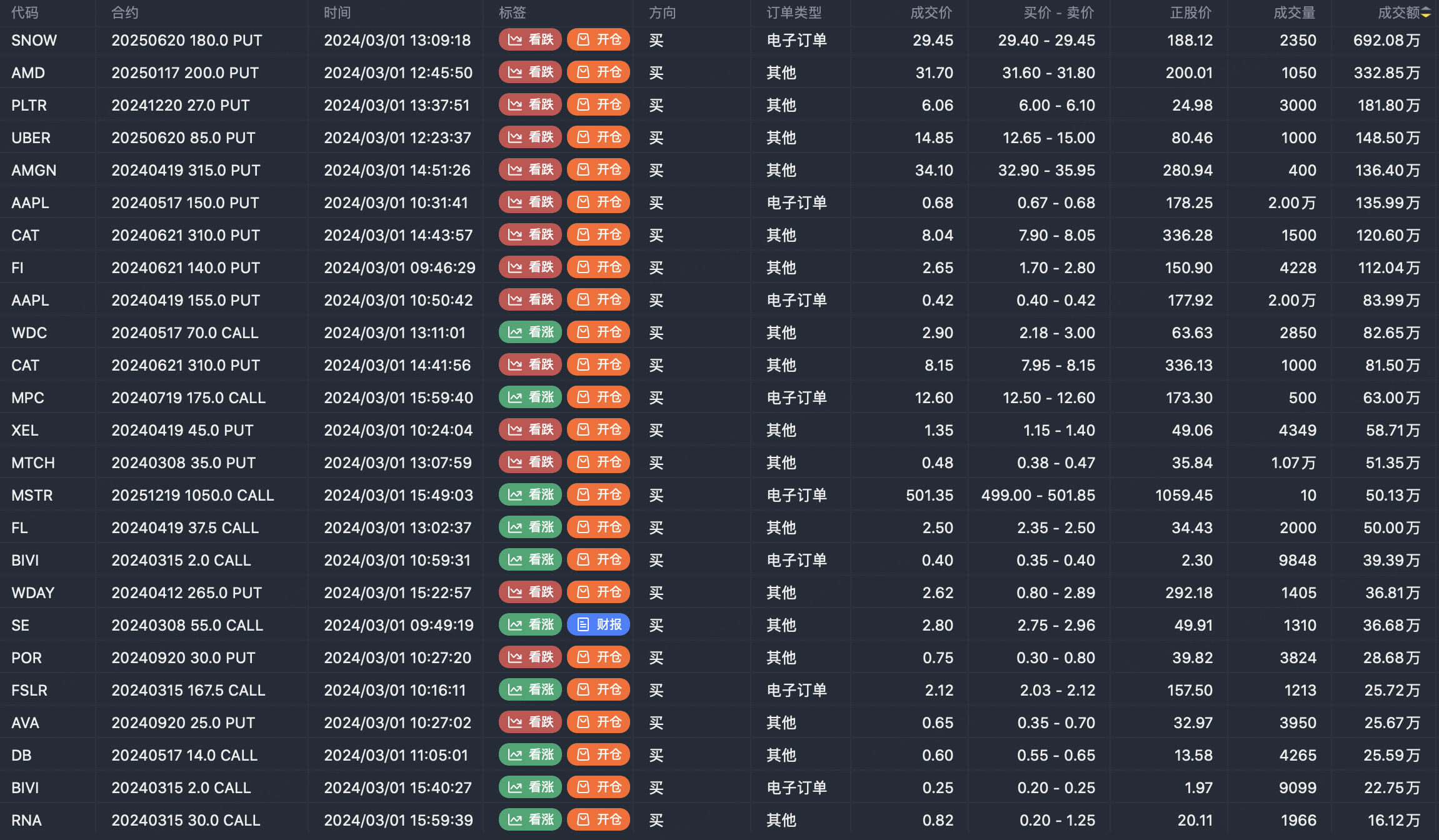

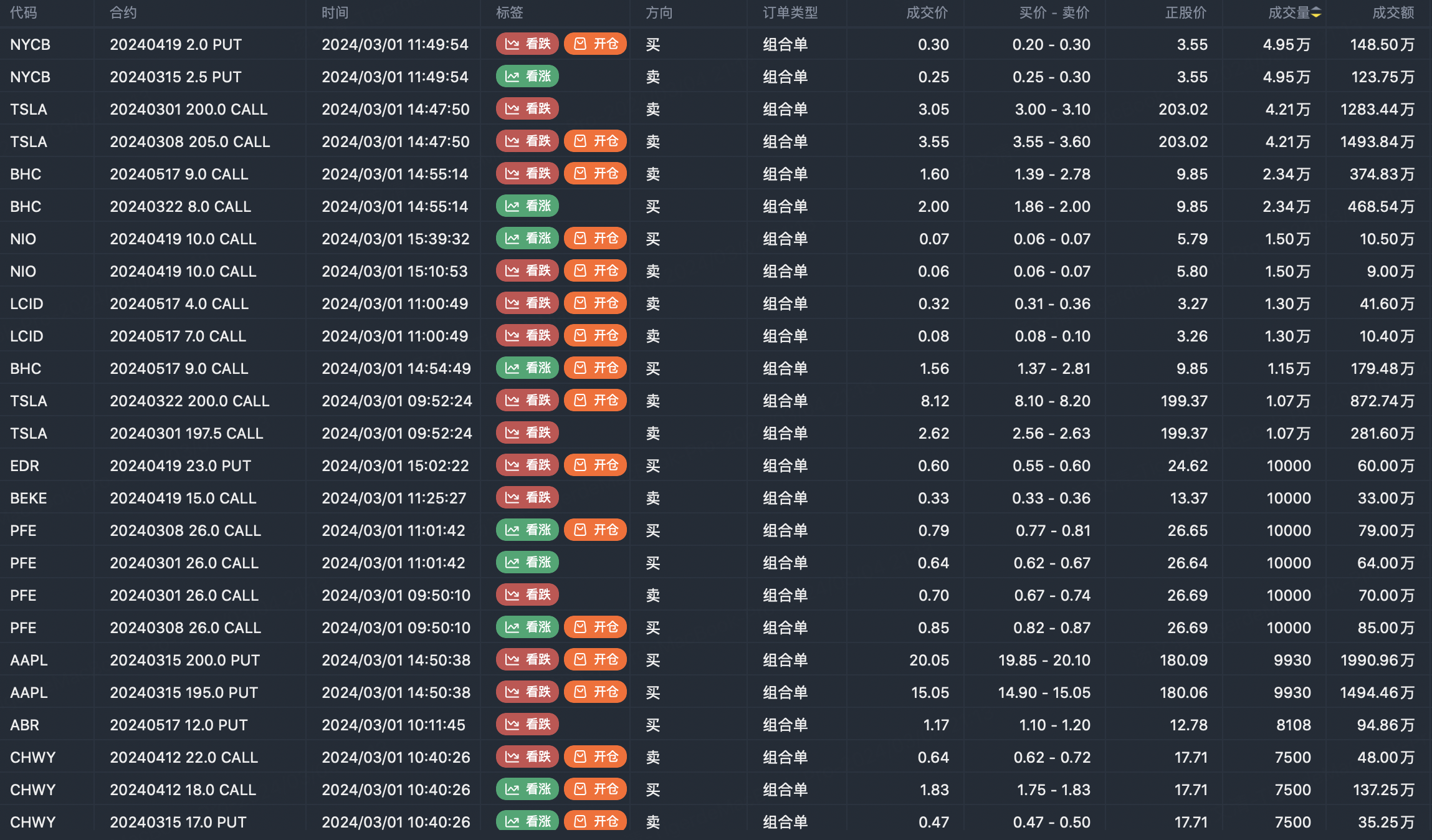

Option buyer open position (Single leg)

Buy TOP T/O:

$SNOW 20250620 180.0 PUT$ $AMD 20250117 200.0 PUT$

Buy TOP Vol:

$AAPL 20240517 150.0 PUT$ $MTCH 20240308 35.0 PUT$

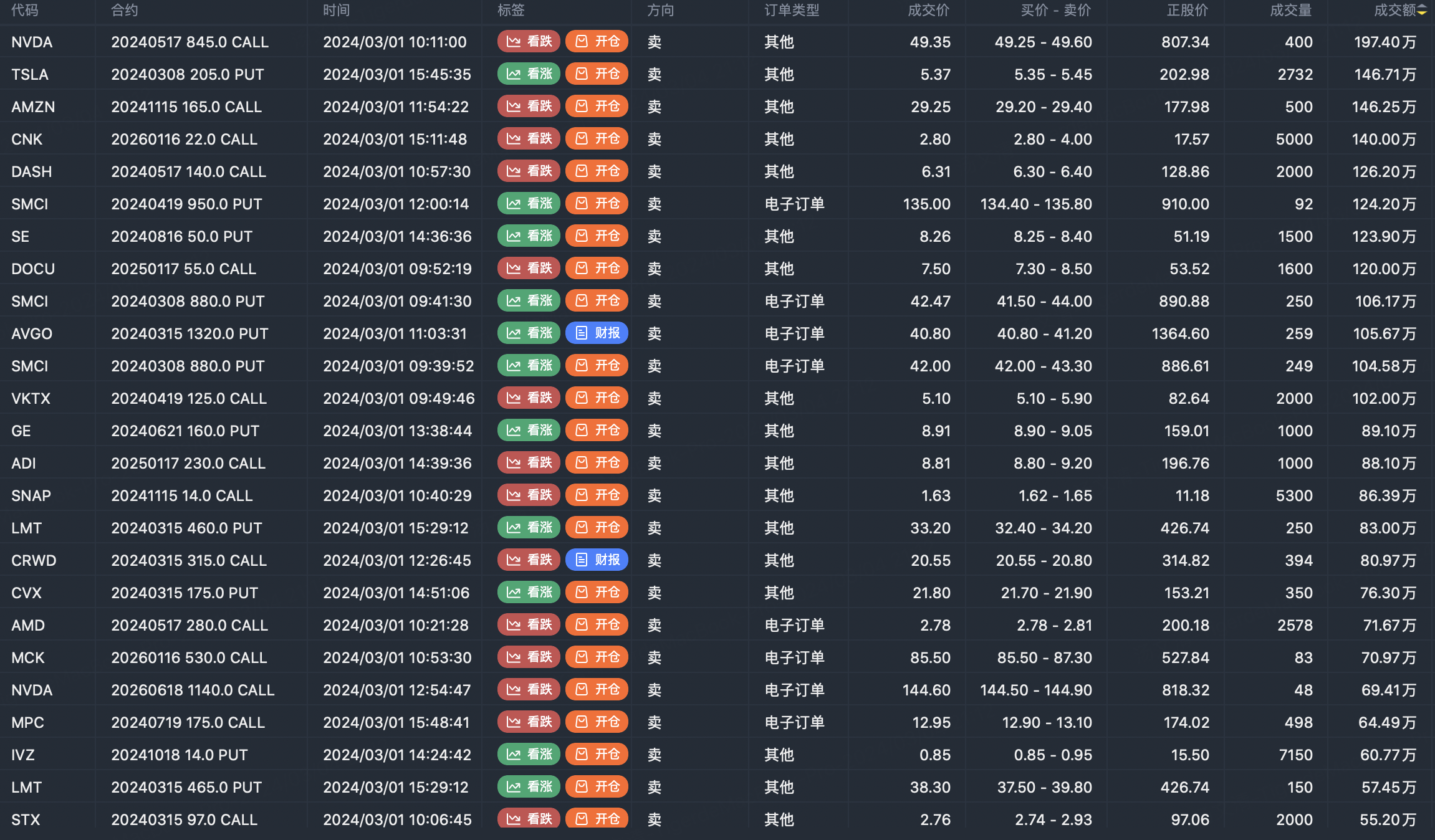

Option seller open position (Single leg)

Sell TOP T/O:

$NVDA 20240517 845.0 CALL$ $TSLA 20240308 205.0 PUT$

Sell TOP Vol:

$AVTR 20240328 23.0 PUT$ $CHPT 20240308 2.0 PUT$

Note: This image data is from Tiger PC. This screen is a significant sell open position for an option contract in the market. A sell of a call option means that the trader believes that the underlying trend has peaked, and a sell of a put option means that the trader believes that the underlying trend has bottomed. These contract openings typically indicate significant activity in the underlying stock, including whether the trader is willing to accumulate a long or short option position.

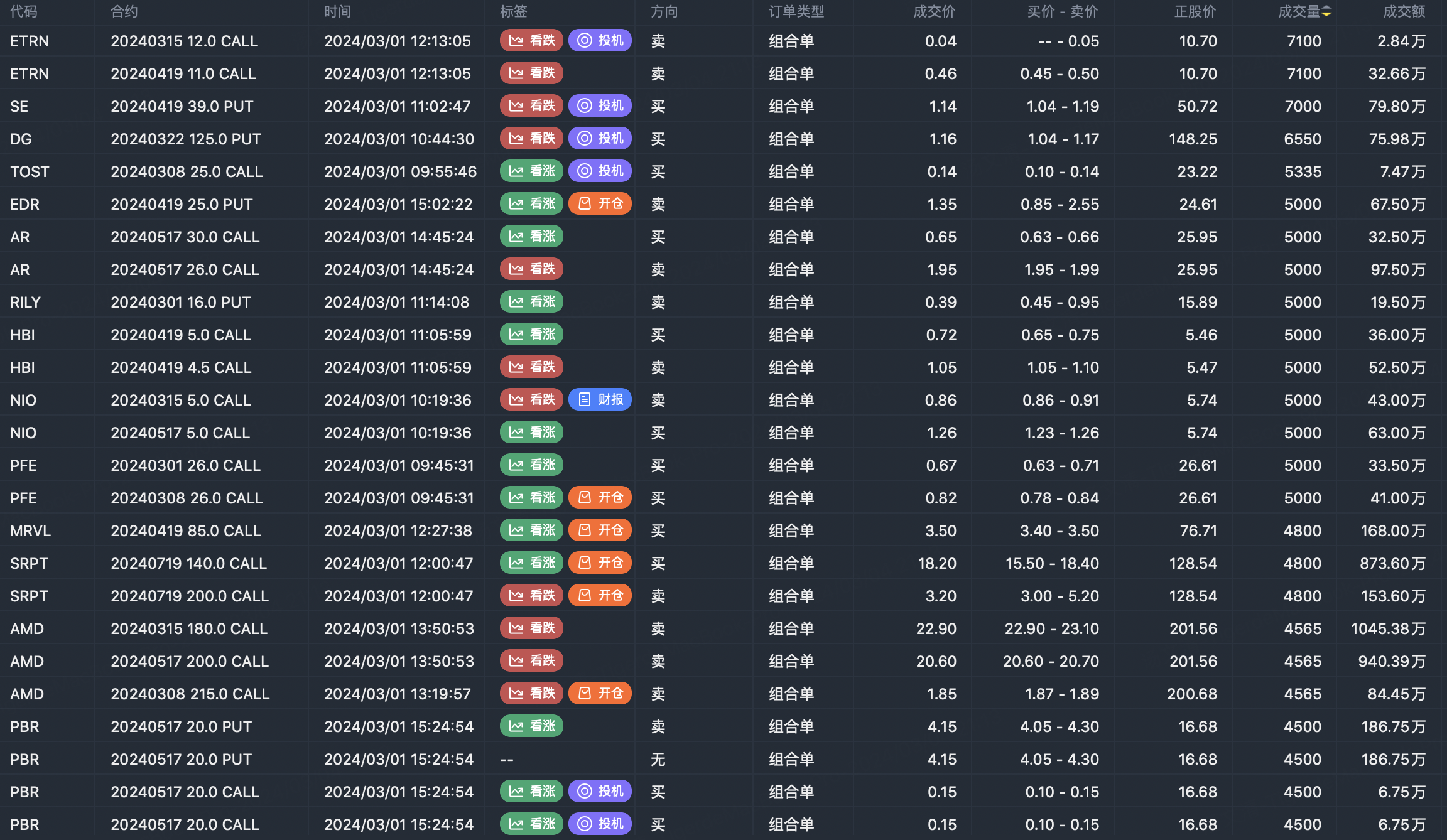

Options portfolio open position

Note: This image data is from Tiger PC. This screening is a significant portfolio of options contracts in the market. Portfolio opening includes a variety of underlying trends, requiring traders to further master the basic knowledge of options for analysis and judgment.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- Ah Huat Kopi·03-04NiceLikeReport