Another Stagflation Risk? How could July CPI "surprise" the market?

As the U.S. Bureau of Labor Statistics is about to release July's Consumer Price Index (CPI) data, the market is increasingly concerned about inflation trends.Recently, stagflation (Stagflation) risk is again clichéd as one of the main risk factors.The emergence of this phenomenon not only affects the economic growth expectations, but also has a far-reaching impact on investor sentiment and market strategy.

Stagflation is the phenomenon where slow economic growth coexists with high inflation.

Historically, the most recognizable example of stagflation occurred in the 1970s, when the U.S. experienced the double whammy of high inflation and high unemployment.Currently, the U.S. economy is facing similar challenges, with rising inflation and slowing economic growth raising market concerns about stagflation.

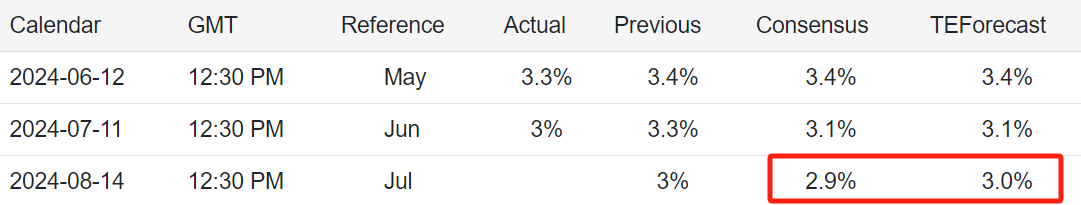

CPI data expectations

According to the general market expectations, the core CPI is expected to increase by 0.2% in July from the previous month, with an annualized growth rate of 3.2%.The overall CPI is also expected to increase by 0.2%, with an annual growth rate of 2.9%.

This data reflects a slowing trend in inflation, but market concerns about the future economic situation remain.If the CPI data failed to slow down as expected, it may trigger the fear of stagflation.

At that point, the market would withdraw some of the "Fed rate cut" trade that had been factored in, and yields on U.S. bonds as well as the U.S. dollar index would likely rally;

The stock market will further factor in recessionary expectations, prompting further declines and putting more pressure on growth stocks.

Definition and Impact of Stagflation

Stagflation is an economic phenomenon in which slow economic growth coexists with high inflation.Its main effects include:

Slower economic growth: Stagflation is usually accompanied by weaker economic growth and lower corporate profitability, leading to pressure on the stock market.

Persistently high inflation: Even if the economy slows, inflation is likely to remain at a high level, increasing cost pressures on consumers and businesses.

Monetary policy constraints: In a stagflationary environment, it is difficult for the central bank to stimulate the economy by cutting interest rates, further exacerbating market jitters.

Specific manifestations of the risk of stagflation in the July CPI

1. Economic slowdown and inflation go hand in hand

Analysis pointed out that the current signs of slowing U.S. economic growth is obvious, especially the weakness of the labor market.If the July CPI data is less than expected, it may trigger market concerns about recession, while high inflation will continue, which is a typical feature of stagflation.

2. Energy market volatility

Volatility in energy prices is an important factor affecting CPI.Recently, while energy prices have declined, geopolitical tensions in the Middle East could lead to supply disruptions, which in turn could push up oil prices.If oil prices spike again, this could lead to a rise in the CPI, despite sluggish economic growth.

3. Impact of the housing market

Housing costs are an important component of the core CPI.Despite the recent slowdown in housing inflation, if home prices continue to rise, there could be continued upward pressure on core CPI.Analysis suggests that if the Fed cuts interest rates early, it could stimulate the housing market and further exacerbate housing inflation.

Investors' coping strategies

The challenges facing investors have intensified against the backdrop of stagflation.The coexistence of a slowing economy and inflation could result in the Federal Reserve's monetary policy options being limited to stimulate the economy through interest rate cuts.This would have a negative impact on the stock market, especially the S&P 500, which could face downward pressure on earnings estimates.Investors may turn to defensive assets to reduce risk and increase allocations to stocks with stable income and low volatility in response to economic uncertainty.

Historical Stagflation - The Stagflation Event of the 1970s

Economic Background

HIGH INFLATION AND LOW GROWTH: During the 1970s, the U.S. experienced sustained high inflation, which at one point exceeded 11 percent annually.At the same time, economic growth was slow and unemployment peaked in 1974 at nearly 9%.

Oil price shock: The oil crises of 1973 and 1979 led to soaring oil prices, which further drove inflation.Rising energy prices directly affected production costs and consumer spending.

Policy Response: The Federal Reserve at the time, under the leadership of Paul Volcker, adopted an aggressive monetary policy to curb inflation by raising interest rates to over 20%.While this policy succeeded in reducing inflation, it also triggered a severe recession.

Current Economic Situation

Economic Background

RISING INFLATION: Annual inflation in the U.S. reached 3% in June 2024, according to the latest data.Although lower compared to its peak in the 1970s, this is still above the Federal Reserve's target level.

Economic growth slowdown: Currently, the U.S. economy is facing challenges to growth, especially in light of global economic uncertainty and supply chain issues, and the pace of growth has slowed significantly.

Policy response: The Federal Reserve faces a dilemma in dealing with inflation, both to control it and to avoid exacerbating the recession.Current monetary policy is relatively cautious and interest rate levels have not yet reached the extremes of the 1970s.

Similarities

Coexistence of high inflation and low growth: The central feature of stagflation, both in the 1970s and in the current economic situation, is the coexistence of high inflation and low economic growth.

Impact of external shocks: The oil crisis of the 1970s and the current global supply chain issues and geopolitical tensions (e.g. the war in Ukraine) have had a significant impact on the economy.

Policy challenges: In both cases, policymakers face the challenge of finding a balance between controlling inflation and supporting economic growth.

Differences

Level of inflation: Inflation in the 1970s was much higher than current levels, and the economic environment was much tougher then.

Evolution of policy tools: The current Federal Reserve has a richer set of monetary policy tools and greater policy transparency, allowing it to respond more flexibly to economic challenges.

Changes in the structure of the economy: Changes in the modern economy in terms of technology, financial markets and globalization have made the economic response mechanism very different from that of the 1970s.

Stagflation as the main risk factor for July's U.S. CPI reflects the complexity of the current economic environment.The coexistence of slowing economic growth and high inflation will have a profound impact on the market, and investors need to pay close attention to the upcoming data releases so that they can adjust their strategies in time to cope with possible market volatility.

Flexible investment strategies and sensitivity to market dynamics will be the key to success in the face of potential stagflation risks.

$S&P 500(.SPX)$ $Cboe Volatility Index(VIX)$ $United States Oil Fund LP(USO)$ $W&T Offshore(WTI)$ $WTI Crude Oil - Sep 2024(CL2409)$ $ProShares UltraPro QQQ(TQQQ)$ $ProShares UltraPro Short QQQ(SQQQ)$ $NASDAQ(.IXIC)$ $Invesco QQQ(QQQ)$ $SPDR S&P 500 ETF Trust(SPY)$ $US20Y(US20Y.BOND)$ $US10Y(US10Y.BOND)$ $US2Y(US2Y.BOND)$ $iShares 20+ Year Treasury Bond ETF(TLT)$ $Direxion Daily 20 Year Plus Treasury Bull 3x Shares(TMF)$ $Direxion Daily 20 Year Plus Treasury Bear 3x Shares(TMV)$

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- neo26000·08-13There is only one number expected this week - 0.2. Any other number...just fasten your seat belts for the roller coaster ride.LikeReport

- kooko·08-13Possible stagflation risk in July CPI data [Doubt][Concern] Stay alert! [Warning]LikeReport

- zuzu99·08-13Great analysisLikeReport