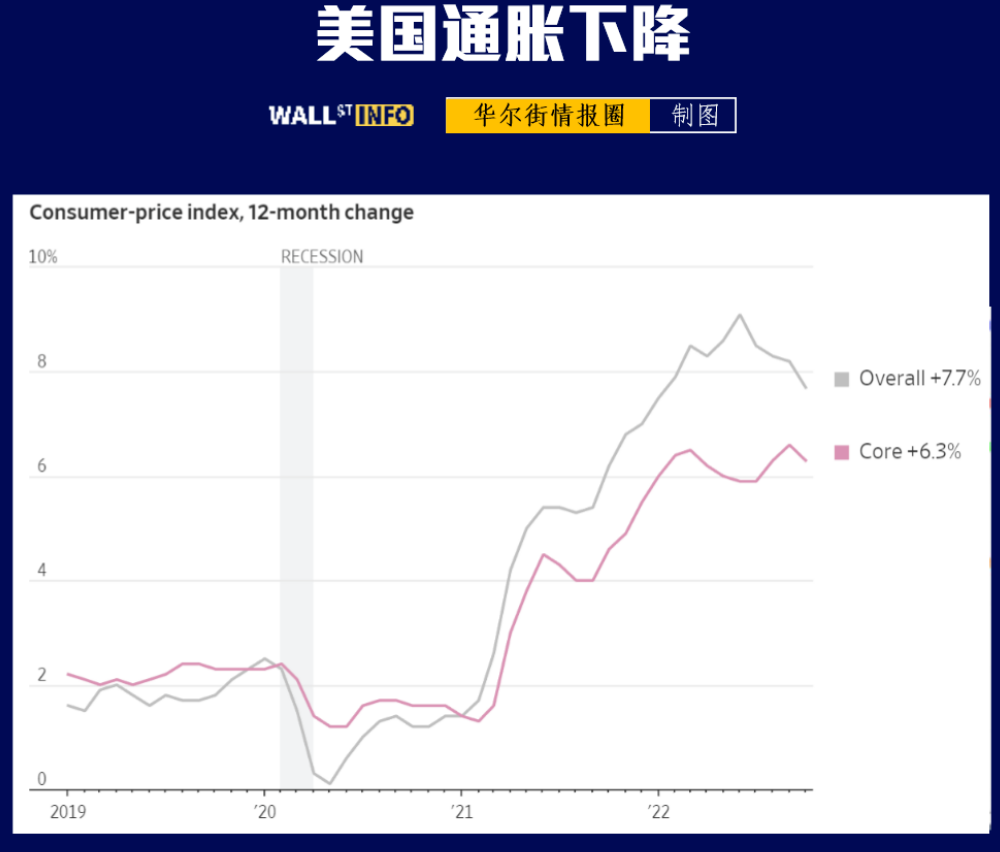

-It has been said for the past few months that "inflation has peaked", but it is not reflected in the data. Last night was the first time that it was really reflected in the data.

After waiting for a year, I finally got good news.

Inflation eased in the United States in October, and both CPI and core CPI rose lower than expected.

-CPI rose by 7.7% year-on-year in October, down from 8.2% in September, and the year-on-year inflation rate of 9.1% in June was the highest in 40 years.

-The core CPI excluding volatile energy and food rose by 6.3% year-on-year in October, which was lower than the 6.6% in September, and the growth rate in September was the highest since August 1982. Fed officials pay close attention to core CPI as a reflection of general price pressure and a forecast of future inflation.

The late news set off a buying frenzy. Riskier assets such as stocks were boosted by lower-than-expected inflation data, which sent safe-haven assets such as the dollar plummeting

-The three major US stock indexes soared, the Dow Jones index rose 3.70%, the S&P 500 index rose 5.54%, and the Nasdaq index rose 7.35%;

-US Treasury bonds rose sharply, and the yield spiraled down. The yield of 10-year US bonds fell by 27.4 basis points to 3.8181%;

-The US dollar index hit the biggest one-day drop in 2009, erasing all the gains since the CPI exceeded expectations in September;

-The euro/US dollar rose by 1.8%. After the CPI data was released, the turnover in the inter-bank market soared, and the futures turnover in half an hour was about 9 billion US dollars;

-Offshore RMB rose 1.5% to 7.1651 against the US dollar

Gold and copper jumped to their highest levels since August, with gold rising 2.8 percent at $1,754.85 an ounce

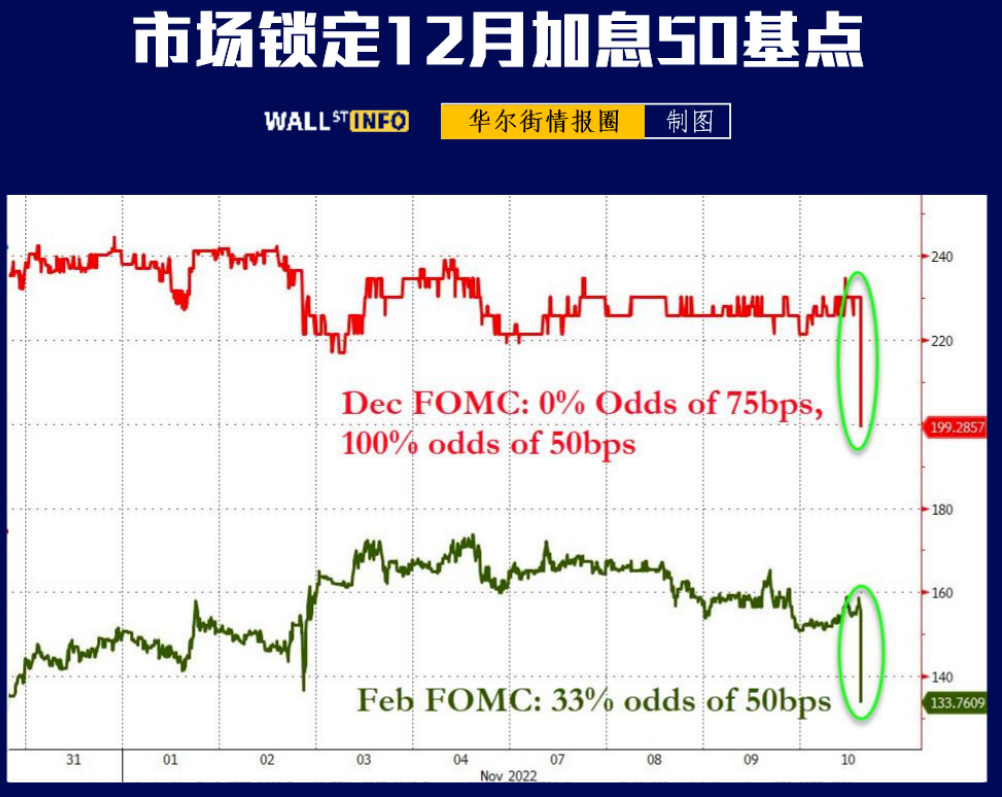

This data has a substantial impact on the Fed's interest rate hike path:

First, the market confirmed that the interest rate increase in December was 50 basis points (the probability of raising interest rates by 75 basis points in December was close to zero);

Second, the market expects the policy interest rate to peak at a level close to 4.9% around May next year (around 5.09% before the CPI data was released).

For retail investors, the more the increase, the greater the excitement. But for professional traders, the next question to think about is: Is the market overreacting?

1) First of all, markets such as equities, bonds and gold are understandably up sharply. This is the first good news about inflation in months.

2) From the perspective of real impact, the weakening of core CPI data leads the market to reprice the terminal interest rate to a low level.

3) The Dallas Fed's Lori Logan added fuel to the fire by suggesting that the Fed would soon slow down its tightening. Today's CPI figures are encouraging, but there is still a long way to go, Logan said.

4) But the Fed may still remind the market that underlying inflation is still three times higher than its target and persists. The Fed still faces a challenge of choosing between excessive or insufficient rate hikes. Guess what?

5) From the market trend, it is not because of the ordinary reaction of improving inflation pattern, but emotional trading amplifies the market trend. After the data was released, the stock market set off a short covering boom (the third largest short squeeze in history), and previously conservative institutions frantically bought call options.

There may be a short period of optimism in the future, but calm down.

$E-mini Nasdaq 100 - main 2212(NQmain)$ $E-mini S&P 500 - main 2212(ESmain)$ $E-mini Dow Jones - main 2212(YMmain)$ $Gold - main 2212(GCmain)$ $Light Crude Oil - main 2212(CLmain)$

Comments