Options Spy | Call options continue to chase the market, bears continue to fight PDD

Europe and the United States are expected to cut interest rates in June, corporate earnings were mixed, and the three major indexes fell slightly.

On Friday, March 22, the S&P 500 closed 523.18, down 0.14%. SPY's comprehensive assessment of options on the day showed bullish sentiment, with selling put options ranked first. The first CALL option opened on Friday was $SPY 20240405 529.0 CALL$ , the strike price was 529, and the new open position was 40,000 lots due on April 5; The first PUT option opened on Friday was $SPY 20240517 420.0 PUT$ , with a strike price of 420 and a new open position of 300,000 lots due on May 17.

Bullish open list 1 $SPY 20240405 529.0 CALL$ is mostly a buy open position, list 2 $SPY 20240405 536.0 CALL$ is mostly a sell open position. Bearish open position list one, two and three are mostly sold open positions.

$PDD Holdings Inc(PDD)$ On March 20, PDD released Q4 financial results, the fourth quarter revenue was 88.9 billion yuan, an increase of 123%, the growth rate is the highest in nearly 10 quarters; Operating profit was 22.4 billion yuan, an increase of 145.73%. Shares opened higher and lower after the earnings report, and erased their weekly gains by Friday's close. Option transactions show continued bearish orders: 1,597 lots 2,874,600 PUT options bought for $PDD 20250117 120.0 PUT$ , 3,888 lots of put options bought for $PDD 20240517 130.0 PUT$

* 10:30 ~ 11:30 every day, real-time sharing of exclusive screening options large order, welcome to click to subscribe.

FANNG option active

$Alphabet(GOOGL)$ buy call options $GOOGL 20240328 152.5 CALL$

$Microsoft(MSFT)$ sell call options $MSFT 20240426 400.0 CALL$

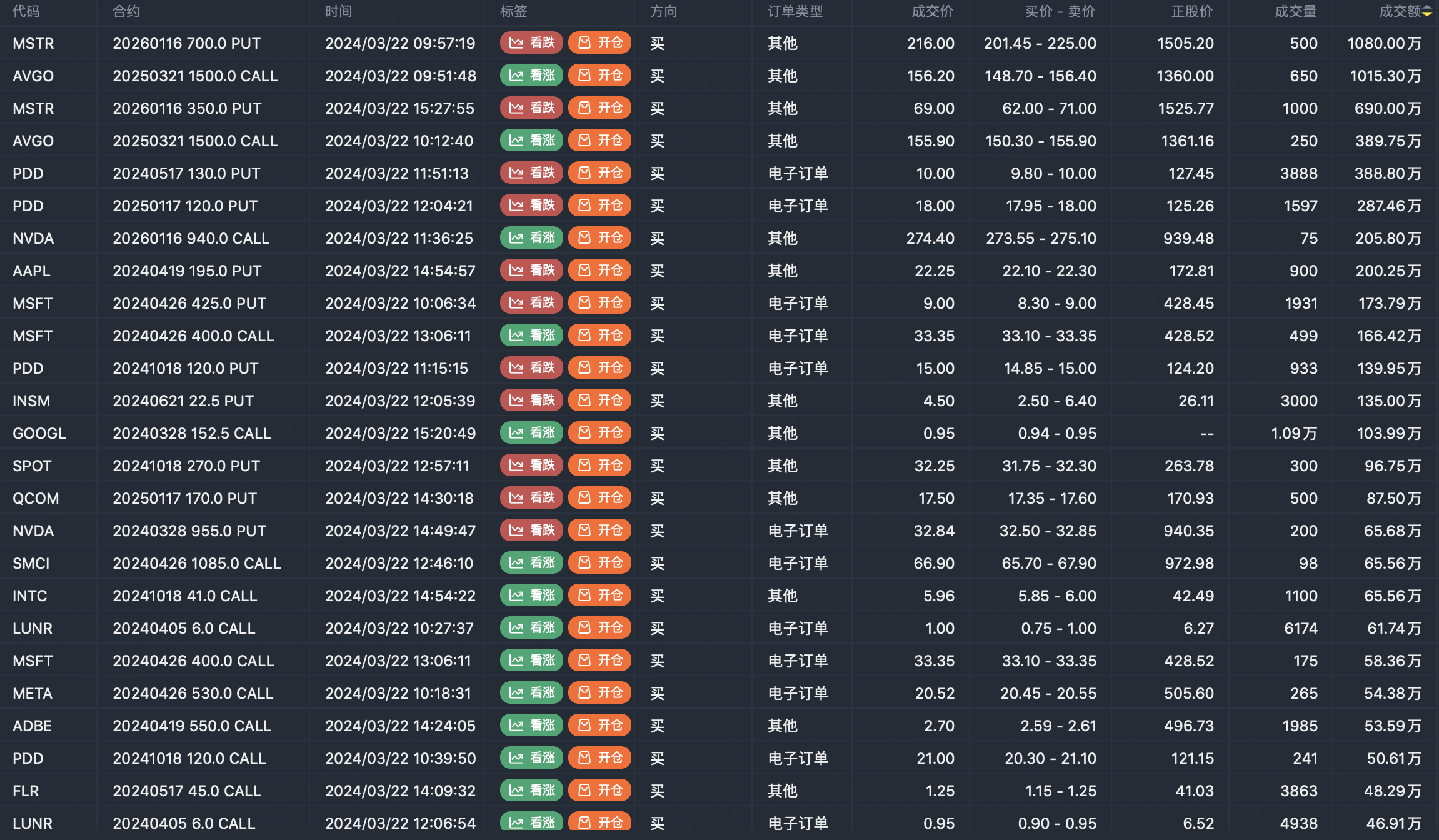

Option buyer open position (Single leg)

Buy TOP T/O:

$MSTR 20260116 700.0 PUT$ $AVGO 20250321 1500.0 CALL$

Buy TOP Vol:

$GOOGL 20240328 152.5 CALL$ $SIRI 20240719 5.5 CALL$

Option seller open position (Single leg)

Sell TOP T/O:

$MSFT 20240426 400.0 CALL$ $SNOW 20241220 160.0 PUT$

Sell TOP Vol:

$PLTR 20240328 22.5 PUT$ $MU 20240419 130.0 CALL$

Note: This image data is from Tiger PC. This screen is a significant sell open position for an option contract in the market. A sell of a call option means that the trader believes that the underlying trend has peaked, and a sell of a put option means that the trader believes that the underlying trend has bottomed. These contract openings typically indicate significant activity in the underlying stock, including whether the trader is willing to accumulate a long or short option position.

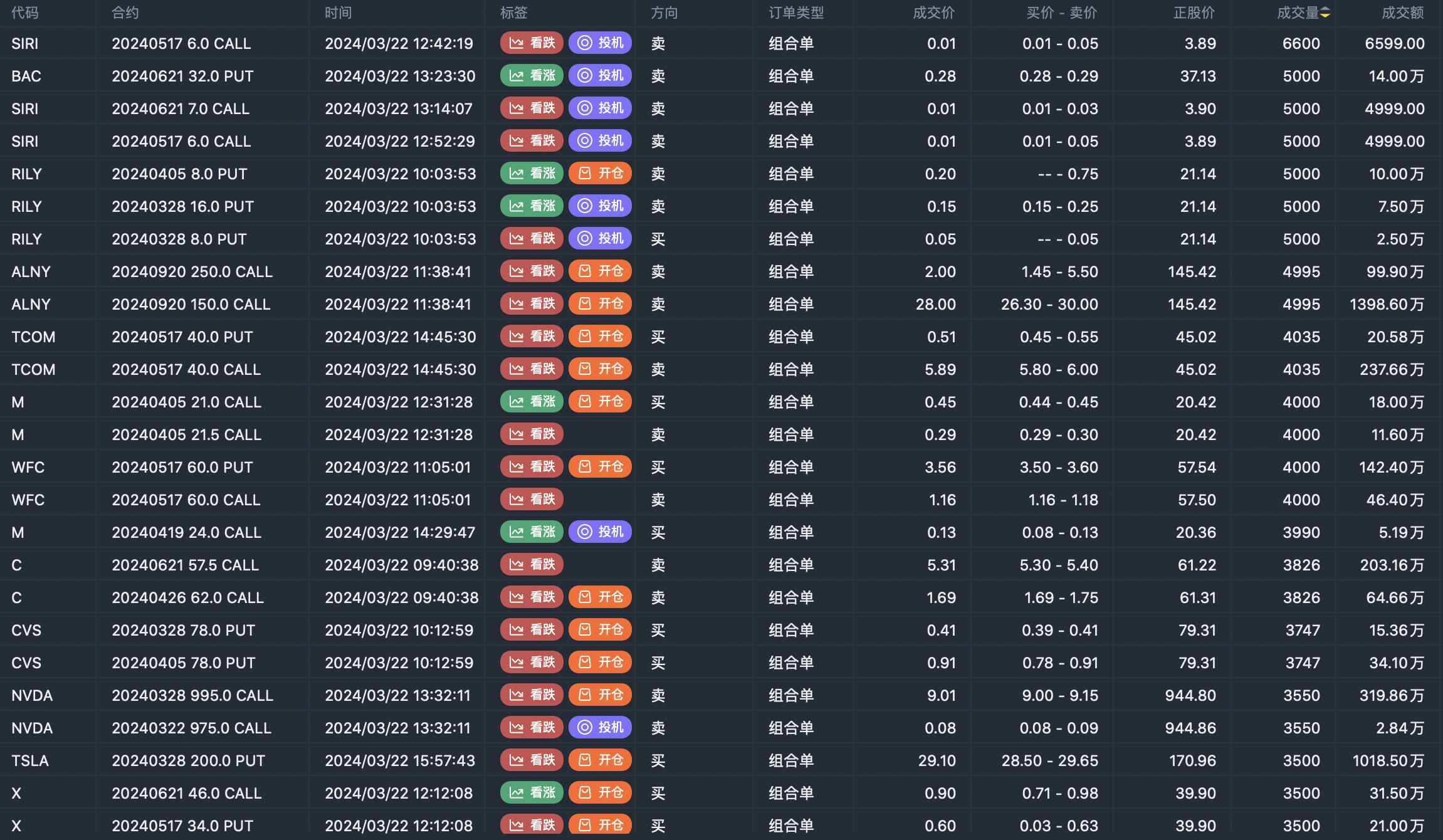

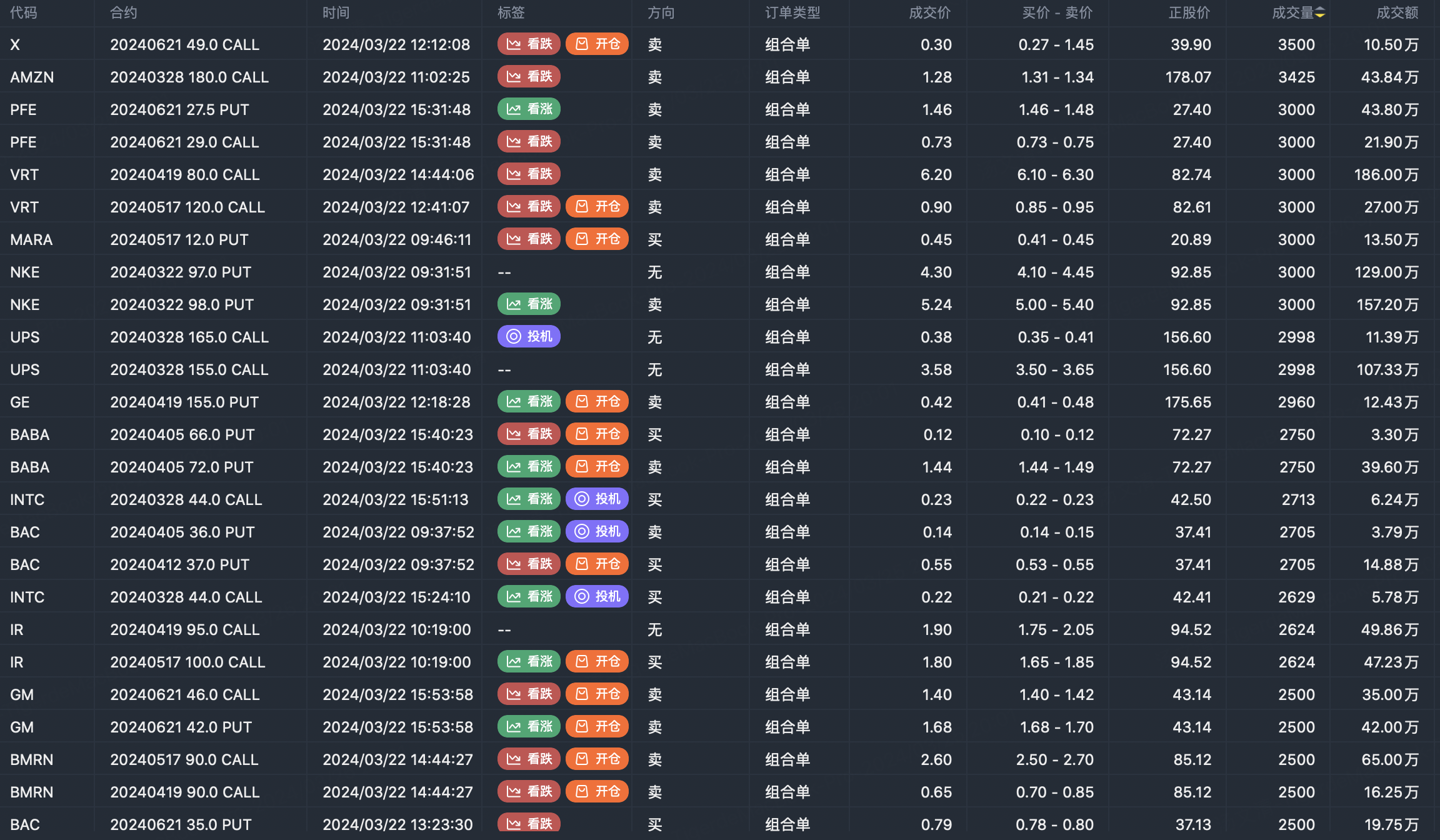

Options portfolio open position

Note: This image data is from Tiger PC. This screening is a significant portfolio of options contracts in the market. Portfolio opening includes a variety of underlying trends, requiring traders to further master the basic knowledge of options for analysis and judgment.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Great ariticle, would you like to share it?

Great article, would you like to share it?

Great ariticle, would you like to share it?

Great article, would you like to share it?