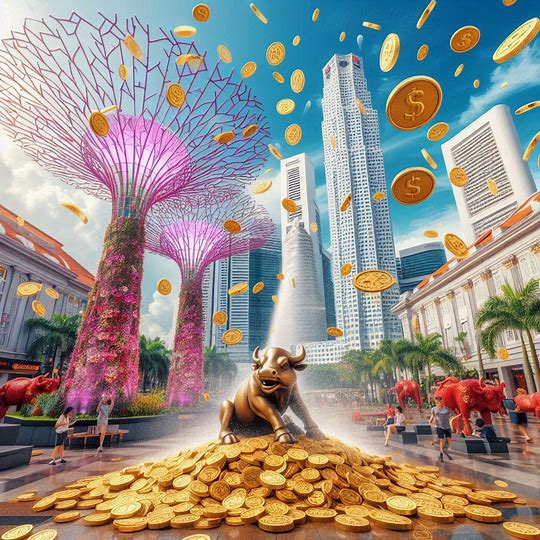

[Events] Singapore Stocks Hit 17-Year Peak – Are You On Board?

The Straits Times Index rose 0.7% on Monday, reaching its highest level since 2007, with an increase of over 12% year-to-date.

The prospect of interest rate cuts has boosted Singapore's Real Estate Investment Trusts (REITs), enhancing the appeal of high-yield markets. REITs have driven much of the growth, while strong dividend expectations and robust loan growth have supported bank stocks. Major Singapore banks have reached record highs, indicating confidence in the financial sector, which may attract more investment.

How to participate?

Just leave a message in the comment area of this post. Share your most profitable Singapore stock trade in the comments and briefly explain your trading thought process and strategy.

How to share positions?

Sharing positions is easy. From your account holdings interface “trade”, then you can click "Share" by each of your stock holdings to share with the community how much money you have made (or lost) on your investments.

Do not forget to take a screenshot of your positions and post them in the comment sections below.

There are tons of coins waiting for you !

🎁 Reward Details

All participants will receive 5 Tiger Coins. Additionally, there are chances to win the following rewards:

🍀 Lucky Trader: We will select the most interactive, insightful, or highly liked comment to receive a SGD 5 stock voucher.

👑 Profit King : One trader with the highest profit from their Singapore stock trade will receive a SGD 5 stock voucher.

⏰ Events Duration

From 24 September 2024 to 8 October 2024

Please leave a message in the comments section of this post . Make sure you include a screenshot of your position as well. $Tiger Brokers(TIGR)$

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

🌟🌟🌟In land scarce Singapore, $PropNex(OYY.SI)$

Propnex stands for Property Network for Excellence. With its strong commitment to excellence in customer service, I believe that Propnex will not only survive but thrive in our fast growing Singapore property market.

Go Long Go Strong Go Propnex! 🚀🚀🚀🌛🌛🌛🌈🌈🌈💰💰💰🇸🇬🇸🇬🇸🇬

@TigerEvents @TigerStars @Tiger_SG @Tiger_comments

With the STI hitting an all-time high, how's your portfolio doing?

Share your best-performing SG stock in the TOPIC 'STI Hits ATH! What's Your Favorite STI Component Stock?' or leave comments under TigerEvents post for a chance to win tiger coins and stock vouchers! 🎉📈

Wonderful news for the $Straits Times Index(STI.SI)$, and I believe that with the soft landing of the US economy and the expectation of further FED rate cuts, the highly weighted bank stocks in the STI such as $DBS Group Holdings(D05.SI)$ $ocbc bank(O39.SI)$ $UOB(U11.SI)$ will continue to generate good returns, which will also benefit the $Straits Times Index(STI.SI)$ .

Welcome SGX Tigers to Trade with Tiger Cash Boost Account and use contra trading to enhance your strategies.

Open a CBA today and enjoy access to a trading limit of up to SGD 20,000 with upcoming 0-commission, unlimited trading on SG, HK, and US stocks, as well as ETFs. Find out more here.

Other helpful links:

How to open a CBA.

How to link your CDP account.

Other FAQs on CBA.

Cash Boost Account Website.