The feeling of 07/08 is back: 2000 for gold, 140 for crude oil?

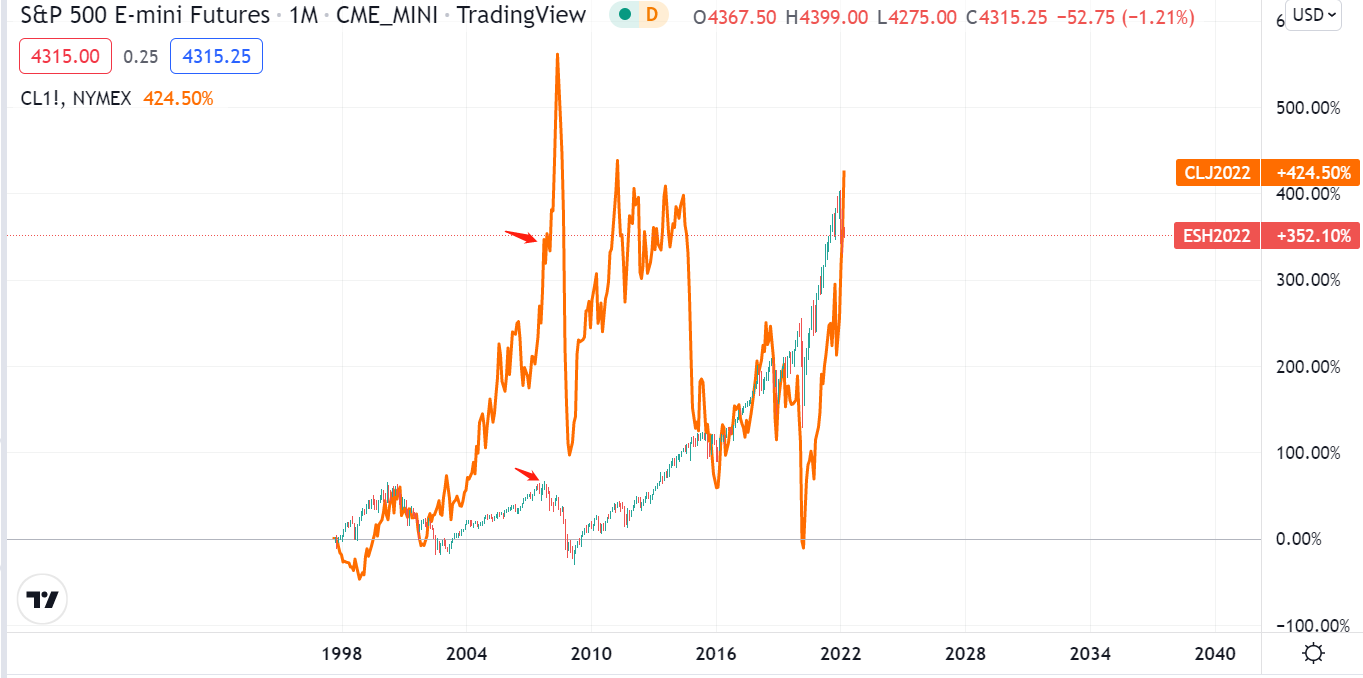

The major gap in the jump at the beginning of last week has not been covered, which confirms the further strengthening of the recent trend. Gold began to rise to the 2000 mark, while crude oil continued to triumph and completely decoupled from the US stock index. The last time the market was so crazy, it had to go back to the financial crisis in 2007/08. However, this geopolitical crisis may be even more violent than at that time.

Keep away from crude oil

In the live broadcast in the middle of last week, we compared the long-term charts of US oil and S&P, and a similar situation appeared on the eve of Lehman moment-US stocks had begun to peak and fall back and be greatly revised, and oil prices continued to surge for some time before a cliff-like crash occurred.Based on this, considering that there is no adjustment of crude oil at present, the speculation head of any left-side transaction is to send money. At present, the volatility of crude oil is no longer suitable for ordinary investors to participate, and it may be the best choice to wait quietly for things to change.

Short Europe

The main logic of shorting Europe + long other regions recommended in the live broadcast is very obvious:The situation in Russia and Ukraine lacks opportunities and methods for a quick solution. Although both the United States and NATO command by remote control, the main battlefield is in the European continent after all. If there is any new large-scale conflict, Europe is the first to be unlucky.

The performance of European stocks and the euro has also reflected investors' concerns in this regard. Although other risky assets and non-US currencies are also falling, the euro and European stocks are obviously the least resistant to decline. Stay away from the main battlefield (short the main corresponding assets) + long other assets of the same type are our views on the current situation.

The same idea can be laid out in advance to other countries and regions where crises/problems may occur, especially those places where they are relatively bearish or have risen relatively high in the early stage.

Gold waits for a new high

Gold continues to rise, which is consistent with our medium and long-term target direction. Bulls from 1900 to 2000 can almost be said to have no effort, and the next major suppression is the previous historical high. Similar to crude oil, the current market environment can't find any reason to suppress gold, and the market trend itself is bullish. So just stay in the car and hold it steady.

Silver started to rise simultaneously, and also made a breakthrough in the trend line. However, from the relative performance, there is still no brilliant place, which is more or less disappointing. However, there is no need to worry too much. Silver may need to break through the 30 mark before those funds who are short on blank silver can throw in the towel completely.At that time, the short-selling market similar to crude oil will come. The end of the precious metal bull market is always the performance time of silver.

Finally, the Russian-Ukrainian negotiations lack substantial progress, and the market risks are increasing. Crude oil decoupled from US stocks, or will continue to be independent and crazy. Short Europe and other regional varieties with the same risks. Gold is waiting for the target of 2200-2300, and silver may have another situation after 30.

$E-mini Nasdaq 100 - main 2203(NQmain)$ $YMmain(YMmain)$ $Gold - main 2204(GCmain)$ $Light Crude Oil - main 2204(CLmain)$

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Great article