The Most Effective Option Strategy For Earnings is HERE!

The market plummeted in last few trading days, as the 10-year US bond yield rose above 2.8%, the kinetic energy stocks fell sharply, and the Nasdaq index once again came to a key position.

Although there is not much deviation between the Fed’s minutes and the March FOMC, but the market began to fall at this time windows as the same as January, and the fluctuation intensified.

Last night $Cboe Volatility Index(VIX)$ closed above $25 again. I said before that the VIX enter a high fluctuation range when it reaches $25. Basically, it can be judged that the several major financial reports will drive big swings on their prices, so straddle and strangle options strategies will become good choices for trading earnings.

Goldman Sachs said an options strategy to profit from the wild earnings!

Watch OUT! Get Straddle and Strangle for earnings season.

Now let's review the key points of them:

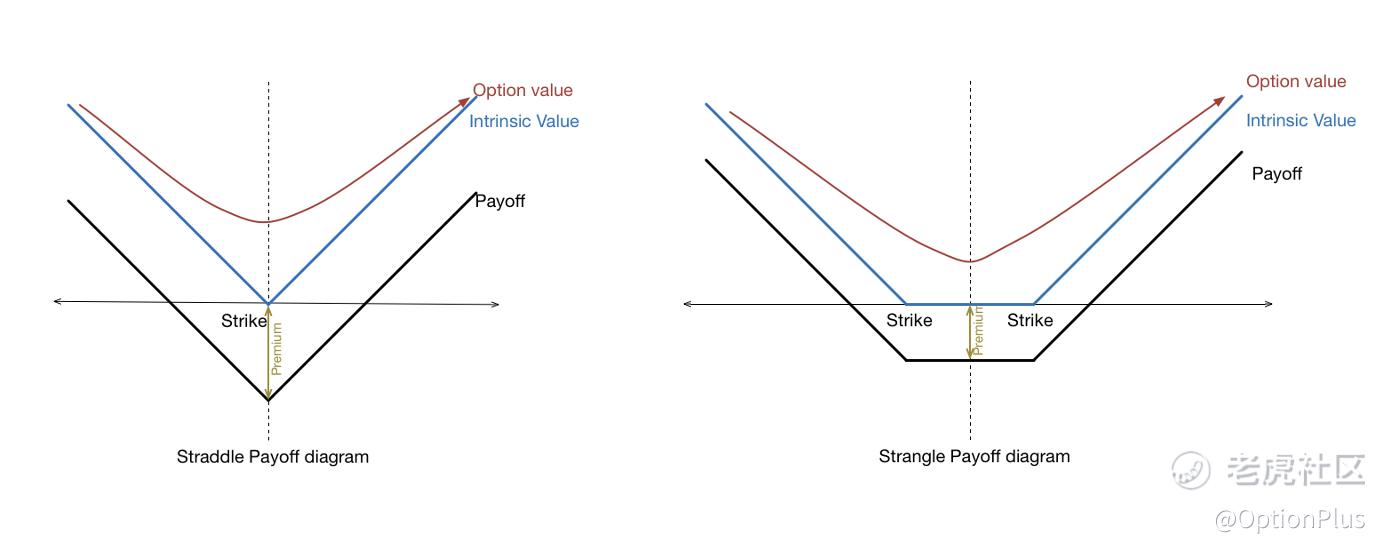

A straddle which a call and put with the same strike price and expiration date is bought. Usually these options are near ATM.

A strangle refers to a call and a put option on distinct strikes, with the same expiration. Usually these options are OTM. If both of these options are ITM, then it is known as agut strangle.

Straddle and Strangle are more expensive than simply buying a call or put, because it needs to buy two contracts, so its biggest risk is that the move is less than expected, and the income of one side is insufficient to cover the cost of two sides, resulting in losses. However, as an option buyer, the biggest loss is the total premium of two contracts paid upfront.

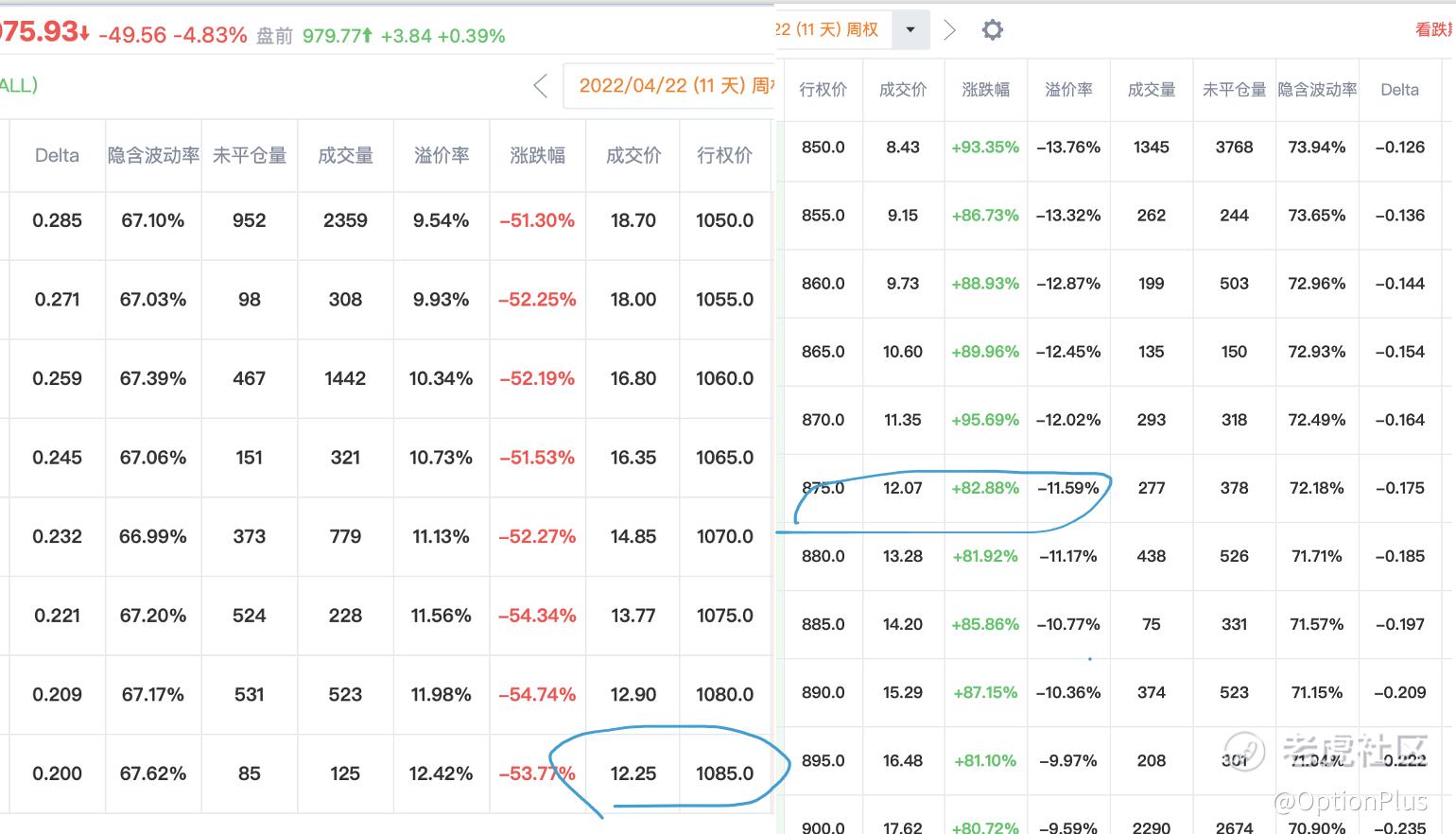

The BETA driven stocks are suitable for strangle, that is$Netflix(NFLX)$And$Tesla Motors(TSLA)$. NFLX will release its result on April 19th after market closes, and TSLA will release on April 20th.

$Netflix(NFLX)$ ,after its last financial report, the stock price plummeted by more than 20%. If you buy its CALL and PUT at the same time, PUT will won more than 200%, completely covering the cost of CALL and PUT.

$Tesla (TSLA) $, after the last result, the stock also plummeted by 11%, and PUT rose more than doubled, which also made a good profit.

Almost all high-beta tech stocks made money with straddle and strangle options last quarter. Will it happen again in this quarter? Nobody can be sure, but we bet from the VIX Volatility Index and the stock option IV.

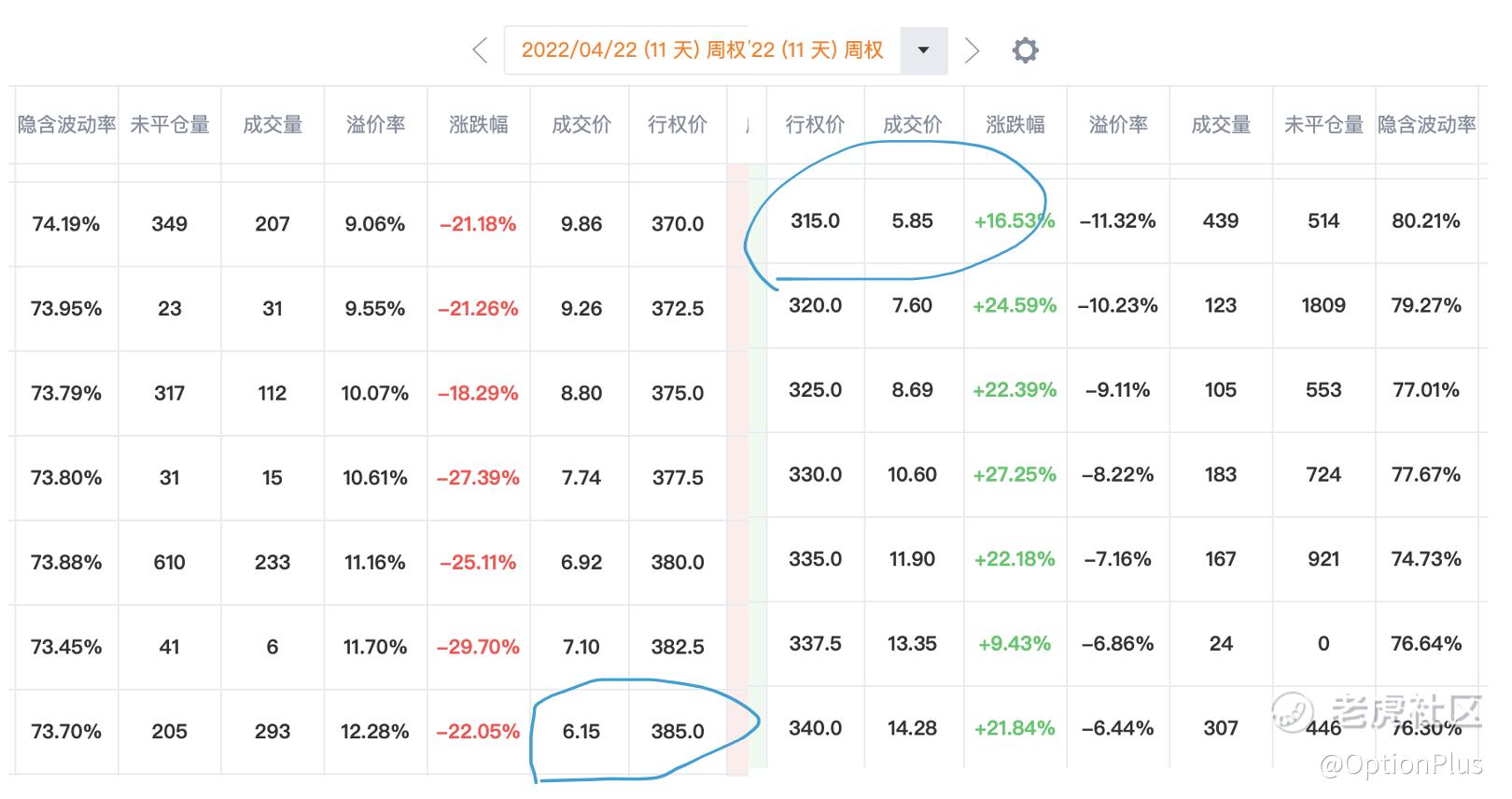

Let's take a look at NFLX's options due next week. Because of the high cost of options, I recommend the OTM options, if the overall cost of a pair of CALL and PUT is controlled around $1000, it should be $315 PUT and $385 CALL, which correspond to the current price rise and fall of about 10%. At present, the implied volatility has reached 80%, and the extreme value of implied volatility last quarter exceeded 100%.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

良好的分享