Last weekend's market nervousness eased at the beginning of this week. The Federal Reserve's "bailout" action played a role in stabilizing the morale of the army, and risky assets opened higher.

With the expectation of raising interest rates weakening, are assets such as short-term US dollars facing trend changes?

On the news front, the Federal Reserve announced earlier that it would launch an emergency financing tool called Bank Term Funding Program (BTFP), which will provide loans for up to one year to banks that mortgage US Treasury bonds, institutional debt, mortgage-backed securities (MBS) and other qualified assets.

The facility would allow banks to obtain loans from the Fed for up to a year by mortgaging Treasuries, mortgage-backed bonds and other debt as collateral. What if the bank can't repay all the loans within one year? As a precaution, the Treasury Department is providing $25 billion in credit protection to the Federal Reserve. "The Fed does not anticipate the need to draw on these support funds," the Fed said in a statement late Sunday.

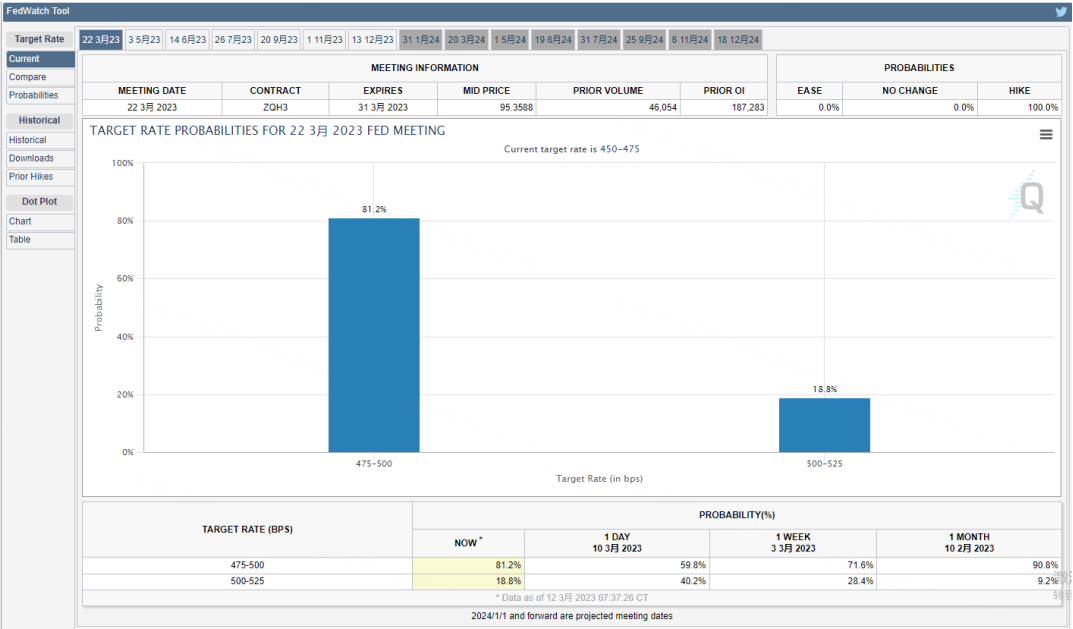

Obviously, the news basically confirmed the Fed's determination to maintain financial market stability, while the sharp drop in US bond yields implied that the probability of raising interest rates by 25 basis points this month began to exceed 50 basis points.

In fact, after Friday's non-agricultural data, the US dollar showed signs of weakness. The leading index of the yen we mentioned last week is also the higher direction of the yen (the yen jumped higher on Monday and led other varieties). On the premise that the market focus is still the Federal Reserve, the short-term US dollar may face the risk of further decline and decline. Especially after the recent weekly line appeared obvious overhead, the US dollar kept a downward trend in the following 2-3 weeks.

What is clear for us traders is that,The dollar remains a safe haven. When the Federal Reserve helped stabilize the market, the aura of the US dollar quickly faded. On the other hand, if there is a big turmoil, money will still flock to this safe haven.

Compared with the short-term market feedback, we think it is more noteworthy to know how many potential thunder such as "Silicon Valley Bank" has not been discovered under the calm market. After more than a decade of ultra-loose cycles, it is impossible for the Federal Reserve and various financial institutions to judge what the 5% federal interest rate will bring.

This is one of the important reasons why the Fed is so decisive this time: once there is a domino effect, there will be much more costs and costs afterwards. Combined with the layoffs of American listed companies in various industries in the first quarter of this year and the end of last year, the economic fundamentals may not be so ideal. Despite getting through this safely, 2023 is not expected to be a peaceful year.

$E-mini Nasdaq 100 - main 2306(NQmain)$ $E-mini S&P 500 - main 2306(ESmain)$ $E-mini Dow Jones - main 2306(YMmain)$ $Gold - main 2304(GCmain)$ $Light Crude Oil - main 2304(CLmain)$

Comments