This Week's Covered Call Rolls: $NVDA, $TSLA, $COIN, $MSTR$

An overview of institutional covered call rolls for the new week:

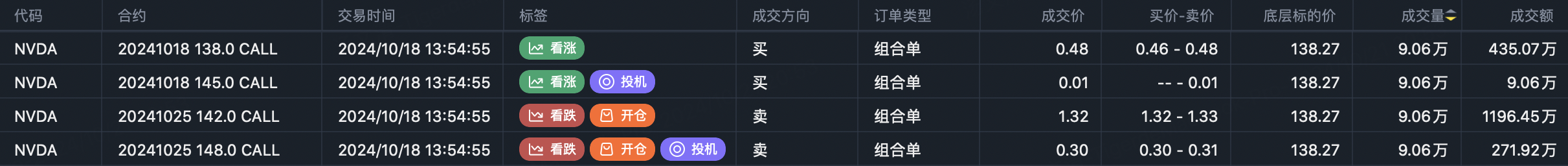

$Nvidia (NVDA)$

Sell $NVDA 20241025 142.0 CALL$

Buy $NVDA 20241025 148.0 CALL$

Institutions closed out the $138 and $145 strikes while opening the $142 and $148 calls. The higher strikes signal continued bullish sentiment on Nvidia this week.

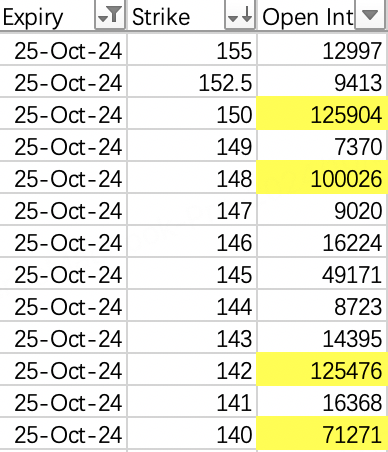

However, there are three call strikes with over 100,000 contracts of open interest expiring this week: $142, $148, and $150. Plus $140 still has 71,000 open after last week's rally attempt.

So while a push through $142 seems manageable, capping gains below that strike like last week could prove challenging for dealers.

Selling the $150 calls ($NVDA 20241025 150.0 CALL$ ) seems lower risk on the call side. For puts, $130 looks appealing but the uptrend makes outright put sales less attractive. I'll wait for a pullback.

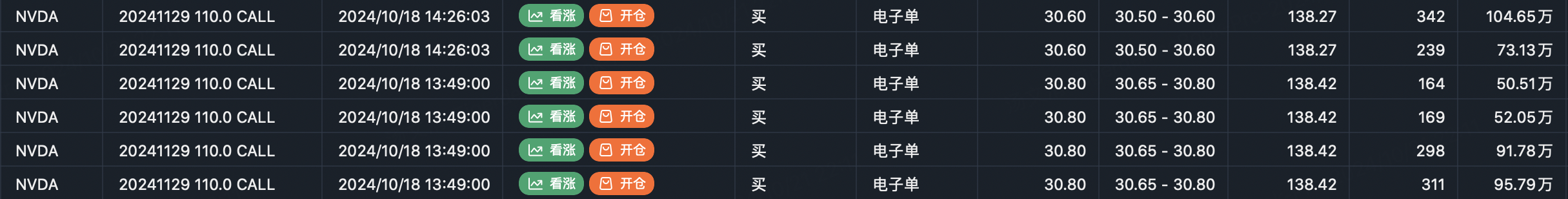

Additionally, there were scattered buyers of the Nov 29th $110 calls ($NVDA 20241129 110.0 CALL$ ) for around 10,000 contracts total. The ongoing bullish Nvidia flows are becoming numb at this point.

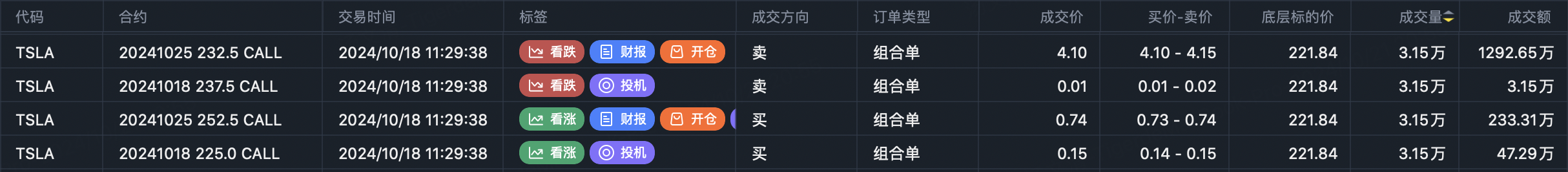

$Tesla (TSLA)$

Sell $TSLA 20241025 232.5 CALL$

Buy $TSLA 20241025 252.5 CALL$

Dealers closed the $225 and $237.5 strikes while opening the $232.5 and $252.5 call strikes - a higher range versus last week, likely due to earnings and Tesla's new "Trump stock" status.

The $200-$240 range still seems fair, so similar trades as before: sell the $200 puts ($TSLA 20241025 200.0 PUT$ ). For a wider call spread, the $250 strike ($TSLA 20241025 250.0 CALL$ ) could cap upside.

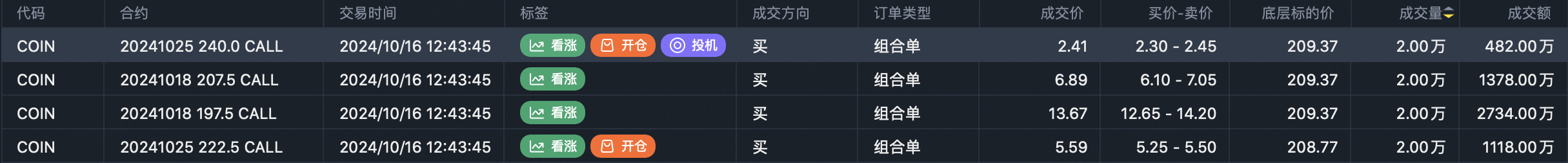

$Coinbase Global, Inc. (COIN)$

Sell $COIN 20241025 222.5 CALL$

Buy $COIN 20241025 240.0 CALL$

Coinbase covered calls remain easy to sell short-dated calls on, though $240 is the highest strike to consider for this week.

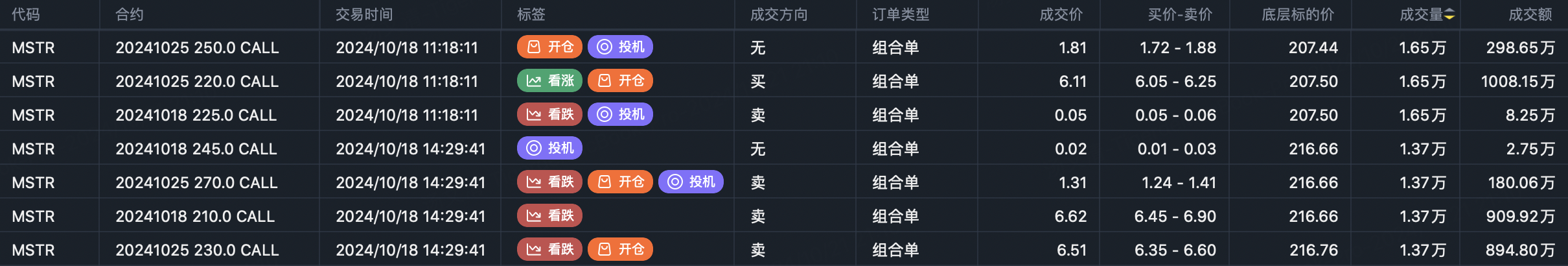

$MicroStrategy Incorporated (MSTR)$

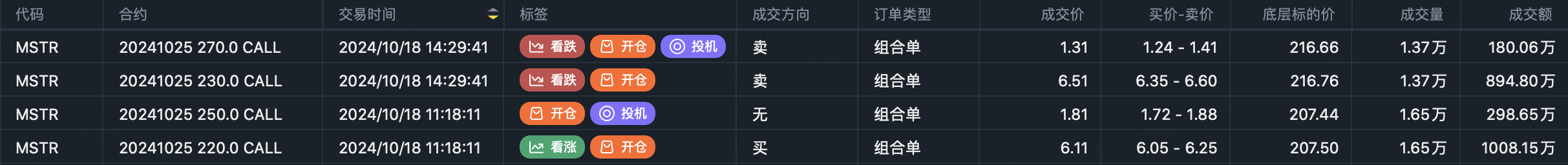

This one looks messy, but removing the Oct 18th expiry makes it cleaner:

Removing Oct 18th, you can see the dealer opened bullish positions in the $220, $230, $250, and $270 call strikes.

I wish this trader was handling Nvidia instead - with such an aggressive call spread, $150+ on Nvidia this week would be a breeze.

For MSTR, simply selling the highest $270 strike ($MSTR 20241025 270.0 CALL$ ) matches their upside views. The premium looks low but actually translates to over 21% annualized.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- KSR·09:38👍LikeReport

- YueShan·00:35Good ⭐️⭐️⭐️1Report