Two Updates: Nvidia Earnings Expectations Around $160, Tesla Naked Call Sellers Take Losses and Exit

Expecting NVDA to close this week around $140-$150, with initial earnings projections above $160.

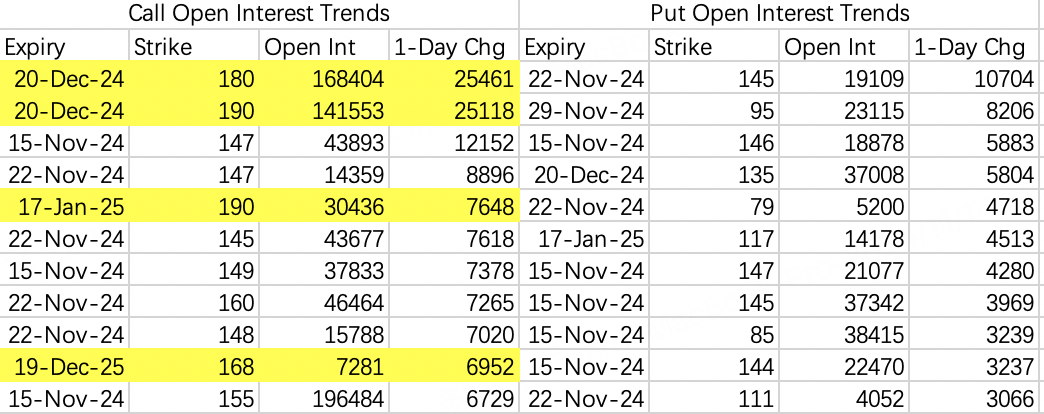

According to new open interest data, large traders have started positioning for next week's earnings report, adding predominantly bullish options exposure overall.

Three notable option trade groups:

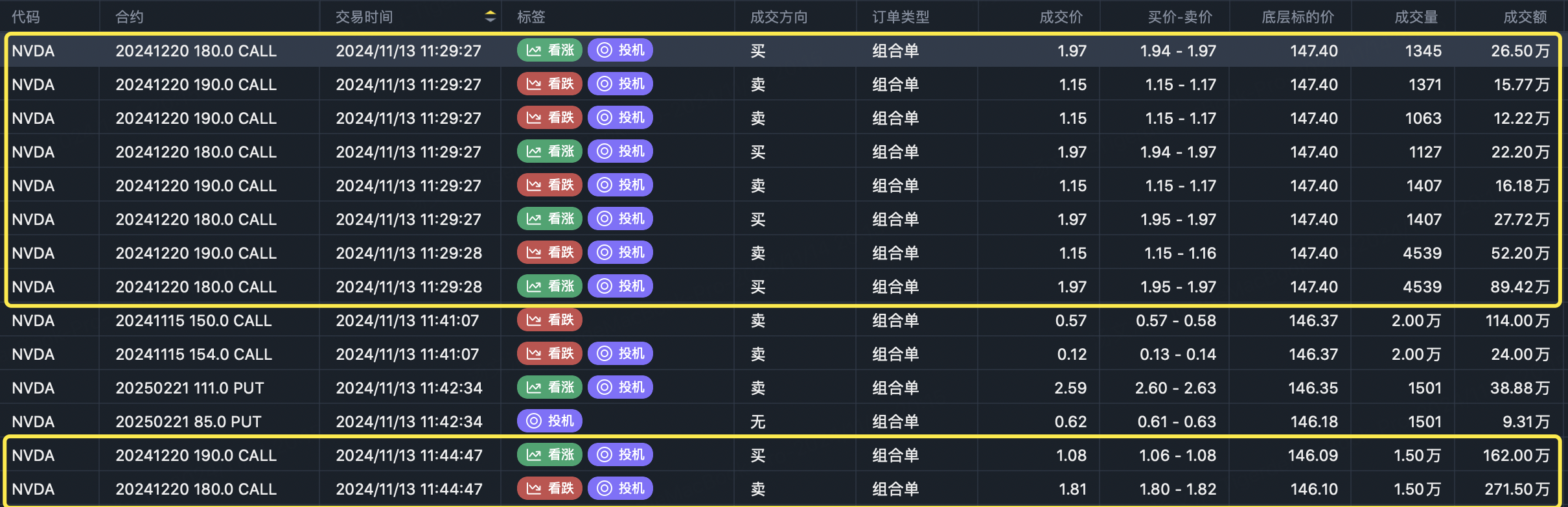

The largest new Opening positions were the December $180 and $190 calls:

$NVDA 20241220 180.0 CALL$ - Opened 25,000 contracts

$NVDA 20241220 190.0 CALL$ - Opened 25,000 contracts

The directional bias is unclear, possibly buying the $180s and selling the $190s, or vice versa. Either way represents bullish opening trades.

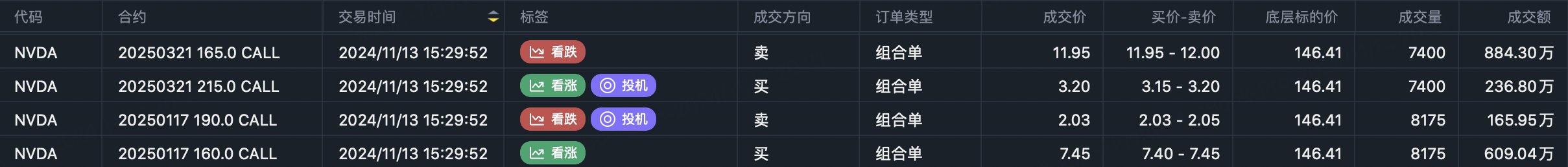

The second major transaction was a closing roll combo:

Closed $NVDA 20250321 215.0 CALL$ and $NVDA 20250321 165.0 CALL$

Opened $NVDA 20250117 160.0 CALL$ and $NVDA 20241220 190.0 CALL$

This was an institutional crowd trade, likely buying the $160 calls and selling the $190s based on previous experience interpreting these flows.

While rolling down the expiration can signal a more bearish stance, there wasn't a clear downside bias in this adjustment beyond collecting premium on the sale.

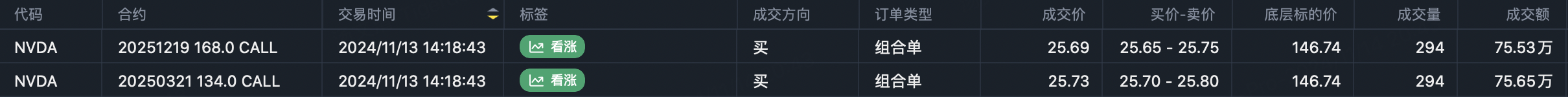

The third unusual trade closed March 2025 $134 calls, rolling into December 2025 $168 calls:

Closed $NVDA 20250321 134.0 CALL$

Opened $NVDA 20251219 168.0 CALL$

Despite not being a crowd print, this was also a more complex multi-leg order. Rolling up the strike is typically seen as a bullish adjustment.

Putting it together, these large players are anchoring around a $160+ strike heading into earnings, expressing an overall bullish bias.

I sold the $156 calls $NVDA 20241115 156.0 CALL$ this week, as well as next week's $135 puts $NVDA 20241122 135.0 PUT$ .

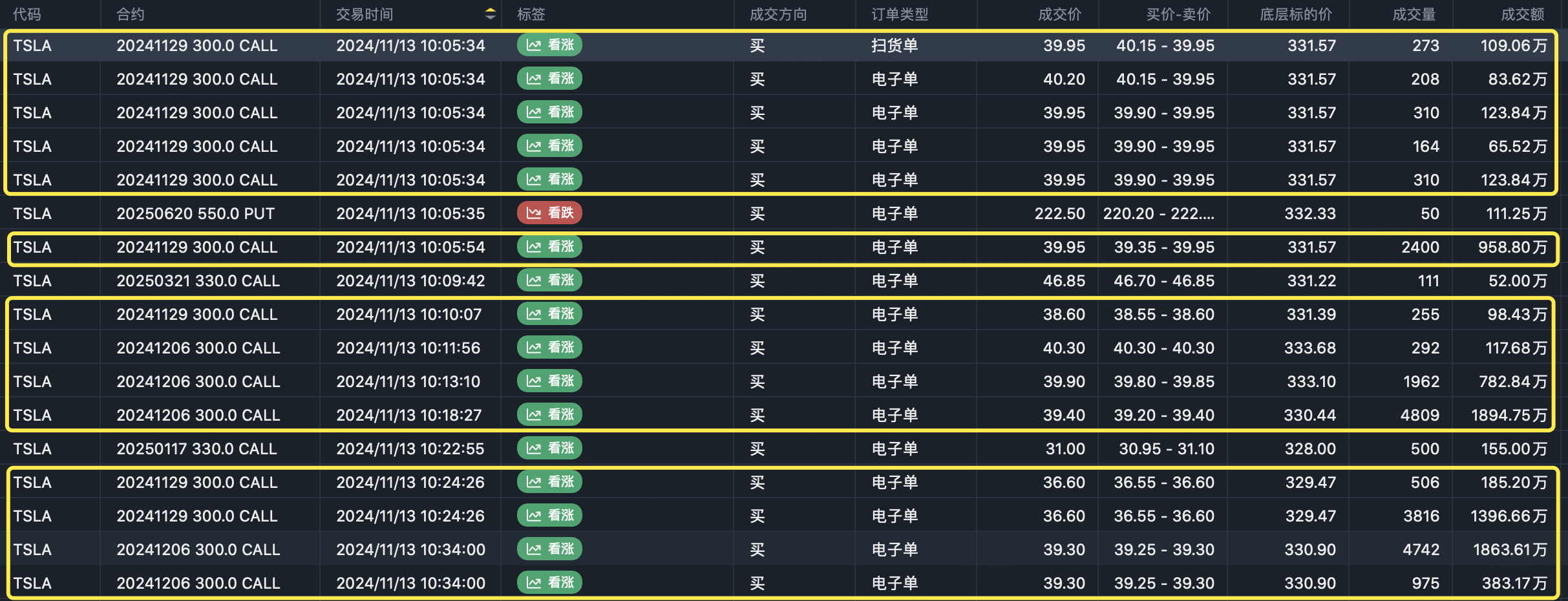

In my article from November 8th, I mentioned someone had sold large naked call trades - the November 29th $300 calls $TSLA 20241129 300.0 CALL$ and December 6th $300 calls $TSLA 20241206 300.0 CALL$ .

On Wednesday, they bought back both of those short call positions to close for roughly 100% losses.

The timing of this cover is quite interesting. The trader likely felt TSLA would not drop below $300 before late November, so they bit the bullet and took the loss on this pullback.

As a bull, I certainly hope they're right. But considering the initial trade was likely ill-advised, there's a decent chance the covering decision was also premature. It does suggest the market is gradually accepting TSLA's valuation above $300 though.

I'm maintaining my TSLA call positions while also selling put spreads like the $280 puts $TSLA 20241122 280.0 PUT$ to reduce my overall premium outlay.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- YueShan·11-15Good ⭐️⭐️⭐️LikeReport