Crude Oil Plummets, While Buffett Keep Adding OXY, Why?

Along with the scorching summer heat, Buffett's enthusiasm for energy stocks has soared.

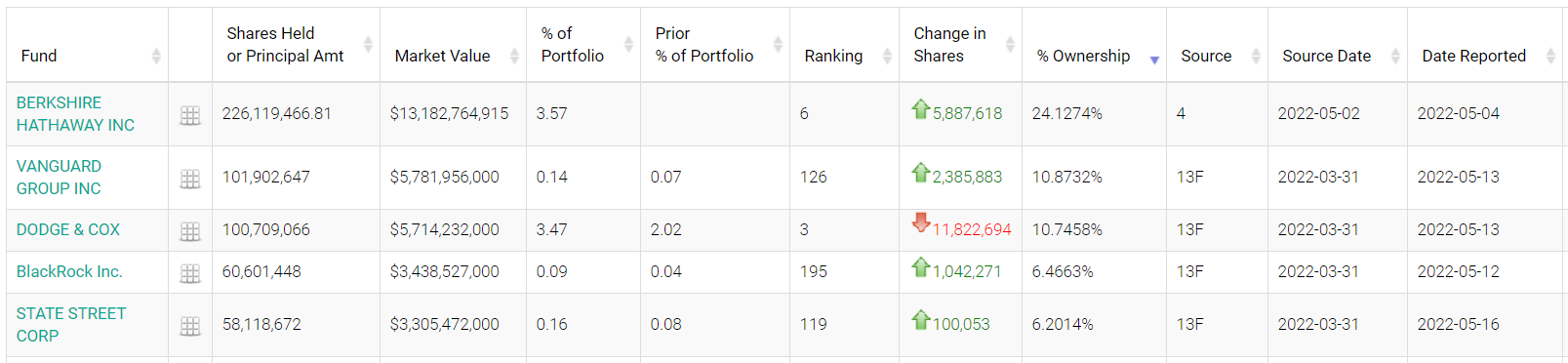

Warren Buffett has used the latest oil dip to add more OXY. Berkshire bought 9.9 million shares of Occidental Petroleum last week for $582 million, according to SEC filings. The total shareholding has climbed to 17.4%, about 60% higher than the second-largest shareholder Vanguard Group.

In addition, Berkshire owns 100,000 Occidental preferred shares, valued at $10 billion, and warrants to acquire an additional 83.9 million shares for $5 billion. This also means that Berkshire's actual stake has far exceeded 20%.

Funds Holding $Occidental(OXY)$  Purchase History

Purchase History

With the recovery of the global economy, the world's strong demand for energy has reignited, the contradiction between supply and demand has become more prominent, and oil prices have also soared.

Berkshire Hathaway has purchased nearly 30 million shares of Occidental Petroleum since the end of 2021. Buffett started buying Occidentally after he spoke with the company's CEO on the company's earnings call in February.

The earnings of Occidental Petroleum in the first quarter of this year did not disappoint the stock market.

- Net profit attributable to shareholders in the first quarter was $4.676 billion, hitting a record high, compared with a net loss of $346 million in the same period in 2021.

- Occidental's net sales in the first quarter were $8.349 billion, soaring more than 50% year over year.

- Free cash flow of $3.3 billion was also an all-time high.

Occidental has been the best-performing stock in the S&P 500 so far this year, with shares nearly doubling by strong earnings and other factors.

What is more noteworthy is that as Berkshire continues to increase its position in Oxy, the market is increasingly speculating that Buffett may intend to acquire all of them. Investment bank Truist Securities said in a report that Berkshire may acquire the entire stake in Occidental once its credit profile improves.

Why Energy Stocks?

At this year's shareholder meeting, Buffett was asked why he was so heavy on oil stocks.

Buffett said that the US government currently has a lot of strategic oil reserves, and now everyone may think that it is a good thing that the United States has so many oil reserves. "But if you think about it carefully, the current reserve is still not enough. It may be gone in three to five years. You don't know what will happen in three or five years."

These remarks have actually revealed the reason for being optimistic about energy stocks: the future energy will be very "scarce".

Crude oil prices tumbled 8%, will the falling channel open?

The slump in crude oil prices hit a new low for two consecutive months since the beginning of May.

Analysts from futures institutions believe that behind the sharp drop in oil prices, European and American continue to fall under high inflation pressure, and the Federal Reserve and the European Central Bank are forced to initiate measures such as raising interest rates and shrinking their balance sheets, causing investors to worry about economic recession.

According to the research report of Hentai Futures, Looking forward to the trend of international oil prices in the second half of 2022, in the short term, it is difficult to accelerate the increase in production in major producing countries, and there is still some support for oil demand. The addition of short-term low inventories will support oil prices. At present, global crude oil and refined oil Inventories are at absolute low levels in recent years. From the perspective of inventory, the support of Brent oil at $90-95 per barrel is strong.

In the medium and long term, with the recovery of supply and the decline of demand growth, oil prices may fall under the rebalancing of supply and demand, but the speed and magnitude of the decline depends on political factors and the speed of the overseas tightening cycle.

SHARE YOUR THOUGHTS

Will you focus on energy stocks or futures?

You may be rewarded with Tiger Coins for sharing your thoughts in the comment💸💸💸

Follow me! Don't forget I am the richest tiger in this community😎😎

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Warren Buffett is an astute investor who has an uncanny sense of buying quality stocks below its intrinsic value. I believe that's what he is doing by buying up more Occidental Petroleum 's shares recently.

I also believe that the current drop in oil stock prices is a golden opportunity to buy more. With the ongoing war in Ukraine and the ban of Russian oil, the demand for oil will far exceed its supply.

Therefore I will stay vested in $Energy Select Sector SPDR Fund(XLE)$ as my defensive play and hedge against high inflation.

@MillionaireTiger @TigerStars @CaptainTiger

Even though Crude Oil prices plummeted recently on recessionary fears, there is still an underlying shortage of supply. This is the key reason why Warren Buffett has been on a buying spree of$Occidental(OXY)$ .

The current demand for oil far exceeds supply as more people take to the skies due to pent up demand from previous Covid-19 lockdowns. Coupled with the ongoing Ukraine war and the ban by US and its allies on Russian oil, the price of oil will continue to increase. Currently the US is in talks with its allies at capping of price of Russian oil. But there is also fear that Russia may retaliate by cutting off its supply to Europe prematurely. Should that happen, the price of oil will skyrocket.

Geopolitical tensions and war have a profound impact on oil prices. Until the war in Ukraine is resolved and the ban on Russian oil lifted by US and its allies, I will stay invested in $Energy Select Sector SPDR Fund(XLE)$ .

@MillionaireTiger @TigerStars @CaptainTiger

I think is because oil 🛢 supplies are low & the demand of oil is high. Even interest rate hike, it will not stop the price increase as it's a need

Oil stocks won't last, there's a limit to how much oil that can be extracted

If not, Musk won't be the richest man in the world