-The Federal Reserve hasMade a confession to the market

In the first trading week of 2023, the minutes of the Federal Reserve's December policy meeting were released. This 14-page minutes of the meeting were the most hawkish since May 2022.

Minutes are usually released three weeks after the Fed announces its interest rate decision, which has been misread by the market for three weeks before.

Here are the key points we have compiled that can affect the market:

1. Reaffirm the determination to fight inflation (fighting inflation is serious)

Summary: We are determined to bring inflation back to the target level of 2% even if there is a risk of rising unemployment and slowing growth.

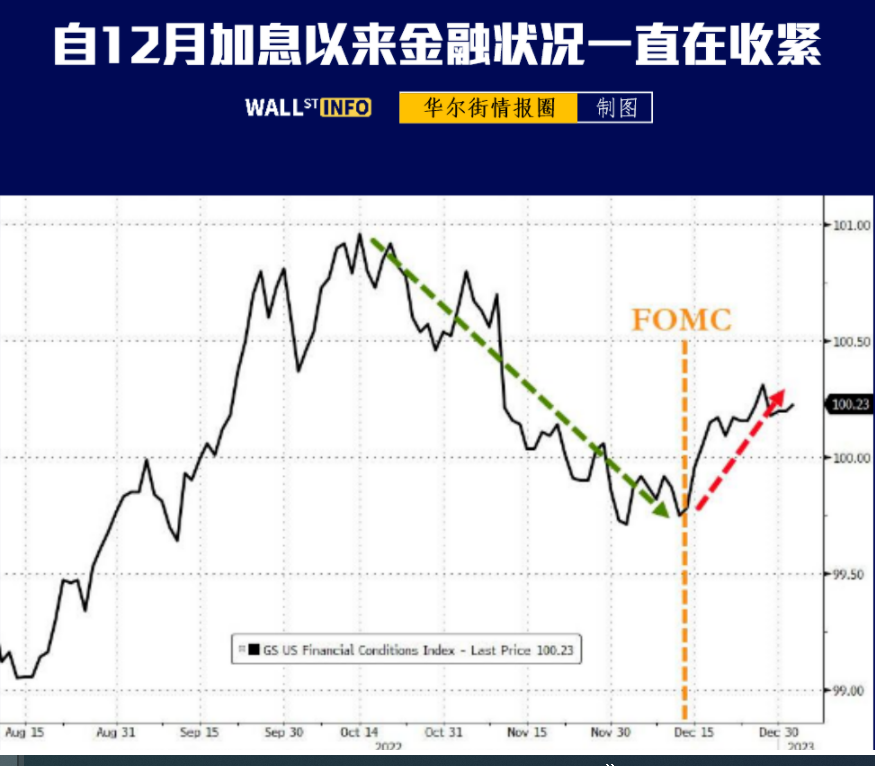

2. Not satisfied with the stock market rise (financial situation relaxation), warning that the financial situation is "unfounded" relaxation

Summary: It was noted that, since monetary policy played an important role through financial markets as a whole, easing of financial conditions, particularly if there was public misunderstanding of the Committee's response, would make the Committee's work of restoring price stability more difficult and complicated.

3. The disconnection between the market and the Fed (the market misread the Fed)

Summary: The Fed's median assessment of interest rates in the Economic Forecast Summary is significantly higher than the market's interest rate expectations.

4. The interest rate issue will be discussed in successive meetings (no signal of how many basis points to raise interest rates at the next meeting is given)

Summary: Most participants stressed that flexibility and selectivity will be maintained, and they will continue to understand the forthcoming data and its impact on economic activities and inflation prospects, and make decisions at successive meetings.

5. Inflation tends to go up and economic growth tends to go down (I am worried that inflation will linger. On the issue of anti-inflation, the Fed has not seen the dawn at the end of the tunnel)

Summary: As inflation is still high, there is an upward risk in inflation forecast; In addition, it is expected that the weak growth of domestic expenditure, the depressed global economic outlook and the continued tightening of financial conditions will increase the downside risks of economic activities, and there will still be the possibility of recession sometime next year.

6. Begin to discuss the upcoming surge in unemployment rate (the influence of non-agricultural data on the market will soon surpass CPI data)

Summary: Some participants commented that as the labor market moves into a better equilibrium, the unemployment rate increase of some groups may exceed the national average.

7. A major concern was revealed, and the market thought that it might cut interest rates in the second half of the year (which aggravated the communication challenge between the Fed and the market)

Summary: No attendees thought it would be appropriate to cut interest rates in 2023.

In fact, it can be summed up in one sentence: We (the Federal Reserve) are serious about fighting inflation, but it has been misread by the market. The current stock market rise will hinder the control of inflation. It is very possible that inflation and unemployment will rise, GDP will fall, and the US economy will decline moderately, but even so, there will be no interest rate cut in 2023.

This is a hawk can no longer be hawkish data, but from the closing situation, it is easy to be misled. It is a mode of "the US dollar falls, everything else rises", with the US dollar index falling, US stocks rising across the board, US Treasury bonds rising and gold rising. At first glance, it was thought that the minutes of the meeting revealed doves' signals. Actually, it's not.

In fact, after the minutes were released (intraday trend), the US stock market narrowed its gains, the yield of policy-sensitive 2-year US Treasury bonds rose, and the US dollar narrowed its decline, which was totally inconsistent with the data seen at the close. The first two trading days of this year have a prominent feature. I can't feel anything from the closing figures, but I experienced great fluctuations in intraday trading, which indicates an unsettled 2023.

To be sure, there is still room for the Fed to continue to be hawkish, and the market has not fully reflected this. Last night was actually the most thrilling night in 2023 (it will take a long time for the market to react), although we can't see anything from the market performance.

Before the minutes of the Fed meeting were released, a Fed official made the most hawkish speech yet.

Minneapolis Fed Chairman Kashkali (who has the right to vote this year) published an article on Medium.com on Wednesday, saying that even if inflation shows signs of decline, the Fed still has at least 100 basis points to raise interest rates in 2023.

It is appropriate to continue raising rates at least for the next few meetings until we believe inflation has peaked. My expectation is to wait until 5.4% to stop, but wherever the end point is, we won't immediately know whether it is high enough to bring inflation down to 2% in a reasonable period of time. In my opinion, any sign that inflation will remain high for a longer period of time indicates the need to raise interest rates to possibly higher levels.

Obviously, many people are directly "against the Fed" now.

$E-mini Nasdaq 100 - main 2303(NQmain)$ $E-mini S&P 500 - main 2303(ESmain)$ $E-mini Dow Jones - main 2303(YMmain)$ $Gold - main 2302(GCmain)$ $Light Crude Oil - main 2302(CLmain)$

Comments