Options Spy | Good landing, Apple ushered in a small peak of selling call options

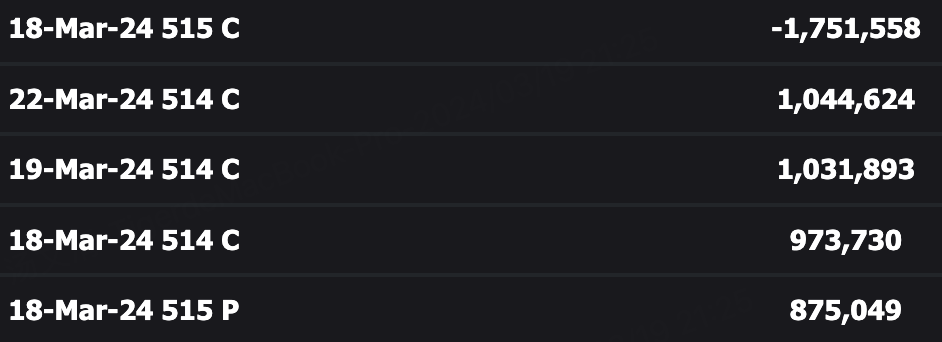

On Monday, March 18, the S&P 500 closed 5149.42, up 0.63%. SPY options direction of the day showed bearish, subdivision sort buy put options sentiment ranked first. delta's first move was to sell the CALL option $SPY 20240318 515.0 CALL$

Apple and Google are reportedly in talks to license Google Gemini to provide new features for iPhone software due out this year. The people briefed on the matter spoke on the condition of anonymity because the discussions were private. It was also revealed that Apple had recently held discussions with OpenAI to consider using its model.

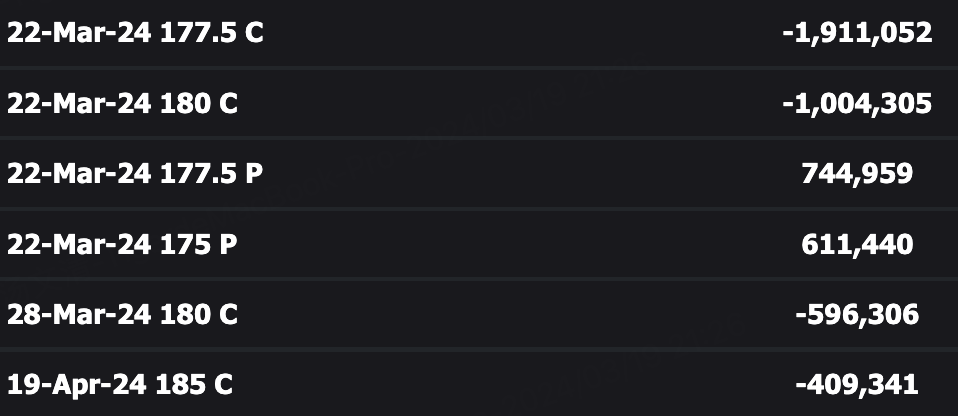

After the close of trading on Monday, CALL selling was overwhelming, and calls were heavily sold during the week: $AAPL 20240322 177.5 CALL$ $AAPL 20240322 180.0 CALL$ , with a volume of 106,200 calls with a strike price of 180. Heavy selling of call positions puts negative pressure on the stock price.

* 10:30 ~ 11:30 every day, real-time sharing of exclusive screening options large order, welcome to click to subscribe.

FANNG option active

$Meta Platforms, Inc.(META)$ buy put options $META 20240419 487.5 PUT$

$Microsoft(MSFT)$ sell call options $MSFT 20240426 460.0 CALL$

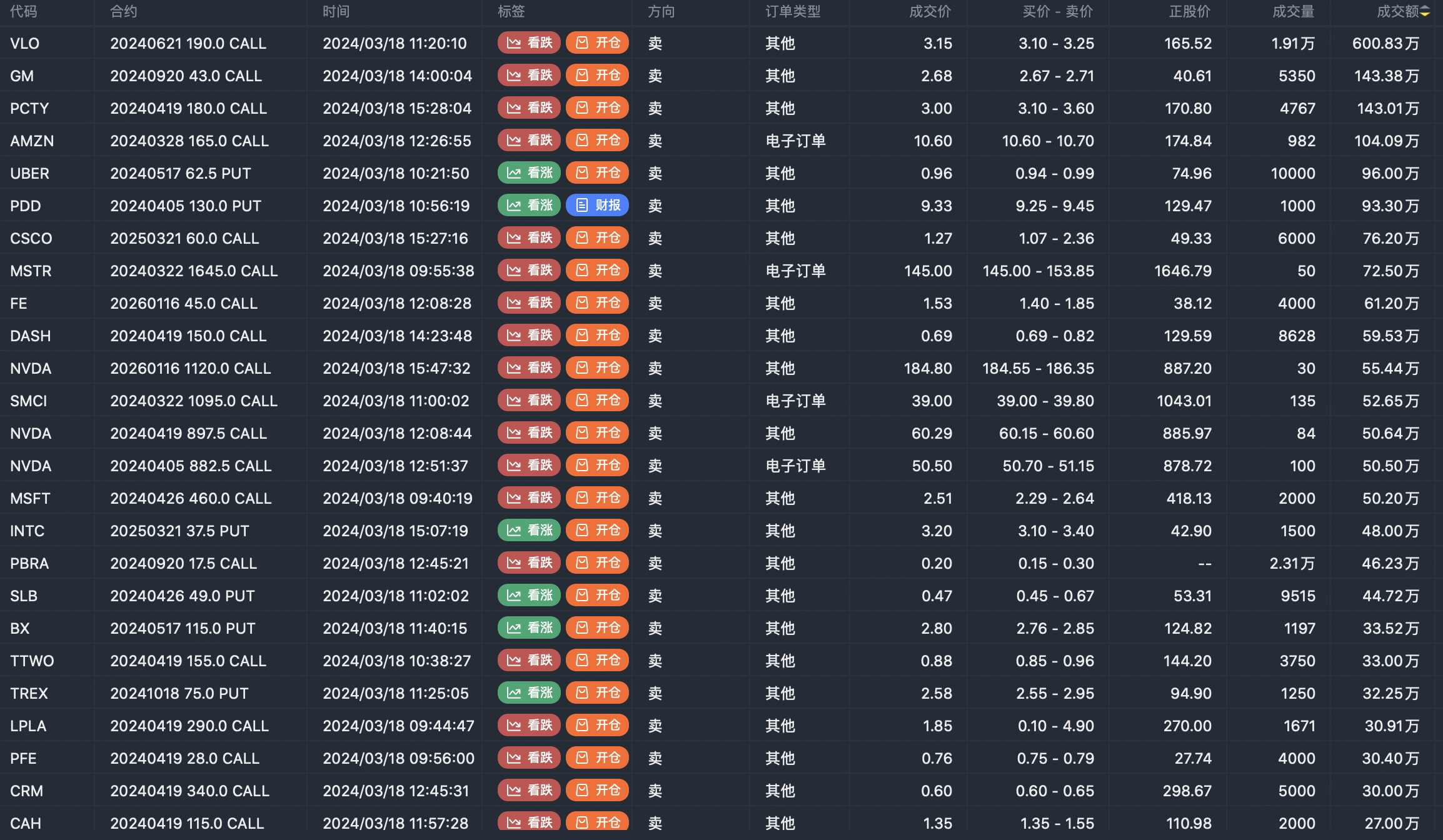

Option buyer open position (Single leg)

Buy TOP T/O:

$META 20240419 487.5 PUT$ $MS 20260116 95.0 CALL$

Buy TOP Vol:

$PBR 20240322 14.0 PUT$ $CCJ 20240328 45.0 CALL$

Option seller open position (Single leg)

Sell TOP T/O:

$VLO 20240621 190.0 CALL$ $GM 20240920 43.0 CALL$

Sell TOP Vol:

$VLO 20240621 190.0 CALL$ $PBRA 20240920 17.5 CALL$

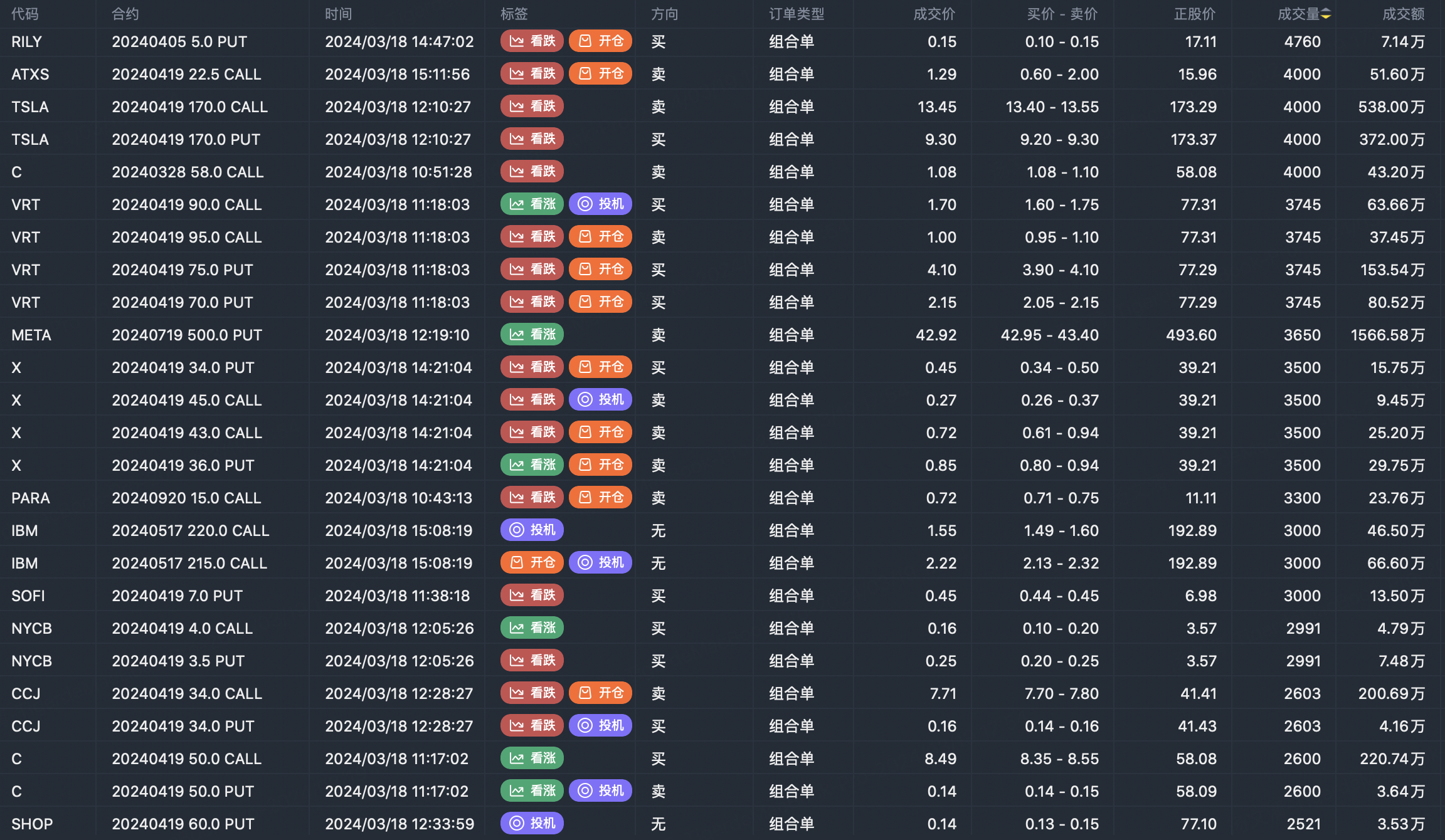

Note: This image data is from Tiger PC. This screen is a significant sell open position for an option contract in the market. A sell of a call option means that the trader believes that the underlying trend has peaked, and a sell of a put option means that the trader believes that the underlying trend has bottomed. These contract openings typically indicate significant activity in the underlying stock, including whether the trader is willing to accumulate a long or short option position.

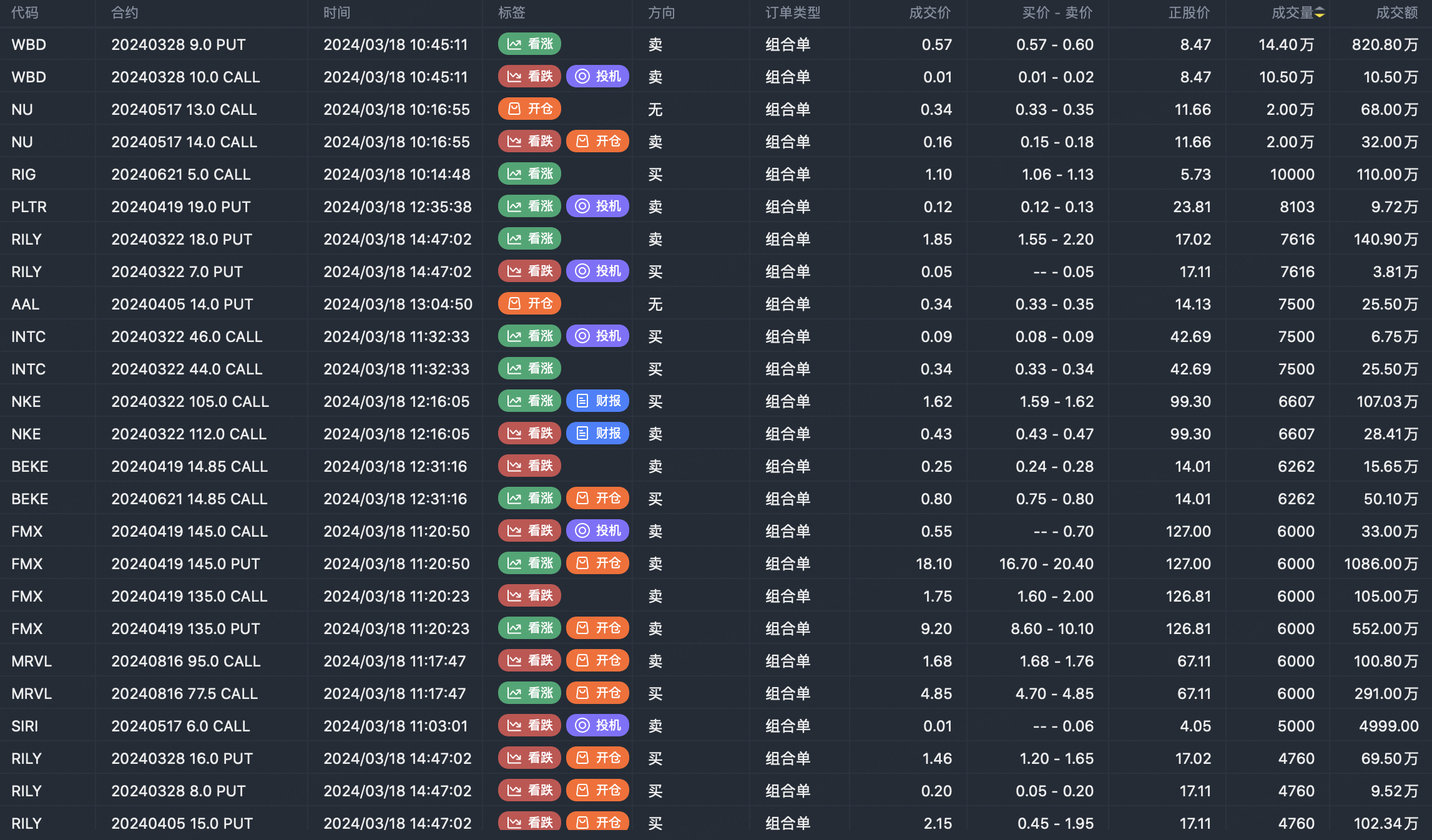

Options portfolio open position

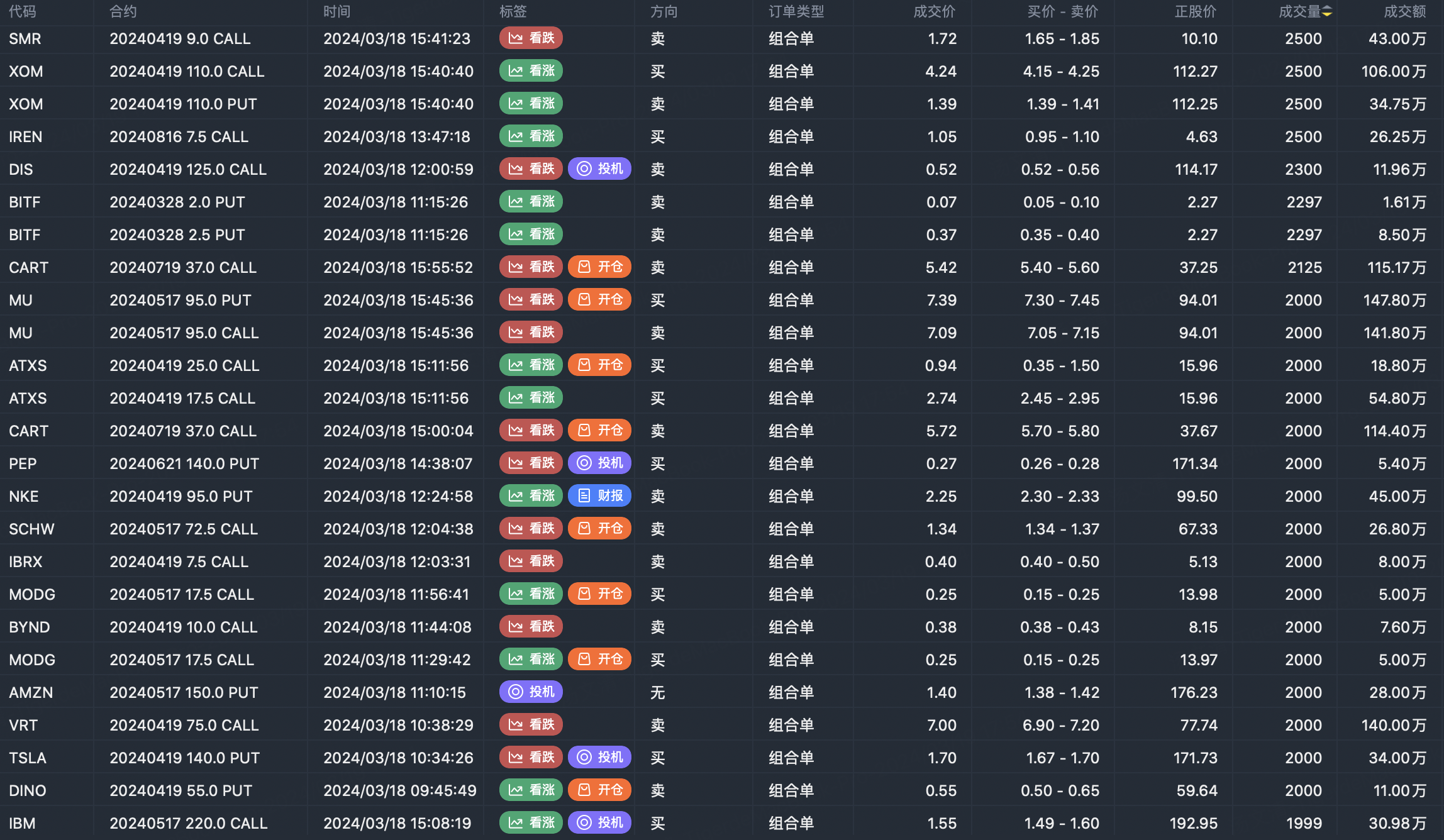

Note: This image data is from Tiger PC. This screening is a significant portfolio of options contracts in the market. Portfolio opening includes a variety of underlying trends, requiring traders to further master the basic knowledge of options for analysis and judgment.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

woah