3 Factors That will Drive U.S. Dollar much more higher!

The CPI data of the United States in January was released, which was consistent with our previous prediction. Prices showed more signs of warming up. And the Fed's path of raising interest rates became more hawkish, the swap market tested a higher peak of raising interest rates, which led the global stock indexes to fall into correction, and crude oil and gold fell deeper.

Under the clear prediction of fundamentals and technology, the rebound of the US dollar has a higher probability of confirmation, but the trend of the US dollar is quite hesitant.This gives us a question:

When the interest on debt of the US federal government is about to exceed 1 trillion US dollars, and under the background that the hidden dollar debt around the world has been over $60 trillion, will a continuously rebounding US dollar eventually detonate the global debt crisis like a fuse? Will the end point of raising interest rates really reach 6%, as the options market bet?

You know, in emerging markets, a wave of currency depreciation has quietly started, just when the US dollar is about to rebound.

CPI exceeded expectations,

There are three major obstacles for the Fed to end raising interest rates!

Before the CPI data was released in January, it was reported that the weight of the CPI was revised by the Bureau of Labor Statistics. No accident, the result of the CPI must be an accident. Sure enough, the CPI data was the same as our forecast at the beginning of this week, and there was an unexpected rise

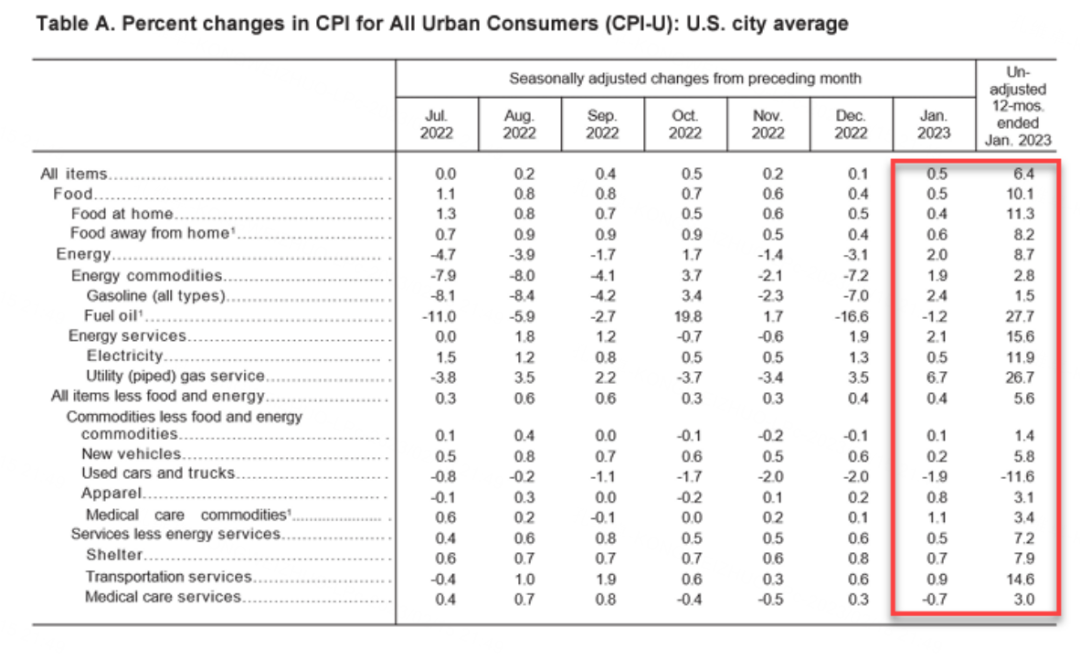

Let's briefly review this data:

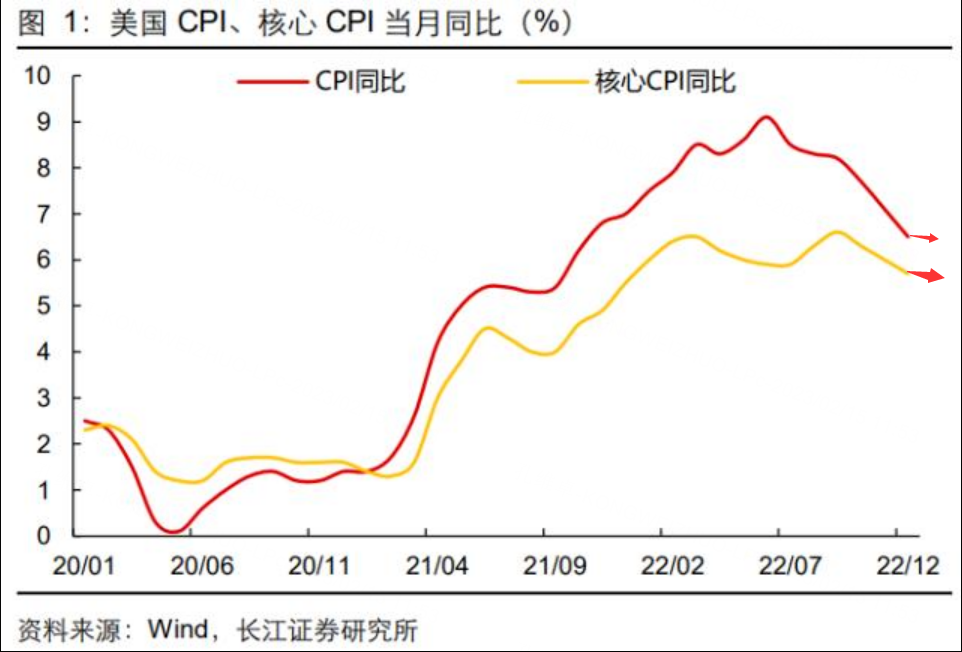

In January, CPI increased by 6.4% year-on-year, exceeding the expected 6.2%, slowing down by 10 basis points compared with the previous value of 6.5%, and the core CPI was 5.6% year-on-year, higher than the expected and previous value of 5.7%, which was the smallest increase since December 2021.

On a month-on-month basis, CPI accelerated upward in January, rising by 0.5% month-on-month, higher than the previous value of 0.1% and higher than the expected value of 0.4%. In January, the core CPI rose by 0.4% month-on-month, which was higher than the expected value and the previous value of 0.3%.

Do you find a contradiction: On a month-on-month basis, inflation accelerated, which was higher than expected; on a year-on-year basis, inflation growth continued to cool down, but the decline cooled down and exceeded expectations, which obviously had a great relationship with the adjustment of weights. It seems that this weight adjustment is to slow down the CPI

Therefore, if we interpret it from the surface alone, it is obvious that the most important significance of this CPI data is:Dispelling the possibility of the Federal Reserve suspending interest rate hikes in the first half of the year and pushing derivatives markets to test higher interest rate hike endpoints, it is difficult for the Federal Reserve to change its tone before its June meeting.

Because in terms of historical rules and fundamental data, after the release of inflation results in January, the Fed faces three huge obstacles to end interest rate hikes

First of all, sticky inflation has not decreased

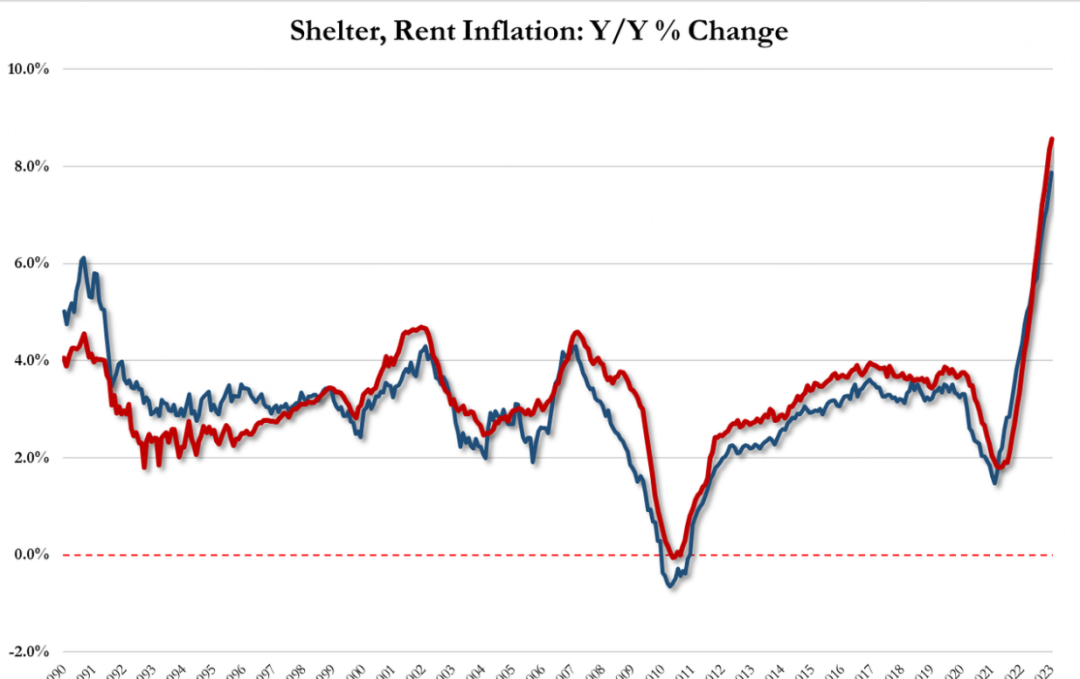

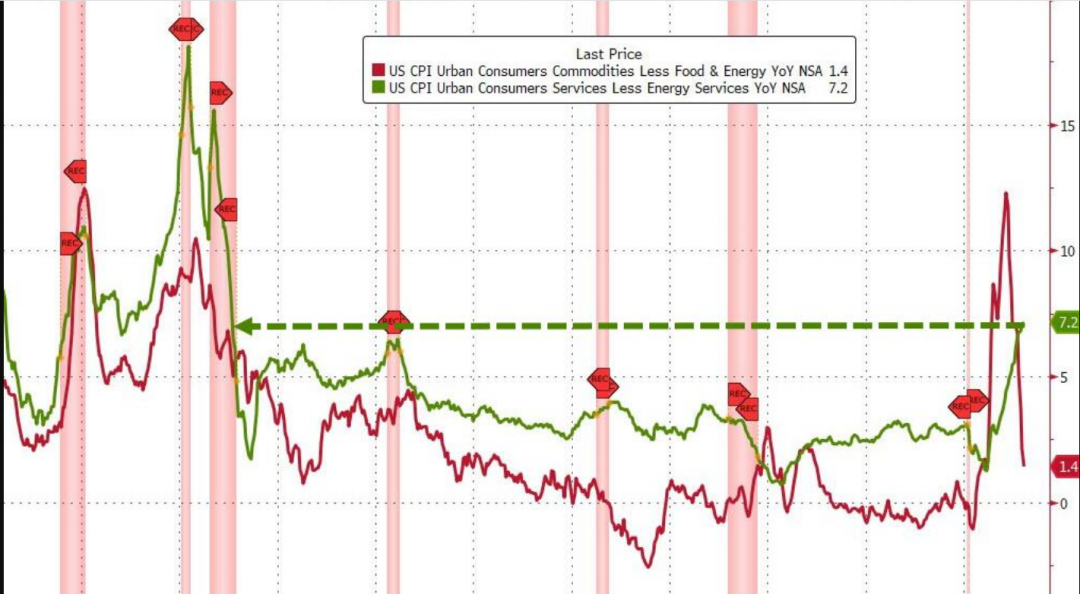

To put it simply, the slowdown in inflation data is almost entirely driven by the slowdown in commodity inflation, while service inflation, that is, the most important inflation item we emphasized before, has not slowed down, and the housing rent inflation with higher weight and the latest increased in weight, shows no signs of slowing down. However, energy inflation, which contributed the most to the decline of price increase before, rebounded again this time, so this is indeed a hawkish result.

Home inflation was +7.88%, up from 7.51% in December and a record high

Rent inflation was +8.56%, up from 8.35% in December and a record high

Services CPI soared to its highest level since July 1982 and commodity inflation continued to slow...

However, commodity inflation has a certain inertia. As we talked about before, in the early stage of inflation, due to the higher price increase, the inventory increase becomes larger, and in the late stage of inflation, there will be a sharp price reduction due to oversupply.

Therefore, the reduction of inflation in services is usually proof that the Fed's interest rate hike is really effective. One of Powell's most important indicators is the service core inflation rate, which excludes the contribution of housing inflation. This indicator has slowed down this time

This result dispels the possibility of a sharp increase in interest rates in the future, but the slowdown is not enough to stop the increase in interest rates.

Simply from the data point of view, this is all the key points we need to pay attention to, and everyone can look at the list for other sub-items:

The second biggest resistance,

the recovery of China's economy drives the rebound of US inflation

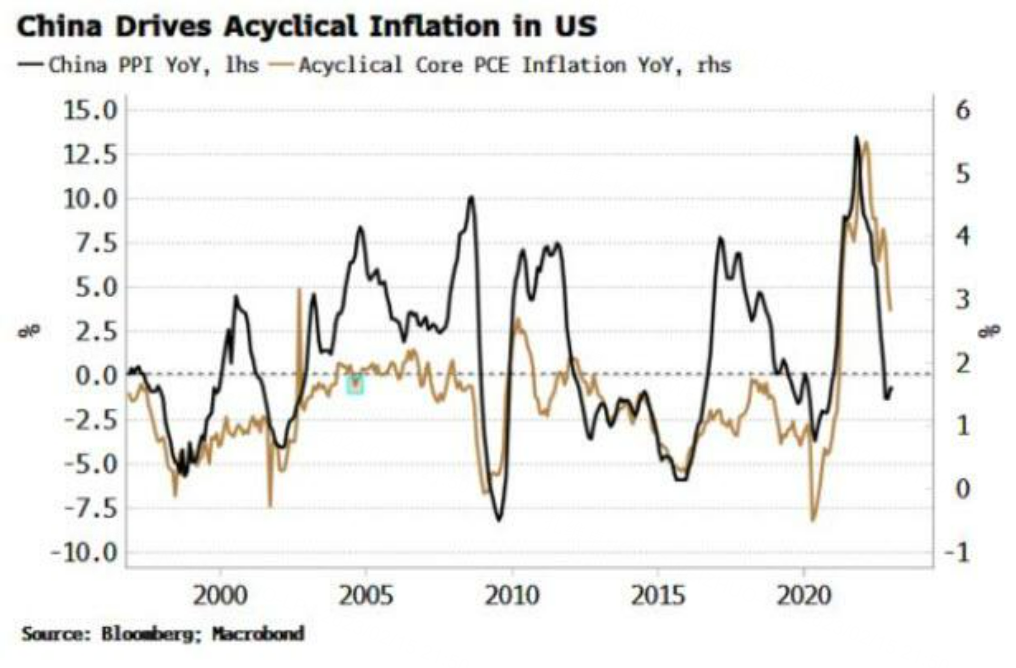

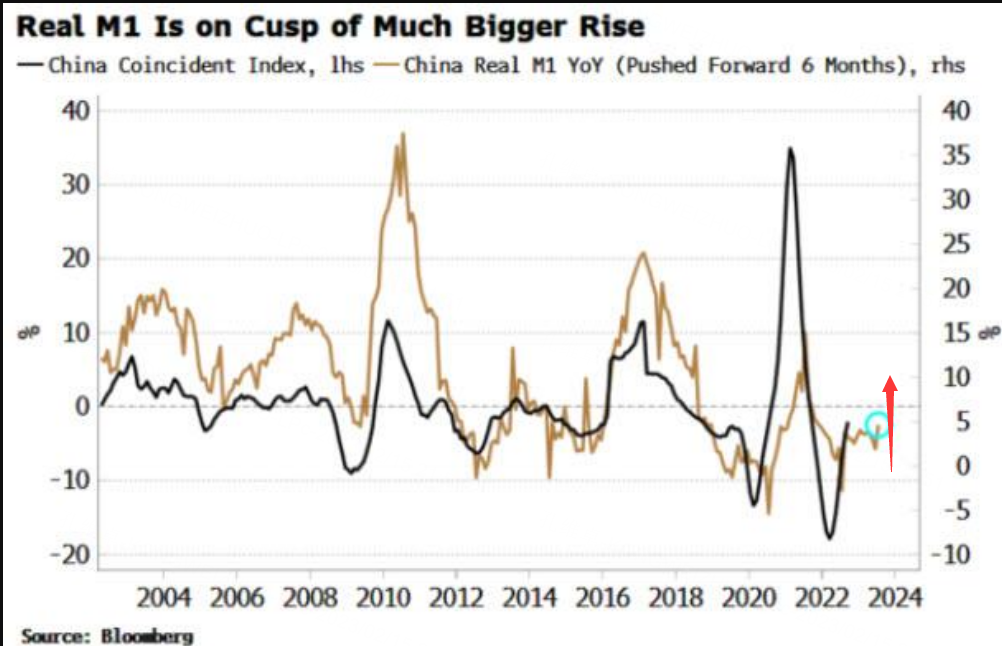

Stimulated by China's re-opening, I believe the Federal Reserve will have more work to do to reduce inflation. After our supply chain is opened, the global energy demand will also rise. After orders increase, a large number of production activities will restart, which will inevitably affect the price increase in the United States.

After all, for the United States, the role of China's economic motor is just opposite to the Fed's interest rate hike.

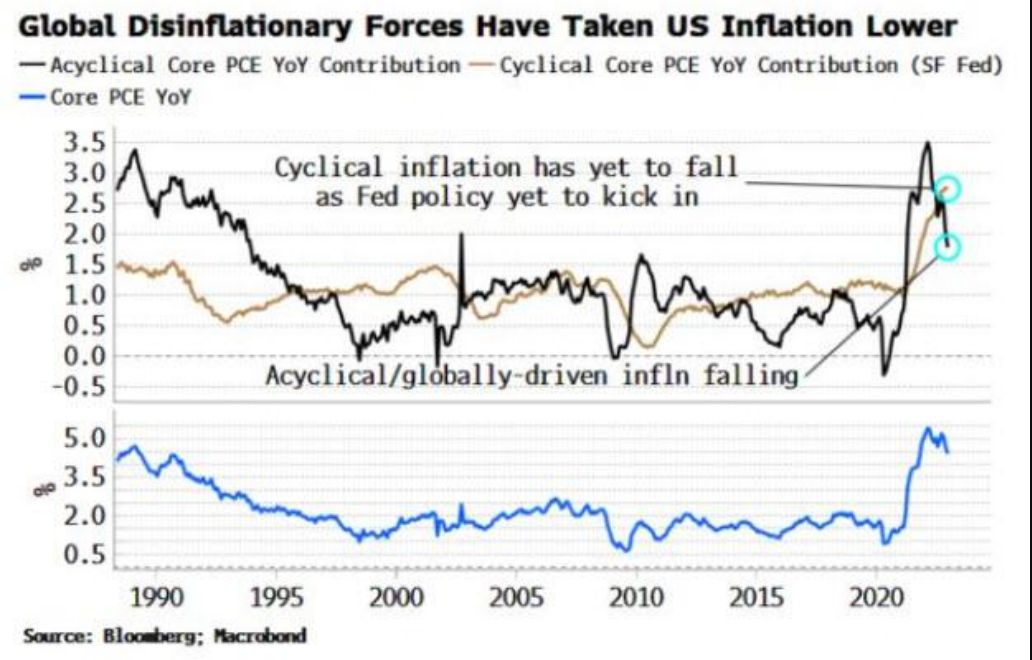

Looking at a set of Bloomberg statistics, If the inflation data is divided into cyclical inflation (that is, the inflation rate of the most affected by the Fed) and Acyclical inflation (that is, the inflation rate of the less affected by the Fed), the current slowdown in inflation growth in the United States is entirely caused by the decline of the Acyclical inflation rate worldwide

While some of the price increases that were greatly disturbed by the Fed did not drop significantly (above), the other part of the acyclical inflation rate was quite consistent with the year-on-year annualized trend of China's PPI data

Then a terrible problem has emerged. With the rising of China's social financing data, a new wave of credit pulse cycle has arrived. The surge of China's M2 data means the rebound of PPI data, which will also pull the rebound of the acyclical inflation rate in the United States, which has fallen a lot. This will undoubtedly give greater upward pressure on prices in the United States in the future

So this data, no matter how you look at it, doesn't look like the Fed is about to suspend interest rate hikes in the first half of the year.

Of course, there is a third major resistance:

historical laws

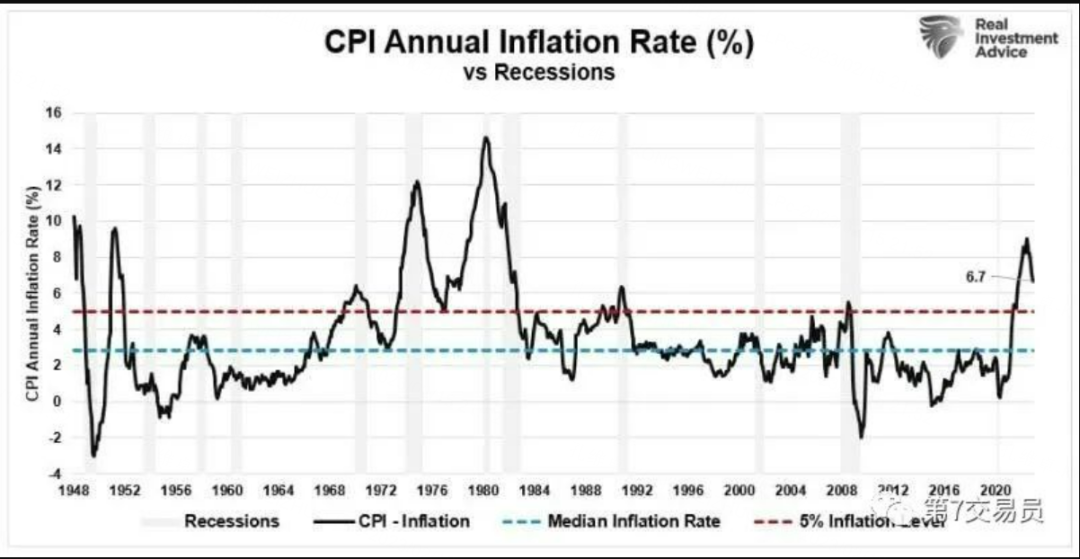

Historically, the inflation rate in the United States needs to be reduced to below 5% and accelerated, so that the Federal Reserve can end the process of raising interest rates and announce that the work of reducing inflation has made progress in stages. However, according to the current CPI slowdown result, it seems that there is no possibility of realizing it in the first half of the year.

As we said in our previous analysis:

Since 1948, the US inflation data for more than 70 years indicates such a rule: CPI is at 5% and 3% are two important points, unless the US CPI falls below 3%, there is still a great possibility of rebound in the future, at least it should fallTo less than 5%,

After holding the rebound in the past two weeks, the US dollar continued to test upwards. When the above fundamental factors were determined, there was resonance confirmation on the technical side.

We once again believe that the US dollar index will form a medium-and long-term low at the point of 100 in the future:

What do you say about this? Leave me a message?

$NQ100指數主連 2303(NQmain)$ $道瓊斯指數主連 2303(YMmain)$ $SP500指數主連 2303(ESmain)$ $黃金主連 2304(GCmain)$ $WTI原油主連 2304(CLmain)$

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Points sass.... M. M.

😊

👍

👍🏻