At 20:00 on May 5, Beijing time, the US Department of Labor released the April non-agricultural employment report, which was also the first non-farm report after the Federal Reserve decided to rate hike by 25 basis points in May.

Before the data was released, the futures market expected the probability that the Fed would keep interest rates unchanged in June to be 99.1%.

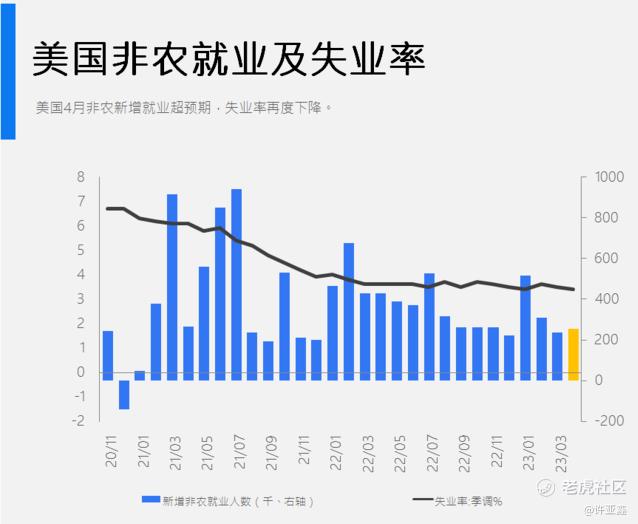

According to the data,In April, 253,000 new non-farm jobs were created in the United States, much higher than the expected 185,000, setting a record of exceeding expectations for the 12th consecutive month.

Meanwhile, the unemployment rate in April was 3.4%, which was lower than the previous value of 3.5% and the expected 3.6%.It hit a 53-year low set in January this year again.

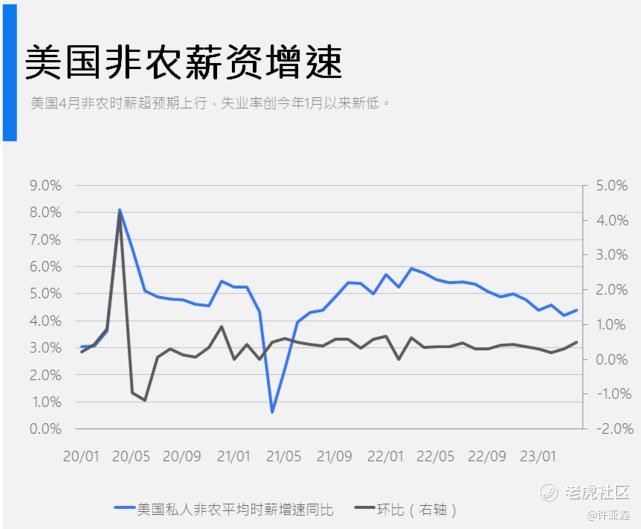

In addition, wage growth continued to accelerate in April. The average hourly wage of non-agricultural employees in the United States increased by 16 cents, 0.5% month-on-month to US $33.36, and increased by 4.4% year-on-year, which was higher than the expected value of 4.2%.

The market's probability of the Fed not rate hike in June dropped slightly to 90.9%, while the expectation of rate hike in June rose to 9.1%, and the probability of cutting interest rates by 25 basis points was 0%. The US Dollar Index rebounded, the prices of gold and silver plunged, and US stock futures fell short-term.

In short,This is a hawkish non-farm payrolls report, which will keep the Fed in troubleThat is, the Federal Reserve wants to suspend the rate hike, and even the market hopes that the Federal Reserve will start to cut interest rates in the third quarter, but the job market does not cooperate. Now, employment is undoubtedly a lagging indicator, but the unemployment rate of 3.4% is extremely tight.This is the 12th consecutive month that non-farm payrolls have exceeded market expectations.

In fact, for tonight's non-farm employment data, we have done a wave of market yesterday, and then made an empty list layout again, which is located in the 2050-55 area:

At this time, someone will ask me, your article yesterday, "0504: Gold price soared to a record high! What's the mystery? "Didn't you list the five advantages of gold? Why did you enter the market to short again? !

In fact, there is no contradiction between the two. Some factors affect the short term, while others affect the medium and long term. For example, this wave of short vacancies we laid out overnight is actually doing non-farm employment data higher than expected.

Fortunately, it is a thing far exceeding expectations. However, according to the trading plan, we are just doing short vacancies, and I do not recommend taking short position for the weekend. After all, the trend is still bullish, and during my live broadcast tonight,It also gives a clear time point and space point of stopping profit.

$E-mini Nasdaq 100 - main 2306(NQmain)$ $E-mini Dow Jones - main 2306(YMmain)$ $E-mini S&P 500 - main 2306(ESmain)$ $Gold - main 2306(GCmain)$ $WTI Crude Oil - main 2306(CLmain)$

Comments

期货市场搞错了,但作为投资者,我对加息和潜在回报感到兴奋

Wow, with such strong job growth and low unemployment rate, investing in stocks seems like a no-brainer!

With such high wage growth, investing a larger amount in US stocks seems like a smart move

Looks like it's a good time to invest in indexes, especially since the job market is so strong.

As an investor, I'm feeling bullish on the US economy after this impressive jobs report