Institutions| Chase High or Not? Possible End of Rally?

In the face of highly uncertain outlook for the US stock market, market opinions are divided.

Should we chase the high or not?

On the one hand, market sentiment continued to be high; on the other hand, analysts warn of unresolved risks and overbought equities.

This article combs through institutions opinions and tries to help investor know more about the future trend.

Bullish

The JPMorgan strategists have remained bullish on US stocks this year even as equities marked their worst first-halfperformance.

JPMorgan Chase & Co. said

the rally -- which has pushed up the tech-heavy Nasdaq 100 index by over 20% -- could run through the end of the year.

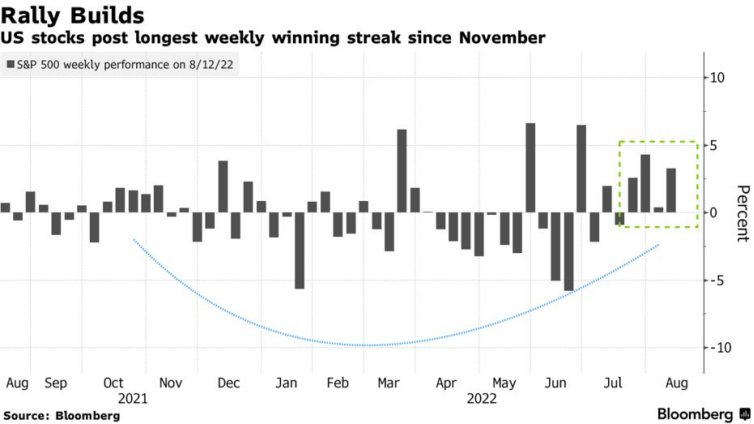

In addition, the retail investors’ sentiment continue to grow as $S&P 500(.SPX)$ won 4 straight weeks.

Bearish

Morgan Stanley strategist Michael J. Wilson, one the most vocal and staunch bears on US stocks, says

the rebound is now overdone.

BlackRock Investment Institute’s Deputy Head Alex Brazier said

We don’t think the equity bounce is worth chasing.

The latest inflation reading isn’t enough to spur the Fed pivot we’ve been waiting for to lean back into stocks.

In addition to inflation and rate hike, they give us suggestions from another perspective.

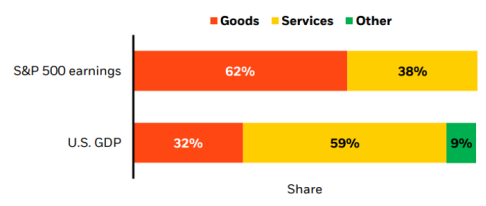

Consumer spending is in the process of shifting toward services and away from goods. Goods account for 62% of the S&P 500’searningsthis year; while services contribute more to US GDP.

What Might Be The End of This Rally?

The $NASDAQ(.IXIC)$ rose above the downside corridor and began its upside move.

The next presurre level for $NASDAQ(.IXIC)$ is the MA 250 of 13800. (the blue line in this figure)

Technically, the broader market may continue its rally in the short term.

Do you think investors should chase high or not?

Share your opinions in the comment section~

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

In life there is always 2 sides to a coin. While it is very tempting to chase the current rally, it is always best to consider the fundamentals of the stock when investing and the macro headwinds. Even though inflation is still high, the markets have been pricing a tapering off of interest rates. I like to invest in quality stocks like Apple, Microsoft and Alphabet as they will continue to grow exponentially in the long term and are more resilient in volatile times.

@Capital_Insights @TigerStars