Important information:

What we are facing now is a rather divided market.

You may have been exposed to too much news about buying the dip of A shares:

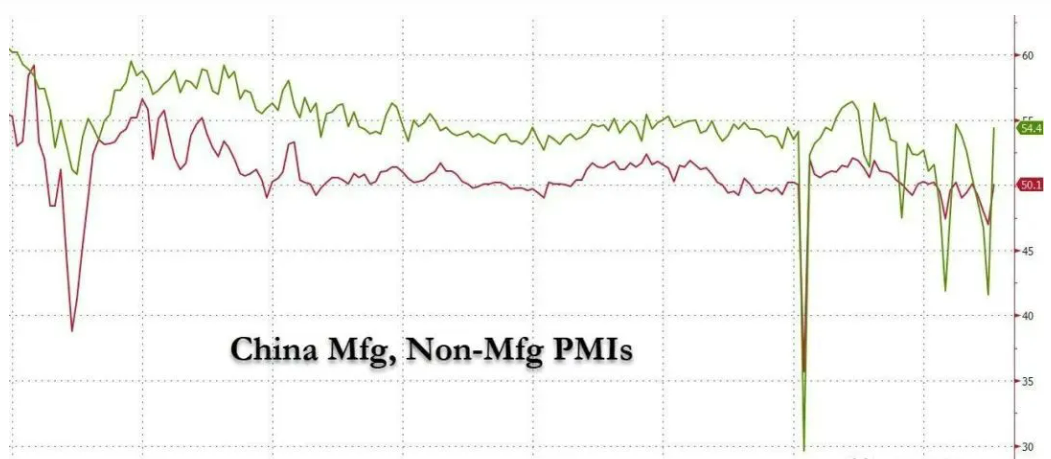

China's macroeconomic data has just given a series of the most eye-catching transcripts: in January, the official PMI data of manufacturing and non-manufacturing both exceeded expectations and returned to the expansion range. Last year's Q4 GDP, industrial added value and retail sales in December, and the growth rate of non-agricultural fixed investment in the whole year of last year all exceeded expectations.

Even the unemployment rate in December was lower than 5.7% in November. There are really too many rising reasons for A shares, but a key question you may not have noticed is: Why did Hong Kong and chinese market fall in correction after the official PMI data was released at the beginning of this week?

The reason may lies in the rebound of the US dollar. After fluctuating at the low level for more than two weeks, the US dollar index once again tried to break through the 20-day moving average, but the initial efforts have failed.

The biggest risk event this week, "Federal Reserve's Interest Rate HIKE and Powell's Speech", has sounded a resounding alarm bell in the US stock market, which is fiercely contested at the watershed. As the path of raising interest rates in the future is clear again, we will also usher in a medium-term opportunity to get on the train.

However, when the falling space of US stocks is opened again, you will find that the choice of boarding point and boarding cycle is not as simple as you think, and the storm is hidden in it. . .

The macro bottoming data of chinese economic stimulated by re-opening and the favorable support of many policies are enough to make a wave of rising market in Hong Kong and A share market after the holiday. What's more, after the US dollar collapsed from the high point, The alleviation of liquidity crisis in bond market and the stability of foreign exchange market added another fierce fire to A share market.

But how long can all this last?

You should know that the improvement of China's economic data will directly affect the changes of global inflation data, especially the demand for energy such as crude oil and natural gas. If the energy price rises again when the inflation of American service industry does not slow down, can the Federal Reserve suspend interest rate hikes in the middle of the year and cut interest rates in the second half of the year as currently expected?

If the current doves' expectations are suddenly collapse under the dynamic "motor" of China, what will happen to the global market?

The pretty Chinese data stimulated Powell to be hawkish ;

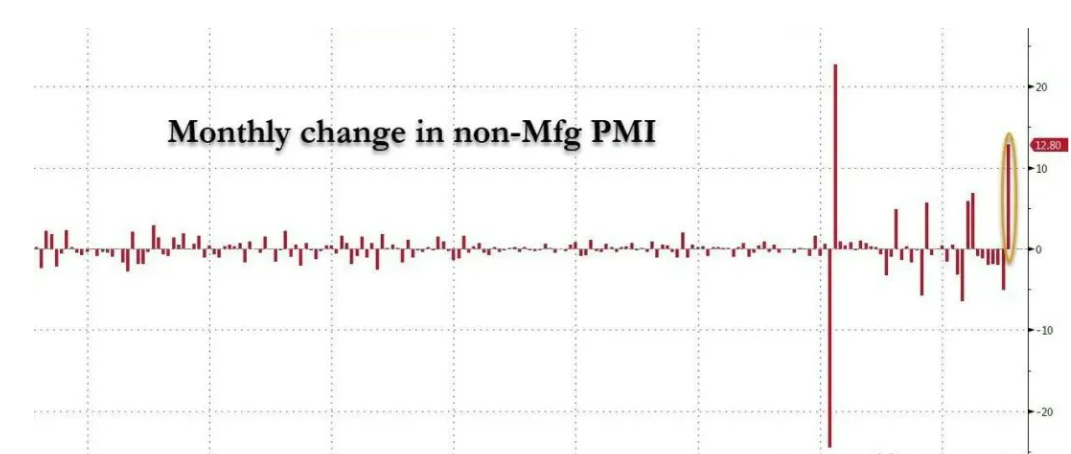

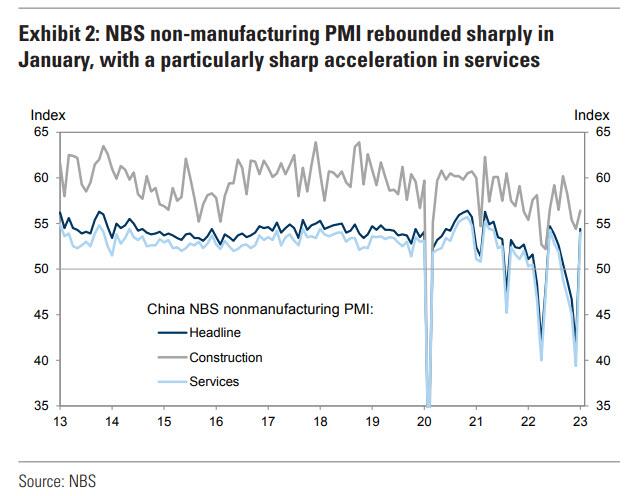

Including GDP, China's retail sales, industrial added value and fixed investment growth all beat expectations in the past month. In January, the official manufacturing PMI entered the expansion area from the previous 47, and the non-manufacturing PMI rose from 41.6 in December to 54.4 in January.

China's non-manufacturing PMI index can be said to have created a record monthly increase. In the past 20 years, the increase in January was the second highest monthly increase on record.

At the same time, with the relief of the debt problem, the growth of construction and service industry also began to accelerate, and the PMI of service industry rebounded sharply to 54.0 (39.4 in December). The construction PMI rose to 56.4 in January (compared with 54.4 in December).

But the question is, why is there a sudden correction in Hong Kong and A stock market when the data is so good?

Can we buy the dip of Shanghai Composite Index, which has risen by more than 20 percentage points from its 52-week low?

On this issue, Hong Hao, an analyst at Bank of jiao yin guo ji, gave a very professional technical observation on Tuesday:

Judging from the change law of Hang Seng Index, the 850-week moving average provides a very accurate technical reference. If the Hang Seng Index can break the suppression of this 850-week moving average in the past two weeks, the upward space in the future will be opened again, but this line will also be a very strong pressure level, which is not easy to break through.

So what will be the trigger for the market correction? There is no doubt: the rebound of the US dollar!

What‘s the next move of US dollar aftter Fed delivering small rate increase

The market is very divided about the current trend of the US dollar. Although the US dollar tried to rebound twice after a long period of weak consolidation, it all ended in failure.

The story of "The Wolf is Coming" was once again staged in the US stock market:

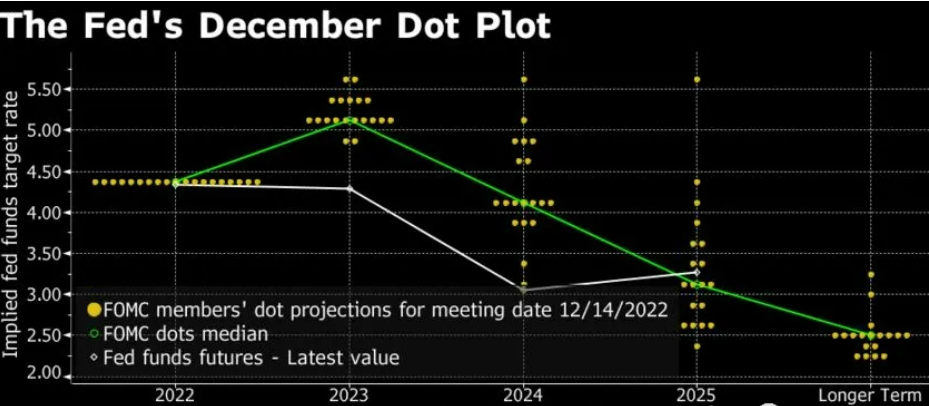

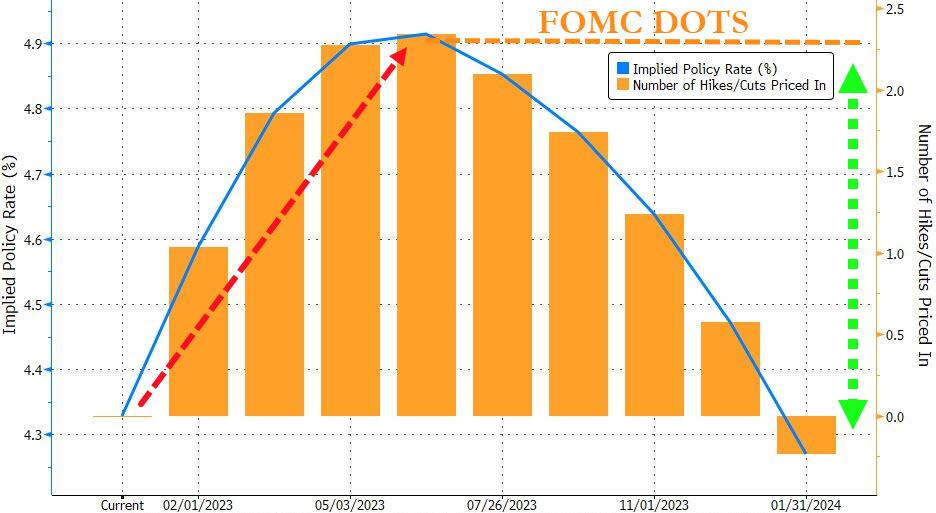

Although a large number of Fed officials have repeatedly stressed the importance of sustained interest rate hikes, and although no one explicitly mentioned suspending interest rate hikes in the first half of the year, the expectations of derivatives markets are still much more dovish than the path of interest rate hikes predicted in the dot plot

Let's look at the expectations of the more radical swap market:

The swap market is priced at suspending interest rate hikes in June and starting to cut interest rates in July (Blue Line). It seems that people no longer believe Powell's previous statement of keeping high interest rates for a long time, and at the same time ignore the hawkish attitude of many Fed officials. Everyone only believes in the market and the recession indicators that have already turned red.

As a result, from the latest news this morning, we can know that Powell's speech is like this:

-We are firmly committed to the target of reducing the inflation rate to 2%, and there is still more work to be done. It is expected that it is appropriate to continue to raise interest rates (further interest rate increases are needed)

-The full impact of the rapid interest rate hike has yet to be revealed, and the progress of slowing down the interest rate hike can be evaluated (the Federal Reserve has entered the interest rate hike evaluation period)

-The labour market remains "extremely tight" and will need to remain restrictive for some time (maintain high interest rates for some time)

-Will need plenty of evidence of moderation in inflation. (Inflation is not good enough to justify a halt to interest rate hikes.)

-We have not yet reached a sufficiently restrictive policy stance, and the Fed is discussing raising interest rates several more times to the restrictive level (there is still room for raising interest rates)

-The Fed has not considered suspending and then resuming interest rate hikes (stopping interest rate hikes will never be an easy decision)

-I still believe that there is a way to follow a soft landing (in contrast, there is a high probability that there will be no interest rate cut this year)

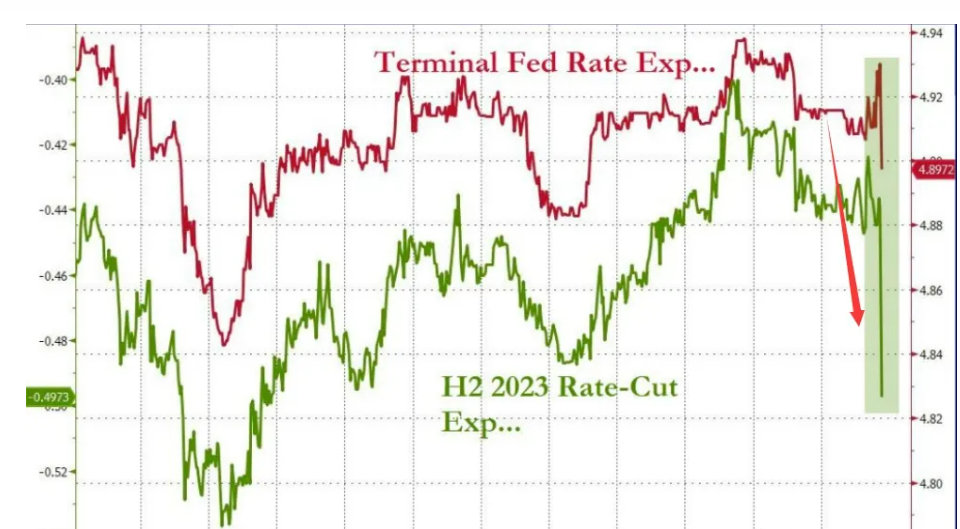

Just as our expected, no message of suspending interest rate hikes was delivered . Apart from saying that it will not cut interest rates or stop raising interest rates, the rest is market determinism talk, and then the sharp drop in market interest rate hike expectations is just a spontaneous movement of the market. In other words, if you don't see a more hawkish expression, you will be treated as a dove's interpretation, because the market does not believe that the Fed will continue to raise interest rates.

Why don't I think the Fed will NOT stop raising interest rates

We believe that the Federal Reserve will not suspend interest rate hikes so early, and the market is too optimistic!

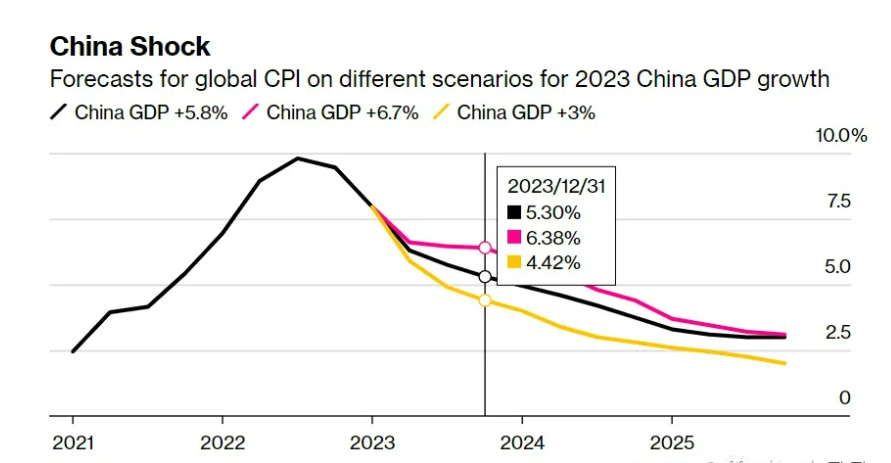

Especially when China's economic motor starts again, it is very likely that American energy inflation will soar again.

Stimulated by the re-opening, many economic data in China rebounded. While China's delivery time plummeted, oil imports also rebounded significantly in the past two quarters

According to Bloomberg's forecast model, when China's GDP growth in 2023 is 5.8% (black), 6.7% (red) and 3% (yellow), the corresponding global CPI data are all above 4%, which also means that it is difficult to complete the return of the US inflation target to 2%

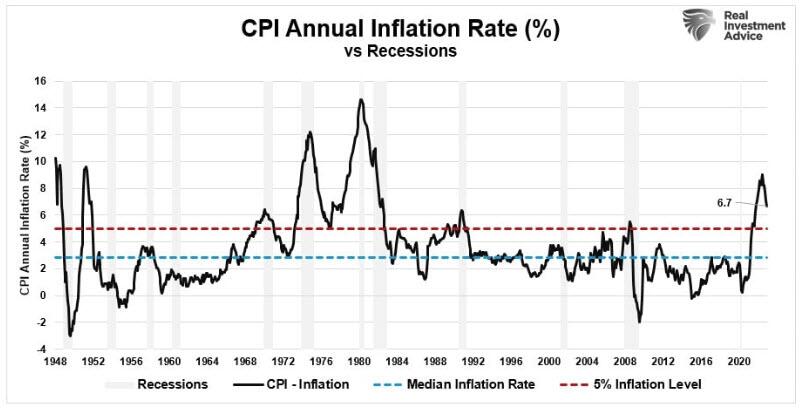

What's more, when we run the inflation data of the United States from 1948 to more than 70 years, we find that,CPI at 5% and 3% are two important points. Unless the CPI in the United States falls below 3%, there is still a great possibility of rebound in the future, at least it should fall below 5%.

We are on the verge of turmoil.

The upward space of US stocks has been opened again

Finally, let's talk about the future market trend. You should pay attention to the statistics of quarterly trend. The volatility of the S&P 500 index in the first three months is in a sharp upward trend

However, as far as short-term technology is concerned, the upward momentum of US stocks is still very large, because S&P has just broken the large triangle consolidation area and successfully won the 250-day moving average, and the future increase will be considerable.

50 days is about to cross the golden fork for 200 days. Once this cross falls to the ground, it will definitely stimulate the rise of US stocks in the short term.

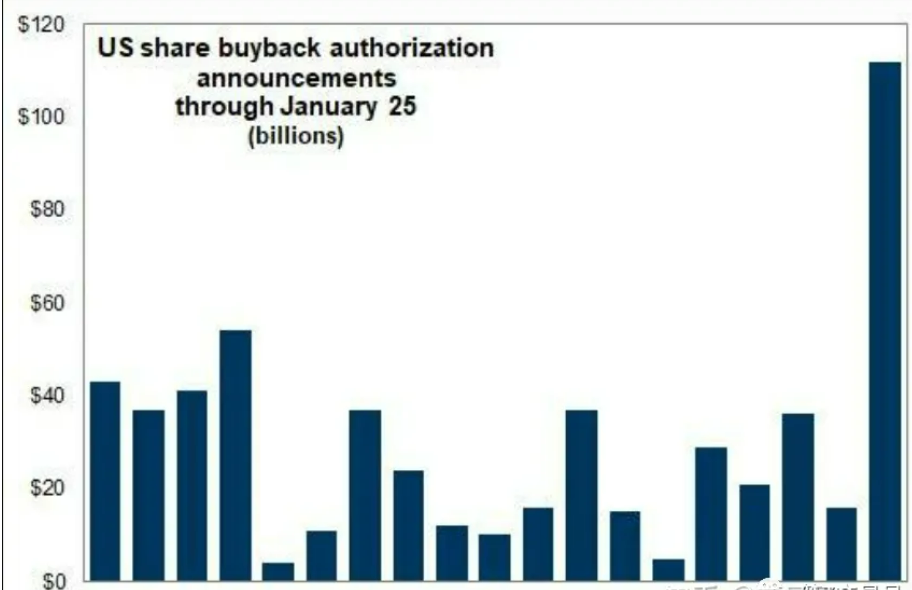

More importantly, starting from this Friday, A large number of corporate repurchase funds will enter the market one after another, and the bottom funds in the US stock market will come. I am afraid it is not so easy to plummet for the market.

But here's what you should pay attention to:

Once the US stock market starts to soar irrationally, the crisis will be brewing at the same time. One day, when the doves' logic is suddenly falsified and the hawks' interest rate hike suddenly appears at the village entrance like a "wolf", the market storm will come.

$E-mini Nasdaq 100 - main 2303(NQmain)$ $E-mini S&P 500 - main 2303(ESmain)$ $E-mini Dow Jones - main 2303(YMmain)$ $Gold - main 2304(GCmain)$ $Light Crude Oil - main 2303(CLmain)$

Comments

a wolf as the intro that the storm will come 😉