Has the dollar bottomed out?What will happen to the Commodities ?

An unexpected non-agricultural data made the US dollar rebound sharply and the gold price plummeted. Don't panic. Maybe this is just the beginning.

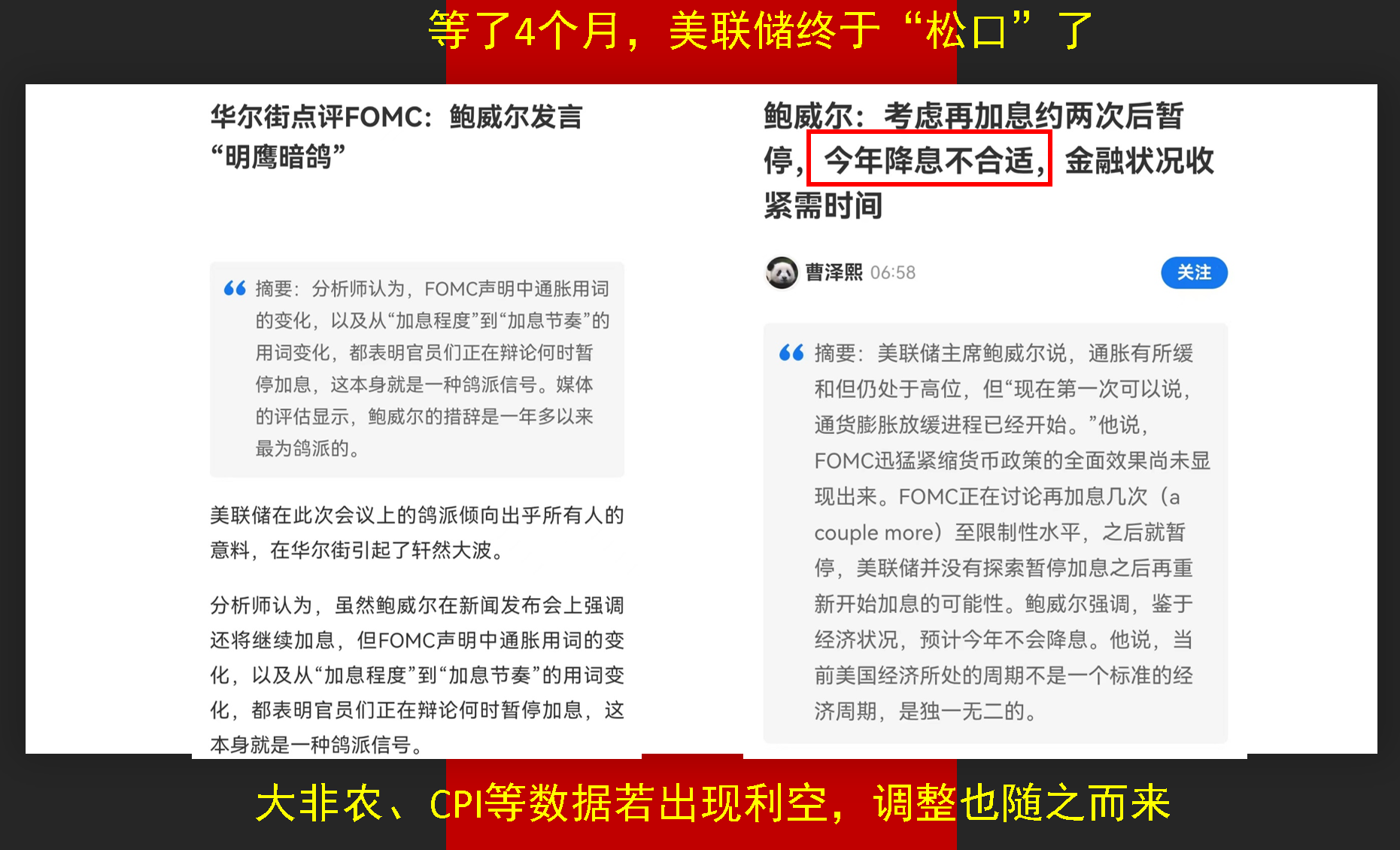

According to the data released last Friday night, the US labor market grew strongly in January 2023. After the quarterly adjustment, the number of non-farm payrolls increased by 517,000, far exceeding the expected 189,000 and 60% higher than the most optimistic expectation of 300,000. At the same time, the unemployment rate was 3.4%, which was the lowest in the past 40 years. Under the guidance of this data, the previous loose and optimistic expectations of financial markets will be repriced.

I told everyone in the live class that when the market is full of optimistic expectations, how many more optimistic expectations are there? Any bad news that exceeds expectations will lead to a large reverse fluctuation in the market. Friday night is a typical case, and it is likely that this is the beginning of the overall financial market from optimistic expectations to pessimistic.

First, the bottoming out of the US dollar index stage is the resonance between the technical side and the news side

Through the market's loose expectations for four consecutive months, the US dollar has also adjusted for nearly four months, which is also the limit time for the US dollar adjustment that I have repeatedly stressed. Driven by last Friday's non-agricultural data, the US dollar index rebounded sharply, which confirmed the arrival of the bottom of the US dollar , followed by a new round of US dollar rebound or continuous rise.

For non-American currencies, the appreciation of the US dollar leads to the tendency and depreciation of non-American currencies, and the extent of depreciation varies from country to country and region. Generally speaking, the last rise of the US dollar is coming, and it is time for the financial market to test.

Second, the golden stage peaked

The live class hours show that gold will face a pressure position in the short term. Although it may not change the trend, the adjustment probability is not small, and the result is a prophecy. I didn't expect that even the upward trend could not be kept under the unexpected non-agricultural data.Although the end of this month is the first anniversary of the Russian-Ukrainian conflict, there are still almost three weeks before that date, which is enough for gold prices to continue to fall sharply.

The current fall of gold price may be around 1800, or even break 1800, because this is the beginning of market speculation that the Federal Reserve will cut interest rates in the second half of the year, and the unexpected non-agricultural data makes the market dispel the expectation of the Federal Reserve to cut interest rates, so it is naturally difficult for gold price to have sustained performance. As far as gold prices are concerned, we can only expect whether Russia will escalate the war and bring a new round of turmoil on the first anniversary of the Russian-Ukrainian conflict.

III. Other commodities

Since the US dollar index has rebounded sharply, the performance of other commodities will not be very good, and it is necessary to wait until the CPI data is released. If the CPI data does not fall beyond expectations, inflation worries still exist, and commodities will still reverse upward with the cooperation of some special events.

$E-mini Nasdaq 100 - main 2303(NQmain)$ $E-mini S&P 500 - main 2303(ESmain)$ $E-mini Dow Jones - main 2303(YMmain)$ $Gold - main 2304(GCmain)$ $Light Crude Oil - main 2303(CLmain)$

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- tk321·2023-02-07at the end of the day please always be well and safe at all timesLikeReport

- Ratt·2023-02-07Time to get gold collection to grow.. Good for me time of year,,LikeReport

- zerolih·2023-02-07informative article, thank you [Like]LikeReport

- Johnsnny·2023-02-08OkLikeReport

- CL_Wong·2023-02-08OkLikeReport

- CKGOH·2023-02-07阅LikeReport

- Gon·2023-02-07[什么]LikeReport

- LifeLearner·2023-02-07好的LikeReport

- LongShort333·2023-02-07okLikeReport

- Liuliusg·2023-02-07okLikeReport