CME group special commentator Kou Jian

In 2023, WTI crude oil price fluctuated in a zigzag shape for a whole year between US $63 and US $95 under the influence of various factors. Before we bid farewell to 2023 and usher in 2024, what factors should we pay special attention to in crude oil trading?

1. The relationship between supply and demand, especially the domestic demand for crude oil and the import volume.

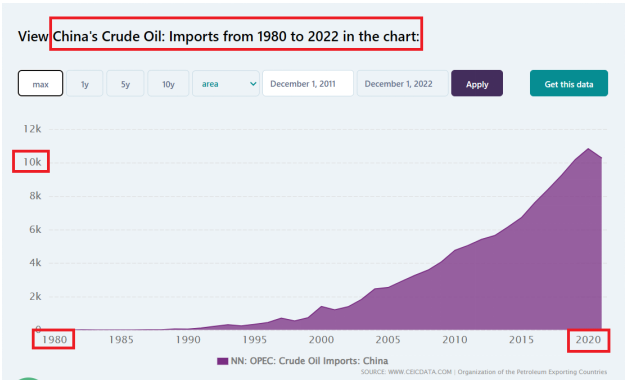

Domestic demand for crude oil has been in a slow downward trend after setting an all-time high of 10,000,000 barrels a day in 2021 (Figure 1). Is the rapid development of renewable new energy in China in recent years the real end of the demand for crude oil?

At present, we can't draw a conclusion too early, so paying close attention to the domestic crude oil import volume in 2024 is an important indicator to judge the future macro trend of crude oil price.

Figure 1: China's crude oil imports from 1980 to 2022

2. Geopolitical influence.

Geopolitical events, such as war, political turmoil, sanctions, etc., may lead to interruption or tension of crude oil supply, thus affecting prices. This year, geopolitics has had a huge impact on the movement of crude oil prices. For example, the Palestinian-Israeli conflict is an obvious case.

3. Policies of producing countries.

The policies and decisions of oil-producing countries, especially OPEC's decisions, have a great influence on the global crude oil supply. OPEC's decision to cut or increase production will directly affect crude oil prices. Saudi Arabia's willingness to cut production this year is an obvious case.

4. Global economic growth.

The growth or recession of the global economy has a direct impact on the demand for crude oil.

When the economy is strong, the demand for industry and transportation increases, and the price of crude oil may rise; When the economy is in recession, the demand drops and the price of crude oil may fall. Therefore, whether the US economy can make a soft landing in 2024 will also have a great impact on crude oil prices.

To sum up, 2024, just like this year, will be a complex zigzag price movement pattern for crude oil prices.

The world geopolitical situation in 2024 will be more complicated than this year. The pace of economic development among countries will also be more inconsistent. In addition, next year is an election year in the United States, and the dazzling instantaneous changes in American domestic politics in the election year will have an impact on crude oil prices more or less.

The Fed's monetary policy next year is still unpredictable, so investors must know how to use crude oil derivatives, especially ultra-short-term derivatives, to hedge and protect their investment and trading positions.

$E-mini Nasdaq 100 - main 2403(NQmain)$ $E-mini S&P 500 - main 2403(ESmain)$ $E-mini Dow Jones - main 2403(YMmain)$ $Gold - main 2402(GCmain)$ $WTI Crude Oil - main 2401(CLmain)$

Comments

What do you think?