Today is very suitable to sell put, the real key is next week

Us CPI data released at 20:30 tonight showed US August unadjusted CPI Y/y recorded 8.3%, beating market expectations of 8.1%, compared with 8.5% last. The unseasonally adjusted annual rate of core CPI rose 6.3 percent in August, the highest since March 2022. U.S. core CPI rose 6.3 percent in August, compared with 6.10 percent expected and 5.90 percent previously.

Core CPI is too high because wage and services inflation are struggling to unwind in the same way as energy prices, and the Fed will no doubt tighten further. But overall, anything below 8.5% would be considered a victory.

The previous three days of market gains too far ahead of the current pullback is very healthy. Otherwise, as in mid-March, I don't even think it would have to fall after the FOMC next week.

In a word, today's market is very suitable for the sell put. The strike price can be chosen as the closing price on September 8th, and the maturity date can be chosen as the current week for conservative reasons.

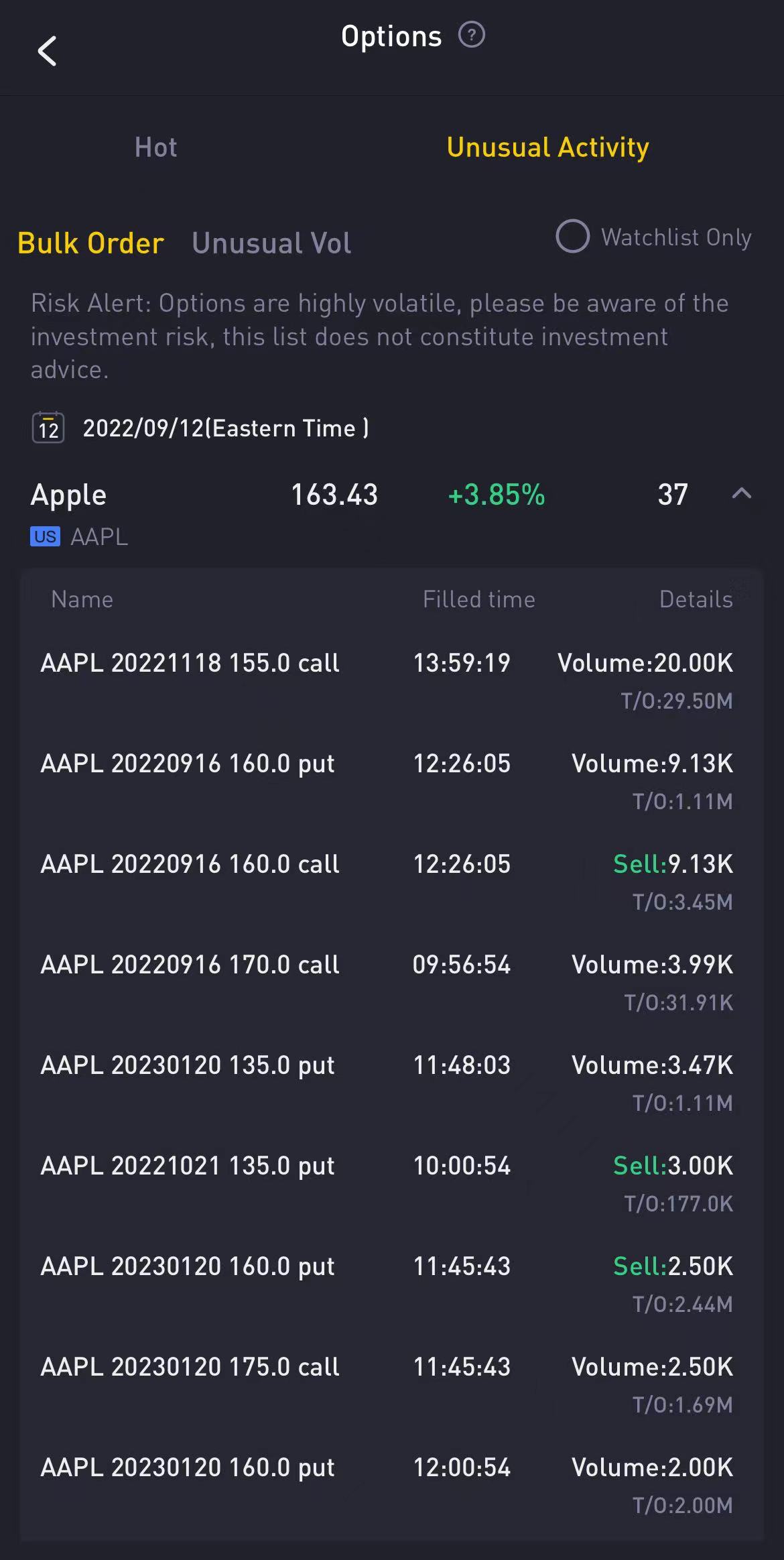

$Apple(AAPL)$

In-the-money option call, 29.5 million total, qualitative jump, nothing to say.

Strike price + price = call to $169. More conservative bullish orders. November expiration. I understand that the high probability is $169 by October, but this also shows that buyers don't mind buying at $155 either. Conservative calls can sell put.

This should be the most comfortable order in the near future, buy with no problem, rise to the top (or $170) remember to close the position.

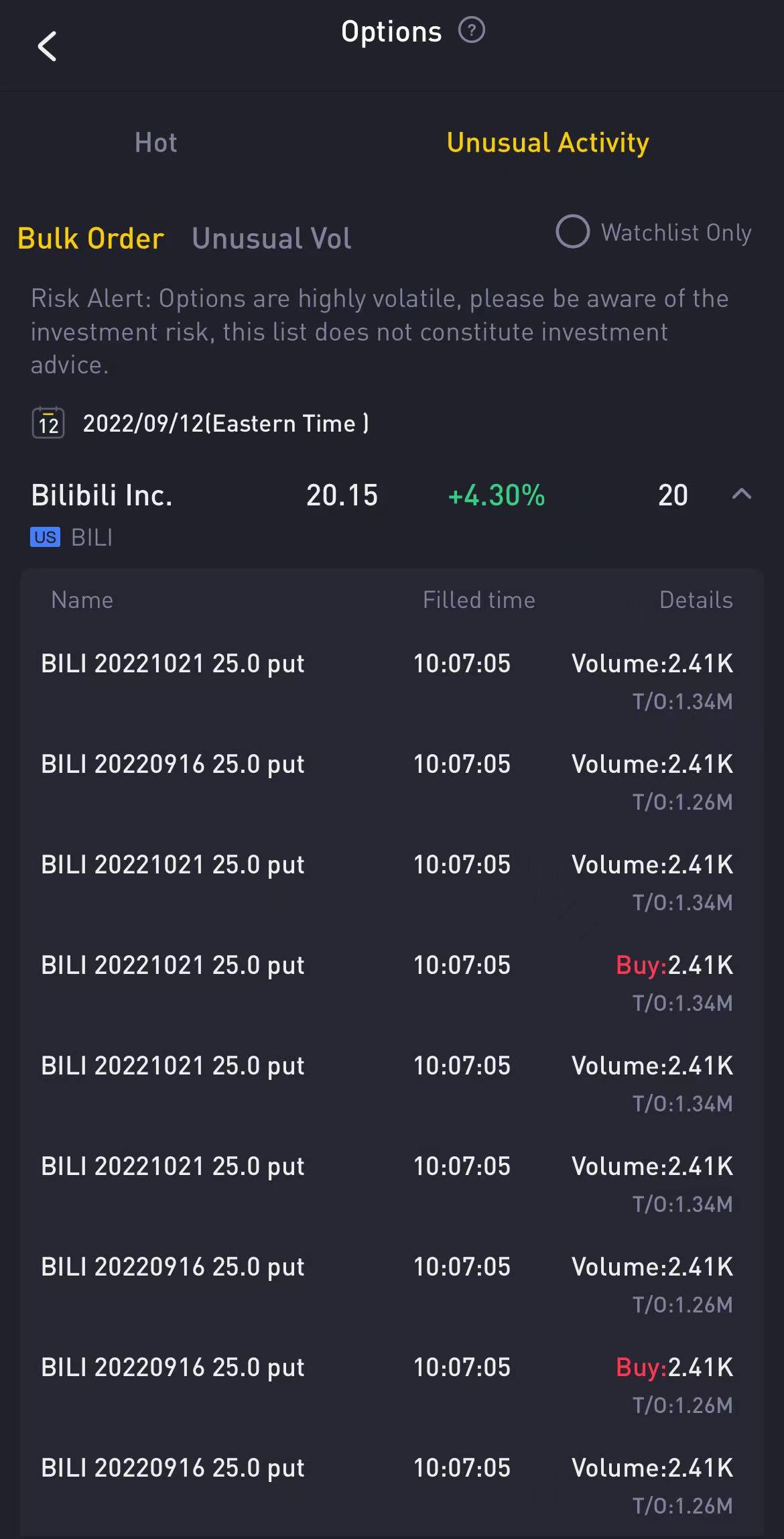

$Bilibili Inc.(BILI)$

$BILI 20220916 25.0 PUT$ ➡️ $BILI 20221021 25.0 PUT$

This pair of large orders is a deep in-price option put, a typical move to roll.

The option delta is 0.8. Although it is a near-term option, it has little time value. It is similar to shorting the underlying stock.

This guy's been shorting Bilibili since last month. According to his layout style, may be due before the thunder, the middle of the surge he will not tube. If this intermediate Bilibili falls in advance can see if he will continue to move positions.

Although a long time but from the previous layout to see his winning rate is very high, may know retail investors do not know the information. But I see a rebound in the stock as a whole, so I'm not going to follow this order. As a hint, if you want to go short, don't be a smart guy and try to buy PUT cheaply. If Bili is still 20 in a month, he won't lose much, but PUT will lose a lot.

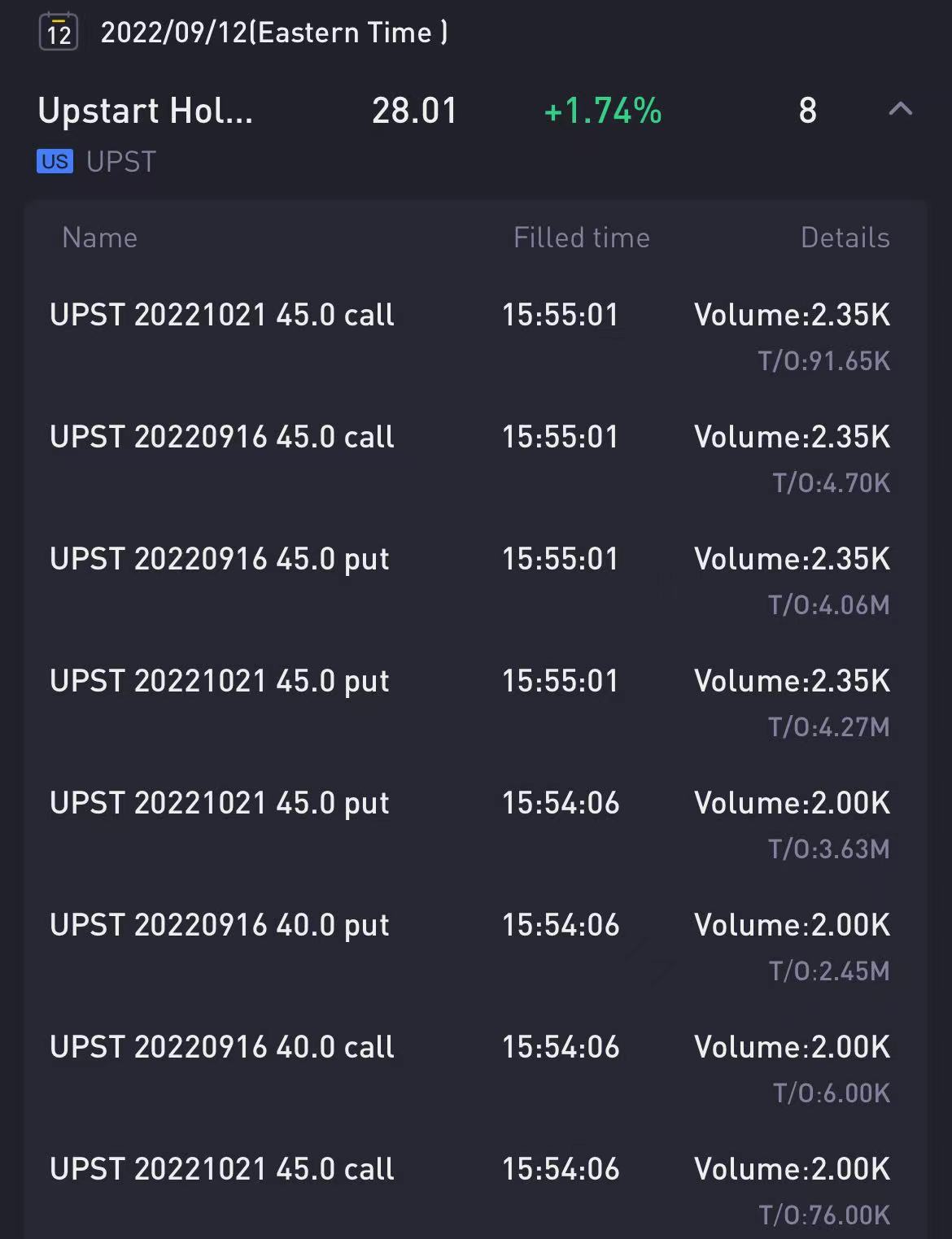

$Upstart Holdings, Inc.(UPST)$

$UPST 20221021 45.0 CALL$ $UPST 20221021 45.0 PUT$

Since August 30, someone has been continuously placing the UPST in the PUT direction. The current price of UPST is $28. The call with a strike price of 45 is an out-of-the-money option, and the PUT with a strike price of 45 is a deep in-money option. The overall strategy tends to be short.

There is no recent negative news or business splitting of the company. If you hold underlying shares, it is recommended to buy PUT to hedge.

It looks like an institutional target, but without clear fundamentals like 3M, I'd buy it as a lottery ticket.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

[Miser] [Miser] [Cool]

伟大的文章