Day3 Education: 5 types of orders for US stock trading

Hey, tigers:

How was your past vacation?you can comment below.

Today is the third day of our column "Learn US stocks by numbers".In this article, I will introduce 5 types of orders for US stock trading.

①Limit(LMT);

②Market(MKT);

③Stop;

④Stop-Limit;

⑤Trailing stop;

Here is a simple introduction.

| Name | Consist | Trading time | 特點 |

| Limit | / | All time | price first |

| Market | / | intraday | trading speed first |

| Stop | Limit+Market | intraday | stop loss, but not fixed price(compare with limit) |

| Stop-Limit | Limit+Limit | All time | stop loss, price first, but the order may not success |

| Trailing stop | the plus of stop | intraday | a better way to control the withdrawal of the order |

1. Limit

A limit order refers to buying or selling a stock at a specific price, which is the most conventional way to place an order.

The biggest feature of the limit order is that the price is flexible, you can trade according to the ideal price in your mind. And, using limit orders, you can trade almost any time period (including pre-market and post-market) to buy or sell a stock at a specific price.

For example, Apple's stock price is $148.71, and you want to buy 100 shares at $140.

At this point, you enter $140 and click Submit. Note that at this time, it is only submitted, and there is no successful transaction.However, once the share price falls to $140, the trade will automatically go into effect.

In the same way, if you want to sell Apple stock with a limit order, entering $160 will not be executed. Only when the market price rises to $160 will the trade be considered a success.

2. Market order

A market order refers to an order that does not specify a specific price, but is executed at the best price that can be executed in the market at that time.

How to understand it?

You know, there are also queues for transactions in the stock market. Sometimes, because the stock price changes too fast and there are too many people queuing up for transactions, it will cause investors to repeatedly modify the order price and delay the transaction.At this time, if you choose a market order, it means that you want to buy at the fastest speed by default, followed by the price.

Let's take an example.

If the transaction price of Apple stock in your mind is $150, and the stock just caught up with the skyrocketing price; then using the market order at this time, the final purchase price may be $160 or even higher.

Limit orders and market orders are the most basic two types of orders, and the remaining three types of orders are generated based on the combination of the two.

3. Stop Loss Order

A stop-loss order refers to an order to buy or sell a stock when the stock reaches a specified price, which is a combination of a limit order and a market order.

For example, if the price of a stock fluctuates a lot, and the current market price is $100, to prevent excessive losses, you place a stop loss order of $95. In other words, as soon as the stock falls to $95, it will automatically sell, preventing further losses.

Many tiger friends will ask, can't this effect be achieved by setting a limit order to sell? Not really, if a stock isn't doing a lot of volume at $95, then your limit order is likely to be out of order. But suppose you set a stop-loss order, and when it reaches $95, it will be sold at the market price, and there is a high probability that it will be sold, but it may not be sold exactly at $95.

The biggest feature of a stop-loss order is actually a double insurance, which ensures that you can sell in time, stop your losses or keep your previous profits.

4. Stop Limit Order

A stop-loss limit order means that when the stock price reaches the first price, an order will be issued to the exchange for the second price; it is equivalent to a combination of limit order + limit order.

When setting a stop-limit order in Tiger Trade App, you will see two prices, one is the stop price and the other is the limit price. The stop loss line here is equivalent to an alarm line. When the stock price falls to the alarm line, it will immediately trigger the prevention system, that is, it will immediately sell at a lower limit price than the stop loss price. In this way, it is very likely that your final transaction price will be between the stop price and the limit price.

Attention!

The range set by the stop-limit order cannot be too large, as it will increase your losses; it cannot be too small, and the transaction may not be executed if it is too small (eg: $168.68 and $168.67).

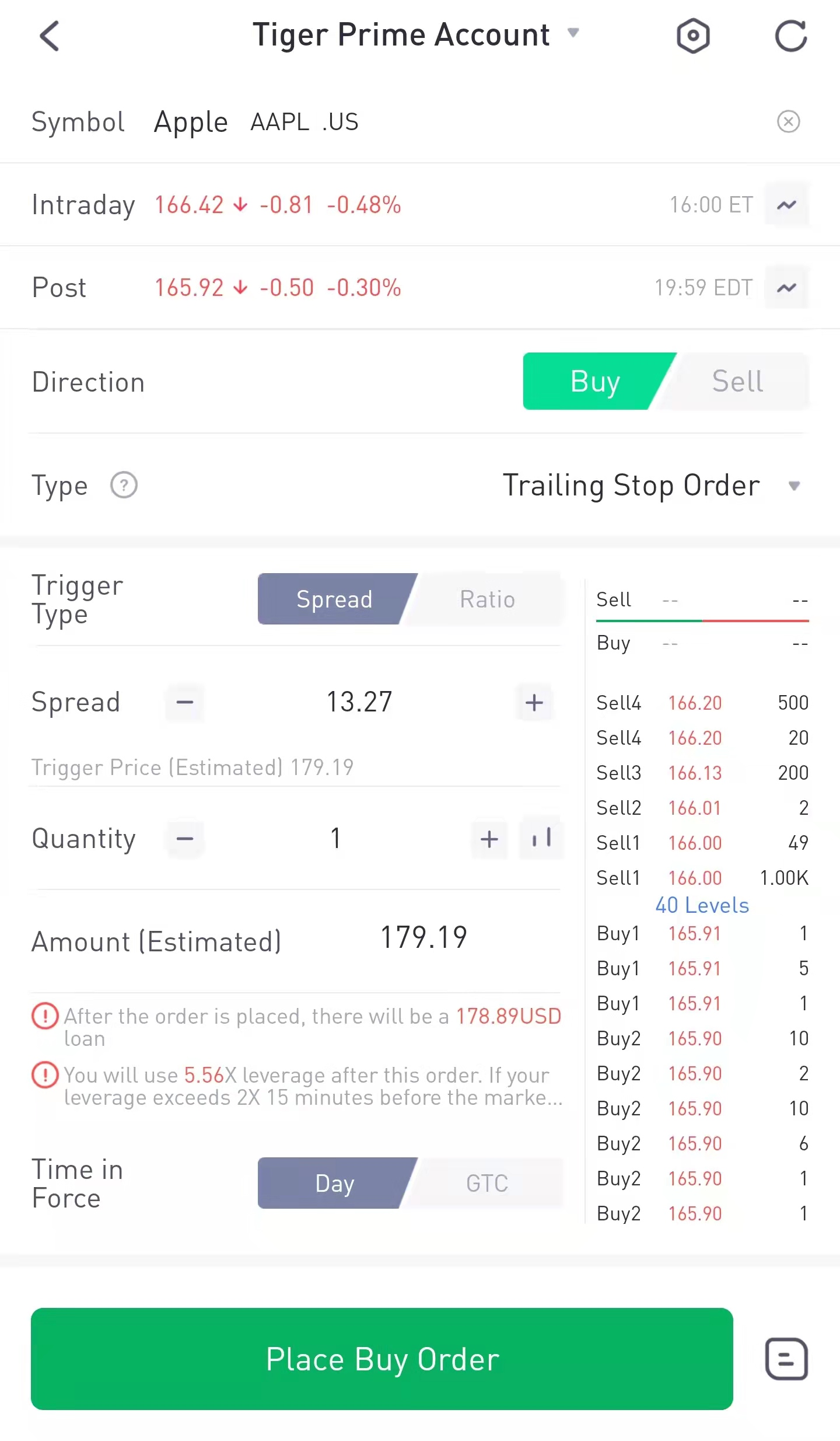

Five, trailing stop orders

Trailing stop-loss order refers to the way of placing a stop-loss order according to the trading trend. You can think of it as a plus version of a stop-loss order.

Select Trailing Stop Loss Order in Tiger Trade App, we will find that there is no price, only spread and percentage options. What does it mean?

For example, if you are particularly bullish on Apple, you place a trailing stop order to buy a stock at $150 with a spread of $2. After buying it, the stock price rose sharply, rising directly to $170, and then began to pull back.

Due to the set price difference of 2 US dollars, when the pullback to 168 US dollars, the system will automatically trigger selling, helping you to keep most of the fruits of victory. This method is called a trailing stop order.

Of course, in addition to the spread, you can also choose a percentage. Assuming you choose a 1% spread, a sell will be triggered when Apple shares retrace from $170 to $168.3 (170-170*1%).

Therefore, a trailing stop order is a better way to place an order with controlled retracement.

Well, here are the 5 common orders in the US stock market, and I will tell you all.

Finally, I will take you to familiarize yourself with the trading interface of Tiger Trade App.

In the Tiger Trade App trading interface, you will see that there are two validity periods, one is the day, and the other is before revocation. Selecting the current day means that the order will be automatically cancelled if there is no transaction at the end of the trading day.

The order is permanent until it is cancelled, and it will not be cancelled on the same day. Everyone needs to pay attention to the risk of permanent orders. For the US stock market where stock prices fluctuate wildly, it is recommended to choose carefully.

Interact today

1. What kinds of orders have you used?

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Easy understand [开心]

Thank you for sharing [抱拳]

请加入留言有机会赢虎币😃 @Chooer @hengsley @HelenJanet @huaer8497 @Venus_M @Kiatkiat88 @koolgal @KYHBKO @Kiatkiat88 @JayceLee

Thank you very much @Tiger_Academy for explaining the following 5 types of orders for US stock trading:

Limit Order

Market Order

Stop Loss Order

Stop Limit Order

Trailing Stop Order

To-date I have only used Limit Order to buy or sell a stock at a specific price, which is the most conventional way to place an order.

The biggest feature of the limit order is that the price is flexible, we can trade according to the ideal price in our mind. And, using limit orders, we can trade almost any time period (including pre-market and post-market) to buy or sell a stock at a specific price.

①Limit(LMT)

②Market(MKT)

③Stop

④Stop-Limit

⑤Trailing stop

Many of which are useful. Gonna put to practise. Paid for painful lesson, will have to practise stop loss order, and be disciplined about it.

Thank you @Tiger_Academy for yet another very useful and informative lesson on 5 types of orders for US stock trading. It is a very handy tool to know how to execute the various types of orders which will certainly enhance the successful outcome of a trade.

I use Limit order for my trades as it gives me the flexibility to set my ideal price. But now that I have learnt the new types of orders, I will practise and try them out. Thanks for your cautionary advice on Stop Limit Order that may result in losses or may not be executed if the margin is too large or conversely too small.

@Tiger_Academy