Bank of Japan Governor Haruhiko Kuroda spoke at a news conference as turmoil overseas hit Japanese markets.

-The news comes from Japan, whose influence has far exceeded that of Japan, and investors are still "standing on the edge of a cliff in jeopardy".

Today's Asian trading session saw a sudden sell-off in global stock markets.

-China's CSI 300 Index once fell by 2%;

-Hong Kong Hang Seng Index once fell by 2%, and Hang Seng Technology Index once fell by 4%;

-The Nikkei index closed down 2.5%.

A piece of news from Japan shocked the market-

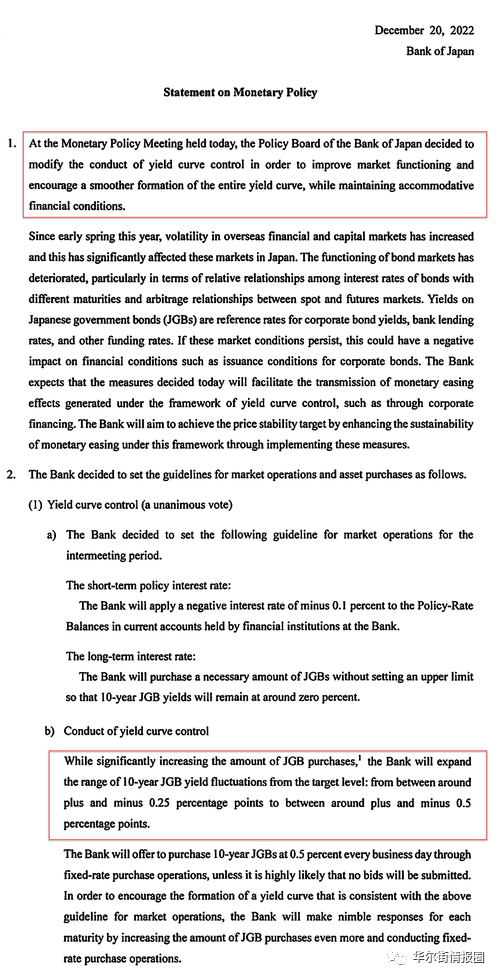

The Bank of Japan announced that it would allow the yield on 10-year Japanese government bonds to rise to about 0.5% (higher than the upper limit of 0.25% in the previous fluctuation range). As the last developed country to insist on low interest rates, Japan's policy is moving towards normalization.

The Bank of Japan said it would set a target range of 10-year Japanese government bond yields between-0.5% and 0.5%. The previous target range was between-0.25% and 0.25%.

Once again, the Bank of Japan tells us that complacency is the devil, which can be said to be the biggest surprise they have brought to the market since they turned negative interest rates in January 2016.

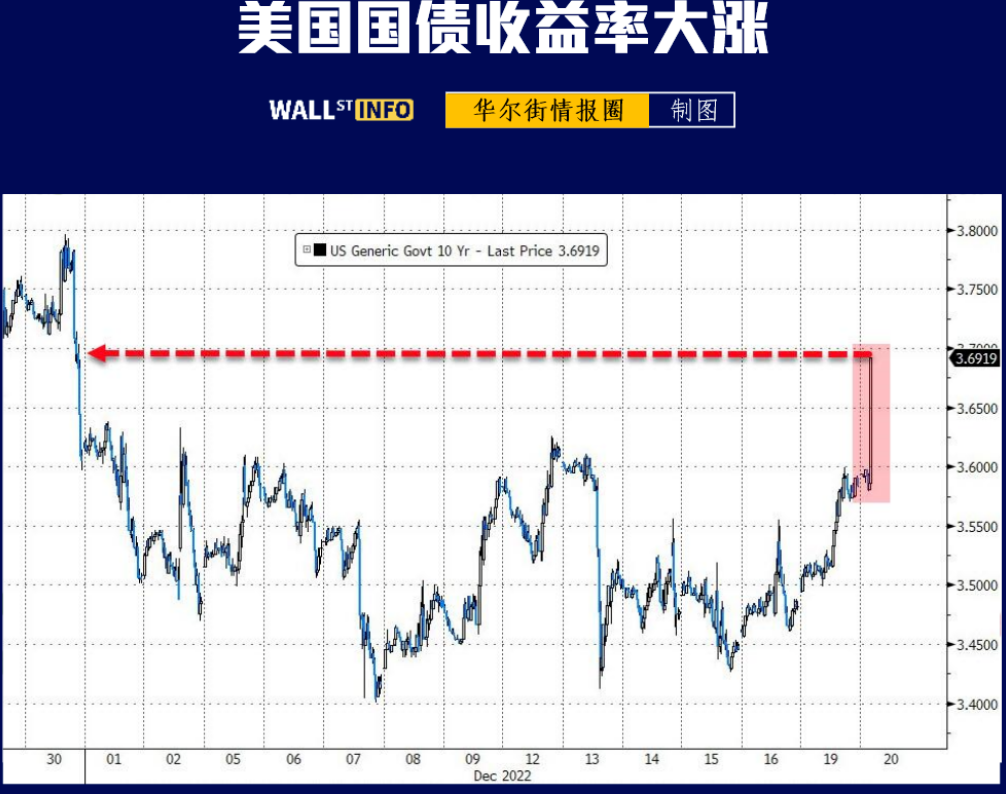

The surprise decision shook global financial markets, sending the yen soaring, Japanese stocks tumbling, U.S. and Japanese bond yields jumping and cross-market assets shaken.

Interestingly, although the increase in Japanese government bond purchases suggested "easing", the yen strengthened against the US dollar because the range of 10-year government bond yields was wider/higher, and in theory the Bank of Japan would have to buy fewer bonds to keep it within its limits.

Don't underestimate the impact of the Bank of Japan's unexpected turn on global markets (the impact is far from over):

First, in the past, the Bank of Japan's firm commitment to defend the yield on 10-year government bonds acted as an anchor, indirectly helping to keep Japan's borrowing costs at world lows.

Second, Japanese investors, one of the largest holders of foreign financial assets, will suddenly have the incentive to repatriate large amounts of money, which means that large amounts of money will flow out of other countries-especially the US Treasury bond market (the anchor of global assets), which already has liquidity problems, and the outflow will tighten the global financial situation.

Third, the policy differences between the Bank of Japan and the Federal Reserve will be slightly reduced, and the previously widened US-Japan spread may narrow slightly, which may lead to a further rise in the yen.

Markets are not static.

$E-mini Nasdaq 100 - main 2303(NQmain)$ $E-mini S&P 500 - main 2303(ESmain)$ $E-mini Dow Jones - main 2303(YMmain)$ $Gold - main 2302(GCmain)$ $Light Crude Oil - main 2302(CLmain)$

Comments