Last week, overseas interest rate cut expectations were further revised, and the CPI in September was higher than expected. At the same time, several Fed officials stated that interest rate cuts may be lower than previous market expectations.

The market's interest rate cut expectations have also improved. The momentum of short-term economic growth has also improved, and copper prices have stabilized and rebounded accordingly. However, we do not think that the data in the United States will continue to strengthen, and we need to consider the possibility that the interest rate cut expectations will rise again.

CORE POINTS

1. Expectations for interest rate cuts continue to be revised, and copper prices stabilize and rebound

Last week, overseas interest rate cut expectations were further revised, and the CPI in September was higher than expected. At the same time, several Fed officials stated that interest rate cuts may be lower than previous market expectations. The market's interest rate cut expectations have also improved. The momentum of short-term economic growth has also improved, and copper prices have stabilized and rebounded accordingly.

However, we do not think that the data in the United States will continue to strengthen, and we need to consider the possibility that the interest rate cut expectations will rise again.

2. Potential secondary inflation risks still exist

Last week, the U.S. CPI and PPI data both exceeded market expectations. The market's expectations for interest rate cuts during the year were revised again, and possible secondary inflation risks subsequently emerged, and precious metal prices stabilized and rebounded.

In the case of repeated interest rate cut expectations, whether it is secondary inflation or soft landing expectations, there is still some room for gold prices to rise. What needs to be vigilant about is the possible liquidity risks in the United States, which will have a fatal blow to gold prices.

1. Base metal market review

Last week, COMEX copper prices first declined and then rose, maintaining a wide range of fluctuations overall. Last week, overseas interest rate cut expectations were further revised, and the CPI in September was higher than expected. At the same time, several Fed officials stated that interest rate cuts may be lower than previous market expectations. The market's interest rate cut expectations have also improved. The momentum of short-term economic growth has also improved, and copper prices have stabilized and rebounded accordingly. However, we do not think that the data in the United States will continue to strengthen, and we need to consider the possibility that the interest rate cut expectations will rise again.

In terms of term structure, the COMEX copper price curve angle has previously shifted downward, and the price curve still maintains a contango structure. At present, COMEX copper inventory has reached the level of 75,000 tons, and the delivery of warehouses even showed signs of acceleration last week. There are rumors that the delivery of COMEX copper positions may last until the end of the year. If this is the case, then the monthly difference will still be dominated by contango, and there is no good chance.

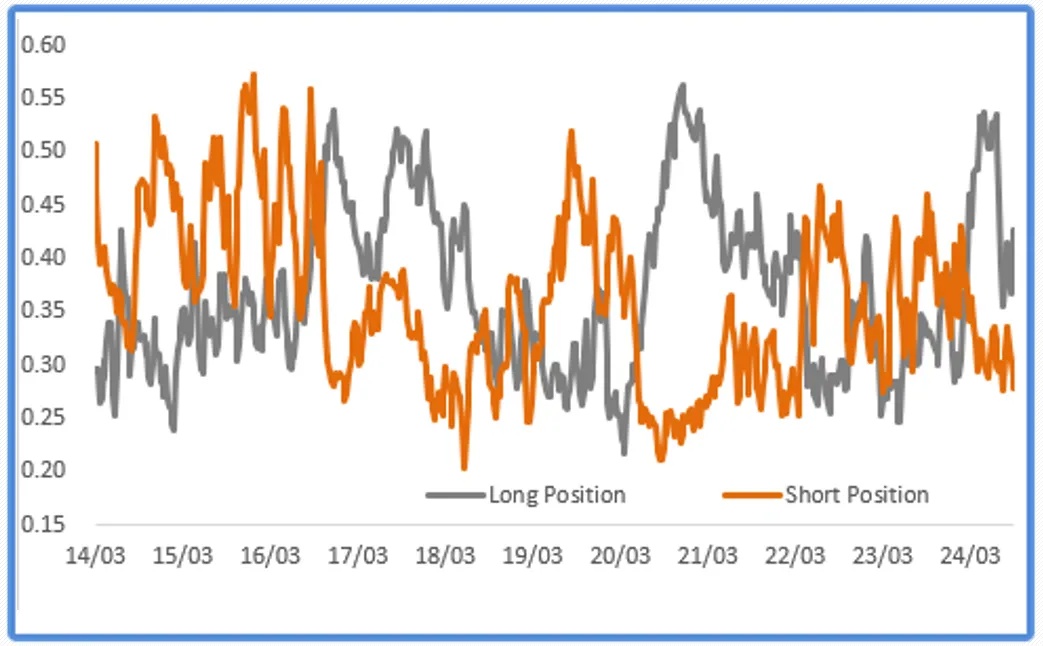

In terms of positions, from the perspective of CFTC positions, the proportion of non-commercial long positions continued to rise last week, matching the price rebound. It is expected that after the implementation of a series of policies in China, the game between long and short positions will become more significant.

Figure 1: CFTC fund net positions

Price comparison and volatility

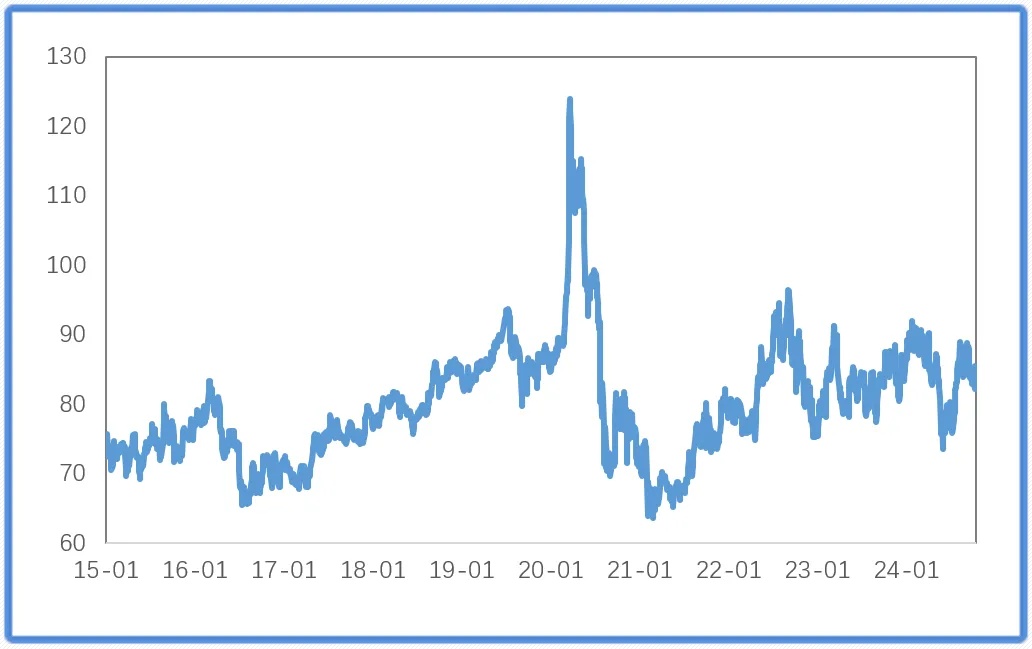

Last week, the price of gold rose, the price of silver fell, and the price of gold and silver fluctuated upward compared with the previous period; Copper prices fell, and the gold-copper ratio fluctuated upward; The price of crude oil rose compared with the previous period, and the increase was stronger than that of gold. Gold and oil fluctuated downward compared with the previous period.

Figure 2: COMEX Gold/COMEX Silver

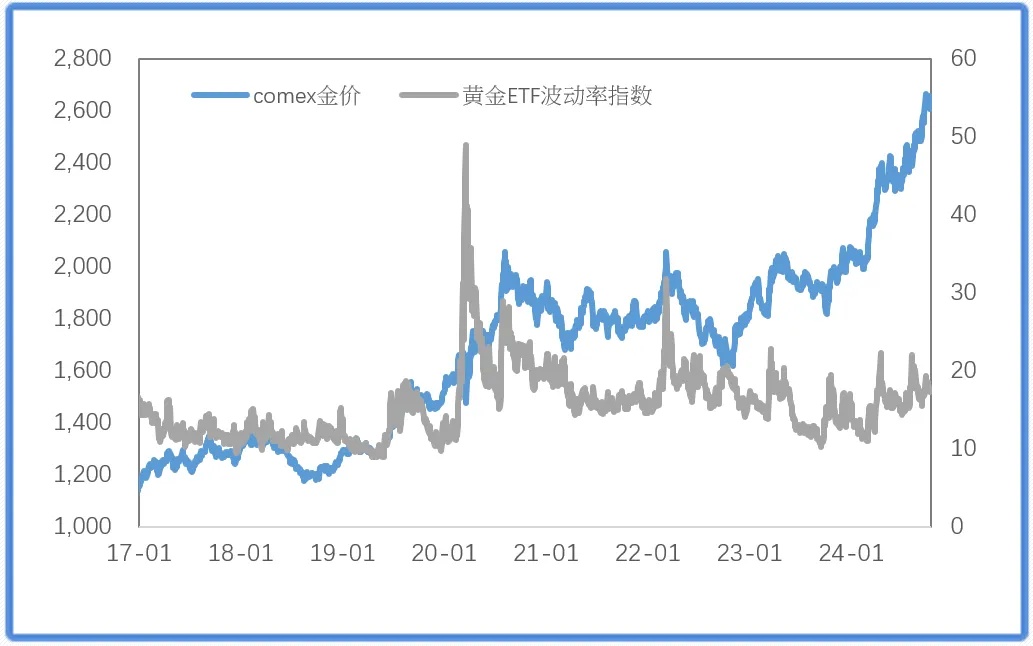

Gold VIX continues to fall, market panic continues to weaken, and safe-haven demand decreases.

Figure 3: Gold volatility

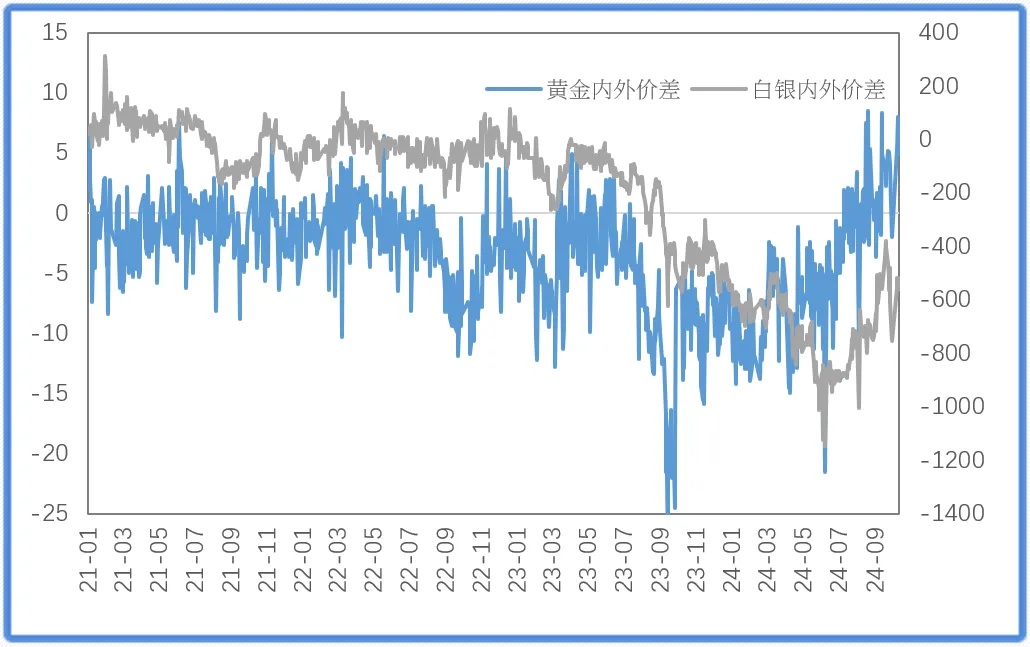

Recently, the impact of the RMB exchange rate has increased compared with the previous period. Last week, the price difference between inside and outside gold increased compared with the previous period, and the price difference between inside and outside silver decreased; The internal and external price ratio between gold and silver has increased.

Figure 4: Inside and outside price spreads of precious metals

Market outlook

Judging from the meeting of the Ministry of Finance over the weekend, although the actual measures and scale were not mentioned, the overall meeting of the National Development and Reform Commission was more pragmatic and is estimated to be more neutral to the market.

At present, the macro and micro foundation of the rise in copper prices is more solid than the rise in the first half of the year, which determines that the lower support of copper prices will be stronger. Around US $10,000/ton is a relatively reasonable valuation.

In the case of repeated interest rate cut expectations, whether it is secondary inflation or soft landing expectations, there is still some room for gold prices to rise. What needs to be vigilant about is the possible liquidity risks in the United States, which will have a fatal blow to gold prices.

$Gold - main 2412(GCmain)$ $Silver - main 2412(SImain)$ $WTI Crude Oil - main 2411(CLmain)$ $E-mini S&P 500 - main 2412(ESmain)$ $E-mini Nasdaq 100 - main 2412(NQmain)$

Comments

Great article, would you like to share it?