The last central bank in the world to insist on large-scale quantitative easing is finally surrendering, but the timing is very interesting.

When the Federal Reserve made great strides to raise interest rates by 75 basis points, and when inflation in the United States kept soaring and showed no sign of peaking, the Japanese central bank withstood the pressure and always adhered to the strategy of unlimited bond purchase, supporting the upper limit of 10-year Japanese bond yield below 0.25%.

BUT How did it happen at this time: after US CPI peaked, hawkish interest rate hikes were confirmed to slow down, and the US dollar finally fell from its high level, it suddenly announced that it would relax the control of yield?

Have you considered another possibility: the doves' surrender of the Bank of Japan is not a belated interest rate hike, but a race of the yen against the US dollar before the recession hit.

The recession may be earlier than we thought before, and the two major safe-haven currencies in the world, the Japanese yen and the US dollar, are already competing for the future return of funds. . .

The actions of the Japanese central bank are unexpected and reasonable

Yesterday, the Bank of Japan's latest interest rate resolution surprised traders around the world. After keeping the policy interest rate unchanged, the world's loosest central bank suddenly announced that it would drastically revise its yield curve control framework and increase the number of government bond purchases every month.

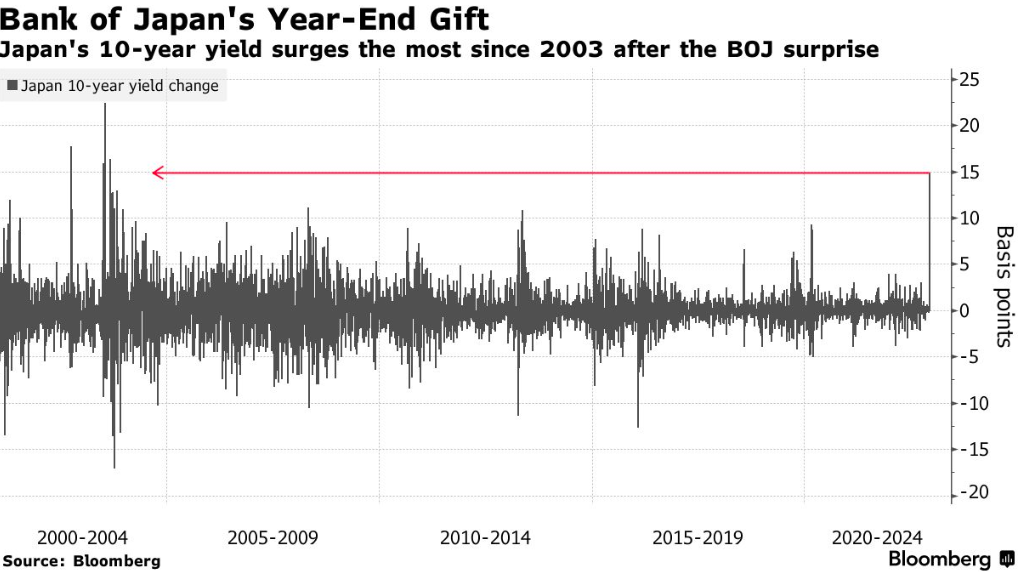

The range of increase is very large, and the fluctuation range has doubled directly, raising the upper limit of 10-year Japanese bond yield to 0.5%. It can be said that this is a plan to raise interest rates in disguise, allowing the 10-year Japanese bond yield to break through the upper limit to reach a higher position, which also means that the Japanese central bank can no longer use the previous funds to buy Japanese bonds.

Even so, the Japanese central bank's holdings of Japanese bonds have accounted for more than 50% of the total market value of Japanese bonds, and according to the statement, the monthly bond purchase amount has increased from more than 7 trillion yen to 9 trillion yen. It seems that although it is a disguised interest rate hike, the whole measure still has a very strong loose taste.

So we feel that this is, to a greater extent, the beginning of a gradual normalization of monetary policy, and the whole statement keeps a lot of dovish measures, which is actually a stress test of the market.

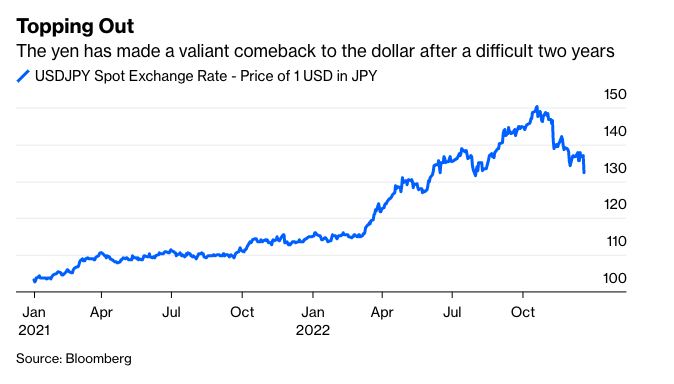

Japan's central bank may want to see how confident the domestic market is in ending the wide volume and welcoming the increase in Japanese bond yields. Their purpose is clear: Compared with the short-term chaos in the domestic market and even stirring the fluctuation of the global bond market, the continuous appreciation of the yen is the most important thing. At the very least, the yen cannot continue to depreciate.

This policy has an immediate effect. In one trading day, the yield of long-term bonds increased20A range not seen for many years.

The increase in the rate of return will certainly help to improve the exchange rate of the Japanese yen against the US dollar. At this time, the Japanese central bank has a greater advantage in raising the rate of return, that is, international capital will consider the Japanese yen more when choosing safe-haven assets before the recession, and more funds will stay in Japan when most funds are buying high US dollars in the future.

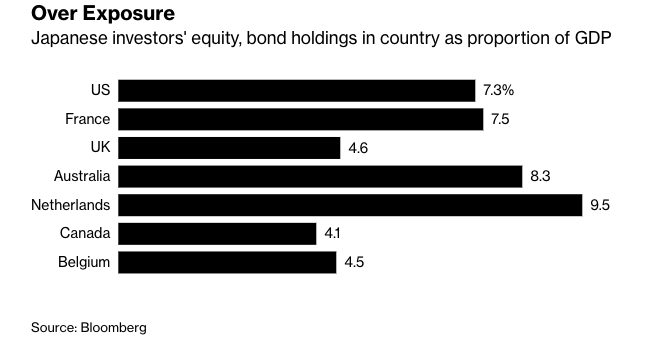

Of course, there is another expected scenario: As a low-interest currency, the Japanese yen has low restrictions on global investment. In recent years, a large number of peripheral market assets invested by Japanese yen may be sold off in large quantities to redeem Japanese yen after the increase of Japanese bond yield. In fact, this is the same as the way that the US dollar cuts leeks. Increasing the yield can also make funds return to Japan.

Therefore, it is of great significance for this policy to be promulgated by the Bank of Japan at this node.

As investors, we need to know that the long-term rise of the yen in the coming period may be relatively stable. At the very least, before the last rise of the dollar comes.

Until the dollar peaked against the yen, the yen was at its lowest real effective exchange rate since 1973. In October, when the exchange rate between the US dollar and the Japanese yen briefly exceeded 150, Japan used its foreign exchange reserves to intervene in the foreign exchange market to stop the decline of the Japanese yen. However, it is impossible to stop the depreciation of the Japanese yen for a long time only by intervening in the foreign exchange market, so Japan can only choose to give up the control of the yield of Japanese bonds. The purpose is to prepare for the future recession and the US dollar to snatch international safe-haven capital.

Is a new round of fluctuations coming?

As we mentioned above, yen investment is widely distributed in the world, and the perennial low-interest yen has almost become the pricing rivet of the global bond market, even as a pricing reference for risk-free returns. The increase of Japanese bond yield is bound to trigger a chain reaction.

UBS estimates that the Bank of Japan's policy adjustment will boost the yen and deal a considerable blow to the yen-related bond markets, namely Australia, France and the United States. In a worst-case scenario, abandoning yield curve controls would send Japanese stocks into a bear market and potentially send U.S. and European stocks down10%.

This is no exaggeration. According to Bloomberg statistics, Japanese investors have invested more than $3 trillion in overseas stocks and bonds, of which more than half are invested in the United States. Other countries, such as the Netherlands, Australia and France, are also vulnerable to the return of Japanese funds.

Fortunately, China's proportion is not large, but the impact on the real estate sector is inevitable. We reminded many times in previous sharing that the real estate sector will be more affected by future fluctuations in the global bond market, especially the turmoil from Japan. And the overall A shares are difficult to have a decent market before the holiday.

$E-mini Nasdaq 100 - main 2303(NQmain)$ $E-mini S&P 500 - main 2303(ESmain)$ $E-mini Dow Jones - main 2303(YMmain)$ $Gold - main 2302(GCmain)$ $Light Crude Oil - main 2302(CLmain)$

Comments