US Dollar Index (DXY) Has Peaked Or Not? They Say...

There are too many factors supporting the rise of the US dollar index at present:

1. The Fed increased the fund rates expectation and strenthened its determination to fight inflation, which keeps rising. There may be more interest rate hikes in the future to put pressure on the economy and inflation,

2. The dollar is tied to energy, which makes the purchasing power of the dollar appreciate. Energy prices fluctuated at a high level, and the United States also became a major energy exporter. After Russian energy was excluded from the European and American trade system, the United States became the largest energy provider in Europe.

3. Dollar is a safe asset. The world is changing rapidly at present with small and medium-sized countries involving in wars. Ukrainian-Russian war may last for a longer time. In addition, China's economic growth may also slow down in the second half of the year, which makes the risk aversion of global capital extremely heated up.The risk aversion buying is also supporting the rise of the US dollar.

Stimulated by multiple favorable factors and continuously aggressive interest rate hikes by the Federal Reserve, the US dollar index has appreciated sharply recently. Just after the last interest rate hike by the Federal Reserve by 75 basis points, the US dollar index reached 111.83, a new high since 2002.

There is no doubt that the dollar has become quite "expensive", but has it risen to the limit? In addition to the Fed's tightening policy, what other factors have benefited from the strengthening of the US dollar? Let's discuss it today.

1. US dollar is already "very expensive", but may continue to rise

The institutions have conducted research and concluded that:

a: According to UBS,

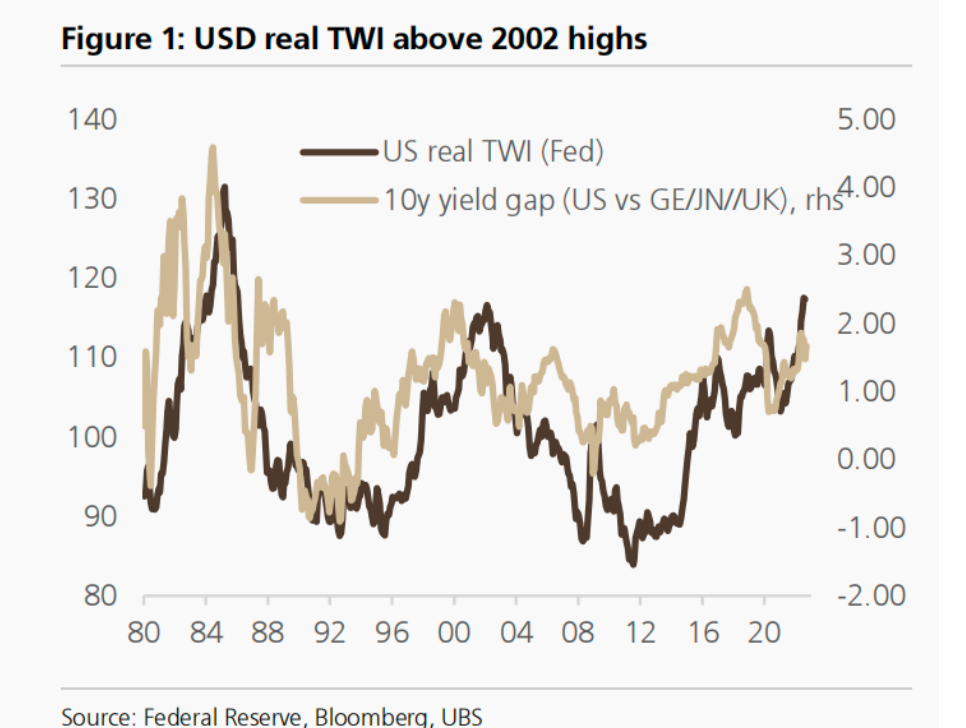

the real US dollar trade-weighted index (USD TWI) has broken through the high point of the strong US dollar cycle from 1995 to 2002 and reached the highest level since 1980s.

b: according to the OECD's absolute purchasing power parity model of the US dollar,

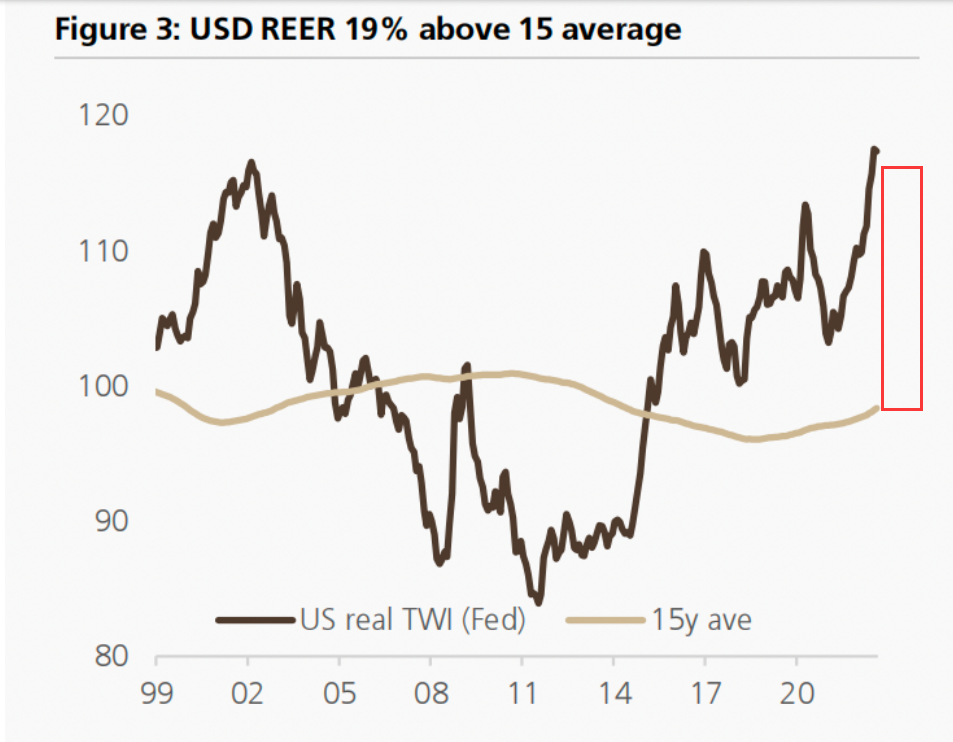

it has risen by 18-19% above the average and exceeded the peak of the strong US dollar cycle in 2002.

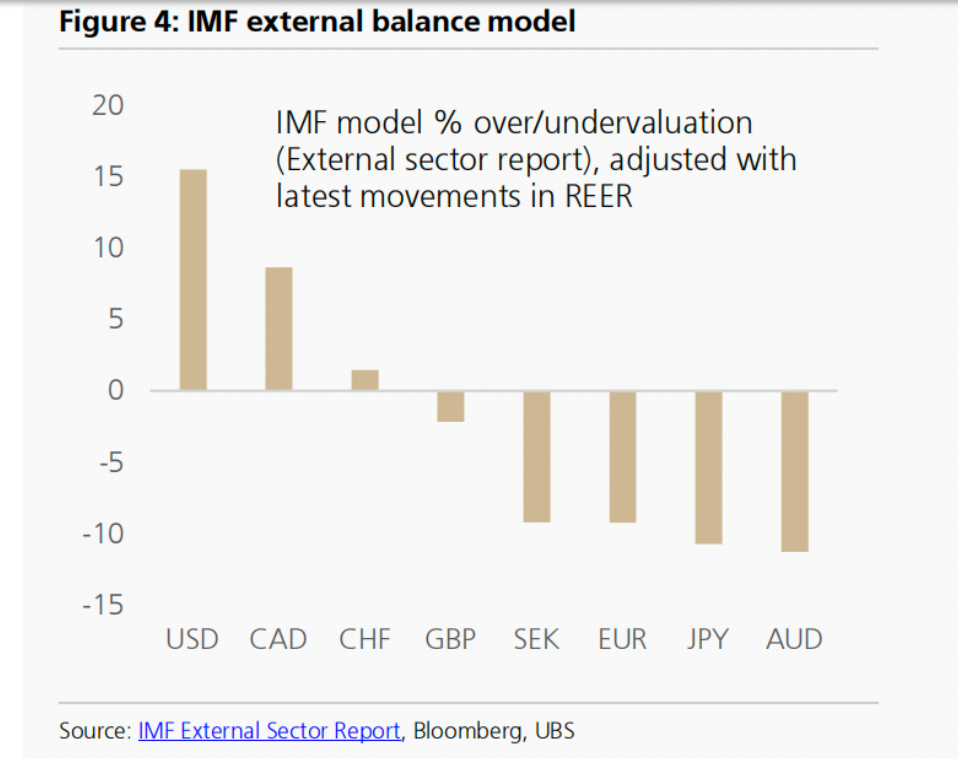

c: International Monetary Fund (IMF) model also shows that the US dollar is overvalued,

it is a cross-test method, and compares the results with different valuation frameworks (such as macroeconomic balance method). The adjusted real TWI trend shows that the US dollar is about 15% higher, which is between the results of the adjusted and unadjusted purchasing power average model.

Although the dollar has become expensive under the general estimation method, the factors behind the dollar's appreciation still exsits.

As we all know, the strengthening of the US dollar has benefited to some extent from the hawkish interest rate hike of the Federal Reserve. As the interest rate hike of the Federal Reserve will not end abruptly in the near future, the appreciation of the US dollar may not slow down immediately.

But UBS believes it may not be the most fundamental factor.

According to the leading indicators of OECD, the global cycle has been quite synchronized, and the major central banks in the world have basically embarked on the road of monetary policy normalization.

However, the global economic slowdown led to the weakening of investors' risk appetite, and they poured into the US dollar to avoid risks, and the US dollar began to strengthen. Such a safe-haven factor is the fundamental reason for the rapid rise of the US dollar.

2. Countries have stepped in to resist the strong dollar

Japne:

Just last week, in the face of the continued decline of the yen exchange rate, the Japanese government finally intervened in the market by selling dollars and buying yen, so as to prevent the rapid depreciation of the yen. This is the first time that government intervenes the market since the Asian currency crisis in June 1998.

Switzerland:

Subsequently, the Swiss National Bank indicated that it is willing to enter the market to intervene in the Swiss franc if necessary.

Thailand:

Thailand's finance minister also said to intervene to curb extreme fluctuations.

UBS analysts believe that

Unless there is a major external shock. Otherwise, the possibility of multi-country coordinated intervention in foreign exchange markets like Plaza Accord is still very small. The dollar is unlikely to fall sharply until the global economy turns to recovery.

3. Is it true that the US dollar will not fall in the near future?

There won't even be any pullback in the process of rising?

Many traders disagree with this, because after several days of rising, the US dollar seems to have obvious signs of overbuying, and a correction may be imminent.

If we compared the Fed rate hikes and the trend of the US dollar index, we can find that during the period when the US federal interest rate is rising, the US dollar can pull back sharply:

At present, the US dollar index has once again risen to the upper edge of weekly climbing channel. Will the long position sell? We need to be ware of this.

What do you think of the rise and fall of the US dollar index?

Will the dollar continue to rise in the near future, or will it peak and fall back?

Share your thoughts in the comment section to win tiger coins~

$E-mini Nasdaq 100 - main 2212(NQmain)$ $E-mini S&P 500 - main 2212(ESmain)$ $E-mini Dow Jones - main 2212(YMmain)$ $Gold - main 2212(GCmain)$ $Light Crude Oil - main 2211(CLmain)$

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

However the Bank of England bought 65 billion pounds of UK bonds to stem a huge market sell off yesterday. This has helped pivot a change in the direction of stocks with all 3 US Indexes closing higher today.

I believe that this is just a Bear Market rally and the US Dollar will continue its upward trend.

In the short to mid term, US Dollar will continue to be strong. So it is prudent to hold US dollars as a hedge against inflation and capital growth.

在接下来的几个月,美元将继续地走高直到美联储停止加息为止!

The strong US Dollar is currently the King of currencies in a world of slowing economic growth and the Ukrainian war.

US Dollar is also the global reserve currency. This means that a large amount of US dollars are held by Central Banks and major financial institutions to use for international transactions. With the aggressive stance of the Feds to fight high inflation, rising interest rates will attract more inflows into the US dollar.

The US Dollar is also regarded as a safe haven asset with the ongoing Ukraine war.

So I believe that the US Dollar will continue to be strong in the short to mid term. It is prudent to hold some US dollar as a hedge against inflation and capital growth.