【🎁有獎話題】奈飛財報將至!如何用期權把握財報行情?

7月18日美股盤後,流媒體巨頭 $奈飛(NFLX)$ 將發佈2024年第二季度財報,引領大型科技股財報潮的開端。

今年以來,奈飛的股價走勢雖有幾番波折,但整體仍保持着昂揚向上的勢頭。截至7月16日,奈飛年內累漲34.83%,最新報收656.45美元。

對於即將公佈的二季度財報,市場普遍預測,奈飛預計實現營收95.33億美元,同比增長16.44%;每股收益爲4.74美元,同比增長44.17%。近期共有33位分析師對該股做出評級,平均目標價爲675.71美元。

股價穩步走高之際,市場仍密切聚焦奈飛的淨新增訂閱用戶數量。在相繼推出含廣告的訂閱服務、打擊共享密碼、探索新市場等有效舉措後,投資者關注奈飛能否持續吸引大量的新用戶,並形成具有競爭力的內容護城河。

用戶增長仍是財報焦點

回顧一季度,奈飛給市場交付了一份超預期的財報數據:公司取得了93億美元的收入和23億美元的淨利,每股盈餘5.28美元,同比激增60%,這些指標均遠超市場預期。最令市場感到振奮的是,奈飛在一季度迎來930萬新增訂閱用戶,幾乎是華爾街預期的一倍,季度末訂閱用戶達到創紀錄的2.696億人。

但與此同時,奈飛卻宣佈從明年一季度起將停止報告季度會員數量和ARM(月度平均單會員收入),僅公佈用戶數達關鍵里程碑的數據;此外,添加年度收入指引(包括年度營業利潤率和自由現金流預測以及季度收入、營業收入、淨收入和每股收益預測);該公司還預警“典型的季節因素將令第二季度用戶增量低於一季度”,暗示用戶增長的積極勢頭會放緩。

受此影響,奈飛在一季度業績公佈後股價暴跌超9%。

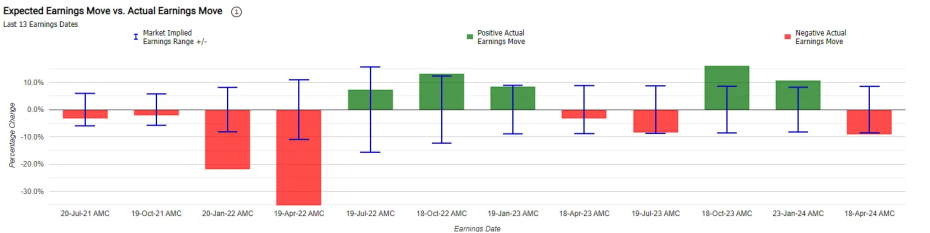

歷次財報日股價如何表現?

根據Market Chameleon,回測過去12個季度業績日,奈飛在業績發佈當天下跌概率較高,約爲58%,股價平均變動爲±11.6%,最大跌幅爲-35.1%,最大漲幅爲+16.1%。當前,奈飛的隱含變動爲±8.8%,表明期權市場押注其績後單日漲跌幅達8.8%;對比來看,奈飛前4季度的績後平均股價變動爲±11.1%。

在此次奈飛財報行情中,可以利用奈飛的波動幅度,用期權策略從中獲利。

寬跨式策略是什麼

做多寬跨式期權中,投資者同時購買價外看漲期權和價外看跌期權。看漲期權的執行價格高於標的資產的當前市場價格,而看跌期權的執行價格低於標的資產的市場價格。這種策略具有巨大的盈利潛力,因爲如果標的資產價格上漲,看漲期權理論上有無限的上漲空間,而如果標的資產價格下跌,看跌期權可以獲利。交易的風險僅限於爲 這兩個期權支付的權利金。

做空寬跨式期權的投資者同時賣出一份價外看跌期權和一份價外看漲期權。這種方法是一種中性策略,盈利潛力有限。當標的股票價格在盈虧平衡點之間的窄幅區間內交易時,做空寬跨式期權可獲利。最大利潤等於賣出兩個期權所獲得的權利金減去交易成本。

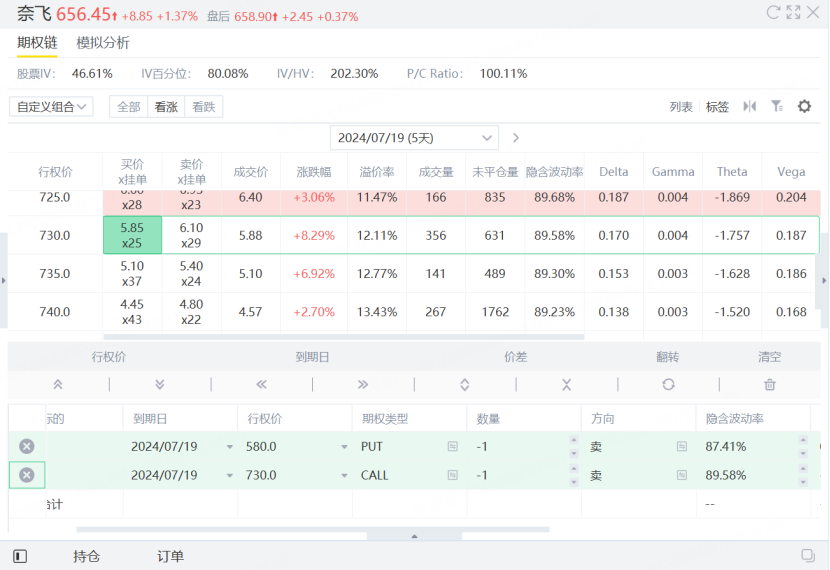

奈飛做空寬跨式策略案例

基於奈飛前4季度的績後平均股價變動爲±11.1%。當前股票奈飛目前交易價格爲656.45美元。投資者可以通過以下操作實施空頭寬跨式策略:

賣出一張行權價爲730美元的看漲期權,權利金爲588美元。

賣出一張行權價爲580美元的看跌期權,權利金爲337美元。

兩個期權的到期日相同。

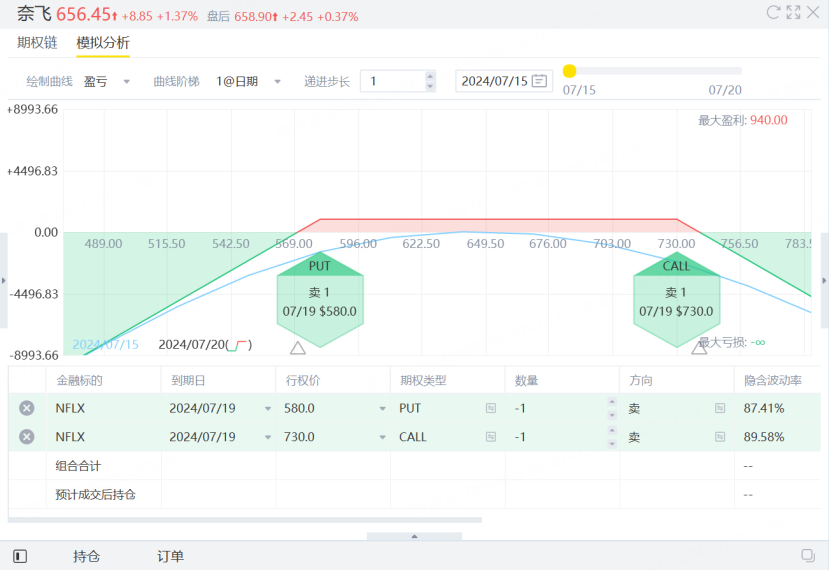

在這種情況下:

如果股票價格上漲超過730美元,賣出的看跌期權將盈利,賣出的看漲期權虧損。

如果股票價格下降低於580美元,賣出的看漲期權將盈利,賣出的看跌期權虧損。

如果股票價格保持在570.75美元至739.25美元之間,兩個期權都會獲得利潤。

寬跨式期權總結

寬跨式期權較適用於市場價格波動較爲劇烈且方向不易確定的情形,能較好地抵禦市場變化帶來的風險。寬跨式期權由於賣出較高執行價的看漲期權,所以整體成本較低。寬跨式期權受限於賣出看漲期權的較高執行價,故潛在收益也有所限制。

總體來說,寬跨式期權則適合那些預期市場波動大但不確定方向,並且希望降低成本的交易者。

小虎們,你們怎麼看後續行情呢?你會怎樣交易奈飛?請在評論區說出你的看法!

🎯分享你的看法贏取獎品

🎁評論即可得獎品如下噢~

🐯對以下帖子的所有有效評論都將收到5個老虎硬幣。

🐯前10名和後10名有合格評論的小虎將獲得另一個10個老虎硬幣。

🐯前5名最受歡迎和高質量的評論將獲得另一個15虎硬幣。

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

receive 5 Tiger Hard Coins for all valid comments on the following posts.

The top 10 and bottom 10 tigers with qualified reviews in 🐯 will receive another 10 tiger coins.

🌟🌟🌟$Netflix(NFLX)$

Netflix has benefited from creating a lower cost subscription service with ads and stop password sharing. It has an extensive range of excellent TV series and movies for subscribers in different languages.

However Netflix is facing increasing competition from $Walt Disney(DIS)$

Even though I am short term Bearish on Netflix, I am long term Bullish on Netflix as it is continuing to provide excellent streaming content to its members and innovating with new products such as online games.

Perhaps Netflix will consider a share split like Nvidia and Broadcom. If that happens its share price will fly like a rocket to the moon!

@TigerStars @Tiger_comments

股價穩步走高之際,市場仍密切聚焦奈飛的淨新增訂閱用戶數量。在相繼推出含廣告的訂閱服務、打擊共享密碼、探索新市場等有效舉措後,投資者關注奈飛能否持續吸引大量的新用戶,並形成具有競爭力的內容護城河。

回顧一季度,奈飛給市場交付了一份超預期的財報數據:公司取得了93億美元的收入和23億美元的淨利,每股盈餘5.28美元,同比激增60%,這些指標均遠超市場預期。最令市場感到振奮的是,奈飛在一季度迎來930萬新增訂閱用戶,幾乎是華爾街預期的一倍,季度末訂閱用戶達到創紀錄的2.696億人。

但與此同時,奈飛卻宣佈從明年一季度起將停止報告季度會員數量和ARM(月度平均單會員收入),僅公佈用戶數達關鍵里程碑的數據;此外,添加年度收入指引(包括年度營業利潤率和自由現金流預測以及季度收入、營業收入、淨收入和每股收益預測);該公司還預警“典型的季節因素將令第二季度用戶增量低於一季度”,暗示用戶增長的積極勢頭會放緩。

After the U.S. stock market closed on July 18, streaming media giants$Netflix (NFLX) $The second quarter 2024 financial report will be released, leading the beginning of the financial report wave of large-cap technology stocks.

Since the beginning of this year, although Netflix's stock price has experienced several twists and turns, it has maintained an overall upward momentum. As of July 16, Netflix has risen 34.83% during the year, closing at $656.45 last.

Little tigers, what do you think of the future market? How would you trade Netflix? Please express your opinion in the comments section

* Analysts predict that Netflix will report revenue of $95.33 billion and earnings per share of $4.74.

* The company's stock price has been on an upward trend this year, up 34.83% as of July 16th.

* Investors are focused on Netflix's net subscriber growth, which was 9.3 million in Q1.

* Netflix has announced that it will stop reporting quarterly subscriber numbers and ARM (average revenue per user) starting in Q1 2025.

* The company has also warned that "typical seasonality will lead to lower subscriber additions in Q2 than Q1."

* Historically, Netflix's stock price has been more likely to decline on earnings days.

* Options strategies that can be used to trade Netflix's earnings include bull put spreads and wide straddles.

receive 5 Tiger Hard Coins for all valid comments on the following posts.

The top 10 and bottom 10 tigers with qualified reviews in 🐯 will receive another 10 tiger coins.

* Investors are focused on Netflix's subscriber growth and guidance for the future.

* Options strategies can be used to trade Netflix's earnings with different risk/reward profiles.

🌟🌟🌟$Netflix(NFLX)$

Netflix has benefited from creating a lower cost subscription service with ads and stop password sharing. It has an extensive range of excellent TV series and movies for subscribers in different languages.

However Netflix is facing increasing competition from $Walt Disney(DIS)$

Even though I am short term Bearish on Netflix, I am long term Bullish on Netflix as it is continuing to provide excellent streaming content to its members and innovating with new products such as online games.

Perhaps Netflix will consider a share split like Nvidia and Broadcom. If that happens its share price will fly like a rocket to the moon!

@TigerStars @Tiger_comments