Abstract: Last week, many central banks around the world showed their determination to deal with high inflation. The Federal Reserve raised interest rates by 75 basis points as expected by the market, while the US dollar index dropped sharply after hitting a new high of 105.80 since the beginning of December 2002, with a cumulative fluctuation of nearly 240 points, and finally closed up slightly on the weekly line. The Swiss National Bank, unwilling to be lonely, unexpectedly raised interest rates by 50 basis points. The market expects Switzerland to end its negative interest rate policy for many years within this year. The Bank of England raised interest rates by 25 basis points as scheduled. Faced with the weak economic outlook, the Bank of England obviously does not dare to follow the Fed easily. The Bank of Japan has become the only major economy to continue to defend ultra-loose monetary policy, and the road of yen depreciation is not over.

1. Global FX Focus Review and Fundamental Summary

The Fed's strong interest rate hike is basically consistent with market expectations in the context of CPI in May

Last week, the Federal Reserve announced a 75 basis point interest rate hike, the largest single interest rate hike in 25 years. As the consumer price index unexpectedly rose in May and once again hit a 40-year high of 8.6%, it was taken as a last resort after the latest data showed that its inflation sniper war had hardly made progress. Fed officials also pointed out that borrowing costs will show a faster upward path, which makes the rapid change of monetary policy more consistent with the views of financial markets on how to control price pressures.

The Swiss National Bank raised interest rates beyond expectations. The market speculated that the negative interest rate policy might end

The Swiss National Bank raised its policy interest rate from-0.75% to-0.25%, which completely exceeded market expectations. This is the first time that the Swiss National Bank has raised interest rates since 2007, but some market analysts believe that the bank may finally bid farewell to the negative interest rate policy this year. Jordan, chairman of the Swiss National Bank, said at the press conference that in the foreseeable future, it may be necessary to further raise the policy interest rate. The SNB had previously insisted that the franc was overvalued, largely justifying expansionary monetary policy. Therefore, this statement is more like preparing for the inflection point of interest rate.

Limited weak economic situation, the Bank of England is difficult to follow the trend of the Federal Reserve

The Bank of England last week raised its benchmark interest rate for the fifth time since December, bringing it to 1.25 percent, its highest level since January 2009. With the Federal Reserve raising interest rates by 75 basis points the night before, some market participants bet that the Bank of England will take greater action, but the economic outlook in the UK is the weakest among major developed countries, which limits the Bank of England from following suit. According to the forecast of the International Monetary Fund and the Organization for Economic Cooperation and Development, the British economy has shown signs of slowing down, and will become the weakest major developed country in the world next year.

2. Trend analysis of foreign exchange futures and options

2.1. Trend of Important Foreign Exchange Futures Contracts (Chart)

2.2. Position analysis of futures market

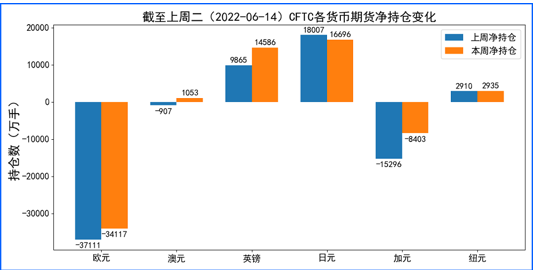

According to the 2022-06-14 futures market position report released by the US Commodity Futures Commission, Last week, the reported total positions of various currencies were as follows: 2,994 lots of net long positions in Euro, 1,960 lots of net long positions in Australian dollar, 4,721 lots of net long positions in British pound, 1,311 lots of net long positions in Japanese yen, 6,893 lots of net long positions in Canadian dollar and 25 lots of net long positions in New Zealand dollar. The currencies converted from long positions to short positions last week were Australian dollar. In addition, the currencies whose one-way total positions have changed by more than 20% are sterling.

2.3. Outlook of key currency pairs

Euro/US dollar:

Euro/USD rebounded strongly after breaking through 1.0490, tested 1.0550 and tried to break through. However, the trading at the end of the week began to show a decline. Looking at the 4-hour chart, random indicators sent negative signals and also supported bearish expectations. Subsequent Euro/USD may fall to the main target of 1.0470 and then 1.0355. However, if the euro/dollar breaks through 1.0550, it will stop the bearish situation and push the currency pair to start a new bullish trend, with the next target at 1.0670.

GBP/USD:

Sterling/US dollar continued to soar after the midweek return last Friday, realizing the construction of bullish technology form, and is expected to rise further this week, and test the next bullish target of 1.2490. Sterling/dollar is expected to be bullish. It should be pointed out that if the pound/US dollar falls below 1.2205, this will stop the expected upward trend and push the currency to turn bearish on the outlook.

AUD/USD:

Aussie/U.S. dollar rebounded to 0.7050 in the second half of last week, and then began to decline after encountering strong resistance at this level, suggesting that the currency will continue its bearish trend this week. At present, we are waiting for the AUD/USD to fall below 0.6995 and continue to fall to the next bearish target of 0.6930. Therefore, unless the Australian dollar/US dollar breaks through 0.7050 and remains above this level,Otherwise, it is still predicted that the currency pair will be bearish in the future.

USD/JPY:

The dollar/yen rebounded strongly after experiencing a strong decline in the second half of last week and hitting the 50% Fibonacci retracement of the latest round of gains. And rose to above 133.50 again. At the same time, the random index of the 4-hour chart also sent a positive signal. As long as the exchange rate remains above 133.50 this week, the bullish trend will remain valid, waiting for the currency pair to test the main target of 135.50 and then 136.00.

2.4. RMB hedging cases

(In this section, we will show a series of cases as operational methods to prevent the fluctuation of foreign exchange rate against RMB.)

Buy call futures + sell imaginary call options:In September, 202X, ABC Company signed an import contract with an amount of US $1 million, and agreed to pay after 3 months. ABC believes the dollar is at a relatively low level against the yuan and may rise in three months, but ABC does not think it will rise above 6.8 in the short term.

Therefore, ABC Company chose to buy 10 USD/RMB call futures contracts with a price of 6.50 due in December on CME trading platform, and sold 10 USD/RMB virtual call options with a price of 6.80 due in December. Option premium income was RMB50, 000 (0.05 * 100,000 * 10).

Assuming that when the contract expires in December, if ABC Company expects a slight increase of less than 6.8 against RMB futures, the RMB futures bought will be profitable, and the put right will not work, thus obtaining option premium income.

$NQmain(NQmain)$ $YMmain(YMmain)$ $Japanese Yen - main 2209(JPYmain)$ $ESmain(ESmain)$ $GCmain(GCmain)$ $CLmain(CLmain)$

Comments