Institutions Self-Implode Shorting $TSLA$; 6 Strategies for $NVDA$ Earnings

After seeing Tesla's new large option trades yesterday, I couldn't help but chuckle at the comedy of errors that could end up fueling a move to $370.

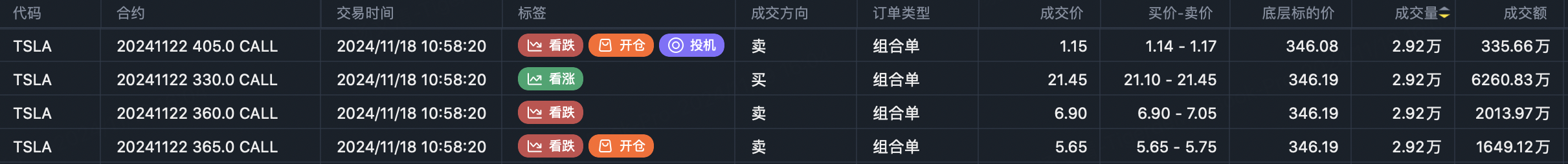

First, the institutional hedgers rolled their $330-$360 collar up to $365-$405, now expecting TSLA to stay below $365 while hedging the $365-$405 upside:

Sell $TSLA 20241122 365.0 CALL$

Buy $TSLA 20241122 405.0 CALL$

As I mentioned yesterday, the logical short strike for a pullback in week 2 should have been the prior $360 highs, not the $330 level from Friday's highs which was excessive.

But with Monday's open above $340, they seemingly lacked conviction in getting back below $330 this week, so they rushed to re-adjust higher.

Buying the $405 calls to cap upside was prudent, contrasting sharply with the self-implosion below.

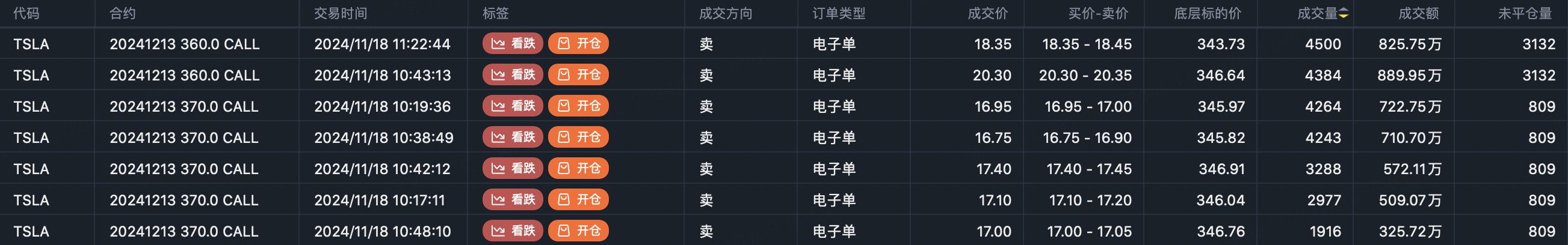

The second major trade was actually two likely related transactions:

Sell to Open $TSLA 20241213 360.0 CALL$ 18,900 contracts

Sell to Open $TSLA 20241213 370.0 CALL$ 40,000 contracts

This trader sold the December 13th $360 and $370 calls for a colossal 18,900 and 40,000 lot respectively.

The concept here is they will face volatile risk exposure if TSLA touches $360 by Dec 13th, requiring margin/deleveraging. And if it rallies just 2.7% higher to $370, they've essentially planted a bomb underneath their position to fuel the move higher.

It ties back to the familiar high/low probability narrative - if TSLA stays subdued into Dec 13th expiry, they'll harvest premium selling these calls. But any sudden upside rip to re-test highs could self-immolate this position as fuel for a squeeze.

This chaotic approach is giving me PTSD flashbacks to the guy who sold the $300 calls a few weeks ago and got run over. Is that you bro? If so, thanks in advance for your contributions.

On Monday we saw a third wave of distinct earnings flows, perhaps positioned more speculatively for volatility after NVDA's pullback.

The first trader did a $155 call debit spread, funding the long calls by selling $130 puts:

Sell to Open $NVDA 20241206 130.0 PUT$ 5,000 contracts

Buy to Open $NVDA 20241206 155.0 CALL$ 5,000 contracts

This is elegant - the put sales roughly offset the debit paid for the $155 calls. Max gain if NVDA rallies past $155, no loss between $130 and $155, and defined risk below $130.

The second trader played a longer-dated $155/$175 call spread, also selling puts to defray the upside call costs:

Sell to Open $NVDA 20250321 120.0 PUT$

Buy to Open $NVDA 20250321 155.0 CALL$

Sell to Open $NVDA 20250321 175.0 CALL$

More robust than the first trade, though I may have chosen a nearer-dated short $175 call.

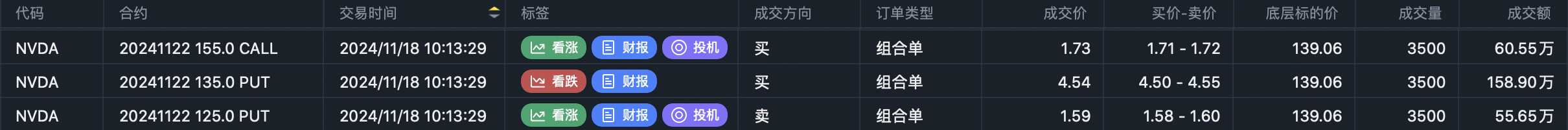

The third trader bought a strangle for a volatility play, seemingly more bearish expecting NVDA between $125-$135 post-earnings:

Sell to Open $NVDA 20241122 125.0 PUT$

Buy to Open $NVDA 20241122 135.0 PUT$

Buy to Open $NVDA 20241122 155.0 CALL$

All this week's expiries, suggesting the $155 calls were mainly for a volatility hedge rather than betting on a big rally.

The fourth trader seems bullish above $150 but protected against a catastrophic decline:

Sell to Open $NVDA 20241122 105.0 PUT$

Buy to Open $NVDA 20241122 125.0 PUT$

Buy to Open $NVDA 20241220 150.0 CALL$

Sell to Open $NVDA 20250117 180.0 CALL$

Again mixing weekly put sales with slightly longer-dated upside exposure, cautiously bullish while guarding against a disaster scenario.

The fifth trader just bought $76 puts expiring this week, likely a retail volatility speculation:

Buy to Open $NVDA 20241122 76.0 PUT$ 21,000 contracts

They paid $2M premium buying these puts at the lows around 9:50am, probably down big already. The market maker selling them these lottery tickets is laughing.

The sixth trader did the opposite, selling volatility by shorting some $110 puts:

Sell to Open $NVDA 20241220 110.0 PUT$

In contrast to the $76 put buyer above, this trader shorted $110 puts on the dip, a relatively safe earnings strangle to sell.

My Position:

After observing for 3 days, the market seems fairly cautious on NVDA earnings expectations. The key levels in focus are whether it can break $150 (with $160 seemingly the upside cap) or if it crashes below $125.

So my trade is: Stock + Sell Put $NVDA 20241122 120.0 PUT$ + Sell Call $NVDA 20241122 160.0 CALL$

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- KSR·2024-11-20👍LikeReport

- YueShan·2024-11-20Good ⭐️⭐️⭐️LikeReport