When the central bank hits the brakes, someone bursts out of the windshield.

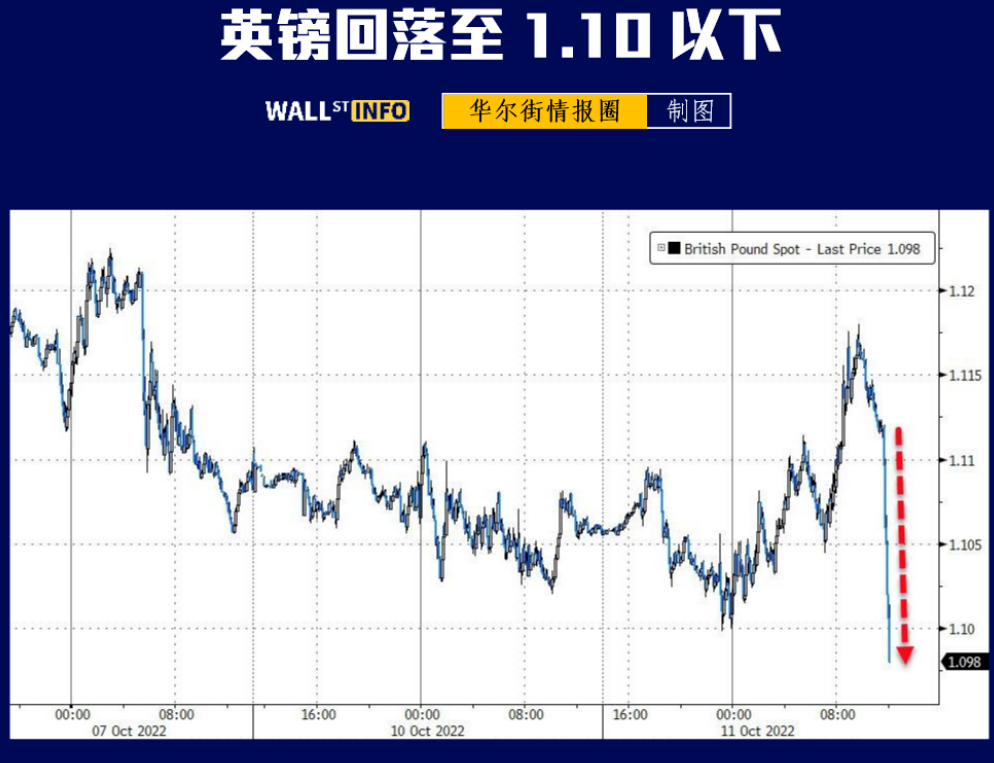

On Tuesday, the global market volatility was not large. On the surface, it was a "dollar rising, everything else falling" model,

1. The US dollar index has risen for five consecutive trading days, but the increase is gradually narrowing. This usually happens, which does not necessarily mean changing the market, but it must be about to meet a bigger market;

2. The US dollar/Japanese yen is close to the 24-year peak, not far from the point where the Bank of Japan intervened in the foreign exchange market last time (145.90);

3. The US stock market began to rise and fall, the Dow Jones index rose, and the S&P 500 index and Nasdaq index both fell;

4. The international oil price fell, but the recession began to be priced behind it (the first market worried about economic recession appeared);

5. The international gold price once rose sharply, because the IMF lowered its global economic forecast for next year. Even so, all the gains in late trading showed that the short-selling sentiment was still very strong;

6. Bitcoin plummeted and fell below $19,000.

But what shocked the market most was the speech of the governor of the Bank of England, which was also the root of the late decline of gold and US stocks.

Bank of England Governor Bailey said at an event organized by the International Finance Association (IIF) on Tuesday that the position rebalancing will be completed before Friday, when the central bank will end its emergency support plan for the UK bond market. Bailey stressed that the plan is part of the Bank of England's financial stability action, not a monetary policy tool, so it must be temporary.

We have announced that it will stop before the end of this week. We believe that rebalancing must end at that time. And my message to the relevant funds and all the institutions involved in managing these funds is: You still have three days, and you must finish the work.

The Bank of England has no intention of seeking to lower bond yields. When the central bank hits the brakes, someone will rush out of the windshield

The mood in global markets is at a very volatile moment, and investors are frightened when the latest US inflation data will be released one day later. The market is worried that this data will provide more reasons for the Fed to raise interest rates.

That figure is an important unknown: As long as the CPI rises above its previous 8.3%, it is a big problem for the stock market. JP Morgan Chase even warned that if the CPI is too high, US stocks may fall by 5% a day.

Suppose CPI is more than 8.3%, the S&P 500 index may fall by 5% in one day

If the CPI is between 8.1% and 8.3%, the S&P 500 index may fall by 1.5% to 2%.

Suppose CPI is below 7.9%, the S&P 500 index may rise by 2% to 3%.

$NQ100指数主连 2212(NQmain)$ $SP500指数主连 2212(ESmain)$ $道琼斯指数主连 2212(YMmain)$ $黄金主连 2212(GCmain)$ $WTI原油主连 2211(CLmain)$

Comments