At 21:30 Beijing time, according to the US Department of Commerce, the annualized real GDP of the United States in the third quarter was 3.2%, the revised data was 2.9%, and the initial data was 2.6%.

This data is very interesting. The initial data is 2.6%, the revised data has risen to 2.9%, and the final data has risen to 3.2%. Is there a arithmetic progression directly? !

I said in the live broadcast course overnight that once the data is good, it is very likely that the US dollar index will rise in the short term, and then the situation of non-US decline, US stocks smashing and precious metals under pressure will begin to appear.

Since real GDP shrank in the first and second quarters, if the performance in the third quarter is still poor, you can imagine how to refute the so-called technical recession. Therefore, the strong data is of course logical.

The Commerce Department said GDP growth in the third quarter mainly reflected increases in exports, consumer spending, non-residential fixed investment, state and local government spending, which were partially offset by decreases in residential fixed investment and private inventory investment.

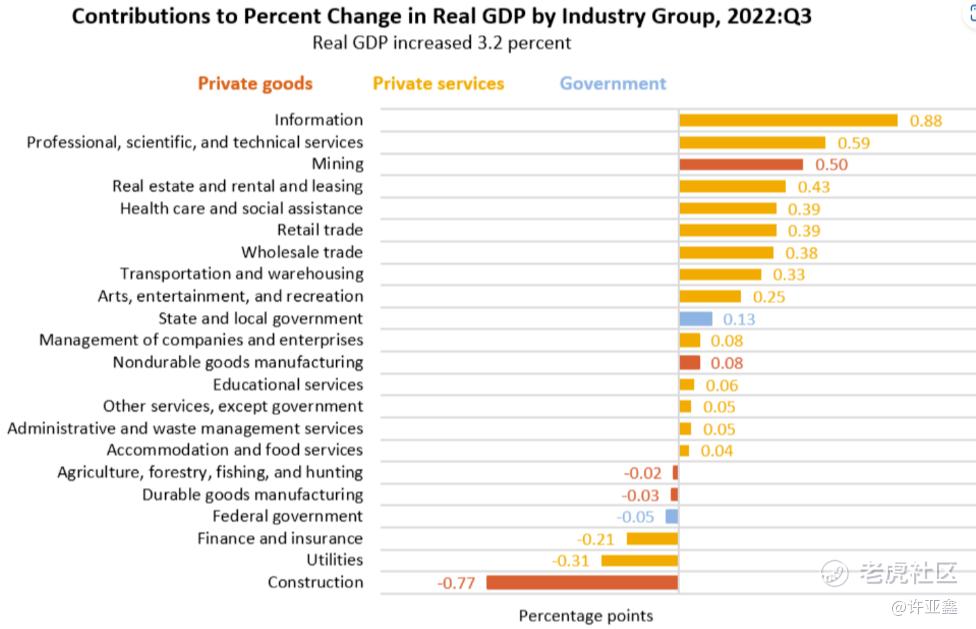

As shown in the above figure, the GDP of private service industry increased by 4.9%, the government increased by 0.6%, and the private commodity production industry decreased by 1.3%. Overall, 16 of the 22 sectors contributed to real GDP growth in the third quarter. But interest-rate-sensitive real estate investment is shrinking at an annual rate of 27.1% as the Fed has raised interest rates seven times this year.

I believes that,In the short term, because GDP data is a lagging indicator of the economy, it means that the market will once again speculate on the expectation that the Federal Reserve will raise interest rates above 5% in the first half of next year. With the rebound of the US dollar index, risky assets will be sold off again. If there is no accident, US stocks will be smashed again tonight.

In the medium term, the GDP growth of the United States is still expected to be positive in the fourth quarter of this year, which is expected to slow down compared with the third quarter, and with the negative effects of the Fed's interest rate hike this year,It means that the GDP data in the first quarter of next year is likely to shrink again, and the probability of economic recession in 2023 is very high.

It is estimated that everyone should remember that after the interest rate meeting of the Federal Reserve in December, the Federal Reserve slightly raised the real GDP growth rate of the United States this year from 0.2% in September to 0.5%, but lowered the real GDP growth rate in 2023 by 0.7 percentage points to 0.5%.

A soft landing or a mild recession, which may be the situation that the Fed wants. Of course, we will hold the best hope, but at the same time, the worst plan to be made is one thing that I has always emphasized-

Be prepared to prevent a deep economic recession, that is, a financial crisis.

After understanding the above logic, everyone naturally understands why we want to publish "Outline of Strategic Plan for Expanding Domestic Demand (2022-2035),After all, the external demand has weakened. If we don't take the opportunity to pull the internal circulation, then there is no solution to this problem.

This solution is already winning numbers, that is, consumption.

$E-mini Nasdaq 100 - main 2303(NQmain)$ $E-mini Dow Jones - main 2303(YMmain)$ $E-mini S&P 500 - main 2303(ESmain)$ $Gold - main 2302(GCmain)$ $Light Crude Oil - main 2302(CLmain)$

Comments

Great