What are the implications of the weakening Renminbi Exchange Rate.

Since mid-January, the exchange rate of RMB against the US dollar has depreciated again, with the maximum depreciation reaching 4.2% as of the close of February 27th.

The main reason for the reversal of the appreciation momentum of RMB exchange rate before is that the economic growth between China and the United States is expected to be poor, that is, the risk of economic recession in the United States has not been fulfilled in the short term, while the strong recovery of China's economy has yet to be verified.

In addition, inflation in the United States is stubborn, and the expectation that the Federal Reserve will slow down or stop raising interest rates has been significantly reversed.

Driven by the scissors difference between the downward interest rate caused by the release of liquidity of RMB at the beginning of the year and the rising yield of US bonds, there is a certain depreciation pressure of RMB in the short term. However, in the medium term, China's economic recovery momentum will not be interrupted in the next 1-2 quarters, and it remains to be seen whether the US economy can maintain resilience under the upside-down US bond yield curve. The exchange rate of RMB against the US dollar will still show two-way fluctuation with high probability, and will not continue to depreciate unilaterally.

The picture shows the price trend of the US dollar/offshore RMB futures contract of CME Institute

There is a certain expected difference in the Chinese and American economies

After the Spring Festival, China's economy has shown an obvious recovery momentum, but the magnitude is less than expected at the beginning of the year. The financial market's response to the domestic economy is characterized by "strong expectation and weak reality".

From the leading indicators, in January, the purchasing managers' index (PMI) of China's manufacturing industry was 50.1%, up 3.1 percentage points from last month and above the critical point, and the prosperity level of manufacturing industry obviously rebounded. However, compared with the indicators of the same period in recent five years, the manufacturing PMI in January 2023 was near the average value, which did not exceed expectations and seasonal rise. In addition, in the service industry, the business activity index of construction industry in January was 56.4%, up 2.0 percentage points from last month, but the business activity index of real estate and other industries was still below the critical point.

In terms of financing demand, the financing demand of the enterprise sector has improved significantly, but the financing demand of the residential sector is still sluggish. According to the data released by the People's Bank of China, in January, RMB loans increased by 4.9 trillion yuan, an increase of 922.7 billion yuan year-on-year. In terms of sub-sectors, household loans increased by 257.2 billion yuan, but still increased by 585.8 billion yuan less than last year, which implies that residents' balance sheets have not been repaired quickly, especially residents' demand for housing is still sluggish, resulting in weak momentum for real estate stabilization and recovery, and slowing down credit expansion.

Among them, short-term loans increased by 34.1 billion yuan, a decrease of 66.5 billion yuan compared with the same period of last year; Medium and long-term loans increased by 223.1 billion yuan, a decrease of 519.3 billion yuan compared with the same period last year.

In January, loans from enterprises (institutions) increased by 4.68 trillion yuan, an increase of 1.32 trillion yuan over the same period of last year, accounting for 71.4% of the new RMB loans in that month. Among them, short-term loans increased by 1.51 trillion yuan, an increase of 500 billion yuan over last year; Medium and long-term loans increased by 3.5 trillion yuan, an increase of 1.4 trillion yuan over last year. From the perspective of new loans in the enterprise sector, the financing demand of the enterprise sector has greatly improved.

Correspondingly, American economic indicators suggest that the risk of American economic recession has not been realized in the short term. According to the data released by ISM, the ISM service industry index in the United States recorded the biggest monthly increase since mid-2020 in January, in which the new orders index soared and the business activity index strengthened. Consumer demand picks up, and it seems that the US economy will not slow down soon. In addition, according to the data released by the National Association of Realtors (NAR), the contracted sales index of existing homes in January unexpectedly rose by 8.1% month-on-month, the biggest increase since June 2020.

Inflation in the United States remained high in January. In January, the PCE price index in the United States rose by 5.4% year-on-year, and the core PCE price index rose by 4.7% year-on-year. As well as a series of strong data on employment, consumer spending, services and manufacturing, increase the risk that the Fed will raise interest rates above the current forecast level. The yield on two-year US bonds, which are more sensitive to the Fed's monetary policy, rose to 4.78% on February 27, the highest since July 24, 2007.

Weak export orders bring downward pressure on the RMB exchange rate

At present, the kinetic energy of China's economic recovery mainly comes from the recovery of domestic consumption and the pull of investment, but exports are facing great downward pressure. According to the data of Shanghai Port, the cargo throughput of the port in January this year was 43.04 million tons, which was about 5 million tons less than that in January 2019, resulting in the accumulation of empty containers in Shanghai Port, even piled up in Taicang, Jiangsu Province. The amount of empty containers stacked at Yantian Port in Shenzhen has reached the highest since March 2020.

Under the risk of economic slowdown or even recession in Europe and America, the export decline appears not only in China, but also in other export-oriented economies such as Japan, South Korea and Vietnam. Data from Japan Maritime Center (JMC) showed that containers exported to the United States by 18 Asian economies fell by 20.1% in January, including 11.8% in ASEAN, 0.1% in India and 19.9% in Japan.

From the perspective of exchange rate pricing mechanism, import and export trade has a great influence on exchange rate. If the surplus expands, a large number of dollars will flow into the domestic market and increase the supply of dollars. From the perspective of purchasing power parity theory, the RMB exchange rate will appreciate, otherwise it will depreciate.

Convergence of spreads between China and the United States also puts pressure on the RMB exchange rate

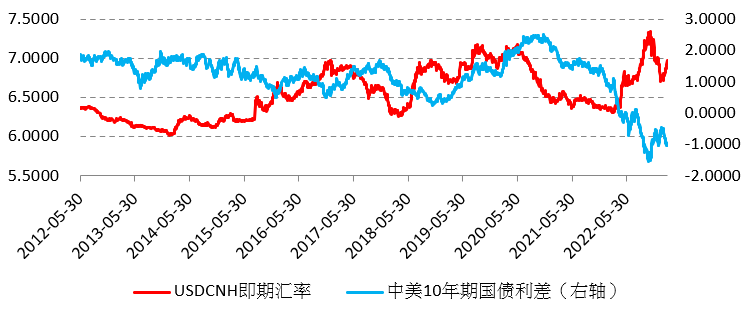

From the perspective of international capital liquidity, because the Federal Reserve still has room to raise interest rates, the nominal interest rate of the US dollar will be at a high level or even have not yet peaked. However, although China's economy is picking up, it is not strong enough, monetary policy is still "I-oriented" and remains appropriately loose, and the tone of the central bank guiding the downward trend of RMB financing interest rate has not changed, which leads to the widening spread between US bond yield and Chinese bond yield, and the residential sector and the enterprise sector have even more reasons to buy US dollars and sell RMB. As of February 27, the spread of national debt between China and the United States has converged to-1. 0019 percentage points since 10 years ago, while in January 2023, the surplus of bank loan settlement and sale of foreign exchange was US $2.5 billion, implying that residents bought US $2.5 billion net.

To sum up, in the short term, the economic growth expectations of China and the United States are poor, especially the risk of economic recession in the United States has not been fulfilled, and the strong recovery momentum of the domestic economy has boosted the strength of the US dollar. In the medium term, the yield curve of US bonds is upside down, and the credit default rate of used cars in the United States is rising. High inflation and high interest rates will make the economic growth prospects of the United States poor, while the momentum of China's economic recovery will probably continue. Although the strength is not strong enough, the general direction still points to the fact that the RMB exchange rate will not continue to depreciate unilaterally. Investors can consider using the US dollar/offshore RMB futures contract (CNH) of Chicago Mercantile Exchange to hedge risks.

$E-mini Nasdaq 100 - main 2303(NQmain)$ $E-mini Dow Jones - main 2303(YMmain)$ $Gold - main 2304(GCmain)$ $Light Crude Oil - main 2304(CLmain)$

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Great ariticle, would you like to share it?