Goldman Sachs said an options strategy to profit from the wild earnings!

In the past two weeks, it can be clearly seen that individual stocks have experienced massive single-day swing after their earnings. At the time, straddle option is the most suitable strategy, and option traders can benefit from the sharp rise and fall no matter whether the prices are up or down.

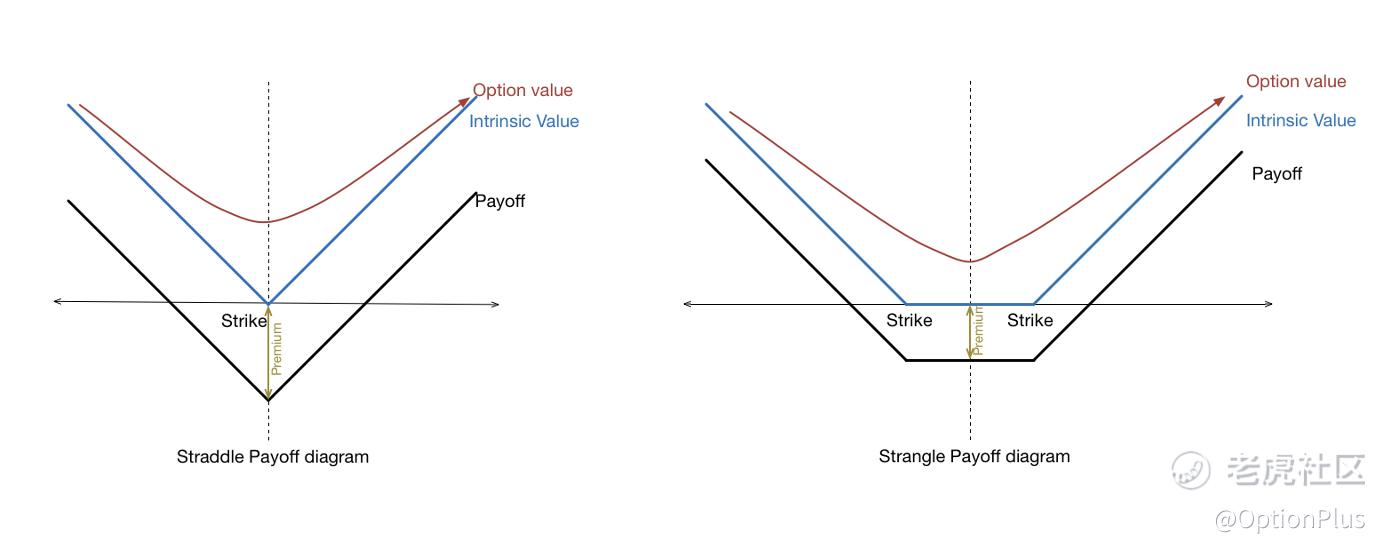

Straddle and strangle are widely used to gamble on earnings, because it is regardless of direction. Buying a call option and a put option, if the swing is large enough, that the profit from one side can cover the costs on both sides and earn extra. The extreme moves in this earning season are especially suitable for straddle and strangle.

In Watch OUT! Get Straddle and Strangle for earnings season. I introduced the straddle and strangle as follows:

A straddle which a call and put with the same strike price and expiration date is bought. Usually these options are near ATM.

A strangle refers to a call and a put option on distinct strikes, with the same expiration. Usually these options are OTM. If both of these options are ITM, then it is known as agut strangle.

"The higher-than-normal moves have driven up the profile of buying straddles around earnings. Buying the closest to at-the-money straddles has returned +15% on premium in the week of earnings, above the historical returns of +3%."

Straddle and Strangle are more expensive than simply buying a call or put, because it needs to buy two contracts, so its biggest risk is that the move is less than expected, and the income of one side is insufficient to cover the cost of two sides, resulting in losses. However, as an option buyer, the biggest loss is the total premium of two contracts paid upfront.

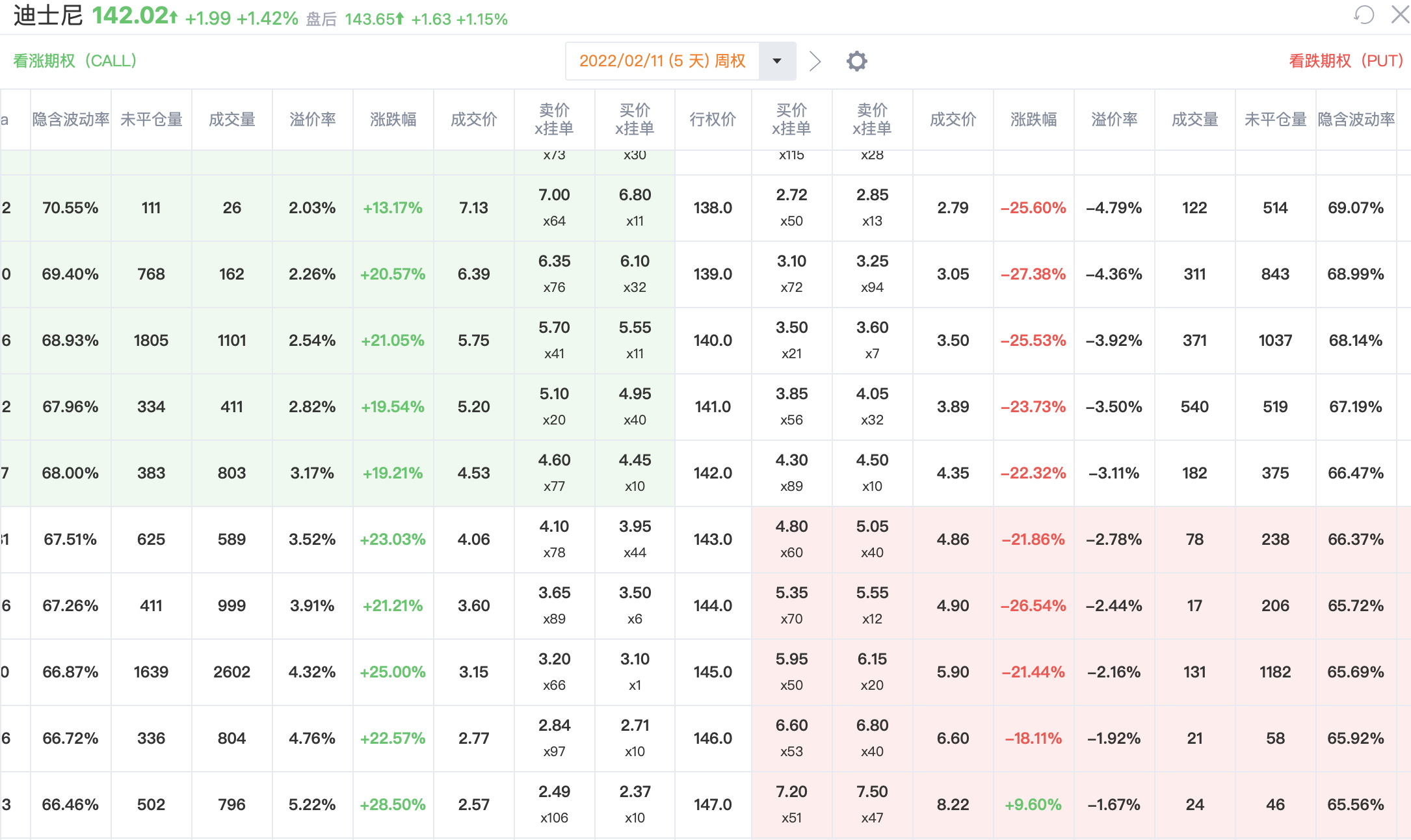

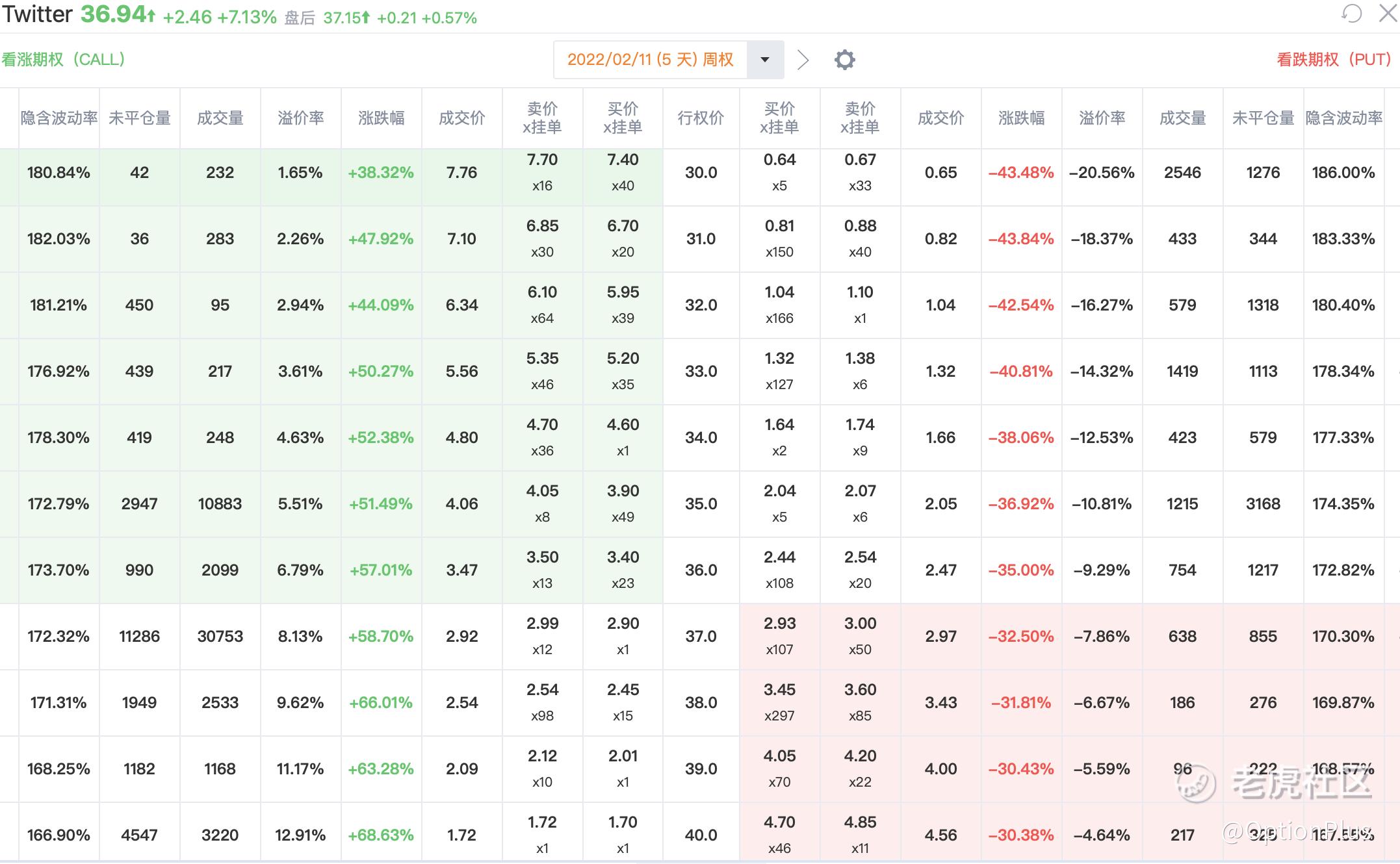

Among the several key earnings this week, there are two straddle candidates are $Walt Disney(DIS)$ And$Twitter(TWTR)$.

At present, the paid-users growth of Disney+ will be the core of the financial report. Because Netflix plunged by more than 20% on the day when it released the unexpected guidance, and Disney, who also relies on streaming media stories, fell by 7% on the day when Netflix plunged. If Disney's result beat the expectation, there will probably be a super rebound (refer to Amazon and Snap). If the financial report is not good, Disney's decline should chase Netflix.

According to Disney's option IV, the option IV due this week is 65%-70%, which has doubled the historical average.

Twitter's IV has reached 170%-180%, which is more than three times the normal situation. Is this high? If compared with Snap's IV exceeds 300% the day before its earnings, so it is not too high.

As Lyft will report on Tuesday, It can give some colors for Uber. If you trade Uber's options, you can pay attention to Lyft's post-earnings moves, if the swing is large, that will inevitably drive Uber's IV to enlarge again, which can benefit before Uber's financial report. If Lyft's financial report does not move greatly, so if you don't want to hold it until Uber's result, you can stop the loss in advance, so Uber may be a better choice.

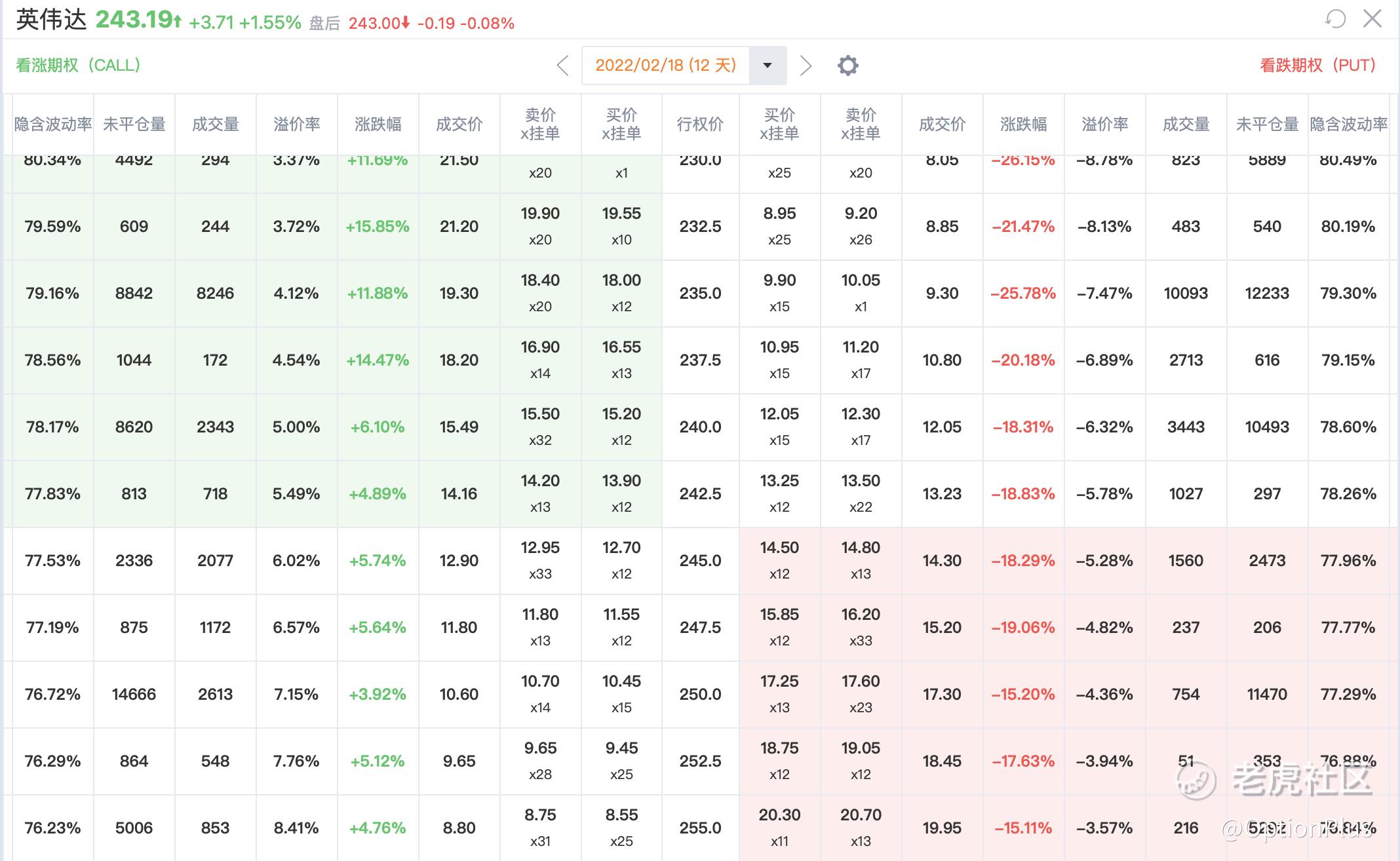

In addition, it must be commented that the Big tech- $NVIDIA Corp(NVDA)$ will be result next week. I saw a large number of straddles laid out last Thursday and Friday. At present, the option IV due next week on February 18th is 75%-80%, which is not much higher than NVDA regular IV (about 50%). Referring to AMD's movement after earnings, NVDA is really suitable for gambling. There are still 7 trading days before the financial report on February 16th. If it goes well, you can eat a wave of IV premium dividends in these 7 trading days.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Interesting

Options trade

Try it out!

Try them out