Summary:

Everything is just beginning. You know, the most thoroughly stripped "naked swimmer" will always act as the first domino to be pushed down before the economic crisis, and the whole process of domino being pushed down is also a continuous accelerating process.

Why do Silicon Valley banks sound the prelude to the American crisis?

Although the bank is small, the problems it reflects are not simple. Let's review these two key points:

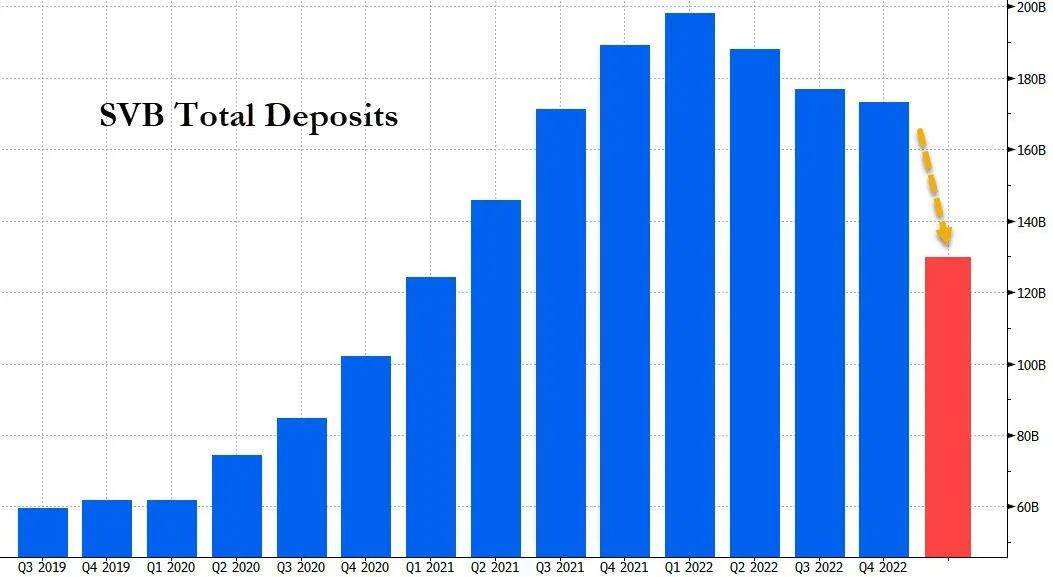

1. After the bank deposit in Silicon Valley triggered a run, the bank's $42 billion deposits were withdrawn in just a few hours! When the business closed on March 9th, the deposit deficit was negative 1 billion, which directly led to Silicon Valley Bank filing for bankruptcy.

2. Just after Silicon Valley Bank declared bankruptcy, The Federal Reserve and the Federal Deposit Insurance took over quickly. The difference between these two things is less than three days. Looking back at the bankruptcy of Lehman in 2008, in order to save the banks that were about to fall, there was a tripartite sawing process between the Federal Reserve, the Ministry of Finance and the banks, which took a long time. So does the rapid response of this supervision also mean that the Fed is prepared, or does it explain:They may be more afraid of losing control, because they probably don't have the conditions to carry out a large-scale rescue, so we can only put out the crisis in the bud.

In fact, the logic of the bankruptcy of Silicon Valley banks is very clear.

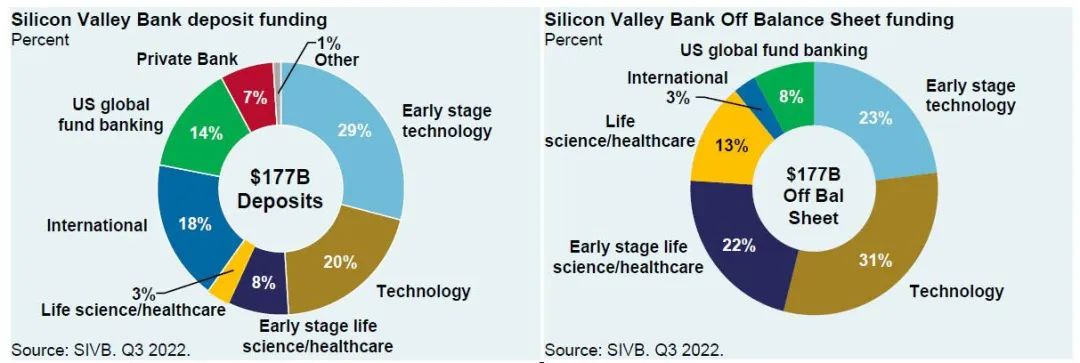

Most of Silicon Valley banks's business is aimed at regional technology companies, and most of the deposit customers are technology start-ups. The funds obtained from IPO, additional issuance, SPAC fund-raising or liquidity actions such as mergers and acquisitions are deposited in Silicon Valley banks in cash.

However, the banking business structure in Silicon Valley is relatively simple, By observing the on-balance sheet and off-balance sheet assets and liabilities of Silicon Valley banks, we can see that most of the funds may come from the depository of venture capital funds in banks.

But one problem with this business is that enterprises need to use money at any time. Silicon Valley banks can't invest in fixed assets for a long time. They can only use liquid short-and medium-term assets to make term mismatches to earn some interest margins. If they had deposited all their funds in the Federal Reserve, they might not have had today's storm. From the pie chart above, less than 10% of red personal banks look like personal deposits. This also determines that when negative news is exposed, these funds will be quickly removed from the books.

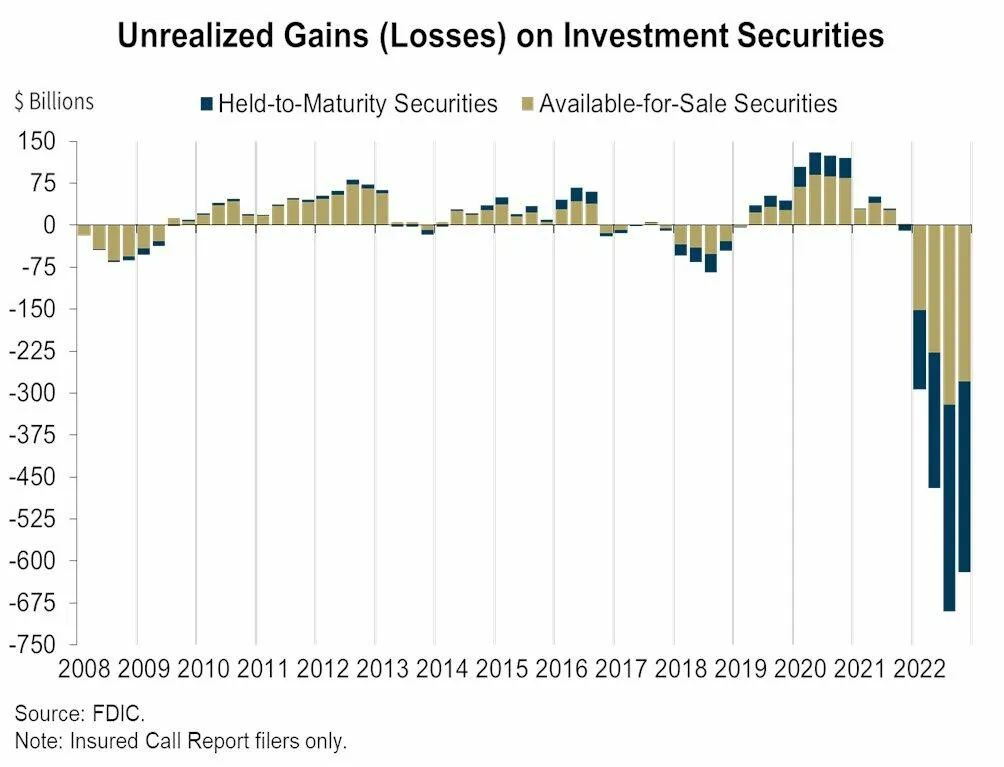

The Origin of this event is that the continuous rate hike of the Federal Reserve triggered the continuous upward trend of US bond yields and depressed the valuation of bonds.

As we all know, when the book price is constant, the higher the yield, the lower the present value. When most funds chase new high-yield bonds, the previous US bonds will be sold off in large quantities, and the prices in the secondary market will continue to fall until the prices of mortgage-backed bonds and Treasury Bond in the hands of Silicon Valley banks are greatly squeezed and dropped.

Let's look at the overall market value loss of US investment grade bonds from last year to this year

Since 2022, the price of holde to mature and saleable bonds has plummeted wildly. The reason is that the Federal Reserve has started to normalize interest rates, and the unprecedented rate hike has greatly squeezed bond prices, causing the asset prices in the hands of Silicon Valley banks to plummet.

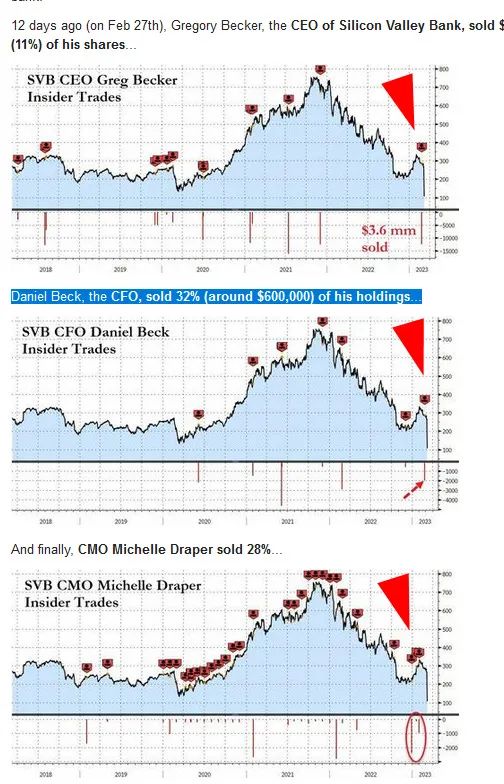

When Silicon Valley banks realized that their assets had shrunk dramatically, and they could not even meet the needs of depositors, a coquettish operation came, that is, the ECO of the bank, which sold stocks for capital many times

This move triggered a run on the market, because everyone instantly understood that this bank was running out of money and could not withdraw money! So we started to make panic withdrawals on a large scale.

As a result, everyone knows: $42 billion was withdrawn in a few hours, and it closed on March 9. Silicon Valley Bank found that the deposit on its books was negative $1 billion.

So why is the tragedy of Silicon Valley banks playing the prelude to recession? Let's look at a statistic

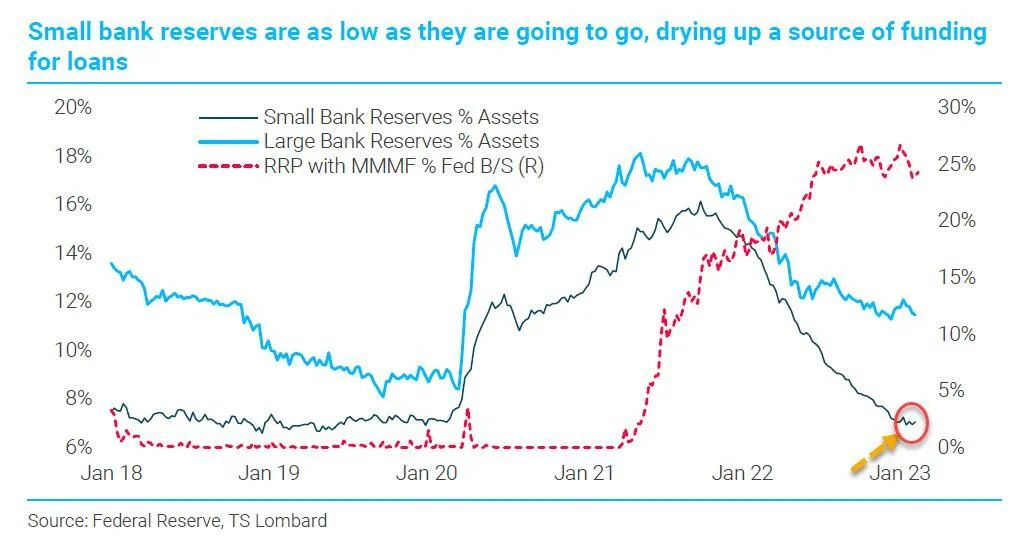

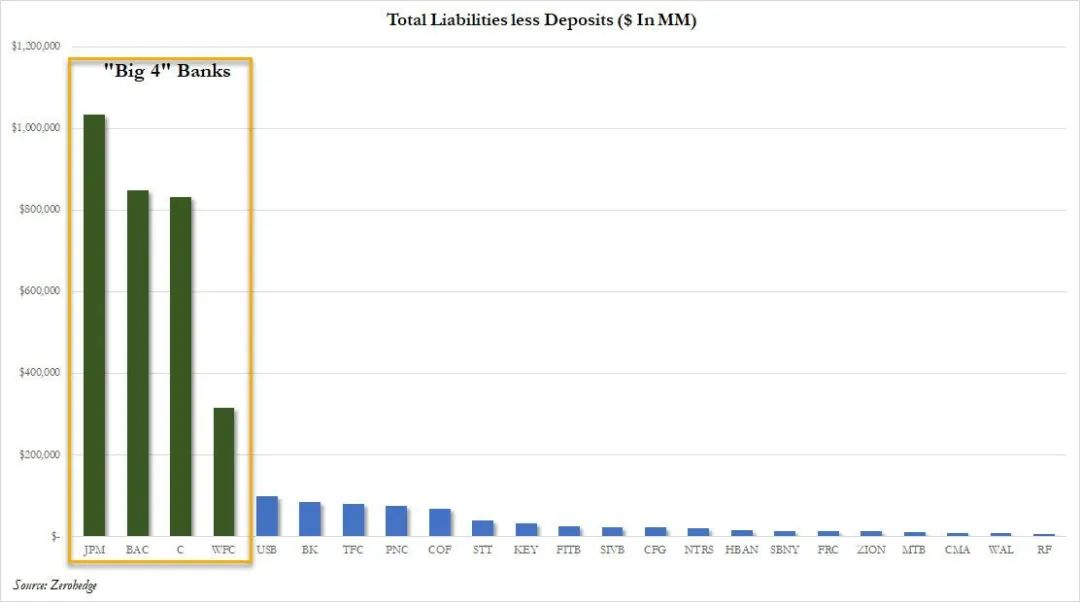

According to the data of the Federal Reserve, a large number of excess deposit reserves in the United States are concentrated in the hands of a few large banks. Except Citigroup, Bank of America, JP Morgan Chase and Wells Fargo, the deposit reserves of other small and medium-sized banks are pitifully small, and the gap between them and big banks is widening.

Because these four major banks have left a large amount of excess reserves, the reserves used to deal with the risk greatly exceed those of other small and medium-sized banks,

The reason is that, The business scope of these big banks is very wide, You can do some risk hedging, equity investment, swap, or foreign exchange business. The revenue sources are wide, and the risk exposure will naturally be offset. For example, Silicon Valley banks unilaterally hold a large number of US bonds and MBS, but if they short US bonds in the futures market at the same time, they can cover some of the risk exposure, but they seem to ignore this risk.

As a result, when the price of US debt plummeted, Silicon Valley banks that lost a lot could only accept bankruptcy.

Don't guess, there must be many small banks with similar problems. The profitability of Silicon Valley banks can still rank 23rd among the top 100 banks in the United States in 2018. Even so, it is doomed, not to mention some other small banks.

And if you think your money is no longer safe, will you still exist in small and medium-sized banks? The normal logic is: You will take it out and store it in the four big banks I just told you, right?

So the next thing to happen is:The storm of panic runs will spread rapidly among small and medium-sized banks, and a large number of depositors will take out their money from small and medium-sized banks and put them in the four major American banks

I believe that this is not the result that the Fed wants to see, and the US Congress will not allow deposits to have the terrible result. Since then, eggs are put in four baskets, and if a financial storm covers them, the risks must be uncontrollable.

So, the only way to completely solve this problem is:

Fed stops rate hike

There may be a good opportunity

Why do you say that? Because maybe at this time, the collapse of US bond price has come to an end.

In the rescue measures, the Federal Reserve gave such a possibility, that is to say, let small and medium-sized banks take their assets, most of which are American bonds, to discount a rescue fund to the Federal Reserve, and the amount of the rescue fund is calculated according to the valuation of assets.

That is to say, the Federal Reserve has robbed the market of the pricing power of bond assets invested by most small and medium-sized banks. right?Think about it,?

On the one hand, it rescued a large number of small and medium-sized banks, on the other hand, it stabilized the plummeting price of US bonds, and also limited the upward range of US bond yields.

Then, it may be difficult for the yield of US bonds to continue to rise.

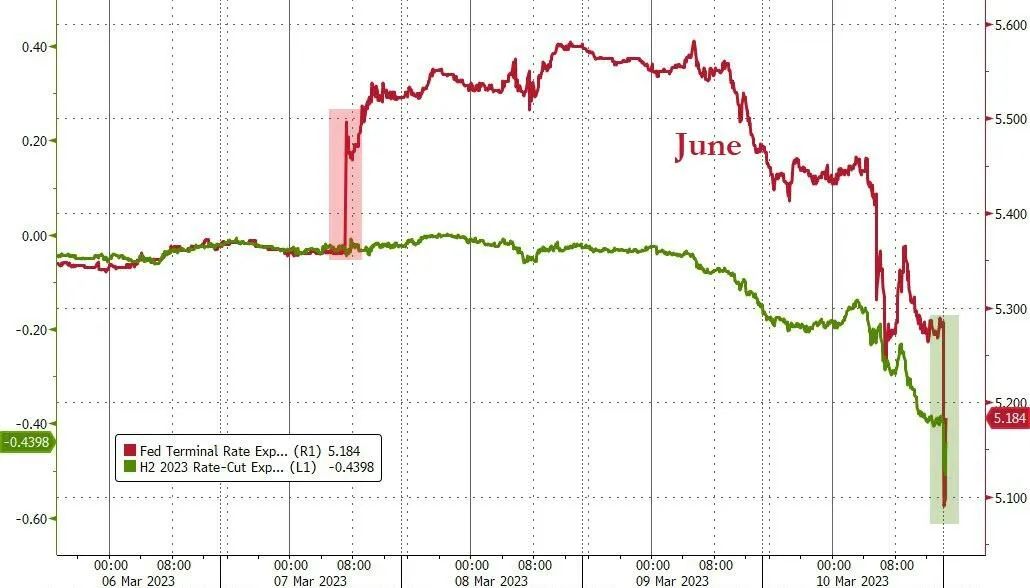

You see, when the Silicon Valley bank thunder came out, the Fed's terminal rate hike expectation plummeted (red) and the possibility of interest rate cuts in the second half of the year rose sharply (green, inverted)

Anyway, there's a good chance,The thunder of Silicon Valley banks blew up a rare gold pit in the price of US bond.

What do you say

$E-mini Nasdaq 100 - main 2306(NQmain)$ $E-mini Dow Jones - main 2306(YMmain)$ $Gold - main 2304(GCmain)$ $E-mini S&P 500 - main 2306(ESmain)$ $Light Crude Oil - main 2305(CLmain)$

Comments