Walmart's Massive New Put Options Activity & Chinese ADRs' Mixed Opportunities and Risks

Chinese ADRs are showing significant options activity, with diverging views on recent market movements.

$X-trackers Harvest CSI 300 China A-Shares Fund(ASHR)$

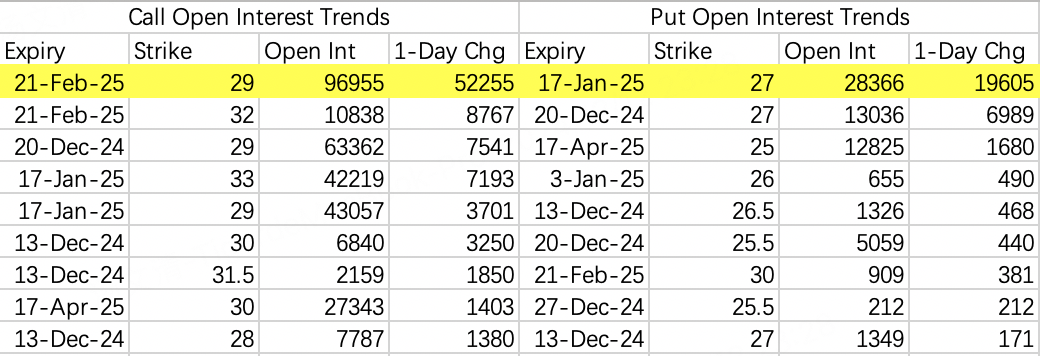

On Wednesday, someone opened a position of 100,000 contracts in February 2025 29 calls $ASHR 20250221 29.0 CALL$ , while another bought 25,000 contracts of January 2025 27 puts $ASHR 20250117 27.0 PUT$ .

Both options' transaction details show automated order placement, not floor trading.

$KWEB$ options mainly saw new open interest in calls, with floor trading showing a bullish spread strategy, direction unclear:

Opening $KWEB 20250117 35.0 CALL$ , volume 9,000 contracts

Opening $KWEB 20250117 37.0 CALL$ , volume 9,000 contracts

$FXI$ showed two notable movements, one through floor trading.

Regular trading saw 13,000 contracts of December 20 31 puts $FXI 20241220 31.0 PUT$

Floor trading opened February 2025 31 puts and 32 calls $FXI 20250221 31.0 PUT$ $FXI 20250221 32.0 CALL$ , 15,000 contracts each.

After Monday's surge, Chinese ADRs returned to baseline. New put options could indicate bearish sentiment or hedging by longs, suggesting expected pullback. New call options represent purely bullish positions - these traders fear missing rallies more than pullbacks.

If joining, I recommend light positions due to pullback expectations. Both stocks and options work, but for options, follow the big players' strategy of choosing longer-dated contracts - a lesson learned from Chinese ADR experiences.

For those wondering about the big player's position in $YINN 20260116 27.0 CALL$ , open interest data shows no closing, only increasing to 170,000 contracts.

Some believe big players can exit without showing in the data through "backdoor" trades - I have no comment on such speculation.

$WMT$

Wednesday saw massive put option activity in Walmart through floor trading, with 200,000 new contracts each:

Opening $WMT 20250620 76.67 PUT$

Opening $WMT 20250620 73.33 PUT$

Trades executed after 3 PM, massive volume but instant execution due to floor trading.

While floor trading prices make direction harder to determine, the contract type matters more than direction - puts suggest bearishness.

With Walmart at 95, these puts targeting 76-73 suggest a potential 20% decline. As a major Dow component, such a decline could signal broader market pullback.

For broader markets, SPY shows balanced call/put opening, while QQQ shows notable bearish activity at the top, with December end 505 puts $QQQ 20241231 505.0 PUT$ trading 51,600 contracts, adding 34,000 to open interest.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- Jcll·12-14Interesting end of year !LikeReport

- huat8783·12-13thanLikeReport