DAY1 Education : Sustainable Competitive Advantages Explained

Hi, tigers~

Today is the first day of column "Learn US financial reports for beginners".

In this article, I will introduce 2 practical methods of how to judge whether a company has competitive advantage.

- Total revenue

- Gross profit

1. Total revenue

You might think, company A with tens of billions of dollars in annual total revenue is much better than Company B with billions of dollars in annual revenue, but is that true? Let me give you an example:

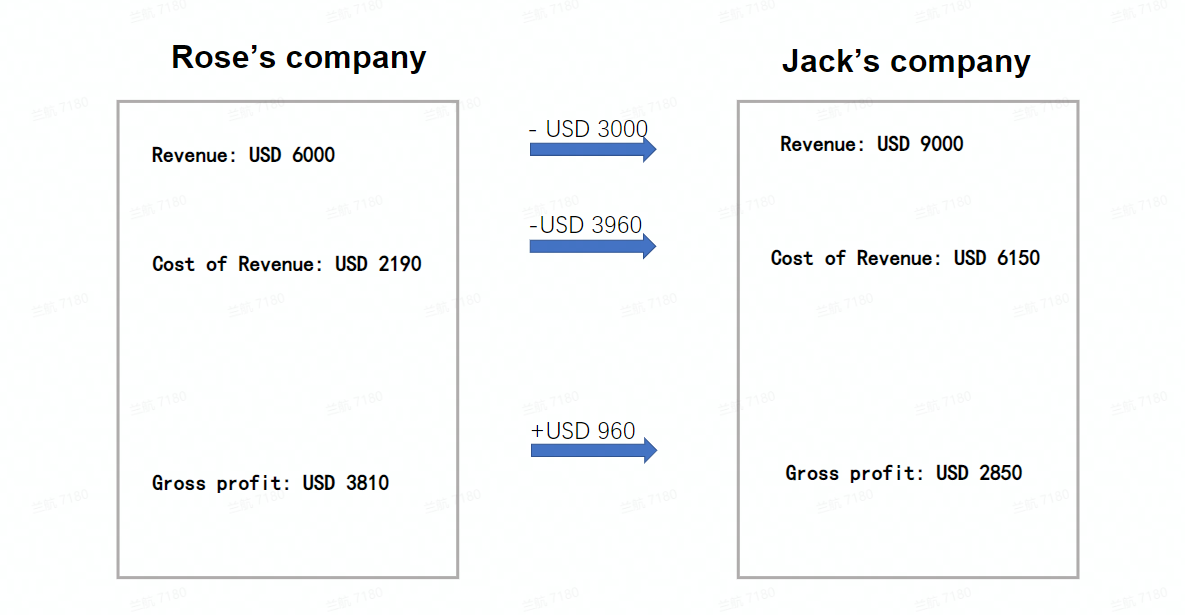

Jack and Rose run separate companies. Jack's company generates $9,000 in revenue per month, while Rose's company generates only $6,000.

From a revenue point of view, you would definitely think that Jack's company is better developed and more competitive.

But if we do a careful analysis and take into account the cost of sales each month, the results may change.

However, although the revenue of Rose company is behind that of Jack, the cost of revenue is well managed and the monthly gross profit can be $3,810 dollars.

It can be seen that Rose has more profit funds than Jack in the company every month.At this point, we get to the first conclusion: you can't judge a company by its revenue alone. You may ask, So what should we pay attention to?

This brings us to the second point: gross profit.

2.Gross profit

Warren Buffett, the investment guru, is very good at picking companies.

He once said that gross profit is the key metric of long-term profitability. Only companies with sustainable competitive advantages can maintain profitability over the long term.

What is this gross profit that Buffett takes so seriously? Why does Buffett focus on this number?

Gross profit = revenue-cost of revenue. Cost of revenue is the total cost of manufacturing and delivering a product or service to consumers.However, high gross profit doesn't mean everything.

Buffett said:" Firms with excellent long-term economics tend to have consistently higher margins." In short, there are two key words: "high gross margin" and "consistency".Let's look at the first key word: -- "higher gross margin".

How to calculate gross margin? The basic equation is: Gross margin = gross profit/revenue.

As we have learned that: gross profit = revenue-cost of revenue. Therefore, gross margin = (revenue-cost of revenue)/revenue.Then it becomes a simple math problem.

We just need to find companies in an industry, count their gross profits, then we can find the top companies.I would like to remind you that gross margin varies greatly in different industries.

For example, the software industry has a median gross margin of 59% by the end of 2021. The top 10 companies in this table all have a gross margin over 91%.

The industry leader Microsoft only has a gross margin of 65%.While in the traditional manufacturing industries like auto and auto components industries, the median gross margin is only 16%.

You can tell from this table that the average of gross margin is only 35%, even for the top 10 companies.So different industries have different gross margins, and we must treat them separately.

Let's look at the second key word: "consistency."

If the company can't sustain its high gross margin, its competitive advantage is not consistent. When many companies are facing a crisis, they may also break out a high gross margin for a period of time through some means of financial fraud.

Therefore, it's necessary to identify the feature of "growth" in the income statements. If the growth is not sustainable, the company doesn't have long-term competitive advantage. We need to look at gross margins for the past 5 years or more.

So, Let's summarize what we've learned today :

- First, we have learned that we can't simply look at "revenue" to judge whether one company has good profitability or not.

- Secondly, we need to focus on the gross profit and gross margin of the company.

- Thirdly, gross margin is a key indicator to assess companies' sustainable competitive advantage. Within an industry, companies who have higher gross margin means these companies have higher competitive advantage.

- Fourthly, we have learned how to calculate gross profit = revenue-cost of revenue, and gross margin = (revenue-cost of revenue)/revenue.

Okay, have you learned the content of today? I hope it can help you to understand the US financial reports quickly.

Share your thoughts with me and other Tigers, You can get cions~😎

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Reducing cost of revenue is impt to increase gross margins which will eventually affect net income (profitability).

Current rising inflation directly affects cost of revenue so pricing power is critical for company's to increase gross margins in this environment.

[财迷][财迷][财迷]

Thanks @Tiger_Academy for highlighting the importance of knowing how to calculate Revenue and Gross Margin. These are excellent metrics to know to find out whether a company has sustainable competitive advantages. Your explanation is very clear and succinct.

I look forward to Lesson 2.😍😍😍

Not really sure EBITDA margin or netincome margin is a better metrics though. I would like to learn these from the upcoming lessons.