Overview

-

The trading range of gold has been narrowing

-

Gold has not rebounded during the recent inflation increase

-

When the Fed is uncertain about the pace of raising interest rates, gold is likely to break through upwards

-

Gold, previouslyseen as a hedge against inflation, does not appear to have benefited from the recent surge in US consumer prices from 2% to 7.5% year-on-year.

In the past 18 months, gold has not only been sideways, but its trading range has been narrowing, which technical traders sometimes call "flag shape". However, in mid-February, 2022, gold may make a breakthrough and usher in an upward trend (Figure 1).

Figure 1: Has gold broken through the narrowing "flag-shaped" trading range?

The recent trend of gold leads to two problems:

Why didn't gold rebound during the period of rising inflation from April 2021 to January 2022?

Why did gold suddenly rise in mid-February?

What factors prevent gold from rebounding?

While higher inflation may in theory be supposed to push gold higher, the reality is more complicated. Soaring consumer prices in the United States have changed investors' views on the future trend of American monetary policy.

As early as October 2021, federal funds futures did not consider raising interest rates in the next 12 months at all. Now that only four and a half months have passed, these futures are expected to raise interest rates six times in the next 12 months (Figure 2).

Figure 2: Investors' expectations of the Fed have changed dramatically since the beginning of October

The interest rate hike is bad news for gold. Although gold can be regarded as quasi-currency, gold savings do not generate interest.Therefore, when investors expect central banks to relax monetary policy, gold prices tend to react positively. When investors expect the central bank to tighten policy, the opposite will happen:

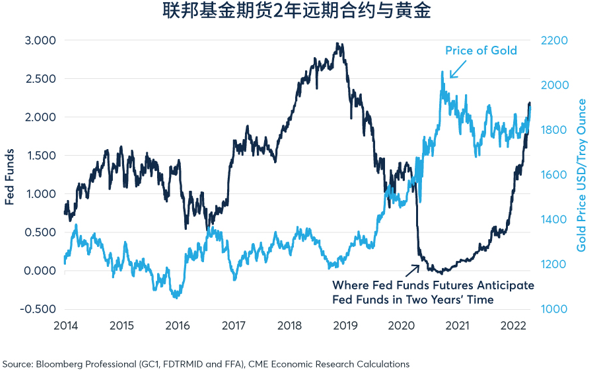

The expectation of higher interest rates makes fiat money deposits look more attractive than gold. You can see the price of gold at a glance by comparing the two-year forward of federal funds with the chart (Figure 3).

Figure 3: Gold prices usually move in the opposite direction to Fed interest rate expectations

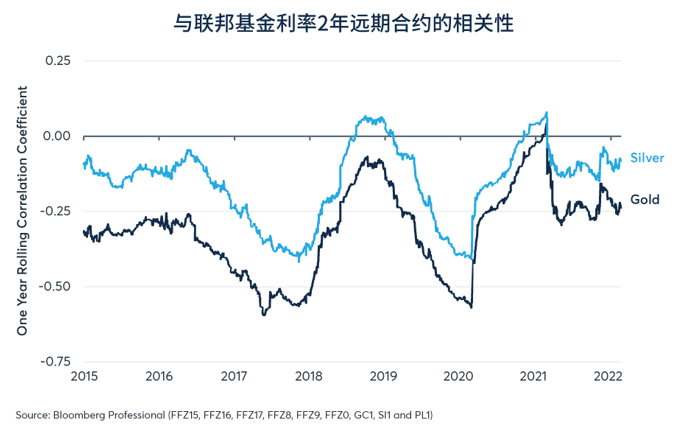

If we link the daily movement of gold price with the expected daily change of Fed interest rate, we will find that gold has almost always been negatively correlated with the change of Fed interest rate in the past two years.

Figure 4: The daily change of gold price is negatively correlated with the daily change of Fed policy expectation

As a result,The expected trend of the Federal Reserve raising interest rates seems likely to prevent gold from rebounding. The Fed's expectation of raising interest rates has changed dramatically,

However, it is worth noting that the price of gold has remained stable as before, which means that gold may benefit from rising inflation after all: rising inflation seems to eliminate the impact of the Fed's expectation of raising interest rates.

In addition, it is worth mentioning that from the beginning of 2019 to mid-2020, even before the COVID-19 pandemic broke out, the expected interest rate level of the Federal Reserve began to decline, and the price of gold rose all the way during the same period.

Why did gold rebound in February?

The Fed's expectation of tightening policy peaked on Monday, February 14th, at least temporarily.

On the same day, Federal Funds Futures set the one-year Fed currency interest rate at 1.74%. In the next few days, the expected level dropped to 1.59%. The two-year interest rate is expected to drop from 2.18% to 2.09%.Minutes from the Fed's January meeting suggested that the Fed may not start raising interest rates as quickly as some investors expected, so investors adjusted their expectation that the Fed might raise interest rates at the pace of 50 basis points to a smaller 25 basis points. (The escalation in Ukraine has also provided support for gold, as investors see the precious metal as a safe-haven asset.)

While the Fed minutes allayed fears that the Fed might raise interest rates too quickly, they also raised concerns that the Fed might not be moving fast enough to be lagging behind in tackling inflation. This view may be aggravated by a series of data released recently.Data on employment, inflation and retail sales also show a picture of a booming economy, in which employment growth is stable and consumer spending is strong, while inflation is also soaring. Slowing down policy tightening seems to please both short-term bond investors and gold pursuers.

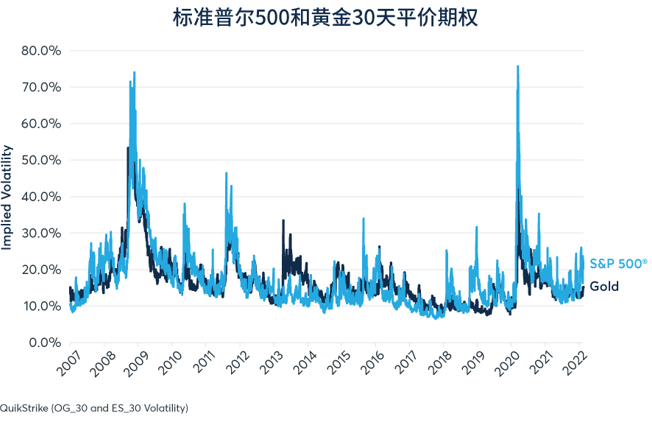

The narrow trading range and lack of actual volatility in gold may also explain why the implied volatility of gold options has dropped to such a low level, even though the cost of options in other markets such as stocks has started to rise in recent months. If gold breaks through the original trading range and starts a strong directional trend, the cost of gold options may also start to rise (Figure 5).

Figure 5: The implied volatility of gold options lags behind the implied volatility rise of stock index options

$NQmain(NQmain)$ $YMmain(YMmain)$ $CNmain(CNmain)$ $CLmain(CLmain)$ $SImain(SImain)$ $HSImain(HSImain)$

Comments