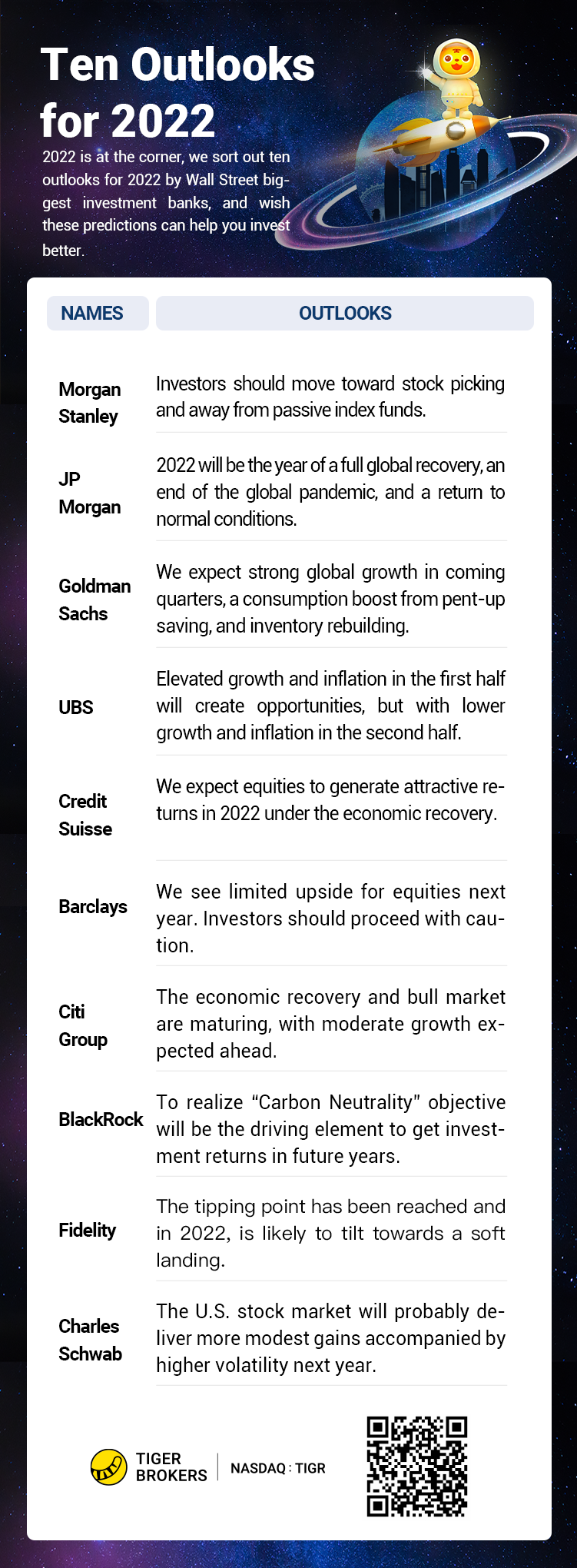

Bullish or Cautious? 10 Wall Street strategists' 2022 Outlook tell you! (PART 1)

Hey Tigers,

2021 is almost done, are you ready to welcome the year 2022?

As investors, our emphasis is always on the global stock market. So what will happen in the next year? What should we pay attention to? And how to save and spend money in 2022?

We collect 10 Wall Street strategists' 2022 Outlook and abstract their viewpoints.

If you are curious about these, let’s have a look:

Globally

Globally

- European and Japanese Stocks Are Calling

- Emerging markets seem primed for growth, but it’s too early to be all-out bullish those markets

- Headwinds from energy prices, regulation, and COVID remain In China,major policy easing wouldn't be seen

FED & Inflation

- Innovation、Deglobalization、Decarbonization、Transformation of the U.S. labor market, the four trends that could further drive higher-than-expected growth and inflation

- Inflation will be at levels higher than many investors have seen before, expects inflation to remain hot, and an aggressive response from the US Federal Reserve.

Stocks & Sectors

- Morgan Stanley sees the S&P 500 moving lower in 2022, sets end-2022 S&P 500 target at 4,400, with equity markets more volatile as earnings growth slows

- If in a bull case scenario, the S&P 500 is expected to reach 5,000 by year-end 2022

- Stock Selection Could Matter More Than Style and Sector

- Bond yields climb and companies try to manage supply chain disruptions & higher input costs.

Globally

- J.P. Morgan Research continues to see global growth accelerating in the final quarter of this year, as it displays the strong underlying fundamentals that will sustain above-potential growth for 2022.

- J.P. Morgan Research estimates a modest 0.5 percentage point of GDP fiscal drag next year.

FED & Inflation

- Global policy rates are expected to end next year only 68 basis points (bp) above their pandemic levels

- Central bank policy is set to remain broadly accommodative despite FED tapering

Stocks & Sectors

- J.P. Morgan Research expects to see the market upside, though more moderate, on better-than-expected earnings growth

- Next year, we expect S&P 500 to reach 5050 on continued robust earnings growth as labor market recovery continues, consumers remain flush with cash, supply chain issues ease, and the inventory cycle accelerates off historic lows.

- Most of the equity upside should be realized between now and the first half of 2022.

Globally

- Relatively optimistic about Russia because of the strength in oil prices.

- Still a little more optimistic in the Euro area than other forecasters

- Slower growth was expected about China Market as of policy and regulatory uncertainty

FED & Inflation

- We have a much more persistent inflation and rate pressure environment than we're expecting

- Inflation probably will still be far above the target in the middle of 2022 & now clearly above 2%

- The FED may be going to start hiking rates around the middle of 2022.

Stocks & Sectors:

- If it would be likely that we'd see some challenges on the equity side.

- There is a significant amount of pressure to invest more in the public sector.

- Forecasts a positive outlook for insurers in 2022, estimate a potential 13% annual earnings per share growth for large-cap managed care organizations (MCOs)

Globally

- Economic growth is likely to remain above-trend for the first half of 2022, benefiting cyclical including eurozone and Japanese equities, US mid-caps, global finances, commodities, and energy stocks.

- As a combination of FED tapering and slowing global growth favor the dollar, relative to currencies bound to looser monetary policies, such as the euro, yen, and Swiss franc.

FED & Inflation

- Inflation should start to fall in the second quarter. Our base case is for inflation to normalize but there is uncertainty

- But from our perspective, the FED would prefer a loser policy based on incoming signals. We don’t anticipate FED hiking rates until 2023

Stocks & Sectors

- Although growth is set to be strong in early 2022, favoring cyclical sectors, a slowdown over the year should start to favor more defensive parts of the market, such as healthcare.

- As interest rates, bond yields, and credit spreads remain low by historical standards. US senior loans, synthetic credit, private credit, and dividend-paying stocks look attractive.

Globally

- In 2022, the global economy is expected to maintain a stable trend, driven by solid demand, fiscal and monetary policy, the easing of restrictions related to COVID-19.

- A continued above-average growth in global industrial production and the need for supply.

FED & Inflation

- Inflation in 2022 is expected to slow to 3.9% after an extreme spike in 2021

- We see recent inflationary pressures as largely transitory, due in part to the temporary nature of the supply shortages.

- Interest-rate rises are most likely in the U.K. and some emerging markets such as Brazil and Turkey.

Stocks & Sectors

- S&P 500 reaching 5200 & Single-digit returns are expected for shares in 2022, lower than in 2021;

- Raw materials should be favorable in 2022,Real estate should continue to grow. Energy markets will remain volatile over winter and gold could fall as normality returns.

- Expecting ESG trends to be key, investors should increasingly value ESG in capital allocation.

CLICK TO READ MORE: Bullish or Cautious? 10 Wall Street strategists' 2022 Outlook tell you! (PART 2)

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- jinxie·2021-12-30It can be seen that many institutions are more optimistic about the SPY index, and next year is still the index4Report

- wywy·2021-12-31Another great and nicely written article. Good summary and concise. Thanks for the sharing. Its through such sharing that all fellow Tiger investor can know the market event timely. Great stuff.2Report

- blimpy·2021-12-30Thank you for sharing, very comprehensive introduction, feel that we are still optimistic about the appearance of the index3Report

- KYHBKO·2022-01-04the outlook seems mixed for 2022 and caution has been highlighted. COVID, supply chain, weather extremities, policies and trade relationship will continue to cause volatility in the market.1Report

- River0·2021-12-30It seems that the differences between institutions are still very big, and it is really difficult to do next year2Report

- NING667·2021-12-30The epidemic remains the biggest disruption to the global economy, and economic recovery depends on the effectiveness of the epidemic2Report

- wywy·2022-01-02Nice and concise article. And thanks for the sharing. Its through such sharing that all fellow Tiger investor can see different perspective and make own assessment. Great summary [Like]LikeReport

- TomCap·2021-12-3021/5000 Tech stocks in the U.S. are still full of imagination and can continue to do so next year2Report

- OutsiderLEO·2021-12-30Next year's theme is still long index stocks, marginal stocks will still be difficult to do next year1Report

- HunterGame·2021-12-30A sustained rise in crude oil prices will be good for the new energy sector and continue to be long Tesla next year1Report

- snuggix·2021-12-30I think the SPY could break 5000 in the first quarter of next year and remain bullish on US stocks2Report

- 合群·2022-01-02we need to be caution in 2022... [暗中观察]2Report

- skyer1athome·2022-01-01Let's be optimistic and the new year is somehow going to be better for everyone1Report

- SPGoh·2022-01-04Great article. Looking forward to part 21Report

- yinghao94·2022-01-04looks like the whole world is positive about 2022 [Miser] [Miser] [Miser]LikeReport

- Lao Tzu Ang·2022-01-03Valuable information. Thankyou.1Report

- LawrenceLBC·2021-12-31nice,thank you for sharing.1Report

- MoonJin·2022-01-04good to take noteLikeReport

- jinhut·2022-01-04thanks for sharing 👍LikeReport

- nhoj01·2022-01-03Great ariticle, would you like to share it?LikeReport