Day8 Education: 3 kinds of risks in US stock market

Hey, tigers:

Let's review the previous lesson first.

Day7 Education:3 typical technical indicators

Today, I will introduce the risks that must be avoided when you invest in US stocks.

①The risk of investing in gross ticket.

②Risk of margin.

③Risk of investment.

The risk of investing in gross ticket

Q: what is a gross ticket?

A: The gross ticket, is a common name for which stock prices are less than one dollar. Also, according to the SEC, any stock priced below $5 can be called a penny stock.

Q: why do you need to pay attention to this risk?

A: The risks of investing in gross ticket mainly come from three aspects:

a. Anticipation of delisting and bankruptcy

b. The stock price is easily manipulated

c. Transaction commissionLet's talk in detail.

Anticipation of delisting and bankruptcy

Gross ticket is originally stock that is on the verge of delisting. Therefore, this stock is very poor from a fundamental point of view.

For stocks that are facing delisting and bankruptcy at any time like this, the stock price will often suffer a sharp plunge, and investors must bear the downside risk of stocks caused by lower liquidity and lower investor expectations.

The stock price is easily manipulated

Because of the low stock price and small transaction volume of gross ticket, it often only requires a large amount of capital to make it fluctuate violently.

Therefore, the gross ticket is very vulnerable to the manipulation of the main funds, in order to attract retail investors to enter the market, and finally harvest the leeks.

Transaction commission

Because of the poor quality of the gross ticket, such stocks are, of course, not the object of value investing. Therefore, most of the investors who trade gross ticket are speculators in the market, and more frequently operate through trading technical lines or trading emotions, which will generate a lot of transaction commission costs along the way.

Risk of marginThe risk of margin mainly comes from the risk of forced liquidation. Forced liquidation means that part or all of an investor's position is forcibly sold by a brokerage. The reason of this kind of risk.

a. Insufficient overnight excess liquidity.

b. Short squeeze.

c. Compulsory recall.

How to understand?

a. Insufficient overnight excess liquidity.

Sometimes forced liquidation occurs because investors are unfamiliar with the trading rules of U.S. stocks.

In the Tiger Trade APP, click "Trade" to see the remaining liquidity level of the overnight excess liquidity. Here, it is important to remind everyone to pay attention to the risk state of the investment account.In most cases, it is possible to proactively close the position by checking the risk state in time to prevent the liquidation. For example, if the overnight excess liquidity is safe or very safe, then you can rest assured. But if it is dangerous or extremely dangerous, it means that your account is likely to be forced to close out.

About 10 minutes before the close of each trading day, the broker will conduct overnight excess liquidity on the account positions. At this time, the overnight excess liquidity value needs to be greater than 0, otherwise some positions will be liquidated before the close.

b. Short squeeze.

Many investors like to short in U.S. stock trading, but it must be noted that shorting is essentially a margin business. In addition to often looking at the risk state of the account, it is also necessary to be alert to the risk of short squeeze.

Unlike borrowing money to buy stocks, short selling is borrowing securities from a brokerage, and you have to pay a margin to the brokerage when borrowing. When the stock price goes up against your expectation, the margin requirement will be higher and higher, so it may be liquidated due to insufficient margin.

c. Compulsory recall

There is also a risk that cannot be prevented, that is, the shorted stocks are forced to be recalled.

This situation is not caused by insufficient margin in the account, but when the proportion of short positions in a certain stock is extremely high, and there are no bonds to borrow in the market, and the lenders who originally held these stocks have to withdraw the stocks for use in the balance. Therefore, the brokerage has to recall the stock from the person holding the shorted stock and return it to the lender.

This situation is not caused by insufficient margin in the account, but when the proportion of short positions in a certain stock is extremely high, and there are no bonds to borrow in the market, and the lenders who originally held these stocks have to withdraw the stocks for use in the balance. Therefore, the brokerage has to recall the stock from the person holding the shorted stock and return it to the lender.

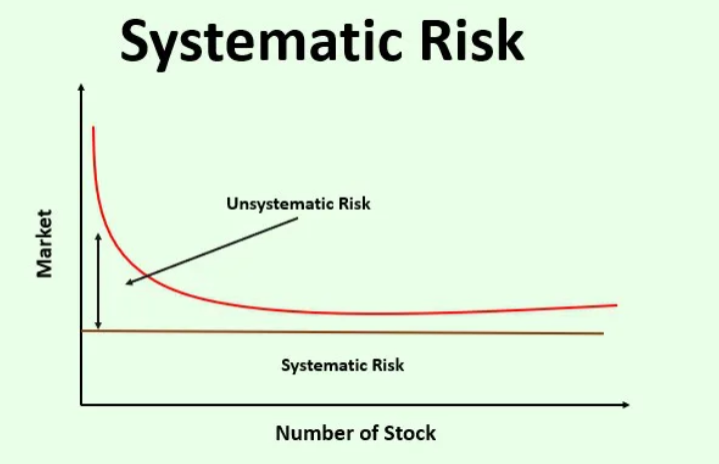

Risk of investment.As long as it is an investment, there will be risks, which most investors can understand. Strictly speaking, investing in any asset in the market is risky. The investment itself mainly corresponds to two kinds of risks, one is systematic risk and the other is unsystematic risk.a、Systematic riskSystematic risk, also known as unverifiable risk.

Simply put, it is a risk that cannot be avoided by diversifying a portfolio.

b. Unsystematic Risk

b. Unsystematic Risk

Unsystematic risk is a risk that can be diversified or avoided. For example, stock price fluctuations caused by factors such as company operations, or risks in a certain industry, etc., are all unsystematic risks.

Here is a formula that you can remember: Total investment risk = Systematic risk + Unsystematic risk.Having a proper understanding of these risks can help you be well-prepared for long-term benefits in the stock market.

Today's topic: Your understanding of investing risks.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

In the current US Bear Markets, today's lesson 3 kinds of risks in investing in the US stock market is so important and relevant.

The 3 risks are

1) Gross Ticket or more commonly known as penny stocks by the SEC. This is due to risk of delisting, bankruptcy, market manipulation and transaction commission.

2) Risk of margin. This can be due to insufficient overnight excess liquidity, short squeeze and compulsory recall.

3) Risk of investing. There are 2 types - Systematic and Unsystematic. Systematic risk is a macro factor like the Covid 19 pandemic. Unsystematic risk is pertaining to the company's performance, or something that is specific to the company.

@Tiger_Academy A Big Thank You for such a valuable lesson on understanding Risks in the US stock market. It underscores and highlights the importance of knowing the risks before making an investment decision for me. I look forward to your final lesson in Day 9.

@Tiger_Academy @TigerStars

Nice advice