Has Nvidia peaked? Trading tipss from institutions

A hot stock up 24% in a week is bound to be a battleground between bears and bulls. I don't need to look at the market to know that at times like this it must be a battle between bulls and bears, with positions determining the direction. If you want to short will anger believe short large single, want to do long will believe long large single. High and low share prices lead to serious speculation, large single signal pollution. But you can also glean some useful information from the perspective of strategy, expiration date and strike price.

Here are six options strategies for NVDA.

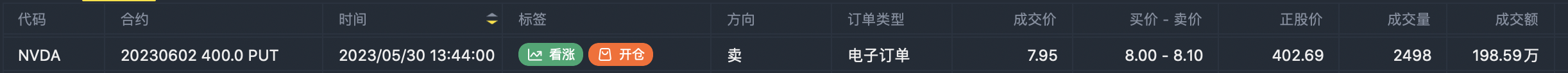

sell put:

sell $NVDA 20230602 400.0 PUT$

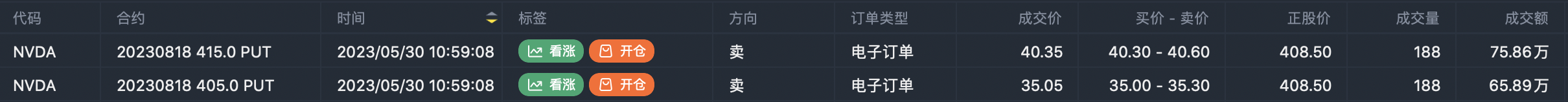

sell $NVDA 20230818 405.0 PUT$

or

sell $NVDA 20230818 415.0 PUT$

Why share the sell put first? I think the seller has more to think about than the option buyer, because if the strike price falls, it's really going to take the order. And the buyer pressure is not so great, the price of high or low will often have gambling psychology, in case continue to rise/fall on the money? That's what the vix measures.

The first sell put seems to have a very average turnover, only less than 2 million, but if you calculate the position that needs to be exercised: 2498x100x$400=$99920000, you will find that this is indeed a large order, very heavy.

Unfortunately, the order is closed today. It seems the trader didn't think it through.

Whether the option buyer moves or the seller moves, the closer the expiration date, the more convincing it is. The following 405,415 is similar, although the volume is not big, but after taking positions have reached more than 5 million. Indicates that the institution feels that either 400,405 or 415 are acceptable position prices.

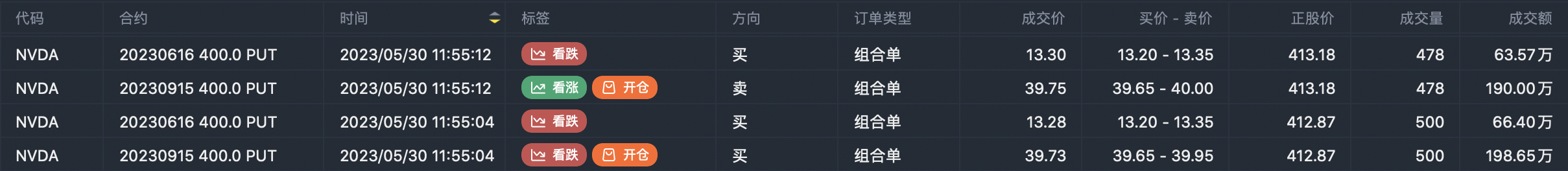

calendar:

sell $NVDA 20230915 400.0 PUT$

Short-term bearish, long-term not bearish. It feels like the institution wants to put a forward sell put, but has little faith in the near-term trend and is afraid of margin calls if the pullback is too sharp, so it adds a buy put leg.

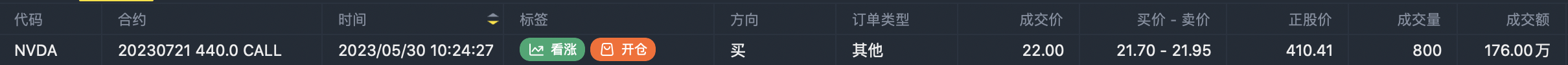

buy call:

buy $NVDA 20230721 440.0 CALL$

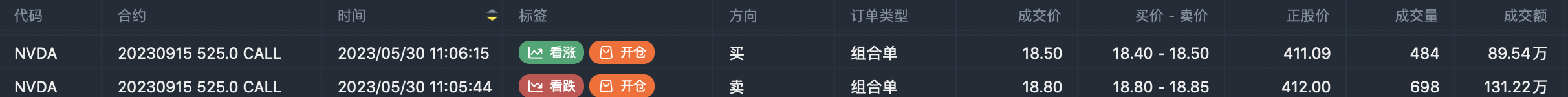

buy $NVDA 20230915 525.0 CALL$

Single leg call, nothing special need to explain, plus leverage bullish, relatively high risk.

sell call

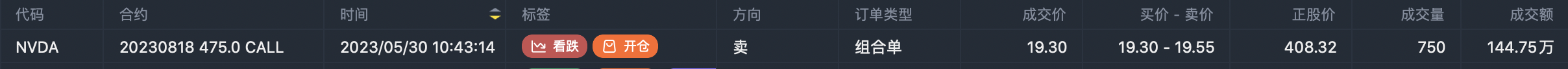

sell $NVDA 20230818 475.0 CALL$

The firm sees Nvidia up less than 475 by August. In addition, I think it also includes the meaning that IV is too high in these two days. If so, the position may be closed after one or two weeks if IV goes down. After all, the risk of selling a call on one leg is too high. The other scenario, of course, is this is a covered portfolio, and the institution itself owns Nvidia shares.

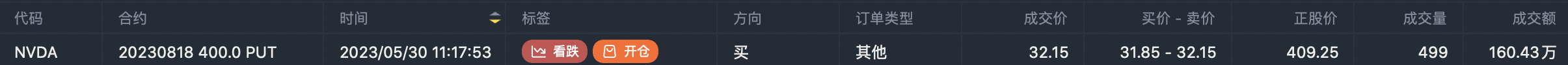

buy put

Unflashy single leg buy put bearish, profit point is 400-32=368, is almost the lowest price on the day of the earnings report, correction range is not very outrageous.

From my personal point of view, I think it is reasonable to sell $NVDA 20230915 400.0 PUT$ , the overall experience will be more similar to stock holding. In fact, at this stage there should be no objection to the stock position, the key is not to leverage. Stock position and leverage are two concepts.

Why is there no objection to the stock position? Microsoft went to 332, but the guy who rolled 80 million didn't close his position. Get a sense of it. $MSFT 20230915 300.0 CALL$

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

在接下来的4个月里,这将会超过200美元

The world will be living in NVIDIA's & Tesla's world when we evolve to 6g.

NVDA实际上从来没有上升过我记得2021年是350,现在不到390

This company makes serious money. Think about it.

Great ariticle, would you like to share it?

NVDA will drop 15 to 20 dollars easily.