This week, there have been two notable pieces of news—one largely speculative and the other more concrete. The speculative news surrounds rumors that Jerome Powell might resign due to a certain issue. However, these reports lack substance for two reasons: first, Powell has only a short time left in his current term, making resignation unnecessary; second, the issue being cited appears to be more of a procedural pretext for testing reactions, with little chance of success. Should the Federal Reserve Chair actually resign under such circumstances, it would destabilize the US financial system—a risk far too serious for mere conjecture.

The more substantial development involves Donald Trump, who has taken initiative ahead of the tariff negotiation deadline by sending letters to key trading partners demanding higher tariffs, urging them to finalize trade agreements swiftly. With no major nation mounting direct resistance so far, the market response has been muted. Even the European Union has postponed its own tariff countermeasures until August 1—a move best interpreted as a negotiating tactic to buy more time. Regardless of the eventual outcome, markets are increasingly focused on the risk of rising inflation.

Tariff escalation and the inflation problem

Higher tariffs are driving a restructuring of global supply chains, which inevitably raises costs in the process. Once inflation expectations are in place, market participants tend to stockpile commodities in anticipation of higher future costs, creating a cycle where early purchases offer a relative advantage. This stockpiling, in turn, fuels price increases in major commodities. Industrial metals like silver and platinum have been particularly sensitive to the recent tariff changes. If the tariff dispute continues, commodities are likely to remain strong performers—even without a rate cut from the Federal Reserve—at least until broader economic issues emerge.

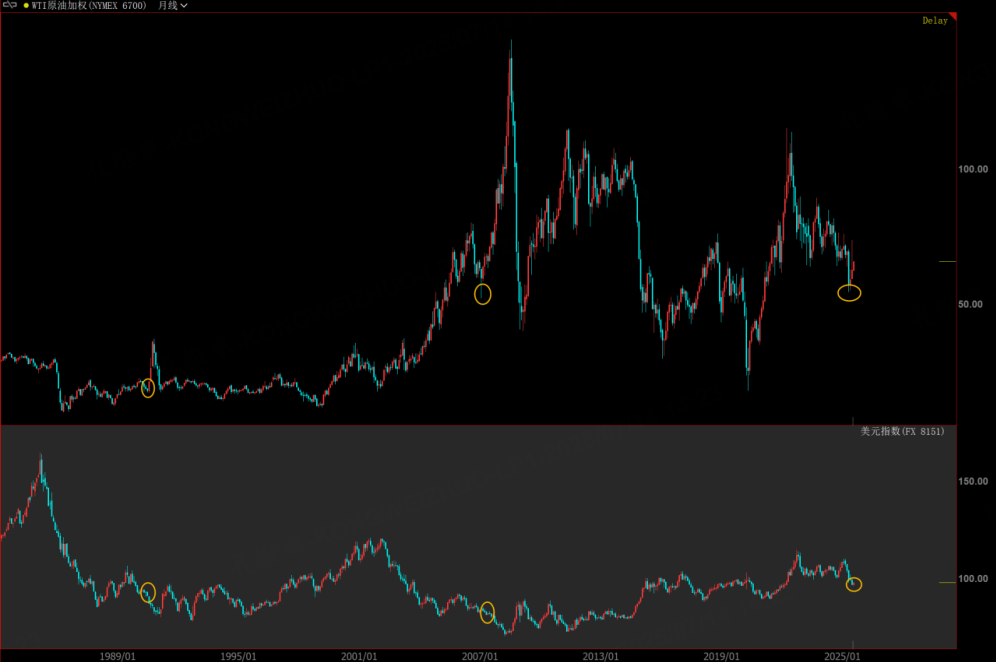

Crude oil, as the primary driver of inflation, is another focal point. Although efforts by OPEC+ to boost production and Trump’s attempts to suppress oil prices have impacted the market, the recent diplomatic developments between Iran and Israel led to a dip that did not breach prior lows. This indicates that, absent significant new supply, oil prices are unlikely to fall further. The seasonal bottom observed in May and June is also consistent with typical timing of key lows (barely different from the trough in 2020). Despite recent volatility triggered by Mideast tensions, my outlook for crude oil remains bullish, with the prospect of prices surpassing $100 per barrel. A sharp rise in oil prices would likely generate follow-through gains in other commodities that have yet to rally.

In agricultural markets, a broad-based rally appears unlikely. Soybean oil and palm oil remain leaders, supported by Trump-era biofuel policies and their correlation with oil prices. Among soybeans, wheat, and corn, only soybeans show meaningful upside potential; the other crops are more affected by tariffs and lack strong momentum.

In the precious metals sector, silver has rapidly approached my previously projected target range of 40 to 50. Whether it is advisable to chase this rally remains uncertain, as recent market moves have frequently surpassed expectations—silver could surge higher, but the volatility is substantial. I recommend using risk-managed instruments such as options for silver trading. Gold, meanwhile, maintains its safe-haven appeal. Its current technical setup offers little guidance; prices could break out in either direction, and it is likely that the broader market’s collective move will determine gold’s trend. In this phase, gold is best approached as a follower of market sentiment.

$E-mini Nasdaq 100 - main 2509(NQmain)$ $E-mini S&P 500 - main 2509(ESmain)$ $E-mini Dow Jones - main 2509(YMmain)$ $Gold - main 2508(GCmain)$ $WTI Crude Oil - main 2508(CLmain)$

Comments