Why Did Dollar Move Higher and Gold Tumble On The June FOMC?

Overnight, the much-anticipated Federal Reserve's June interest rate meeting debuted. The Federal Reserve announced in the early hours of June 13, 2024, Beijing time that it would continue to maintain the target range for Federal Funds rate between 5.25% and 5.50%.This is the seventh consecutive time rates have been kept unchanged since September last year.The Fed's decision was in line with market expectations.

Since March 2022, the Federal Reserve has conducted 11 rate hike, ranging from 25 basis points at the beginning to 50 basis points later, and 75 basis points for 4 consecutive times. After the subsequent rate hike gradually slowed down, so far rate hike has been suspended 7 times in a row, choosing to stay on hold. The market generally expects the Fed's next move to cut interest rates.

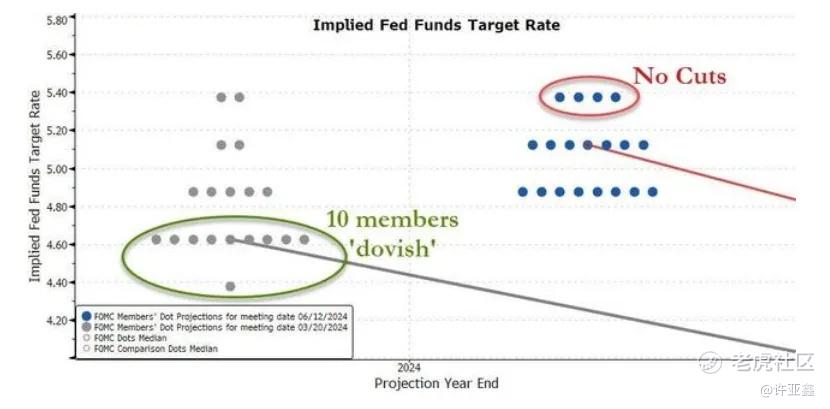

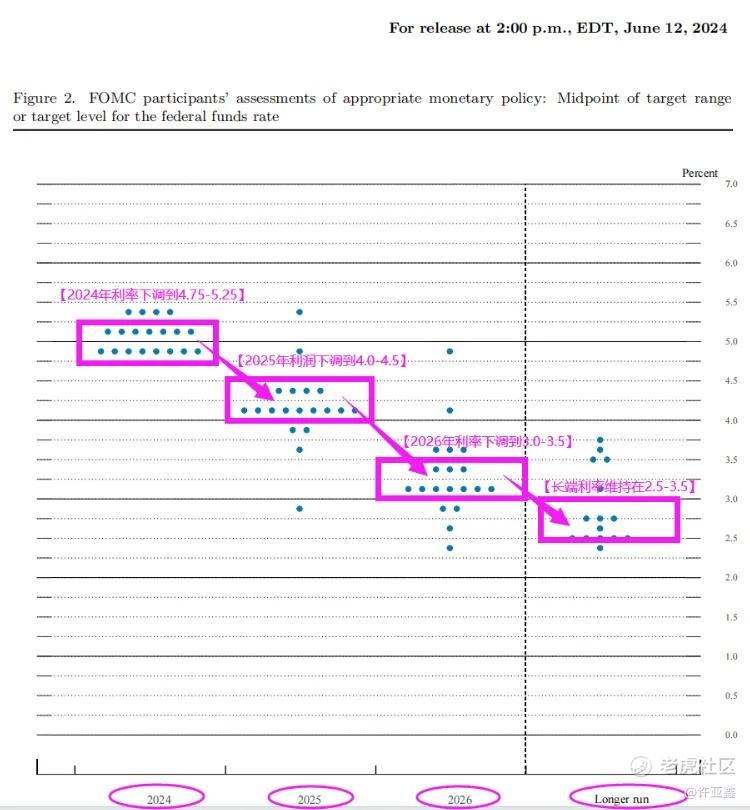

As I mentioned to you before, the focus this time is to look at the dot plot. The results that come out suggest that,There may only be one interest rate cut this year (in line with Scenario 3 mentioned above), and 100 basis points will be cut in each of the next two years.

As shown in the figure above, compared with the dot plot in March this year, Fed officials' expectations for interest rate cuts this year have dropped significantly. Only eight of the 19 Fed officials who provided rate forecasts expect policy rates to fall below 5.0% this year, compared with 15 officials who had rates below 5.0% last time.

In March, 10 Fed officials made dovish forecasts for at least three rate cuts this year, and no one did so this time. Therefore,This time it is a hawkish dot plot adjustment.

In addition, Fed officials raised their core PCE inflation forecast for 2024 to 2.8% from 2.6% and for next year to 2.3% from 2.2%, but kept their forecast for reaching the 2% policy target in 2026 unchanged.

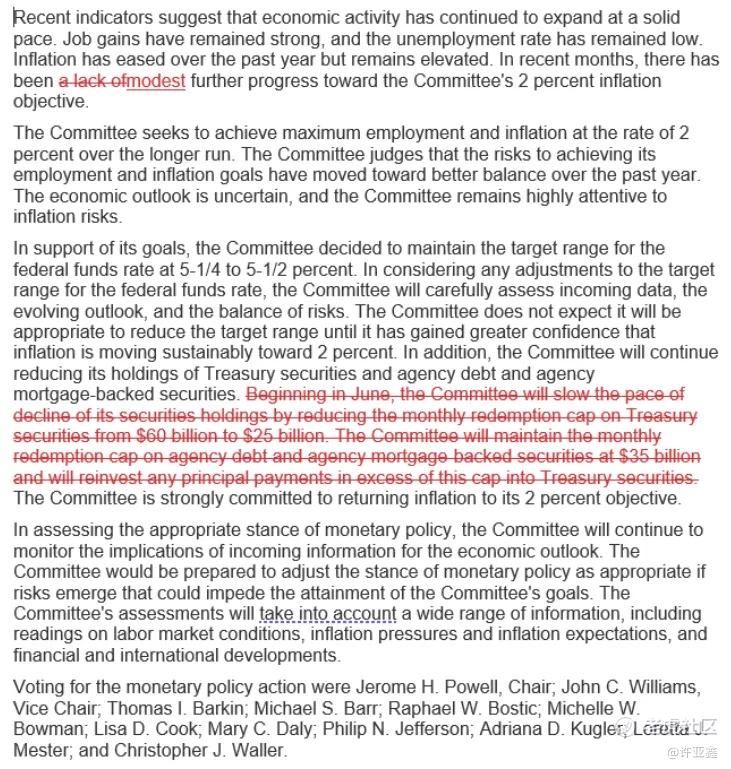

After talking about the dot plot, let's take a closer look at the post-meeting statement in June Compared with the one in early May, the general content is changed, mainly reflected in two aspects--

First, in terms of inflation,The last statement was, "In recent months, in achieving the Fed's inflation target of 2%,Lack of further progress.The statement this time is, "In recent months, in achieving this inflation target,Moderate further progress has been made.”

Second, QT. For the first time in nearly two years, the last statement revised the wording on the plan to shrink the balance sheet (shrinking balance sheet), announcing that starting this month, the monthly shrinking balance sheet cap on Treasury Bond in the United States will be lowered by US $35 billion to US $25 billion. The shrinking balance sheet cap on securities (MBS) remains unchanged. This time, these rhetoric has been deleted and renamed, "The FOMC will continue to reduce its holdings of U.S. Treasury Bond, agency debt and agency MBS."

Finally, let's talk about Fed Chairman Powell's question-and-answer session at the press conference.

Powell said that the U.S. economy has made significant progress, and recent indicators show that economic growth is still expanding at a steady rate.

Inflation has eased significantly, but remains too high.He acknowledged that the monthly inflation data has moderated, but confidence has not yet reached the level of interest rate cuts. "We have made moderate progress, but we need more good data."

Speaking of the May CPI report released before the market, Powell said, "We are happy to see today's inflation data and hope to have more similar data." He emphasized that the test of interest rate cuts is more about inflation moving closer to 2% confidence, "We see today's CPI report as progress, which strengthens our confidence."

The Fed will continue to make decisions meeting by meeting, "We have not committed to a specific path of rate cuts."No one is taking rate hike as a base case, "We think interest rates will eventually need to come down."

Regarding the labor market, Powell said the bank is closely watching for signs of weakness in the labor market, but has not yet seen such signs.Job growth may be somewhat over-read, but it's still strong; Turnover rates have fallen, job openings have dwindled, and it is no longer the overheated state it was a few years ago.

The first rate cut has an impact on the economy, and the timing is very important. It is not yet time to announce the date of the rate cut. But in the long run, more important is the entire interest rate path, not just the first rate cut.

-END-

$NQ100 Index Main Link 2312 (NQmain) $$SP500 Index Main Line 2312 (ESmain) $$Dow Jones Main 2312 (YMmain) $$Gold Main Link 2312 (GCmain) $$A50 Index Main 2403 (CNmain) $

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- BernardLL·06-14If u know the real answer, u will be damn rich1Report

- Taurus Pink·06-15[龇牙] [龇牙] [龇牙]LikeReport