Downside Expectations for Large-Caps Ease, Small-Caps Seen Extending Gains

The surprisingly cool U.S. April jobs report stoked hopes for an earlier start to Fed rate cuts, sending the VIX fear gauge to a one-month low and pushing Treasury yields lower. Apple rallied nearly 6%, leading tech stocks higher.

As the S&P 500 gradually rose, options market data showed continued adjustments to hedge put positions by raising strike prices. For QQQ, downside expectations for May were lowered, with a decline of less than 2.7% priced in by May 31st expiration. Small-cap Russell 2000 options saw active buying of calls, implying expectations for the index to trade above 205 by June 21.

Details:

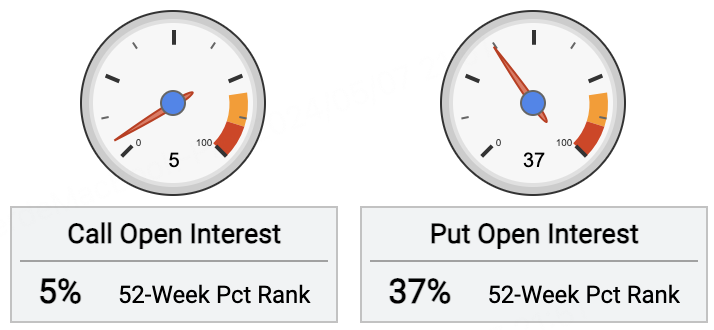

The $SPDR S&P 500 ETF Trust(SPY)$ options overall reflected a bullish trading sentiment, with sellers of put options dominating. Open call interest declined -4.9% over the past 5 days. Open put contracts increased 7.2% over the same period.

For call options, investors' largest opening position was the $SPY 20240507 518.0 CALL$ with a 518 strike, adding 23,000 contracts.

The most sold put option was the $SPY 20240614 405.0 PUT$ with a 405 strike, adding 350,000 contracts as part of a put spread with the $SPY 20240614 450.0 PUT$ . This implies expectations for a decline of less than 12.9% in the S&P 500 ETF by June 14 expiration.

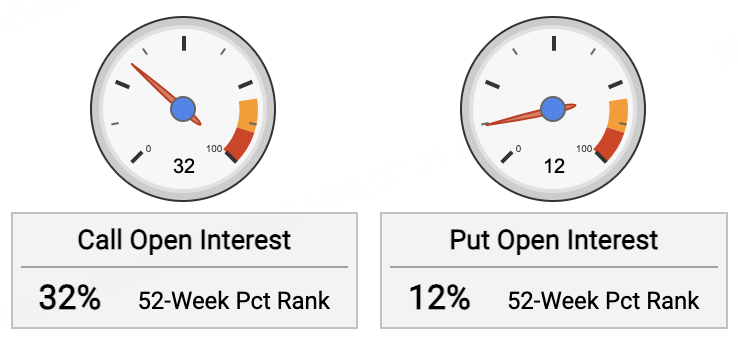

The $Invesco QQQ(QQQ)$ options overall showed a bullish trading sentiment, with sellers of put options dominating. Open call interest increased 1.1% over the past 5 days. Open put contracts grew 1.5% over the same period.

For call options, the most actively traded was the $QQQ 20240524 470.0 CALL$ with a 470 strike, adding 5,850 contracts. This suggests expectations for upside in QQQ to be capped below 6.8% by May 24.

For put options, investors sold the most new $QQQ 20240531 428.0 PUT$ with a 428 strike, adding 7,510 contracts. This implies expectations for a decline of less than 2.7% in QQQ by May 31 expiration.

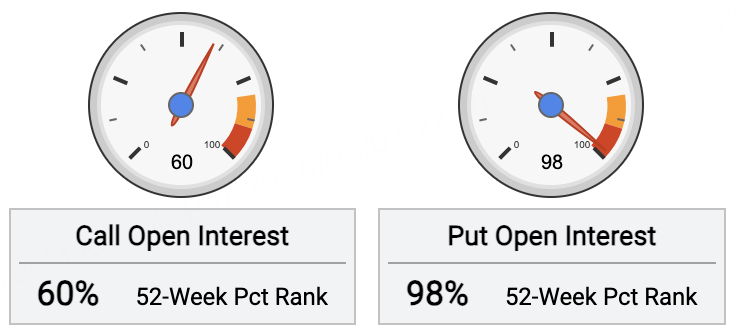

The $iShares Russell 2000 ETF(IWM)$ options overall reflected a bearish trading sentiment, with buyers of put options dominating. Open call interest grew 5% over the past 5 days, while open put contracts increased 5% over the same period.

For call options, investors sold the most $IWM 20240621 205.0 CALL$ with a 205 strike, adding 10,000 contracts. This signals expectations for IWM to trade above 205 by June 21 expiration.

For put options, investors heavily bought the $IWM 20240621 194.0 PUT$ with a 194 strike, adding 87,000 contracts as part of a put spread with the $IWM 20240621 192.0 PUT$ . This implies expectations for a 4.9% decline in IWM by June 21.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- KevinKelly·05-07Small-cap stocks, on the other hand, are expected to extend their gains.LikeReport

- Tom Chow·05-08goodLikeReport