Gold Prices Top $1900, But Still Bullish?

Gold prices rose sharply today on the news that Ukraine fired mortars and grenades into pro-Russian areas. If the two sides open fire, then gold prices are bound to soar. But given its low probability, let's conduct technical analysis on the gold price trend over the past year and the coming direction of gold futures.

After rising to the resistance level of 1880, gold futures began their significant pullback in the past two weeks.

You may wonder if this is a buying opportunity. Can gold future return to its peak of $2,000?

Tumbling Gold and Uncertain Rates

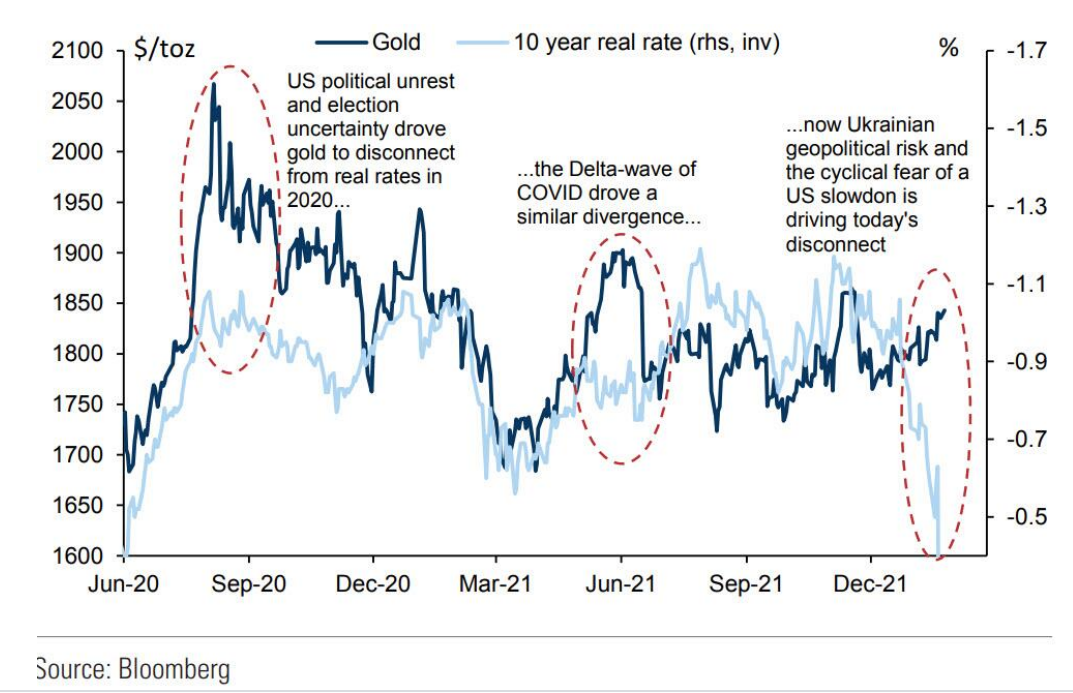

Looking at this graph, the gold price has been up and down in the two years since it fell from its high in August 2020. After the pandemic began, the U.S. market has experienced repeated changes in monetary policy. (from near-zero rates to seven rate hike expectations)

You can make a comparison. Almost every decline in gold from its highs corresponds to a rise in U.S. Treasury futures. Thus, as long as there is uncertainty about the rate hike policy, gold prices are hardly stable.

When the yields of other investment products rise, the investment value of gold naturally decreases. At the same time, the increasing US Dollar Index also leads to lower gold prices because the return on dollar assets is linked to the value of the dollar.

So over the last year, as expectations of rate hikes were rising, US Treasury yields have gone up. Whenever the market anticipated that rate hikes would accelerate or there would be more rate hikes, the gold price fell sharply.

Let’s find out why.

This significant rise in gold is not natural from a technical level, rather it's the result of Ukraine-Russia Tensions.

The geopolitical crisis in Ukraine and Russia has caused a spike in gold prices that should have pulled back after hitting the resistance level. With regard to time, this rally is within the cycle of an impending retracement. So I am not optimistic about the sustainability of this gold rally.

When the situation in Russia and Ukraine eases, the gold price will back to its original level.

So are the gold futures still bullish?

I am cautiously bullish for 3 reasons.

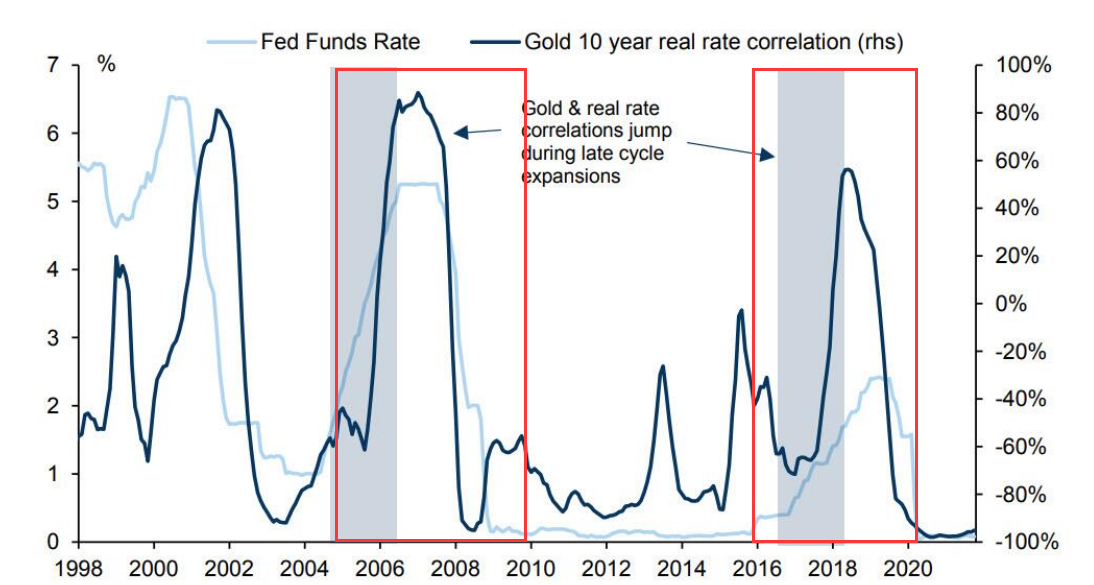

First, the negative correlation between gold and U.S.Treasury yields has been challenged.

In addition, after the market priced in the hawkish policy of rate hikes, gold futures always bottom out and its support level keeps pulling up. This is a very strong technical signal.

Secondly, we should also note that the negative correlation between gold futures and the 10 year real rate has also been challenged.

Historically, gold futures tend to rise during periods of rate hikes when its negative correlation with long-term real rates is invalid. That's what's happening right now, with gold showing greater resilience during the recent rise in the US 10 year real rate.

Finally, stagflation is another bullish factor.

We all know that the US is currently experiencing a poor macroeconomic environment, falling consumer confidence, and slower GDP growth, but the inflation rate has been hitting record highs.

It is a typical signal of stagflation. During this period, gold futures generally enjoy a rally. So will gold go up this time? I very much look forward to it. I'm going to open a long order at a price around 1840 and buy more if it goes up.

What's your view about gold futures? Bullish or Bearish?

Will you buy more gold futures?

Share your opinions in the comment section.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Limitted supply 🤔

[Cool]