The anticipated July Federal Reserve policy meeting is upon us. There are two main points of interest for this session:

First, whether the Fed might unexpectedly cut rates earlier than expected (which is considered unlikely), and second, the degree of dissent among committee members regarding the rate decision.

While the likelihood of an early rate cut is low, it’s notable that “the Boss” recently visited the Fed and publicly pressured Chairman Powell to lower rates. The market largely expects the first rate cut to come in September; if it happens as early as July, it would suggest these political pressures were effective and that further cuts might accelerate.

Regarding committee votes, if the Fed keeps rates unchanged, attention will turn to how many policymakers dissent. A high level of dissent would indicate significant internal pressure on Powell and could raise expectations for imminent rate cuts. Conversely, a unified committee would likely dampen hopes for rapid easing, potentially leading to market volatility.

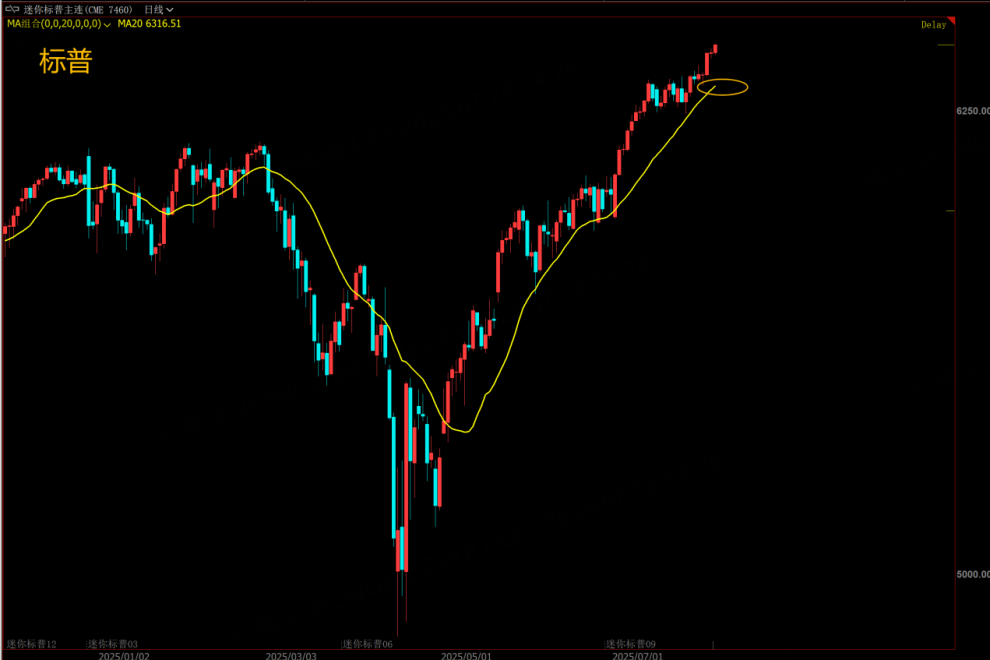

Will the Fed Meeting Hold Back U.S. Equity Indices’ Upward Momentum?

Even with the Fed’s anticipated inaction, the market generally expects a rate cut in the near future due to the strong influence of “the Boss.”

As a result, the Fed’s policy stance isn’t expected to weigh heavily on the U.S. equity indices right now. Instead, the main driving factor is the upcoming trade tariff negotiations in early August. With the deadline nearing, only a few agreements have been reached, making the outcome of last-minute talks the biggest uncertainty for this week.

Technically, there isn’t much to analyze about the equity indices at this point; simply following the trend does the job. The 20-day moving average continues to act as an effective trendline: follow the trend, and should it break downwards, we’ll consider how to react.

As a Fed Rate Cut Nears, the Yield Curve Continues to Widen

While the FOMC’s actions may have limited impact on U.S. equity indices, its effect on the bond market remains significant.

Currently, the U.S. bond market is showing clear divergence under expectations for future rate cuts. Long-term bond prices have been relatively steady at their lows, while prices for shorter-term two-year bonds have been gradually rising.

Short-duration bonds are closely linked to Fed rate expectations, while long-duration bonds respond more to economic and inflation outlooks. Ongoing inflation concerns continue to limit declines in long-term yields; the more rate cuts are anticipated, the stronger inflation expectations become, meaning long-term bonds require higher yields as compensation.

Historically, the spread between long and short-term yields has approached as much as 3%. At present, the difference is only 0.5%, suggesting that even if the Fed cuts, long-term bond prices may see limited upside.

Nevertheless, this does not spell major risk for long-term bonds; more likely, they will continue to fluctuate around a bottom, requiring greater patience from investors.

Alternatively, some allocation from long-term to short-term bonds could allow investors to benefit from short-term gains as rates fall. When the yield difference widens to around 2.5%, it may be time to consider returning to long-term bonds.

$E-mini Nasdaq 100 - main 2509(NQmain)$ $E-mini S&P 500 - main 2509(ESmain)$ $E-mini Dow Jones - main 2509(YMmain)$ $Gold - main 2508(GCmain)$ $United States Oil Fund LP(USO)$ $WTI Crude Oil - main 2509(CLmain)$

Comments