Now‘s the ‘perfect opportunity’ in copper

Last week, the regular meeting of the State Council once again stated that liquidity tools should be used to stabilize economic growth in a timely manner, and the market showed certain expectations for RRR reduction. Therefore, we can see that although the pressure of epidemic prevention and control in China is increasing recently, the prices of most industrial products, including copper prices, are firm, and it seems that most areas are not affected by the epidemic.

At the same time, although domestic refined copper stocks have accumulated, they are still at a relatively low level. We think that the next game is between expectation and reality. The difference is that the expectation turns stronger and the reality turns weaker. The strong expectation mainly comes from the liberalization of the epidemic next year, the restoration of real estate, the economic recovery and so on. It is expected that this game will continue in the future.

1. Review of COMEX copper market last week

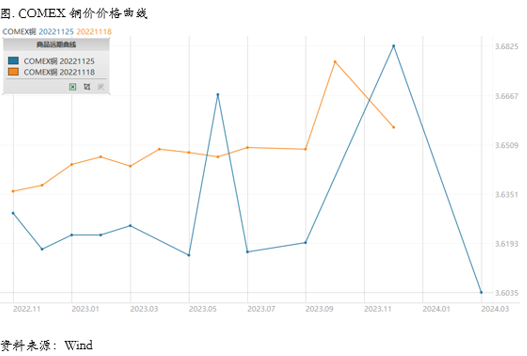

Last week, COMEX copper price fluctuated and sorted out, showing a narrow range of operation as a whole. Last week, the overseas macro was relatively calm, The minutes of the Federal Reserve's November interest rate meeting were released in the middle of the week, However, there is not much incremental information involved in the minutes of the meeting.

The most noteworthy thing is the introduction of the concept of "recession", which makes the market expect that the Fed is really worried about the upcoming economic recession, and the rate hike will further slow down. At the same time, the one-year inflation expectation of the University of Michigan dropped last week, which also made the market relax. In addition, other macro indicators showed a further slowdown in overseas economic activities last week, a further decline in European PMI, and a weaker sales of new homes in the United States, all of which showed signs of recession, bringing the pace of market transaction recession closer.

COMEX copper price curve has shifted downward compared with the previous one, and the near end of the price curve has changed greatly, from the previous contango structure to the back structure. After the price increase last week, the inventory in North America has accumulated, indicating that the high price will indeed attract the explicit invisible inventory.

Of course, because the absolute quantity of inventory is still very low, the back structure still has strong support. If we only look at the macro and meso data of the United States, we will find that the situation is not optimistic. Many fields related to copper demand have entered the stage of active destocking, but this macro situation has not yet been reflected at the micro level. However, with the fall of the US dollar and nominal interest rate, and the absolute price rising to a high level, the cost of handing over invisible inventory is decreasing, and such a high price is also faced with the need to lock in profits, so it is necessary to guard against a certain degree of handing over in the future.

Cross-market arbitrage strategy in domestic and foreign markets

Last week, SHFE/COMEX price comparison was running at a high level. In the absolute price shock consolidation, the price comparison changed relatively smoothly, indicating that the domestic import market was relatively balanced in the near future. Looking back, we think that the logical support of anti-nesting is gradually weakening. The main reason is that the domestic output is not low, but the demand side is facing the continuous disturbance during the high epidemic period in winter, and the static management areas are increasing, and many economically developed areas are also included, which has a self-evident impact on demand.

In this case, the subsequent inventory tends to accumulate rather than further destocking, so the import profit may not need to be givenThe window is open, so the price comparison may temporarily lose its main logic and fluctuate more with the exchange rate, which has absolute volatility of the price itself.

$E-mini Nasdaq 100 - main 2212(NQmain)$ $E-mini S&P 500 - main 2212(ESmain)$ $E-mini Dow Jones - main 2212(YMmain)$ $Gold - main 2302(GCmain)$ $Light Crude Oil - main 2301(CLmain)$

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- fxaw·2022-11-30can you suggest which etf or stock for the best copper exposure? agree with your thinking, i've been looking the copper index for some time too but i never invest in copper4Report

- Kyesu·2022-12-01Read and thanks1Report

- AnDy8910·2022-12-02OkLikeReport

- CExecutive·2022-12-01OoLikeReport

- TKCat·2022-12-01👍1Report

- 老虎爱上猫·2022-12-01👍LikeReport

- pcwong·2022-12-01[微笑]LikeReport

- Ekraaj·2022-12-01KLikeReport

- CCX888·2022-12-01goodLikeReport

- 神话者·2022-12-01[微笑]1Report

- FCY13·2022-12-01goodLikeReport

- Newnew·2022-12-01Hi2Report

- earn a meal·2022-12-01Ok1Report

- Dblchsbrger·2022-12-01Ok1Report

- Barbarazhao·2022-12-01Ok1Report

- kevin chang·2022-12-01👍LikeReport

- AnDy8910·2022-12-01OkLikeReport

- MC8989·2022-12-01👌1Report

- Angela79·2022-12-01OkLikeReport

- Elky·2022-12-01tksLikeReport