Stock Market Plunge: Not Really Powell's Fault for Entering the Meeting Room Left Foot First

TL;DR: Next week's SPY trading range: 590-580.

The title is a joke - I think it's unfair to blame Powell for the plunge.

Wall Street is playing innocent by putting all blame on the old man. This plunge wasn't exactly unexpected; it had been brewing for a while. Institutions had been selling NVIDIA calls for two weeks at 140, waiting for a pullback since early December - they just needed an excuse for the plunge.

The upcoming president's preferences are crystal clear - whoever triggers a stock market crash would be seen as opposing the future president.

As usual, the FOMC meeting became the convenient trigger for the market selloff. Wall Street is using this opportunity for market correction, and after the adjustment, growth will resume its normal pattern.

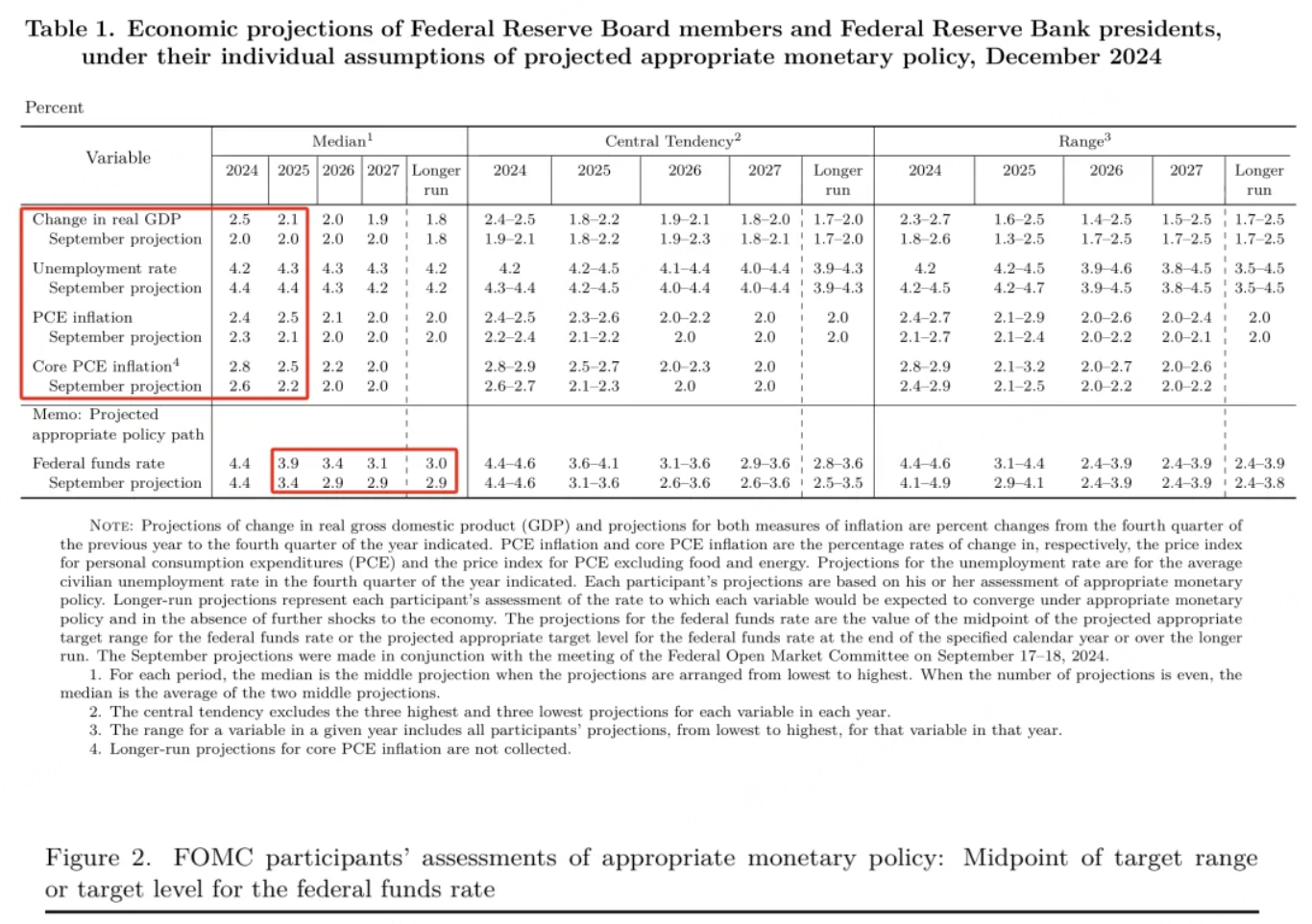

Regarding specific policies, the dot plot indicates two rate cuts next year, showing a strong hawkish tendency.

The meeting revised up economic forecasts for 2024/2025, lowered unemployment rate predictions, and raised inflation forecasts, with a significant upward revision for 2025 inflation expectations.

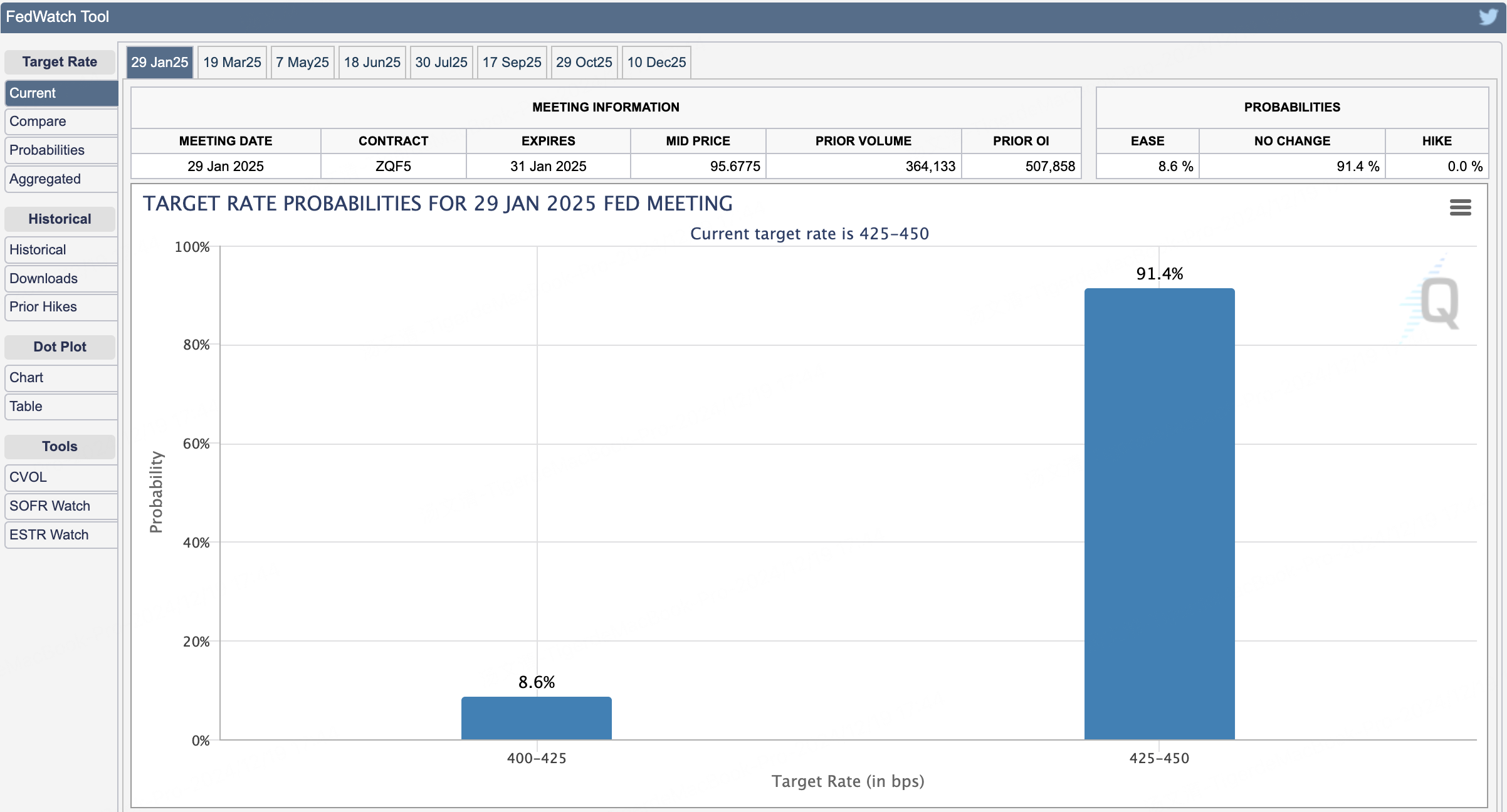

Current expectations show unchanged rates in January, remaining at 4.25-4.5%. There's a 43.4% probability of a rate cut in March.

Everyone's main concern now is how far the market will fall.

The bearish position in 565 puts $SPY 20250321 565.0 PUT$ mentioned in Tuesday's post remains open. With less time decay in longer-dated options, there's no need to roll the position.

Will it drop to 565? Possible, but probably not next week. Option trading details suggest next week's SPY trading range will be 590-580.

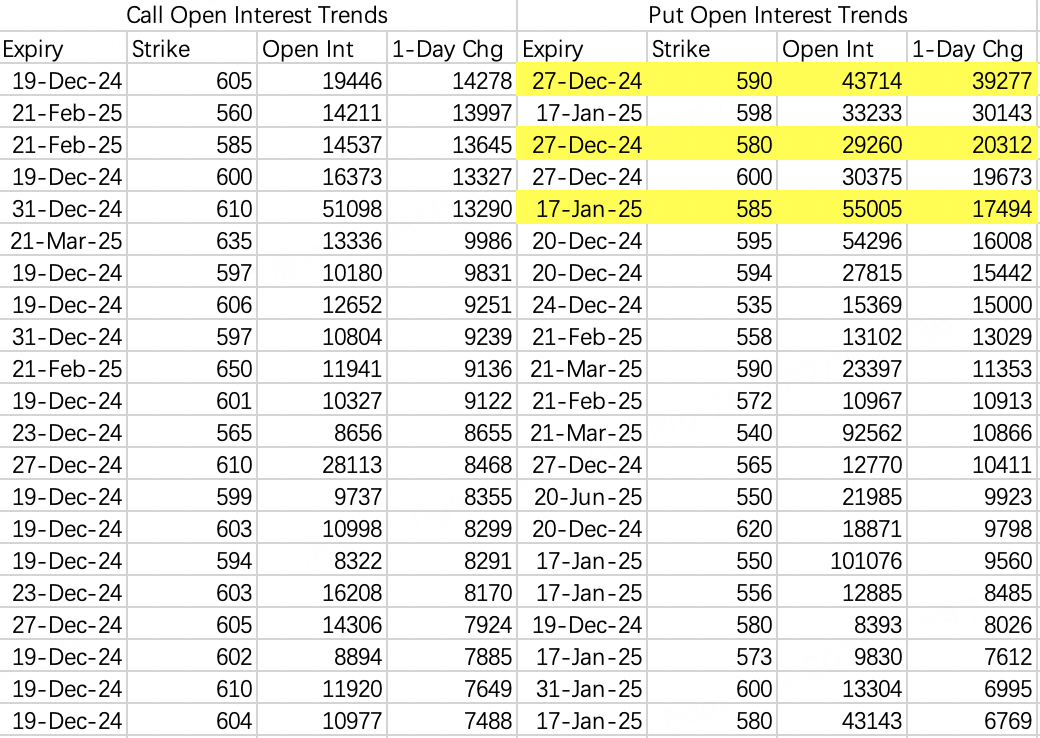

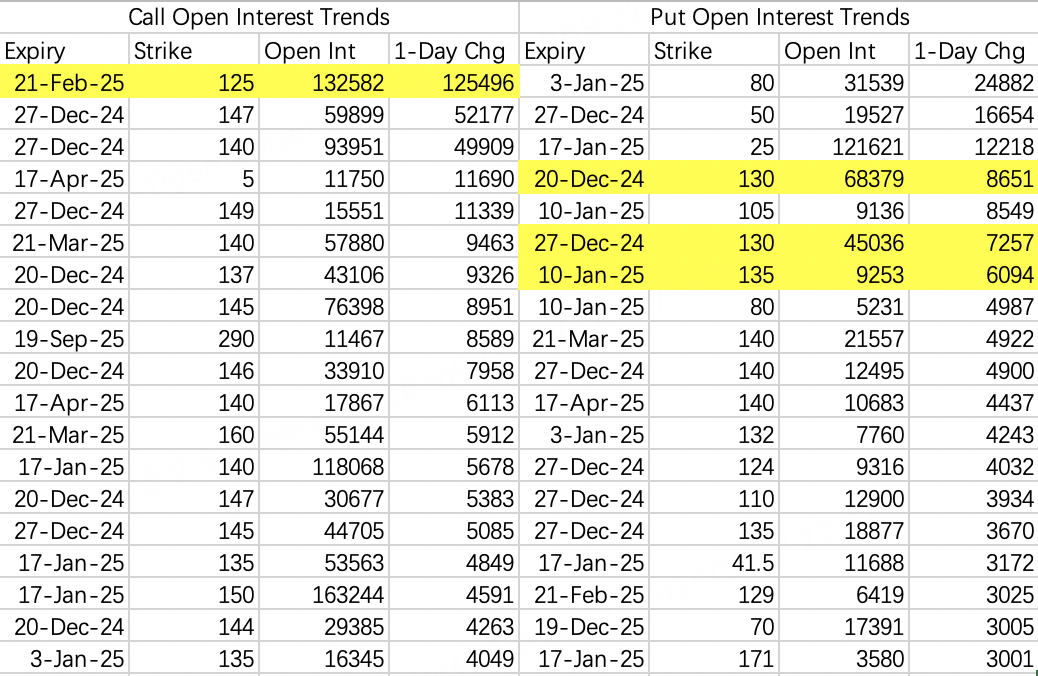

Looking at put strike prices, Wednesday's market wasn't particularly panicked, contrasting sharply with August 5th's plunge. Strike price selections were quite rational.

Two key observations from the details:

Next week's largest put spread position:

Buy $SPY 20241227 590.0 PUT$ - 20,000 contracts opened

Sell $SPY 20241227 580.0 PUT$ - 20,000 contracts opened

This was a roll-over trade, closing this week's 595/575 puts, suggesting the trader doesn't expect next week's low to exceed this week's.

New put positions for January also cluster around 590-580.

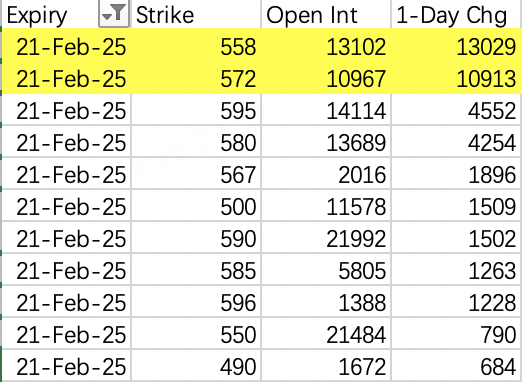

Post-February new put positions have lower strike prices.

February put details alone show expectations of higher volatility. The large position $SPY 20250321 565.0 PUT$ also expires after February.

NVIDIA's options data shows similar trends, possibly even stronger than the broader market.

Details suggest a 130 floor for the next two weeks, with some 120 puts being closed recently.

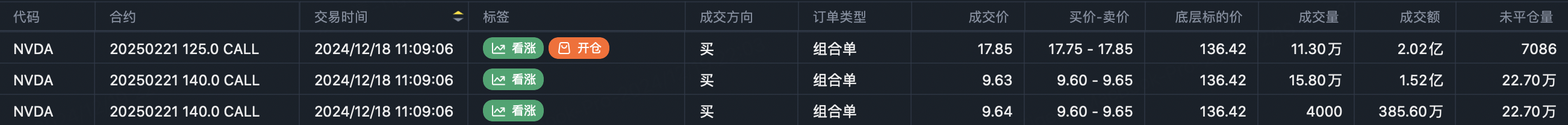

Notable is the largest call position $NVDA 20250221 125.0 CALL$ - this is a roll-over from the $2 billion trader.

Indeed, yesterday at 11:00, before FOMC, the $2 billion trader rolled over positions, keeping the same expiration but lowering the strike from 140 to 125, reducing contract volume from 162,000 to 113,000 - quite unusual.

Yesterday's institutional rollovers included weekly call sellers, rolling from 135-139 to 140-147, suggesting next week's downside target below 140.

This isn't bullishness - they were forced to adjust after Wednesday's squeeze.

The rollover timing wasn't wrong; open interest suggests next week's range might be 130-140.

However, this doesn't mean NVIDIA won't pull back. The $2 billion trader's significant strike price reduction is telling. With many wanting to buy in, institutions might play some tricks. This pullback could be messy, possibly like mid-April's sudden drop during complacent times.

Don't worry too much about next week. Choose longer-dated puts for shorts; next week's puts might face manipulation. Short selling is more suitable now. Enjoy Christmas and New Year's week; the real challenge comes after the holidays.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- KSR·12-20👍LikeReport