Credit Suisse Risk, which exploded the market last week, and was finally solved under the special treatment of regulators. Finally, UBS announced that it would acquire Credit Suisse for 3 billion Swiss francs, which is 40% lower than the latter's market value on Friday.

At the same time, the Swiss government covered some losses, the Swiss National Bank gave liquidity assistance of 100 billion Swiss francs, and Credit Suisse bonds with a face value of about 16 billion Swiss francs were completely written down.

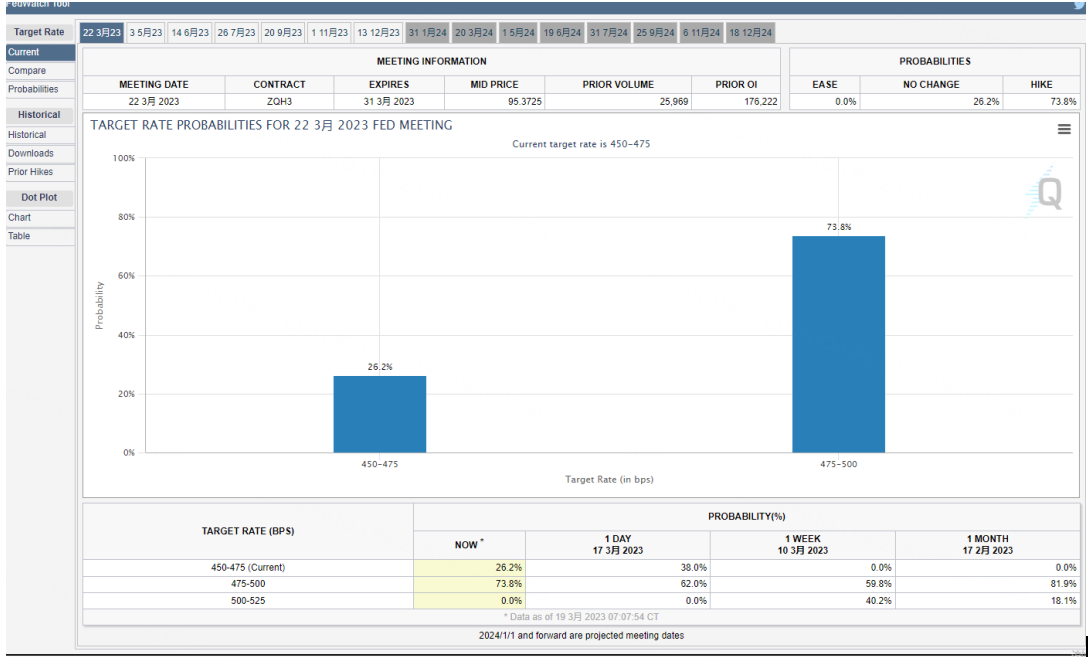

After the above news, the market returned to a relatively stable situation. According to fedwatch data, the probability of 25 basis points of Fed rate hike this week accounted for 70%. If this data is maintained, the final result may be the same. This FOMC's path of follow-up monetary policy may become the focus of more attention in the market.

There is no doubt that the big winner of the two major risk events of Silicon Valley Bank and Credit Suisse is gold, which once approached the 2000 integer mark.

Since this month, the Golden Moon Line has completed the outsourcing and devouring combination.Although it was previously thought that the price of gold had a chance to rebound and return to the seesaw, the current rise still exceeded expectations.

If the current portfolio is maintained, historically, there is only one similar situation in 2016, when there was a large pullback/retracement after the gold price rose for another month. Although the price and trend at that time were different from those at present, considering that it was not far from the historical high. Therefore, if bulls continue to work hard upward in the next 3-4 weeks,However, if the news can't provide a stronger driving force, it is necessary to pay attention to the downside risks. In the longer term, gold has the opportunity to set a new high, but the timing and news may come later.

Crude oil is a victim of short-term risk-off. Last week, the oil price fell below the trading range since December last year, and the lowest was around $65. There is no new news or change on the supply side, so we think that mainstream funds are worried about the long-term demand side to a greater extent.

In addition to crude oil, copper price, another important reference point, has also suffered a continuous downward trend in the near future, and finally returned to a relatively positive correlation with oil. Based on the performance of these assets, it is reasonable to suspect that both the Federal Reserve and the Swiss National Bank are delaying the arrival of a bigger thunder, rather than solving the crisis at its root. Even if the second quarter passes smoothly, the falsification of the US/global recession in October-November will become a new test.

From a trading point of view,This week, because there is another major risk news/event, it is not easy to grasp. It is suggested that we can wait and see for a while, wait for the news to come out and the market to fully digest it, and then take advantage of the trend. Of course, if gold continues to rise sharply and approach the historical high, the cost performance of shorting is still appropriate.

$E-mini Nasdaq 100 - main 2306(NQmain)$ $E-mini Dow Jones - main 2306(YMmain)$ $E-mini S&P 500 - main 2306(ESmain)$ $Gold - main 2304(GCmain)$ $Light Crude Oil - main 2305(CLmain)$

Comments